What Does Uphold Charge For Asset Listing

Imagine a bustling marketplace, vendors hawking their wares, potential customers milling about, each hoping to find the next big thing. Now, picture this market existing in the digital realm, where cryptocurrencies and other digital assets take center stage. One of the prominent marketplaces in this space is Uphold, a platform known for its wide array of tradable assets. But what does it take for a new asset to secure a coveted spot on Uphold’s list?

The process of listing an asset on Uphold, like any major exchange, involves a thorough evaluation and, crucially, a fee structure. While Uphold doesn't publicly disclose a standardized "listing fee," the cost and criteria for inclusion depend on various factors, including the asset's potential, regulatory compliance, and the resources required for integration.

The Intricacies of Asset Listing

In the dynamic world of digital assets, securing a listing on a platform like Uphold can be a game-changer for a project. It provides increased visibility, liquidity, and ultimately, legitimacy. However, this privilege doesn't come without its hurdles. The path to listing is paved with careful consideration and significant investment.

Understanding Uphold's Approach

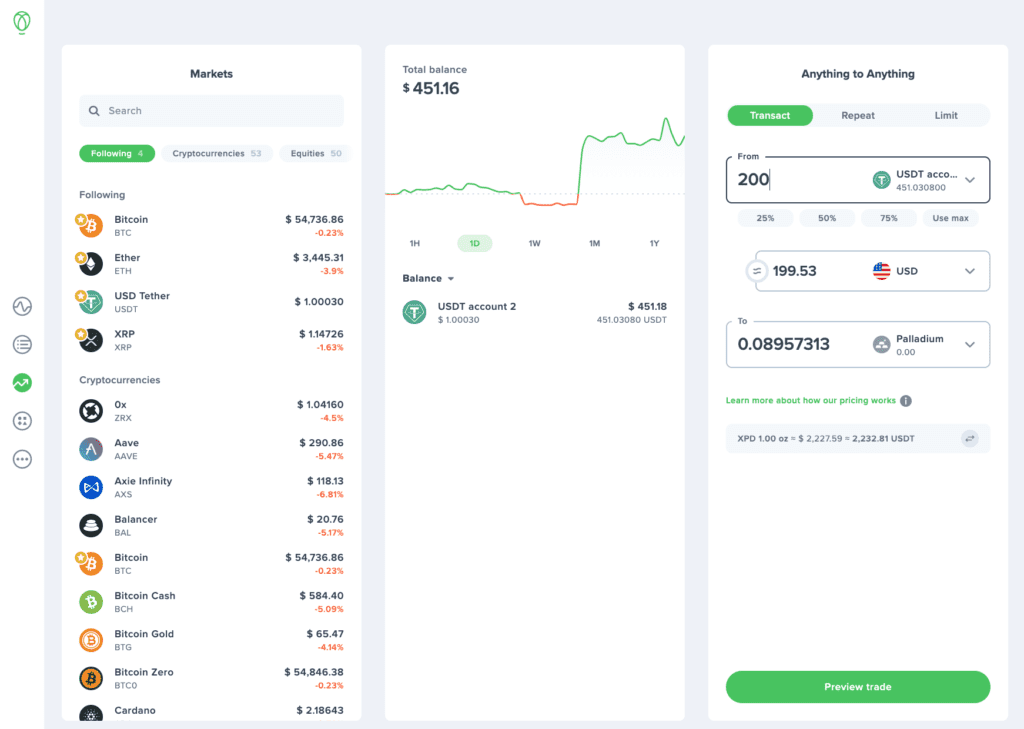

Uphold distinguishes itself with its "Anything-to-Anything" trading platform, allowing users to seamlessly convert between various asset classes, from cryptocurrencies to fiat currencies and even precious metals. This unique feature necessitates a rigorous evaluation process for any new asset seeking inclusion.

Unlike some exchanges that may have a more standardized, publicly advertised fee structure, Uphold tends to adopt a more individualized approach. This is due in part to the diverse nature of assets it supports and the ever-evolving regulatory landscape surrounding digital currencies.

The listing decision is not solely based on financial compensation. Uphold carefully assesses several qualitative and quantitative factors. They aim to ensure that any asset listed aligns with their core values and meets the expectations of their users.

