Which Of The Following Is Classified As A Plant Asset

Urgent clarification needed for accounting professionals and business owners! Misclassification of assets can lead to significant financial reporting errors.

This article definitively answers the question: Which of the following is classified as a plant asset, providing a clear understanding for accurate financial management and compliance.

Understanding Plant Assets: The Core Definition

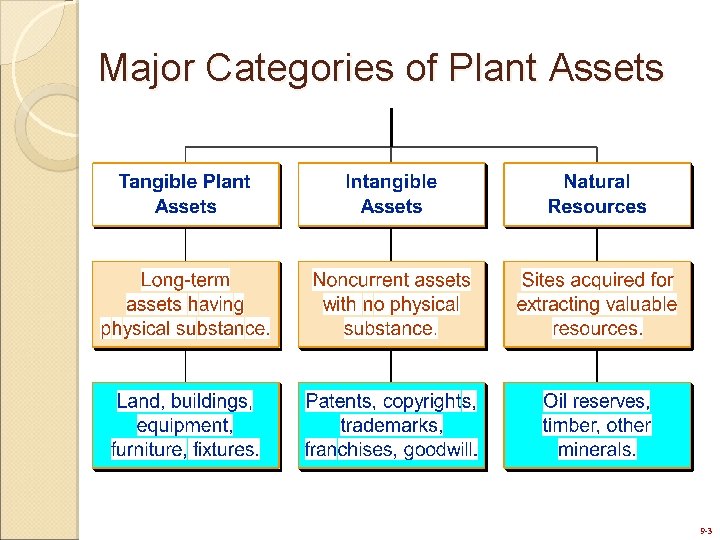

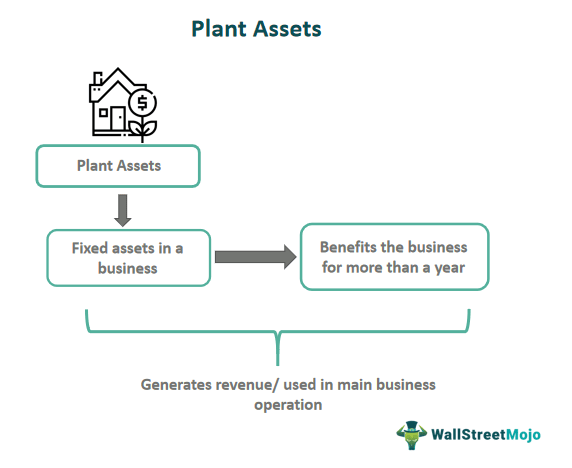

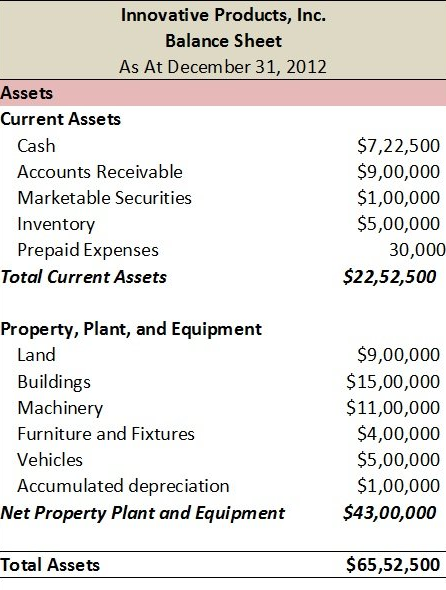

Plant assets, also known as fixed assets or property, plant, and equipment (PP&E), are tangible assets that a company uses to generate income over a period of more than one year. These assets are not intended for resale in the ordinary course of business. They are crucial for long-term operational efficiency.

Key Characteristics of Plant Assets

Plant assets possess three primary characteristics: they are tangible, have a useful life exceeding one year, and are used in operations to generate revenue. This excludes items held for sale or quickly consumed.

The Answer: What Qualifies as a Plant Asset?

