695 Credit Score Good Or Bad

Imagine you're at a bustling farmer's market, the scent of ripe peaches and freshly baked bread filling the air. You spot a beautiful hand-woven basket, perfect for carrying your treasures. But as you reach for your wallet, a nagging question pops into your head: Will my credit be good enough to finance that future home renovation or a small business loan?

That feeling of uncertainty is familiar to many. A credit score, that three-digit number, wields significant power over our financial lives.

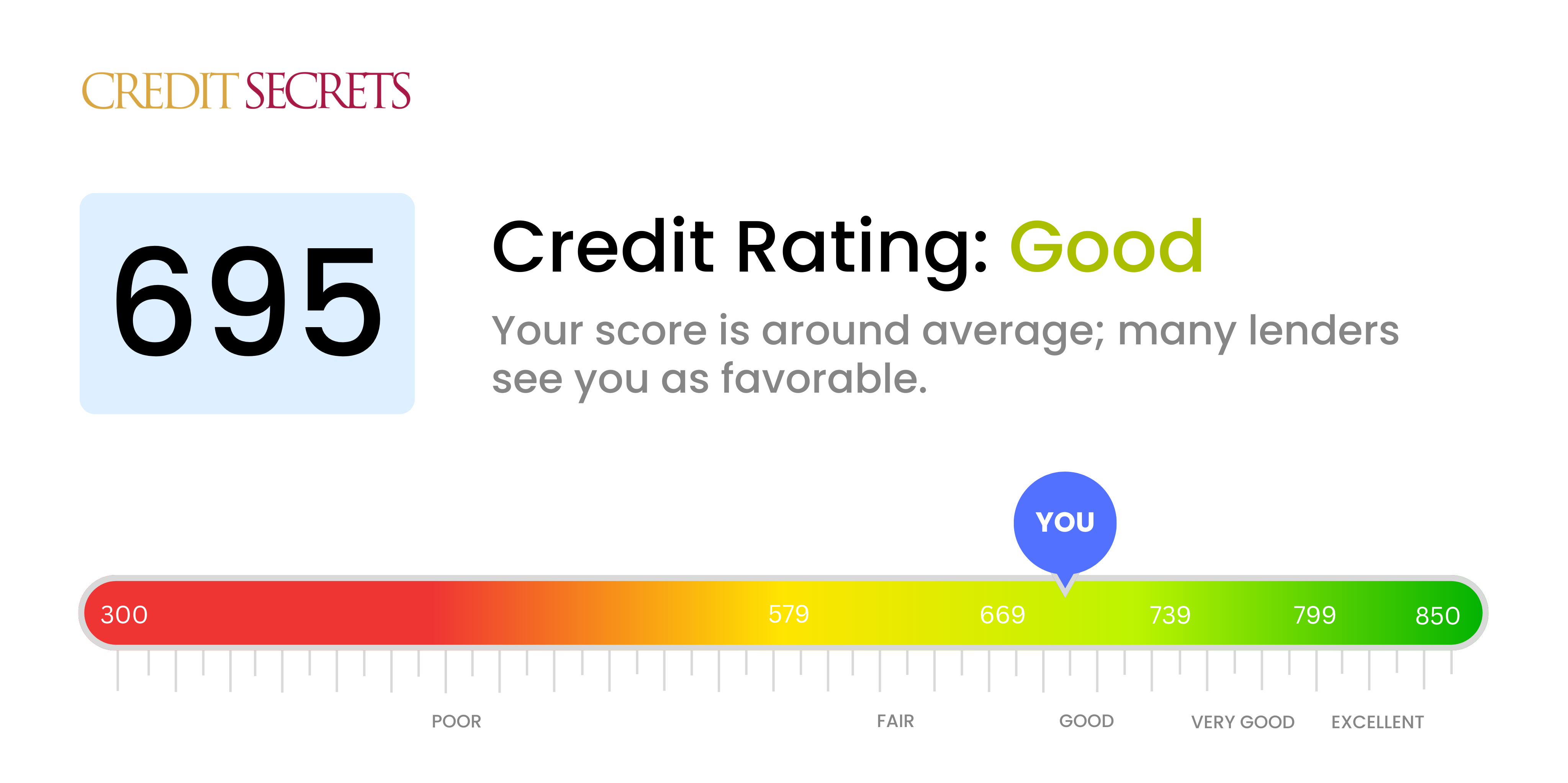

The core question is, "Is a 695 credit score good or bad?"

