Buy Gold And Silver Denver Co

Denver, Colorado, has seen a steady interest in precious metals, particularly gold and silver, as residents seek to diversify investments and hedge against economic uncertainties. Local coin shops, bullion dealers, and investment firms report a consistent flow of individuals looking to buy these metals, driven by a variety of factors ranging from inflation concerns to geopolitical instability.

This trend reflects a broader national pattern, but Denver's unique economic landscape and demographics contribute to its particular appeal for precious metal investments. The city's growing population, coupled with a strong job market in sectors like technology and aerospace, has created a segment of residents with disposable income and an interest in alternative investment strategies.

This article examines the current market for gold and silver in Denver, exploring the reasons behind the demand, the key players in the local market, and the potential implications for investors.

The Lure of Precious Metals: Why Denver Residents Are Buying

The motivations behind buying gold and silver in Denver are multifaceted. A primary driver is the perceived hedge against inflation. As the cost of living continues to rise, many residents view precious metals as a way to preserve their purchasing power.

Gold and silver are often seen as stores of value that can maintain or even increase in worth during inflationary periods, unlike traditional currencies that can erode over time. “We’ve definitely seen an uptick in interest whenever inflation figures are released,” says Sarah Miller, a financial advisor at Denver Wealth Management.

Geopolitical instability also plays a role. Events such as international conflicts, trade disputes, and political uncertainty can fuel demand for safe-haven assets like gold and silver. These metals are considered relatively stable investments during times of global turmoil.

Furthermore, some Denver residents are drawn to the inherent tangible nature of precious metals. Unlike digital assets or stocks, gold and silver are physical commodities that can be held and stored. This provides a sense of security and control for some investors.

Michael Thompson, owner of Denver Gold & Silver Exchange, notes, "People like knowing they have something real they can hold onto. It's a feeling of security that's hard to replicate with other investments."

Key Players in the Denver Gold and Silver Market

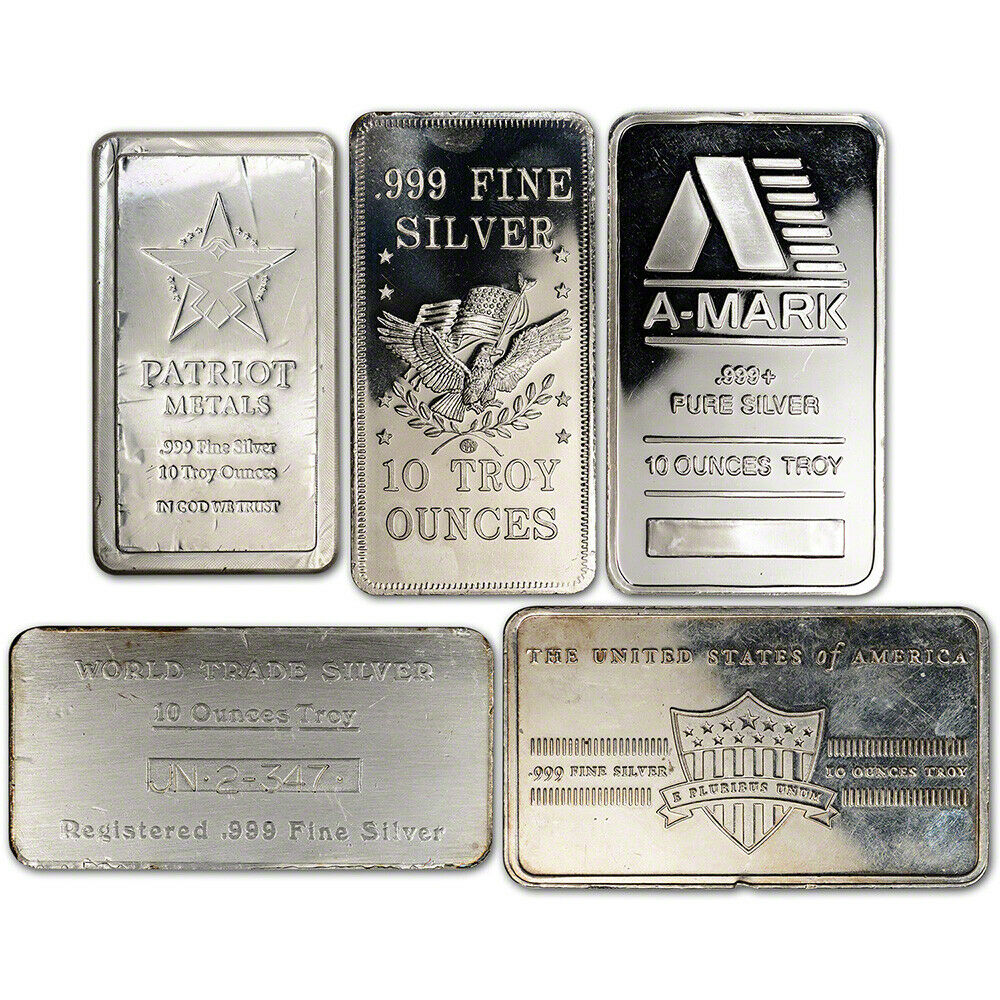

Denver's precious metals market is composed of various entities catering to different investor needs. Local coin shops, such as Rocky Mountain Coin and Colorado Numismatic Services, offer a wide range of gold and silver coins, bullion, and collectibles.

