Businesses Acquire Long Term Financing From Two Major Sources

The midday sun cast long shadows across the bustling marketplace, a hive of activity where small business owners haggled over prices and customers sampled local delicacies. For many entrepreneurs, this vibrant scene represents both the promise and the challenge of building a thriving enterprise. Behind the smiling faces and bustling stalls lies a constant quest for stability, a need often met by the strategic pursuit of long-term financing.

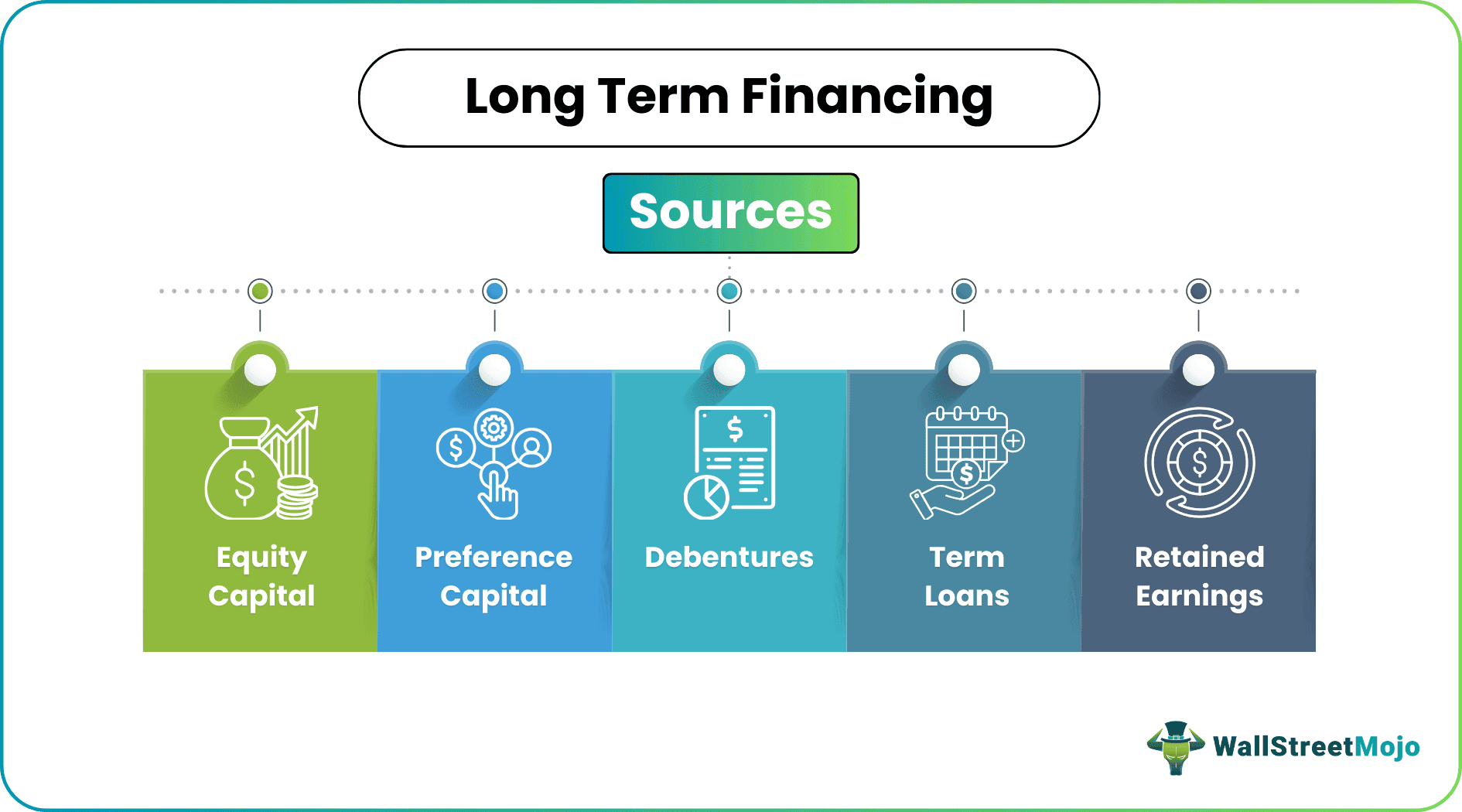

This article explores how businesses are increasingly securing their future by strategically leveraging two key sources of long-term financing: private equity and government-backed loan programs. Understanding these avenues is crucial for entrepreneurs seeking to expand, innovate, and navigate the complexities of a competitive market.

The Evolving Landscape of Business Finance

Historically, businesses relied heavily on traditional bank loans for long-term capital. However, the financial landscape has transformed significantly over the past few decades.

The rise of private equity firms and the expansion of government initiatives have opened up new and often more flexible avenues for businesses seeking to fuel their growth.

Private Equity: A Partner for Growth

Private equity firms invest directly in private companies, providing capital in exchange for equity, or a share of ownership.

This investment often comes with strategic guidance and operational expertise, making it a particularly attractive option for businesses poised for rapid expansion or those seeking to restructure.

According to a report by Preqin, a leading data provider in the alternative assets industry, private equity deal value reached record highs in recent years, demonstrating the increasing appetite for private company investments.