A 695 credit score is generally considered fair. It's a step above "poor," but it's also shy of being considered "good." This score opens some doors but keeps others firmly shut.

Understanding Credit Scores

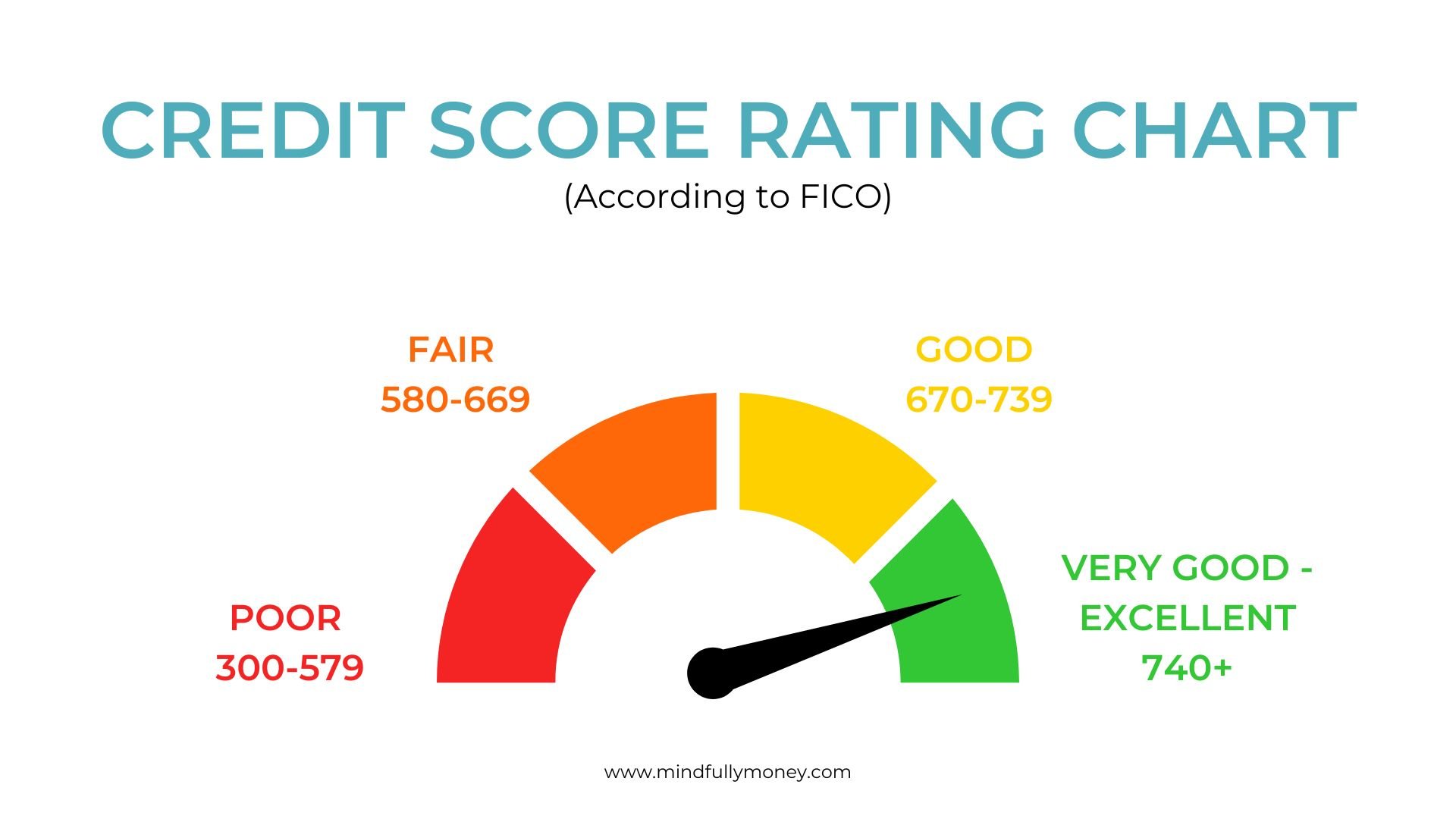

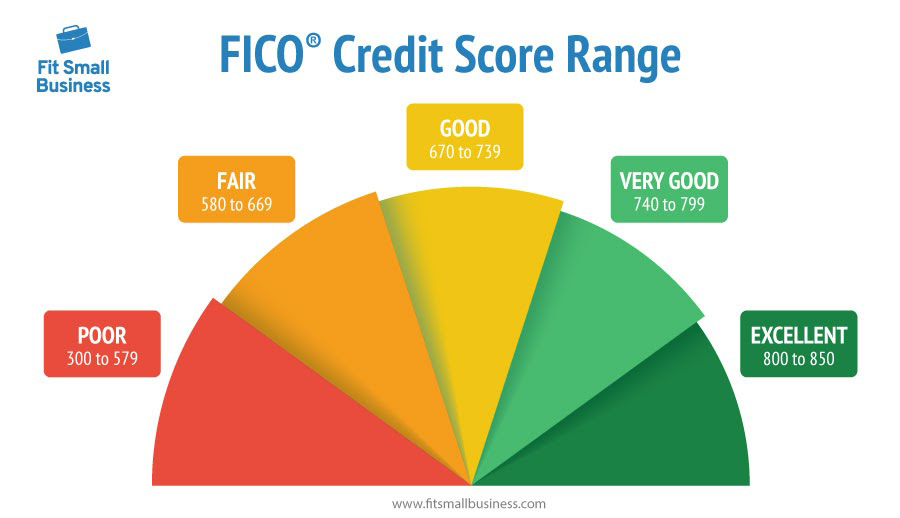

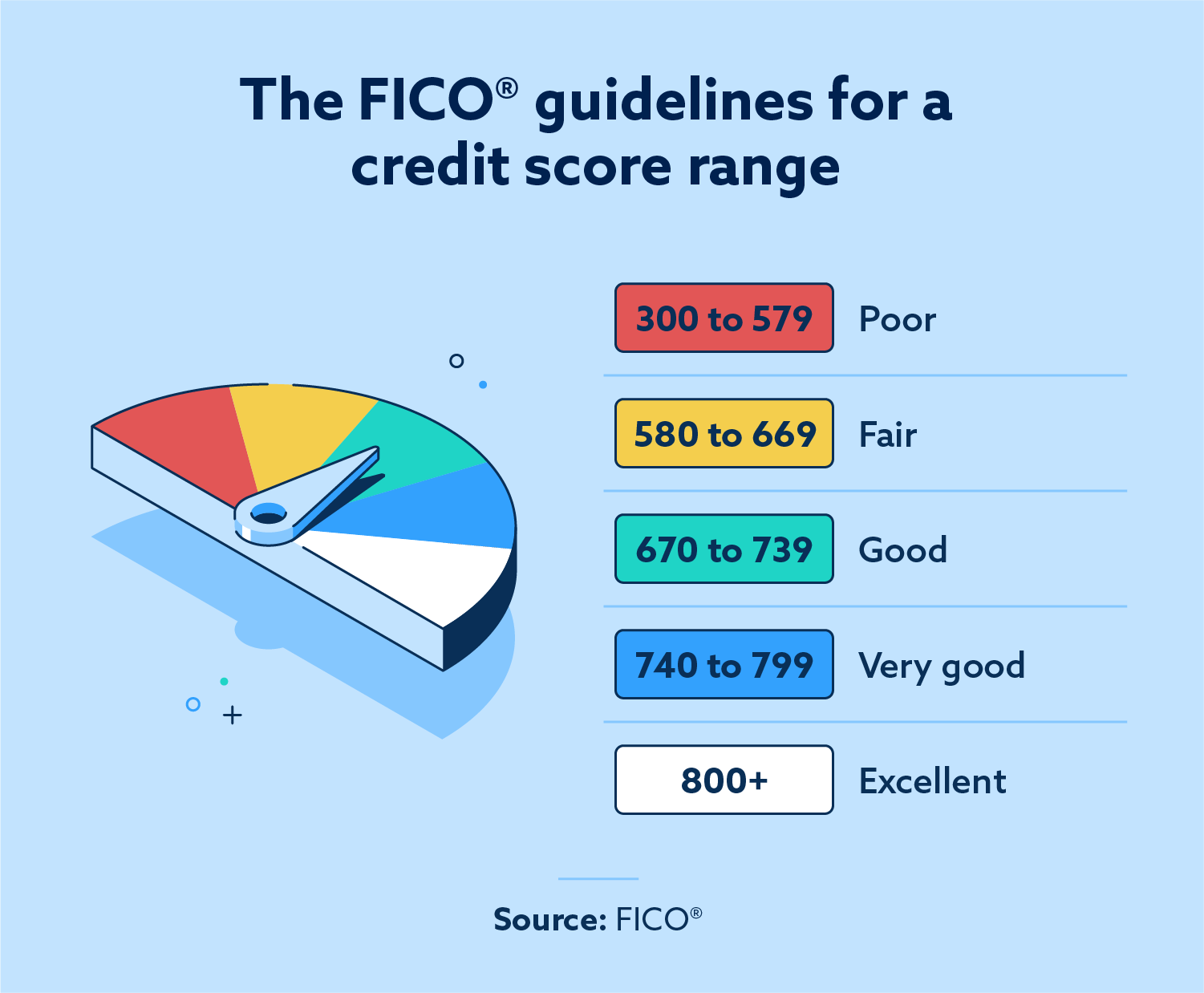

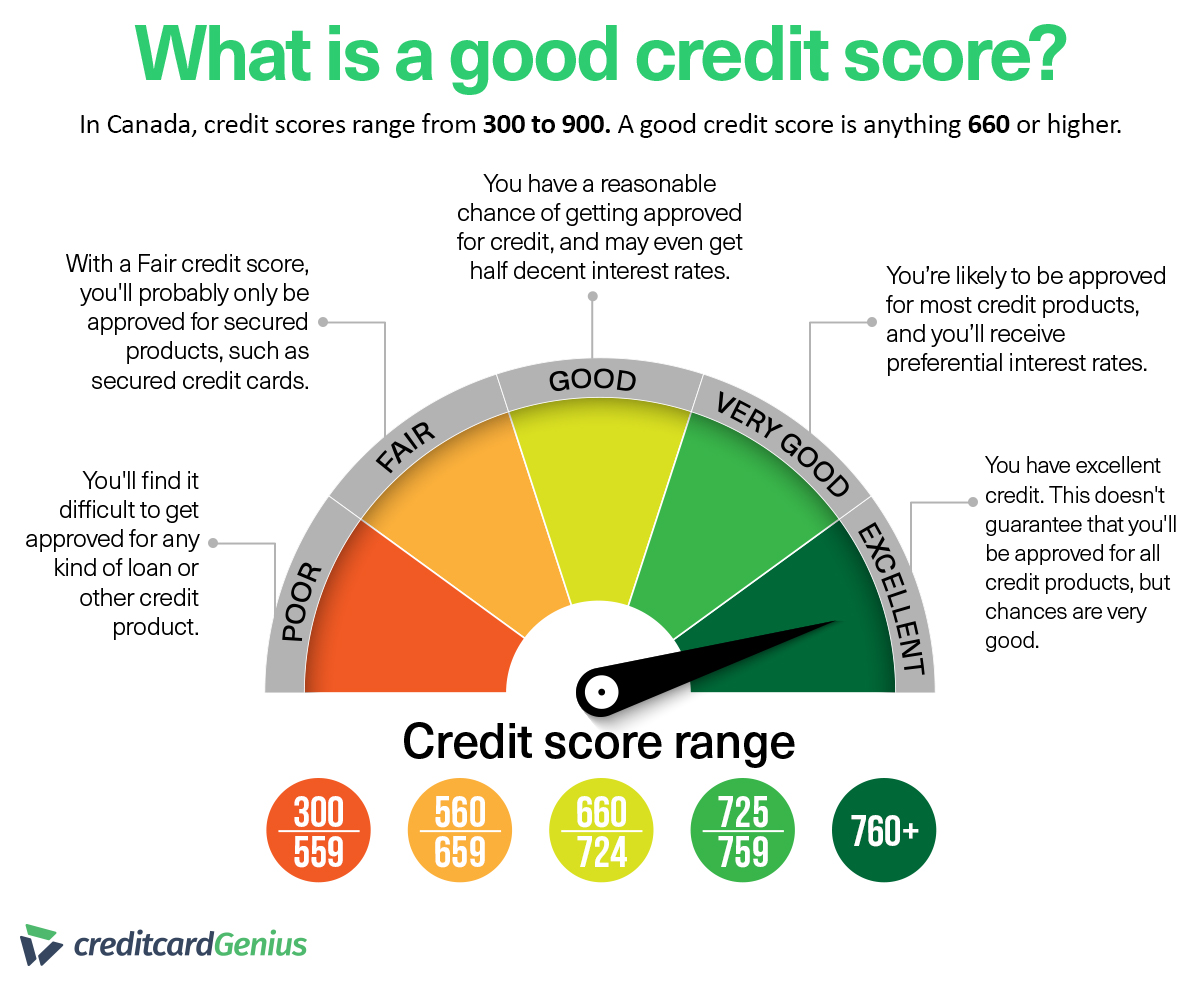

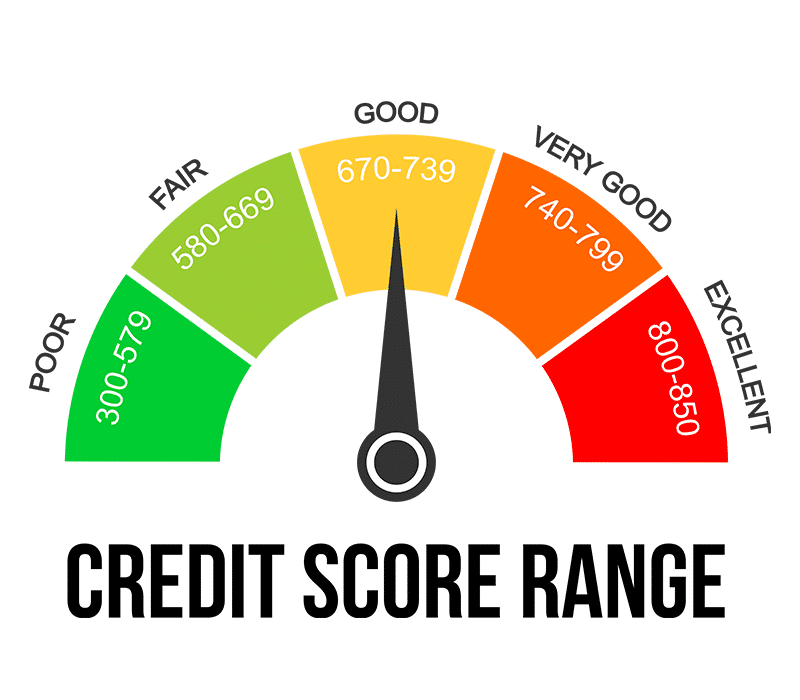

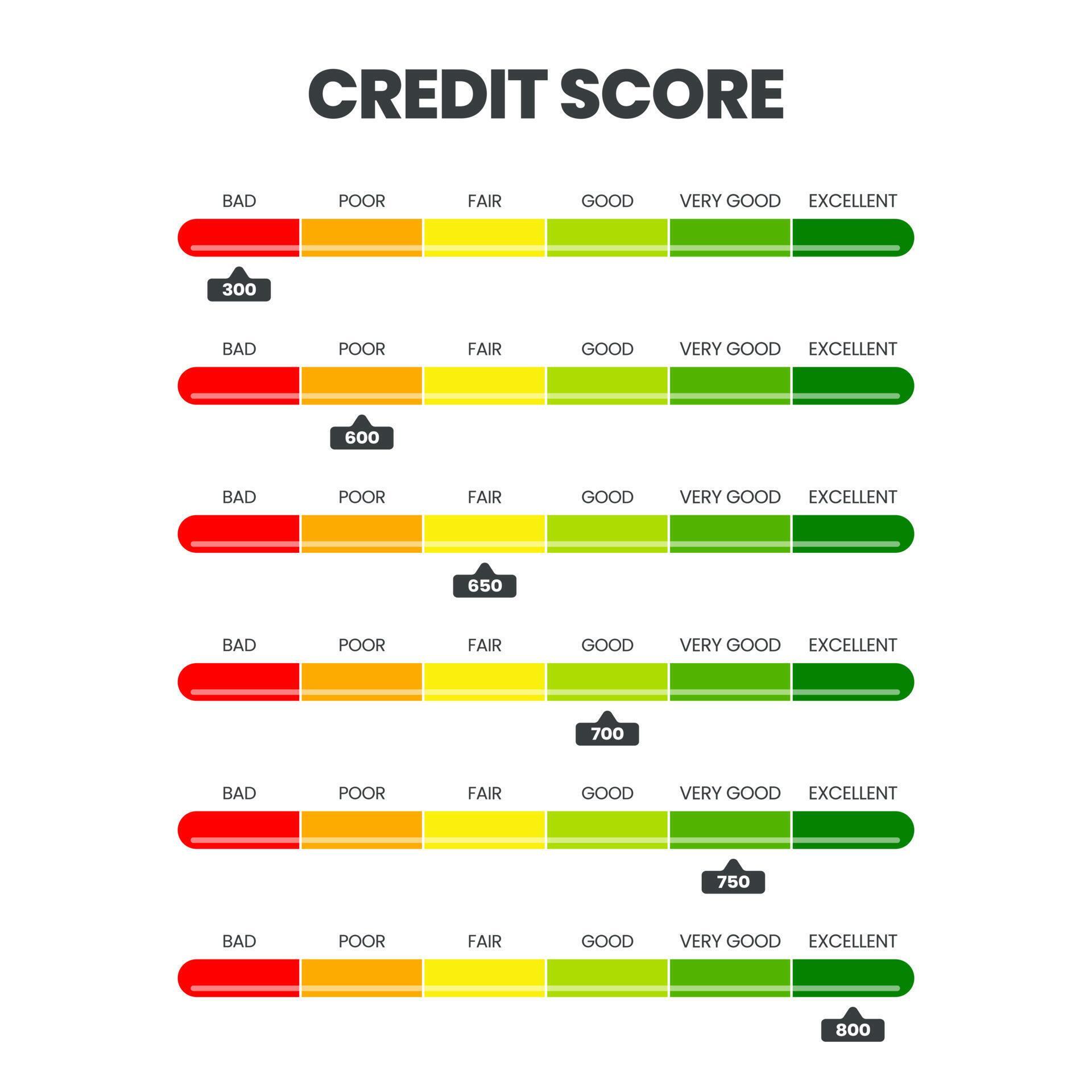