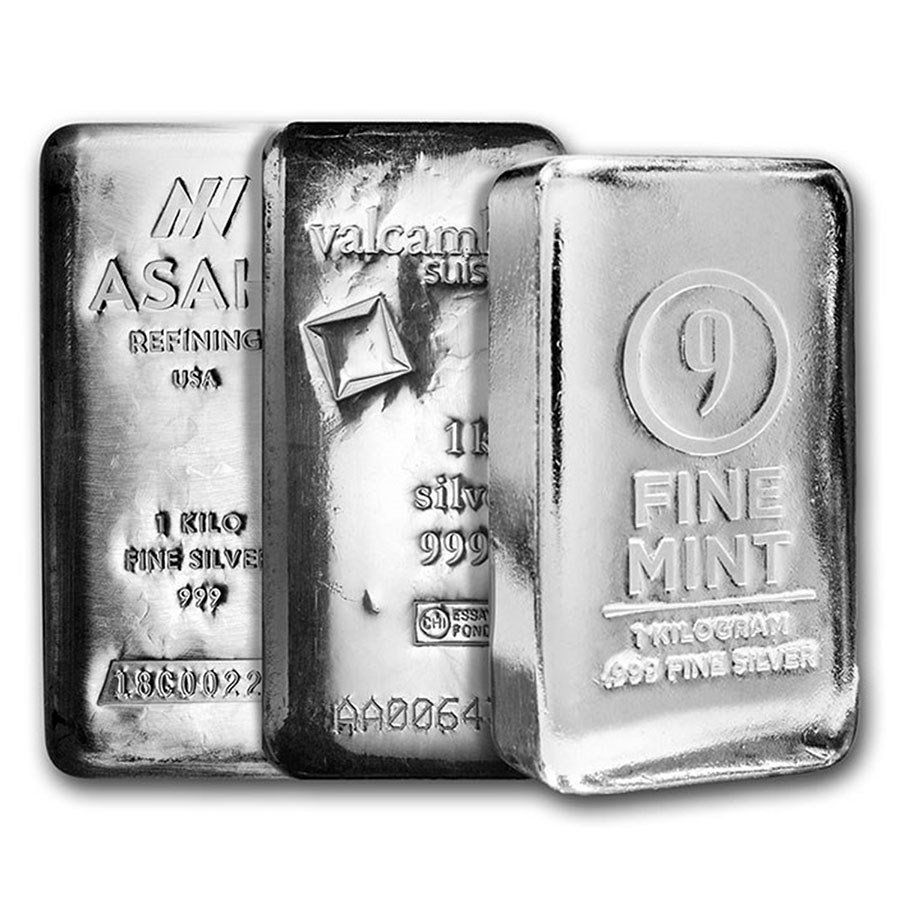

These shops often attract hobbyists and collectors, as well as those seeking smaller investments in physical gold and silver. Bullion dealers, including national firms like APMEX and regional players like Dillon Gage Metals, provide a platform for buying and selling larger quantities of gold and silver bullion.

Investment firms, like Denver Wealth Management, also offer precious metals as part of their portfolio management services. They typically provide guidance and expertise on integrating gold and silver into a broader investment strategy.

Navigating the Market: Tips for Denver Investors

For Denver residents considering buying gold or silver, it’s crucial to conduct thorough research and due diligence. Understanding the different types of precious metals available, such as gold bullion, silver coins, and exchange-traded funds (ETFs), is essential.

Investors should also compare prices from different dealers to ensure they are getting a fair market value. Checking the spot price of gold and silver, which is the current market price for immediate delivery, is a good starting point.

Storage options should also be considered. Physical gold and silver require secure storage, either at home in a safe or at a depository. Some bullion dealers offer storage services for a fee.

Finally, it’s important to be aware of the risks involved in investing in precious metals. Gold and silver prices can be volatile, and there is no guarantee of profit. Diversification is always recommended as a core investment strategy.

Potential Impact on Denver's Economy

The growing interest in gold and silver in Denver has several potential impacts on the local economy. It supports local businesses such as coin shops and bullion dealers, creating jobs and generating tax revenue.

Increased demand for precious metals can also attract new businesses and investment to the Denver area. However, it is important to note that the precious metals market can be influenced by global economic factors, and local trends may not always be sustainable.

Overall, the heightened interest in gold and silver reflects a broader trend of investors seeking alternative assets and hedging against economic uncertainties. Whether this trend will continue depends on a variety of factors, including inflation rates, geopolitical stability, and investor sentiment.

As Thompson from Denver Gold & Silver Exchange states, "The market is always changing. But the intrinsic value of gold and silver, and people's desire for security, is a constant."