Building Multiple Streams Of Income

The old adage "don't put all your eggs in one basket" has never been more relevant. In today's volatile economy, relying solely on a single income stream is a high-stakes gamble that many can no longer afford to take.

This article provides a concise guide to building multiple streams of income, offering actionable strategies for financial security and independence in an uncertain world.

The Imperative of Diversification

The traditional model of a single job providing lifelong financial stability is increasingly outdated. According to a 2023 report by McKinsey Global Institute, automation and economic shifts could displace millions of workers, highlighting the vulnerability of relying on a single source of income.

Diversification is no longer a luxury; it's a necessity for weathering economic storms and achieving long-term financial goals.

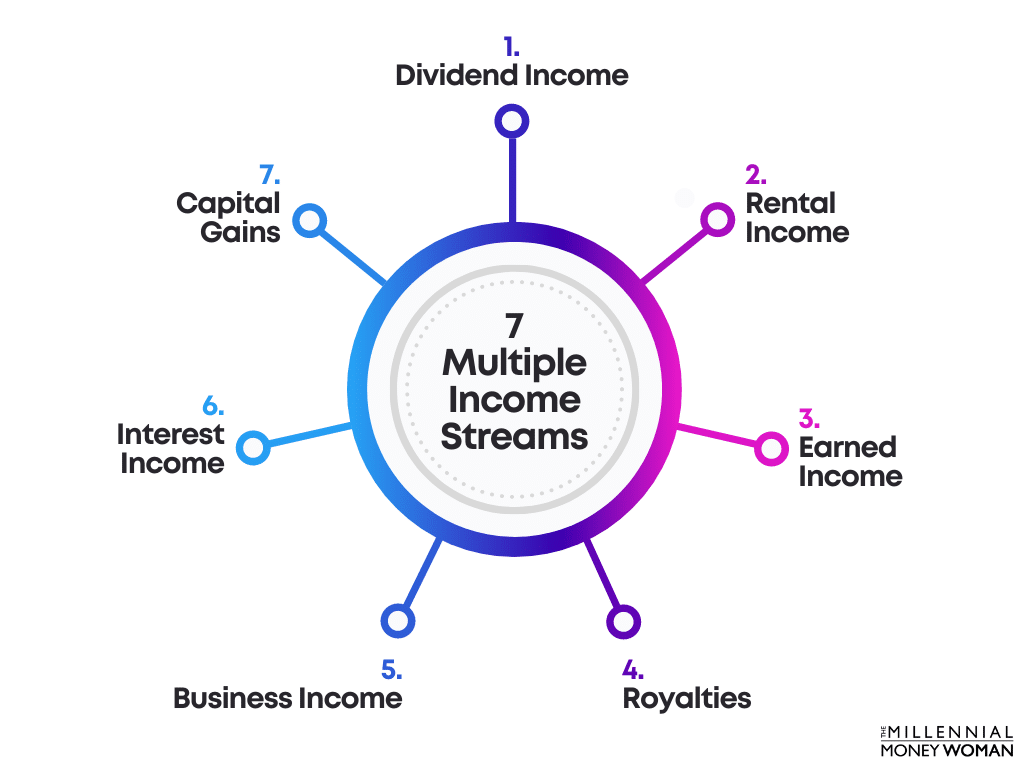

Exploring Income Stream Options

Freelancing and Consulting

The gig economy offers unparalleled opportunities to leverage existing skills and expertise. Platforms like Upwork and Fiverr connect freelancers with clients across various industries, providing a readily accessible marketplace for services like writing, graphic design, and software development.

According to Statista, the global freelance market is projected to reach $455 billion in 2023, demonstrating the growing demand for independent contractors.

Investing in Stocks and Bonds

Investing in the stock market, while carrying inherent risks, can generate passive income through dividends and capital appreciation. Bonds, considered less volatile than stocks, offer a more stable, albeit lower, return.

Consulting with a financial advisor is crucial to develop an investment strategy aligned with your risk tolerance and financial goals.