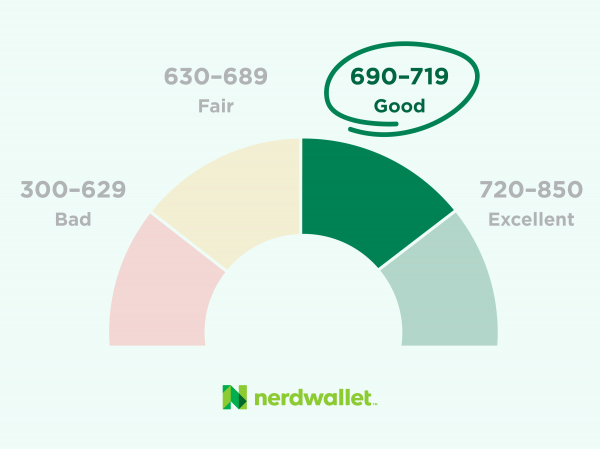

Before delving deeper, let's understand the basics. Credit scores, most commonly FICO scores, range from 300 to 850. These scores are calculated based on your credit history and financial behaviors.

These numbers reflect your creditworthiness and act as an indicator to lenders on how likely you are to repay debt.

What Makes Up a Credit Score?

Several factors influence your credit score. Payment history carries the most weight, accounting for about 35% of your score.

Amounts owed (credit utilization) contributes around 30%, followed by length of credit history (15%), new credit (10%), and credit mix (10%).

Consistently paying bills on time significantly boosts your score. High credit card balances impact the score negatively.

The 695 Score in Context

A 695 credit score places you in a somewhat precarious position. According to Experian, a score between 580 and 669 is considered fair, while a score between 670 and 739 is considered good. A 695 falls right in the middle, leaning towards good but still firmly within the fair range.

Experian states that a fair credit score can limit your options and result in higher interest rates.

The closer one gets to the "good" range the better the benefits one can acquire.

What a 695 Score Means for You

With a 695 score, you may be approved for credit cards and loans, but don't expect the best terms. Expect higher interest rates compared to those with scores in the "good" or "excellent" range.

This higher interest rate can translate to thousands of dollars in extra payments over the life of a loan. Securing a mortgage might also be more challenging or require a larger down payment.

The higher interest rate can significantly impact how much you can afford. It's essential to be aware of these limitations.

