Businesses Match Their Long Term Capital Needs To

A seismic shift is underway as businesses globally recalibrate their strategies, meticulously aligning long-term capital needs with innovative financing solutions. This move, spurred by economic volatility and rapidly evolving market landscapes, demands immediate attention from investors and stakeholders alike.

This strategic realignment signifies a critical transition, necessitating businesses to proactively match their future financial demands with optimized capital structures to ensure sustained growth and stability in the face of uncertainty.

The Driving Forces Behind the Shift

Several key factors are fueling this urgency. Inflationary pressures, rising interest rates, and persistent supply chain disruptions are forcing companies to reassess their long-term financial projections. Geopolitical instability adds another layer of complexity, impacting investment decisions and risk assessments.

Furthermore, the accelerating pace of technological innovation and the push for sustainability are creating new capital-intensive opportunities and requirements. Companies are adapting to these forces through strategic capital allocation and novel financing approaches.

Data Highlights the Trend

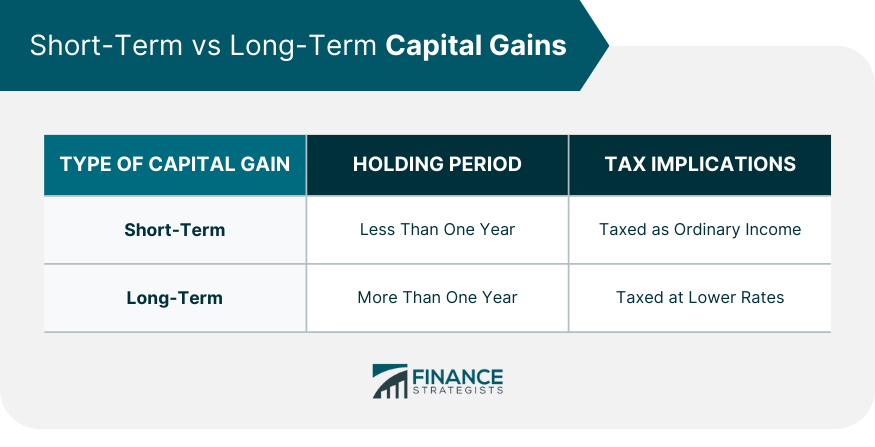

According to a recent report by Bloomberg, global corporate bond issuance has decreased by 15% in the first half of 2024, signaling a more cautious approach to debt financing. This reflects a growing preference for alternative funding mechanisms, including private equity and venture capital, for long-term projects.

Deloitte's latest CFO Survey indicates that 72% of CFOs are prioritizing capital preservation and efficiency over aggressive expansion plans. This underscores a widespread commitment to responsible financial stewardship in the current economic climate.

