When Will Super Micro Computer Stock Split

Super Micro Computer (SMCI), a company riding the wave of artificial intelligence infrastructure demand, has seen its stock price soar in recent months, leading many investors to wonder: when will the company enact a stock split?

While a stock split doesn't fundamentally change the value of a company, it can make shares more accessible to a wider range of investors. This article delves into the likelihood of a SMCI stock split, examining the factors that influence such a decision and the potential impact on shareholders.

The Ascendancy of SMCI and the Stock Split Question

Super Micro Computer, often referred to as Supermicro, designs and manufactures high-performance server and storage solutions. The company's focus on AI, machine learning, and other computationally intensive applications has fueled significant growth, making it a prominent player in the tech hardware sector.

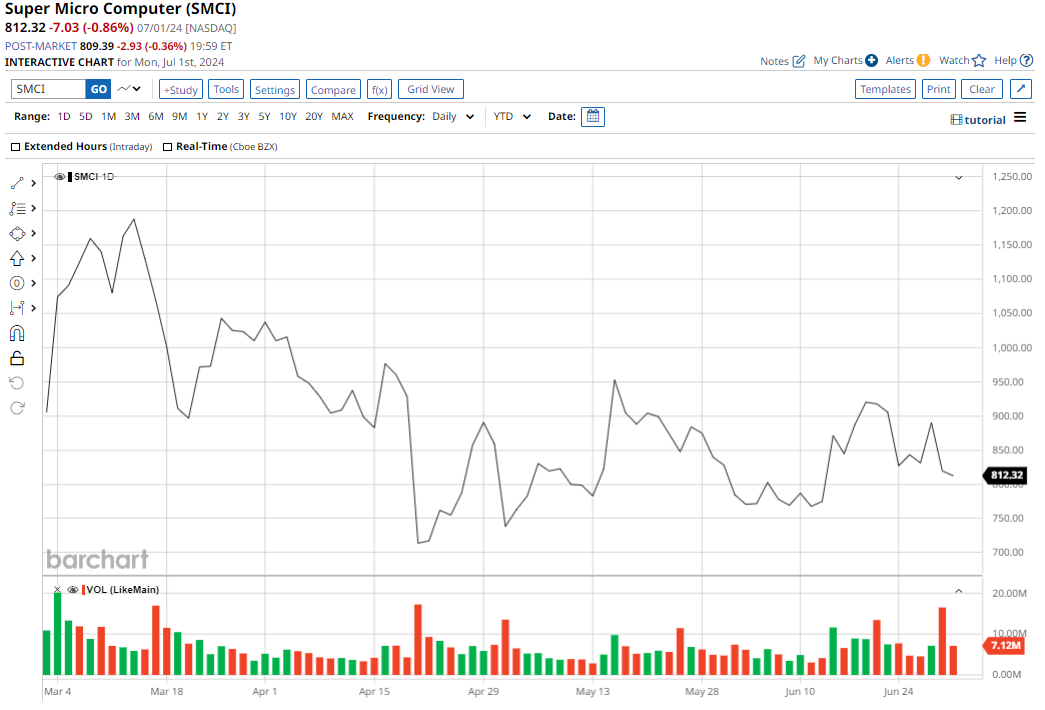

The company's stock price has mirrored this success. This rapid appreciation has placed SMCI among the more expensive stocks on the market, prompting speculation about a potential stock split.

What is a Stock Split?

A stock split is a corporate action where a company increases the number of outstanding shares by dividing each existing share. For example, in a 2-for-1 stock split, each shareholder receives one additional share for every share they own.

The market capitalization of the company remains the same, but the price per share is reduced proportionally. Thus, a stock trading at $1,000 per share before a 2-for-1 split would trade at $500 per share after the split.

The primary motivation behind a stock split is to make the stock more affordable and attractive to retail investors.

Factors Influencing a Stock Split Decision

Several factors influence a company's decision to implement a stock split. These include the stock price, the trading volume, and the company's overall strategy.

Historically, companies consider stock splits when their share price becomes perceived as too high, potentially deterring smaller investors. Increased trading volume after a split can also boost liquidity.

Furthermore, management often assesses investor sentiment and market conditions before proceeding with a split.

SMCI's Current Position

As of recent trading, SMCI's stock price remains elevated, increasing the likelihood of a split. However, Supermicro has not made any official announcements regarding a stock split.

Investors closely monitor the company's earnings calls, investor presentations, and SEC filings for any hints or indications. "We are always evaluating options to enhance shareholder value," a representative stated indirectly.

The company's leadership team must weigh the potential benefits of increased accessibility against the administrative costs and potential signaling effects of a split.

Potential Impact of a Stock Split

A stock split by SMCI could have several implications for investors and the broader market. A reduced share price could attract a larger pool of retail investors, potentially increasing demand for the stock.

Increased liquidity could also lead to tighter bid-ask spreads, making it easier for investors to buy and sell shares. Some analysts believe that a stock split could further fuel SMCI's stock price appreciation.

However, it's important to remember that a stock split is primarily a cosmetic change. The underlying fundamentals of the company remain the most important driver of long-term value.

Investor Perspective

For existing shareholders, a stock split has no immediate impact on the value of their holdings. They simply own more shares at a lower price per share.

However, the potential for increased demand and liquidity could lead to higher stock prices in the long run. New investors might find the lower share price more appealing, making it easier to build a position in SMCI.

It is crucial for investors to conduct their own due diligence and consider their individual investment goals before making any decisions based on a potential stock split.

Conclusion: Waiting for the Signal

While the high stock price of Super Micro Computer makes a stock split a plausible scenario, the company has yet to announce any concrete plans. Investors will need to remain vigilant, monitoring official communications from SMCI for any updates.

A split could increase accessibility and liquidity, potentially benefiting both existing and new investors. However, the long-term success of SMCI will ultimately depend on its ability to continue innovating and capitalizing on the growing demand for AI infrastructure.

Until an official announcement is made, the timing of a SMCI stock split remains a matter of speculation and anticipation within the investment community.

:max_bytes(150000):strip_icc()/GettyImages-1828862796-8edc3853717b4c69997e7c860b87a74c.jpg)

:max_bytes(150000):strip_icc()/SMCIChart-5f54e186a1524867963140675dd8ff4e.jpg)