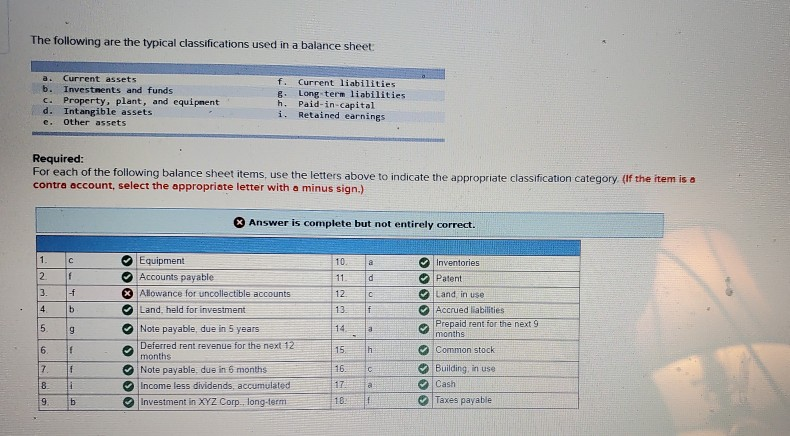

Based on established accounting principles, the correct answer to the question "Which of the following is classified as a plant asset?" is typically one of the following:

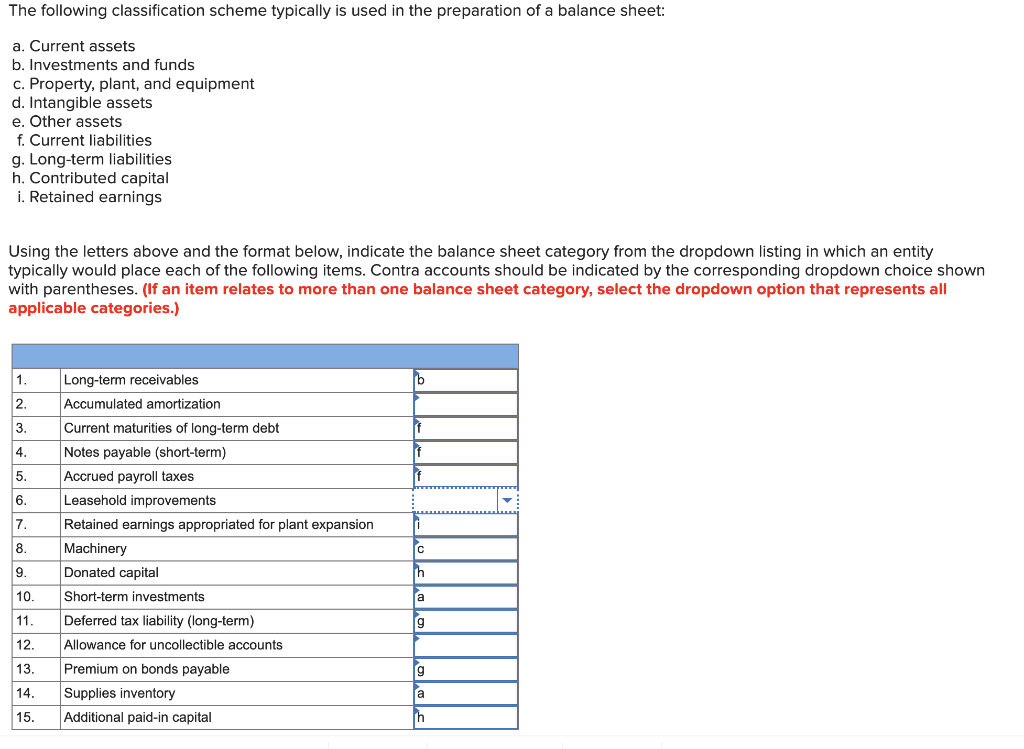

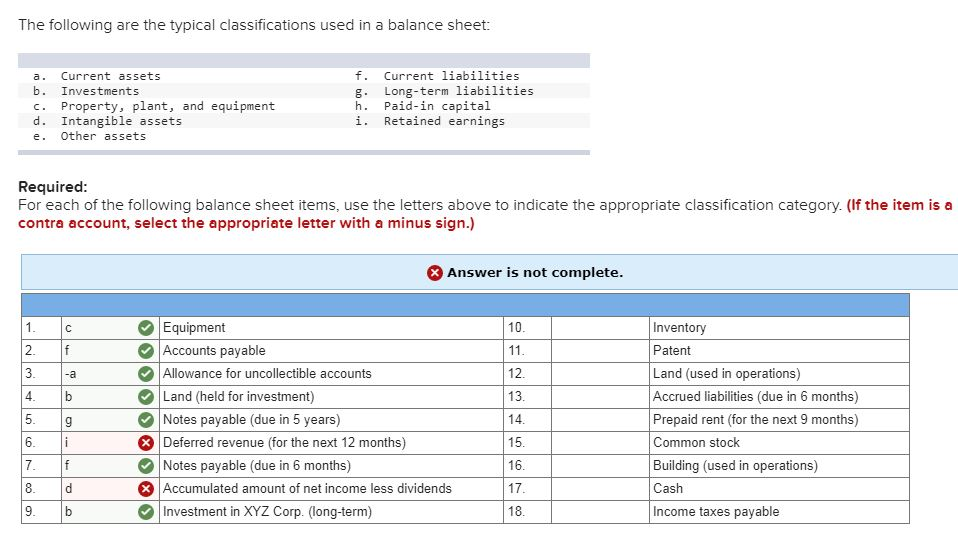

Land is often a plant asset, especially when it houses a company's buildings or is used for resource extraction. Buildings, including factories, offices, and warehouses are definitive plant assets. Equipment, such as machinery, vehicles, and furniture used in operations, also falls under this category.

Any improvement on the building like: A permanently Installed AC unit should be considered a plant asset as well.

Examples and Exclusions

Consider a manufacturing company: the factory building is a plant asset. The machinery used to produce goods is a plant asset.

Inventory, while tangible, is not a plant asset. It's held for sale. Similarly, accounts receivable, being intangible, is not considered a plant asset.

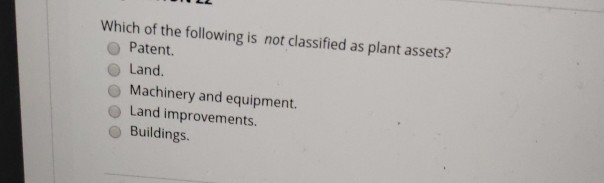

Addressing Common Misconceptions

A common mistake is classifying short-term assets as plant assets. Supplies, even if tangible, are consumed quickly and don't fit the long-term use criteria.

Another error lies in including intangible assets like patents or goodwill in this category. Intangible assets lack physical substance, despite their value.

Implications of Misclassification

Incorrectly classifying a plant asset can distort a company's financial statements. This affects key ratios like return on assets (ROA) and debt-to-asset ratios.