Sarah Chen, CEO of a rapidly growing sustainable packaging company, shared her experience securing private equity funding. "We had a great product and a strong team, but we needed capital to scale our operations and meet growing demand," Chen explained.

"Partnering with a private equity firm not only provided us with the necessary funds, but also brought valuable insights and connections to help us navigate the complexities of a rapidly changing market."

The investment enabled Chen's company to expand its manufacturing capacity, develop new product lines, and ultimately increase its market share.

However, it's important to acknowledge the potential drawbacks of private equity. Giving up a portion of ownership can be a significant decision for founders, and aligning interests with investors requires careful consideration.

Furthermore, private equity firms typically have a specific investment horizon, meaning they will eventually seek to exit their investment, which can sometimes lead to changes in the company's strategic direction.

Government-Backed Loan Programs: A Safety Net and a Catalyst

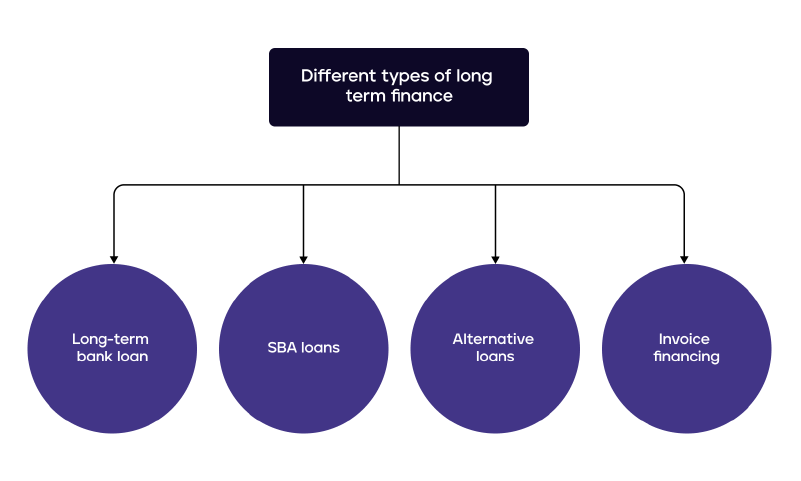

Government-backed loan programs are designed to support businesses that may not qualify for traditional financing or those operating in underserved markets.

These programs often offer more favorable terms, such as lower interest rates and longer repayment periods, making them an attractive option for small and medium-sized enterprises (SMEs).

The Small Business Administration (SBA) in the United States, for example, offers a variety of loan programs designed to help small businesses start, grow, and recover from disasters.

According to the SBA, its loan programs have helped millions of small businesses access the capital they need to thrive. Similarly, in Europe, the European Investment Fund (EIF) provides guarantees and other instruments to support SMEs across the continent.

These programs are particularly beneficial for businesses operating in sectors deemed crucial for economic development, such as renewable energy, healthcare, and education.

David Lee, owner of a small organic farm, utilized an SBA loan to purchase new equipment and expand his operations. "Without the SBA loan, I wouldn't have been able to invest in the technology needed to improve our efficiency and increase our yields," Lee stated.

The loan allowed Lee to modernize his farm, reduce his environmental impact, and ultimately increase his profitability.

While government-backed loan programs offer significant benefits, they also come with certain requirements and restrictions. Businesses must meet specific eligibility criteria and comply with regulations.

Navigating the application process can sometimes be complex and time-consuming, requiring businesses to seek guidance from financial advisors or consultants.

The Strategic Synergy: Combining Resources

Increasingly, businesses are finding innovative ways to combine private equity and government-backed loan programs to maximize their access to capital.

For example, a company might secure a government-backed loan to finance the initial stages of a project and then seek private equity investment to fund its long-term growth and expansion.

This strategic synergy allows businesses to leverage the strengths of both types of financing, mitigating risks and maximizing opportunities.

Financial experts emphasize the importance of careful planning and due diligence when seeking long-term financing. "Businesses need to thoroughly assess their financial needs, understand the terms and conditions of each financing option, and develop a clear strategy for utilizing the funds effectively," advises Dr. Emily Carter, a professor of finance at a leading business school.

"A well-thought-out financing plan can significantly improve a business's chances of success."

Moreover, building strong relationships with both private equity firms and government agencies is crucial for securing financing and navigating the complexities of the funding process. Attending industry events, networking with potential investors, and seeking mentorship from experienced entrepreneurs can all contribute to building a strong network.

Looking Ahead: The Future of Business Finance

The landscape of business finance is constantly evolving, driven by technological innovation, changing investor preferences, and evolving government policies.

The rise of fintech companies and alternative lending platforms is further expanding the range of financing options available to businesses.

Staying informed about these trends and adapting to the changing environment is essential for entrepreneurs seeking to secure their future.

As the sun sets on the marketplace, casting a warm glow on the remaining stalls, the spirit of entrepreneurship remains undeterred. The pursuit of long-term financing may be challenging, but it is also a vital step in building a sustainable and thriving business.

By understanding the nuances of private equity and government-backed loan programs, and by strategically combining these resources, businesses can unlock their full potential and contribute to a vibrant and resilient economy.