Key Factors Influencing Listing Costs

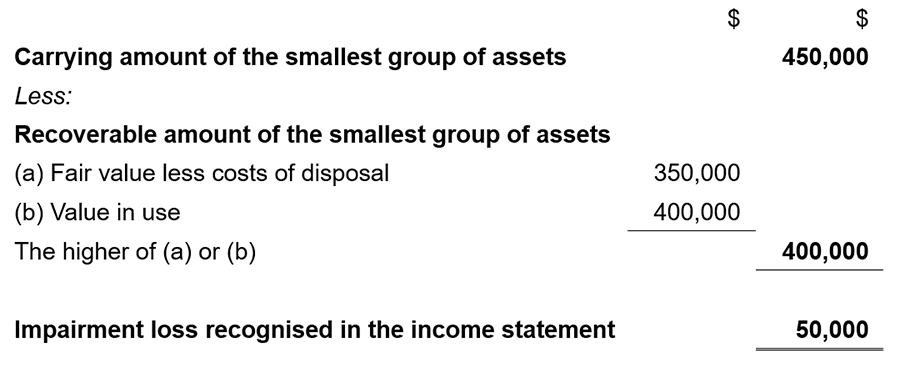

While a fixed listing fee is not typical, the overall cost associated with getting an asset listed on Uphold can be substantial. This expense encompasses several components, reflecting the work required from both the asset project and Uphold itself.

The complexity of technical integration plays a significant role. Integrating a new asset into Uphold's platform requires significant engineering effort and rigorous testing. The more novel or complex the asset's technology, the higher the integration cost will be.

Compliance with legal and regulatory frameworks is paramount. Uphold operates in multiple jurisdictions and must adhere to varying regulatory requirements. Ensuring that a new asset complies with all applicable regulations is a critical and potentially expensive undertaking.

Due diligence and security audits are non-negotiable. Uphold conducts thorough due diligence on each asset to assess its underlying technology, security, and team. Independent security audits may also be required to identify and mitigate potential vulnerabilities.

Marketing and promotion are also crucial. While not directly a "listing fee," projects often allocate budget for marketing and promotion campaigns to raise awareness and drive adoption of their asset on the platform.

The Role of Market Conditions and Asset Potential

Beyond the technical and regulatory considerations, Uphold also evaluates the potential demand and long-term viability of an asset. An asset with a strong community, innovative use case, and a clear roadmap is more likely to be considered favorably.

Market conditions also play a role. If there's strong market interest in a particular type of asset, Uphold may be more inclined to list a promising project in that category. However, this doesn't guarantee listing, and the asset still needs to meet Uphold's stringent criteria.

Ultimately, Uphold seeks to list assets that will benefit its users and contribute to the overall growth and stability of the digital asset ecosystem.

Beyond the Monetary Cost

It's essential to recognize that the cost of listing an asset on Uphold extends beyond monetary considerations. The time and effort required from the project team, the need for transparency and open communication, and the commitment to long-term development are all vital aspects of the process.

Uphold places a strong emphasis on community engagement and responsiveness. Projects that actively engage with their community and demonstrate a commitment to addressing user concerns are more likely to build trust and credibility.

The ongoing maintenance and support of an asset after listing are also crucial. Projects must be prepared to provide regular updates, address any technical issues, and adapt to changing market conditions.

A Look at the Digital Asset Landscape

The landscape of digital asset exchanges is constantly evolving. As more platforms emerge and the demand for digital assets grows, the competition for listings intensifies. This dynamic environment places even greater emphasis on the quality, security, and potential of each project.

Uphold remains a prominent player in this space, known for its user-friendly interface, wide range of supported assets, and commitment to regulatory compliance. Securing a listing on Uphold can provide a significant boost to a project's visibility and credibility.

However, the high standards and rigorous evaluation process ensure that only the most promising and well-developed assets make it onto the platform. This approach protects users and contributes to the long-term health of the digital asset ecosystem.

The Future of Asset Listings

As the digital asset industry matures, the process of asset listings is likely to become more transparent and standardized. Regulatory clarity will play a crucial role in shaping the future of asset listings, providing clear guidelines for exchanges and projects alike.

The increasing adoption of decentralized technologies may also lead to new approaches to asset listings, potentially reducing the reliance on centralized exchanges. However, platforms like Uphold will continue to play a vital role in providing a secure and regulated environment for trading digital assets.

In conclusion, while a fixed "listing fee" may not be the defining factor, the cost associated with getting an asset listed on Uphold is a complex and multifaceted equation. It reflects the need for technical integration, regulatory compliance, security audits, and ongoing maintenance. Projects seeking to list their assets on Uphold must be prepared to invest significant resources and demonstrate a commitment to quality, transparency, and community engagement.