The Road to a Better Score

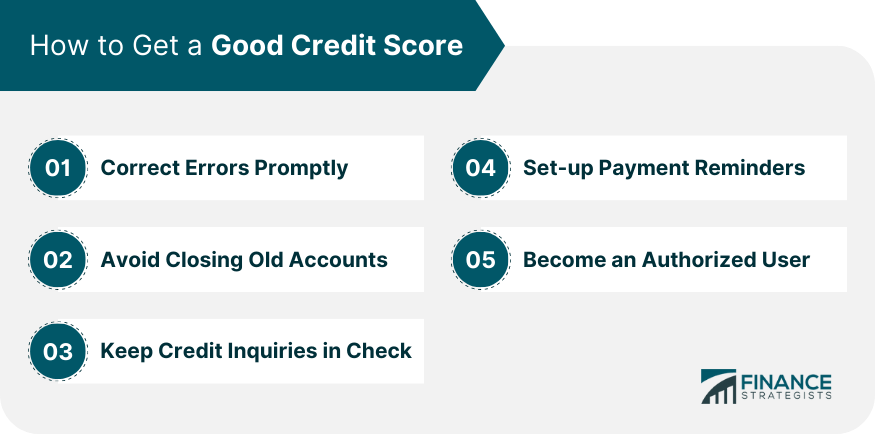

The good news is a 695 score is not a permanent sentence. With diligent effort, you can improve your credit score and unlock better financial opportunities.

Several proven strategies can help.

Strategies for Improvement

Pay bills on time, every time. Set up automatic payments to avoid late fees.

Reduce your credit utilization. Aim to keep your credit card balances below 30% of your credit limit, and ideally below 10%. For example, if your credit limit is $1,000, try to keep your balance below $300.

Check your credit report regularly. Dispute any errors you find, as mistakes can negatively impact your score. You can get a free credit report from each of the three major credit bureaus (Equifax, Experian, and TransUnion) annually through AnnualCreditReport.com.

Avoid opening too many new credit accounts. Each application can trigger a hard inquiry, which can slightly lower your score. Only apply for credit when you truly need it.

Consider becoming an authorized user on someone else's credit card. If the cardholder has a good credit history and pays their bills on time, their positive behavior can reflect on your credit report. Make sure the card issuer reports authorized user activity to the credit bureaus.

Real-Life Scenarios

Let's consider some practical scenarios. Imagine Sarah wants to buy a new car. With a 695 credit score, she might be approved for an auto loan, but the interest rate could be several percentage points higher than someone with a score of 740 or above. This translates to higher monthly payments and more interest paid over the life of the loan.

Similarly, David is applying for an apartment. While he might be approved, the landlord might require a larger security deposit due to his fair credit score. Some landlords use credit scores as part of their tenant screening process.

Therefore, even if you are approved, the price is going to be higher with a lower credit score.

Expert Insights

Financial experts emphasize the importance of understanding your credit score and taking proactive steps to improve it. According to FICO, "Consumers with higher credit scores generally have more access to credit and can secure lower interest rates, which saves them money over time."

Ted Rossman, a senior industry analyst at CreditCards.com, advises, "Focus on the basics: pay your bills on time and keep your credit utilization low. These two factors have the biggest impact on your credit score."

This is what the experts say. You can gain significant improvements by focusing on those two main aspects.

The Psychological Impact

Beyond the tangible financial implications, credit scores can also affect your mental well-being. Constantly worrying about your credit score can cause stress and anxiety. The pressure to maintain a good score can be overwhelming.

Building a healthy relationship with credit involves understanding its power and managing it responsibly. It's not just about chasing a higher number; it's about building a solid financial foundation.

Learning how credit works can make you feel more confident and at ease. By understanding credit, you can avoid stress and be prepared.

Looking Ahead

A 695 credit score is a stepping stone. It's a sign that you're on the right track, but there's room for improvement.

Take it as an opportunity to assess your financial habits and implement positive changes. With patience and persistence, you can elevate your score to the "good" or "excellent" range.

This means better interest rates, more financial freedom, and a greater sense of security.

Conclusion

So, is a 695 credit score good or bad? It's neither. It's fair. It is a sign of progress that points towards a potentially brighter financial future.

By taking proactive steps to improve your credit, you can unlock better opportunities and achieve your financial goals. That beautiful hand-woven basket at the farmer's market? It's within reach, along with so much more.

Remember, your credit score is not a reflection of your worth. It's simply a tool that, when understood and managed effectively, can help you build the life you desire. Keep learning, keep improving, and keep striving for your financial dreams.