Inaccurate depreciation calculations stemming from misclassification can also impact profitability reporting and tax liabilities.

Who is Affected?

This information is critical for accountants, bookkeepers, business owners, and financial analysts. Everyone involved in financial reporting must have a clear understanding of plant assets.

Small businesses and large corporations alike need to ensure accurate categorization of these assets for compliance and informed decision-making.

The Importance of Professional Guidance

When in doubt, consult with a Certified Public Accountant (CPA) or a qualified financial advisor. They can provide expert guidance specific to your business situation.

Proper asset classification is essential for maintaining accurate financial records and avoiding potential penalties.

Next Steps: Ensuring Accuracy

Review your company's asset classifications immediately. Verify that all plant assets are correctly identified and depreciated.

Implement or update your internal controls for asset management to prevent future errors. Proper documentation is key.

Ongoing Developments

Accounting standards are constantly evolving. Stay updated with the latest pronouncements from the Financial Accounting Standards Board (FASB).

Continuous professional development is vital for maintaining accurate financial reporting practices. Ongoing training on asset classification is key.

![Which Of The Following Is Classified As A Plant Asset [Solved] Common categories of a classified balance | SolutionInn](https://dsd5zvtm8ll6.cloudfront.net/questions/2024/04/660a5f0c399e9_724660a5f0c361ff.jpg)