Real Estate Investments

Real estate can provide rental income and long-term capital appreciation. Options range from traditional property ownership to Real Estate Investment Trusts (REITs), which allow investors to participate in the real estate market without directly owning property.

Careful market research and due diligence are essential before investing in real estate. Local market condition will significantly affect return on investment.

Creating and Selling Online Courses or Digital Products

Sharing knowledge and expertise through online courses or digital products can generate passive income. Platforms like Teachable and Udemy provide tools and resources to create and market educational content.

Identify a niche market with demand for your specific skill set to increase the likelihood of success.

Affiliate Marketing

Affiliate marketing involves promoting other companies' products or services and earning a commission on each sale generated through your unique referral link. This can be done through blog posts, social media, or email marketing.

Building an audience and establishing trust are key to successful affiliate marketing. It is very important to be transparent with audiences.

Mitigating Risk and Managing Multiple Streams

While diversification reduces risk, it's crucial to manage each income stream effectively. Track income and expenses diligently to identify areas for improvement and ensure profitability.

Dedicate sufficient time and resources to each venture, avoiding overextension. Consider outsourcing tasks when possible.

Next Steps

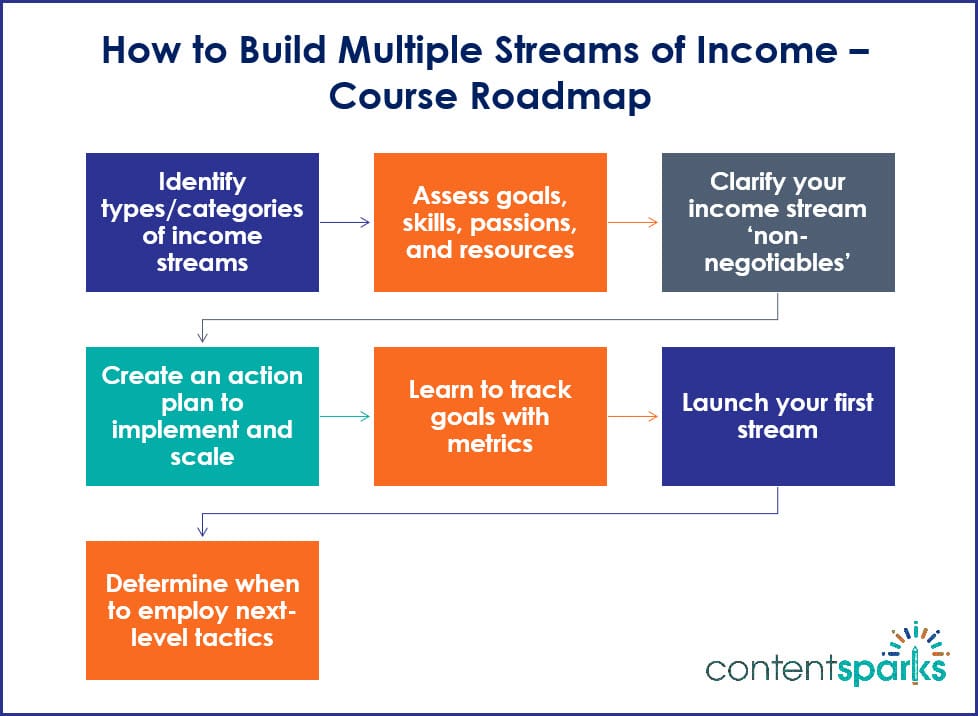

The journey to financial independence through multiple income streams requires dedication and strategic planning. Research different income opportunities, assess your skills and resources, and develop a clear roadmap for achieving your financial goals.

Stay informed about market trends and be prepared to adapt your strategies as needed. Start small, build momentum, and continuously learn to maximize your earning potential.

![Building Multiple Streams Of Income How to Create Multiple Streams of Income [7 Proven Methods]](https://themillennialmoneywoman.com/wp-content/uploads/2022/02/How-to-Create-Multiple-Streams-of-Income.webp)