Matching Needs to Solutions

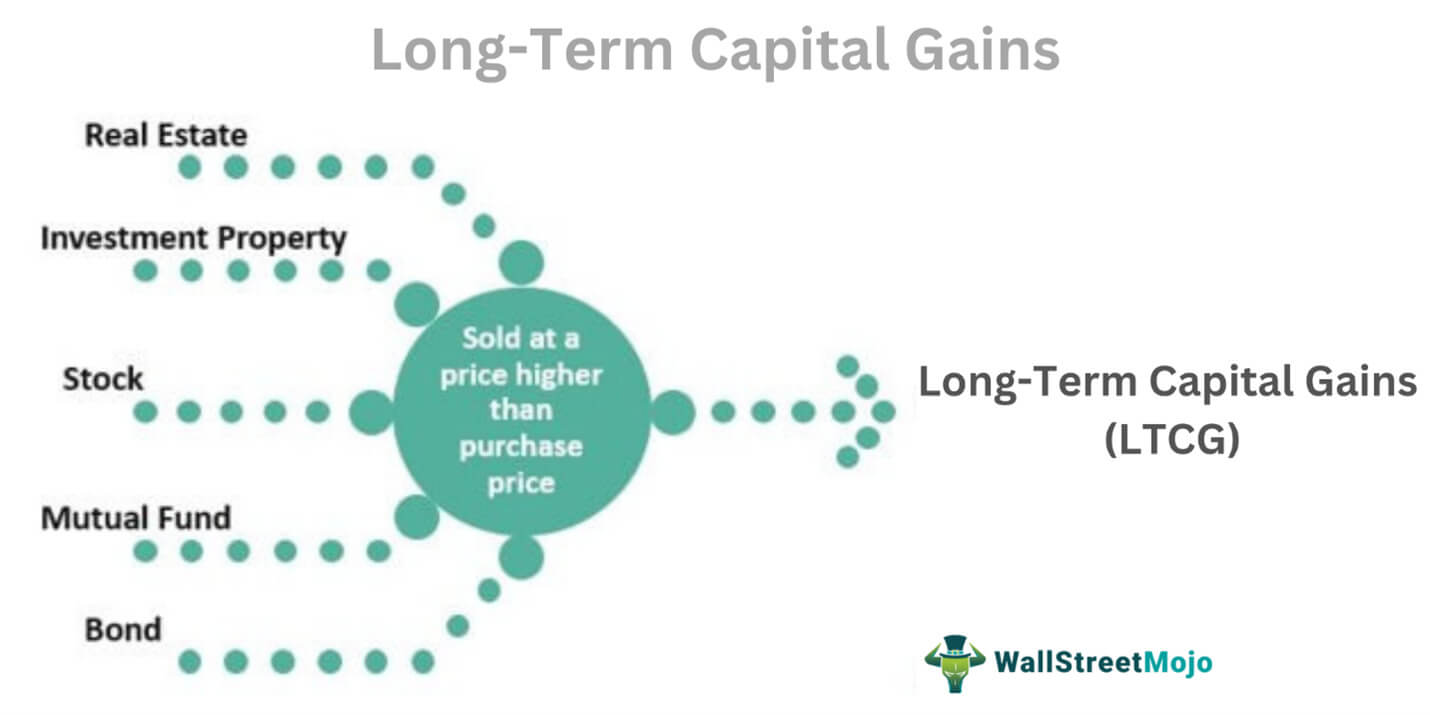

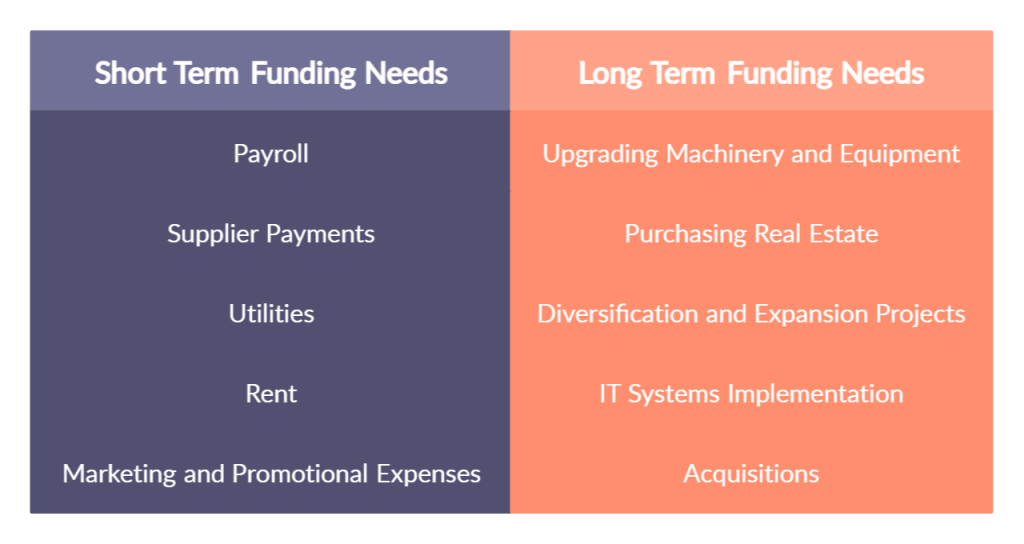

Companies are employing diverse strategies to align their long-term capital needs with appropriate funding sources. These include carefully evaluating the cost of capital, diversifying funding sources, and leveraging government incentives for sustainable projects.

Specifically, infrastructure projects are increasingly utilizing public-private partnerships (PPPs) to distribute risk and access long-term funding. Renewable energy ventures are actively pursuing green bonds and sustainability-linked loans to attract environmentally conscious investors.

Technology firms are turning to venture capital and strategic partnerships to fuel innovation and expansion, particularly in areas like artificial intelligence and cybersecurity. This reflects a willingness to share equity in exchange for the long-term capital required to scale rapidly.

Case Studies: Real-World Examples

Tesla, facing significant capital demands for its Gigafactory expansions, successfully navigated the market by issuing a mix of debt and equity, coupled with strategic government incentives. This diversified approach allowed them to secure long-term funding while managing risk and maintaining investor confidence.

Ørsted, a leading renewable energy company, has consistently utilized green bonds to finance its offshore wind projects. This strategy has not only secured substantial funding but has also enhanced the company's reputation as a sustainability leader, attracting impact investors and lowering borrowing costs.

Microsoft's strategic acquisition of Activision Blizzard, primarily financed through a combination of cash and debt, demonstrates a long-term bet on the future of gaming and the metaverse. This showcases the strategic use of capital to secure a competitive advantage in a rapidly evolving industry.

The Impact on Stakeholders

This shift has significant implications for various stakeholders. Investors must carefully evaluate the financial health and capital allocation strategies of companies before making investment decisions. Lenders need to adapt their risk assessment models to account for the evolving financing landscape.

Employees should be aware of potential changes in company strategy and resource allocation. Policymakers need to create a supportive regulatory environment that encourages responsible capital management and sustainable investment.

Looking Ahead

The trend of businesses meticulously matching their long-term capital needs to suitable financing solutions is expected to continue. As economic conditions remain uncertain, companies will likely prioritize financial resilience and adaptability. Further developments in sustainable finance and fintech are poised to play a crucial role.

Businesses must proactively assess their capital needs, explore diverse funding options, and embrace responsible financial management to thrive in the long term. Continuous monitoring of market dynamics and strategic adaptation are essential for navigating the complexities of the evolving economic landscape.

+Decisions.jpg)