Mesp Michigan Education Savings Plan

Lansing, MI – As the cost of higher education continues to rise, many Michigan families are looking for ways to save for their children's future. The Michigan Education Savings Program (MESP) offers a tax-advantaged way to invest for qualified education expenses. This program is designed to help families across the state achieve their educational goals.

The MESP, a 529 college savings plan, provides a flexible and accessible way to save for future education costs. It aims to alleviate the financial burden of higher education. It gives residents the opportunity to invest in their children's or grandchildren's futures.

What is the Michigan Education Savings Program?

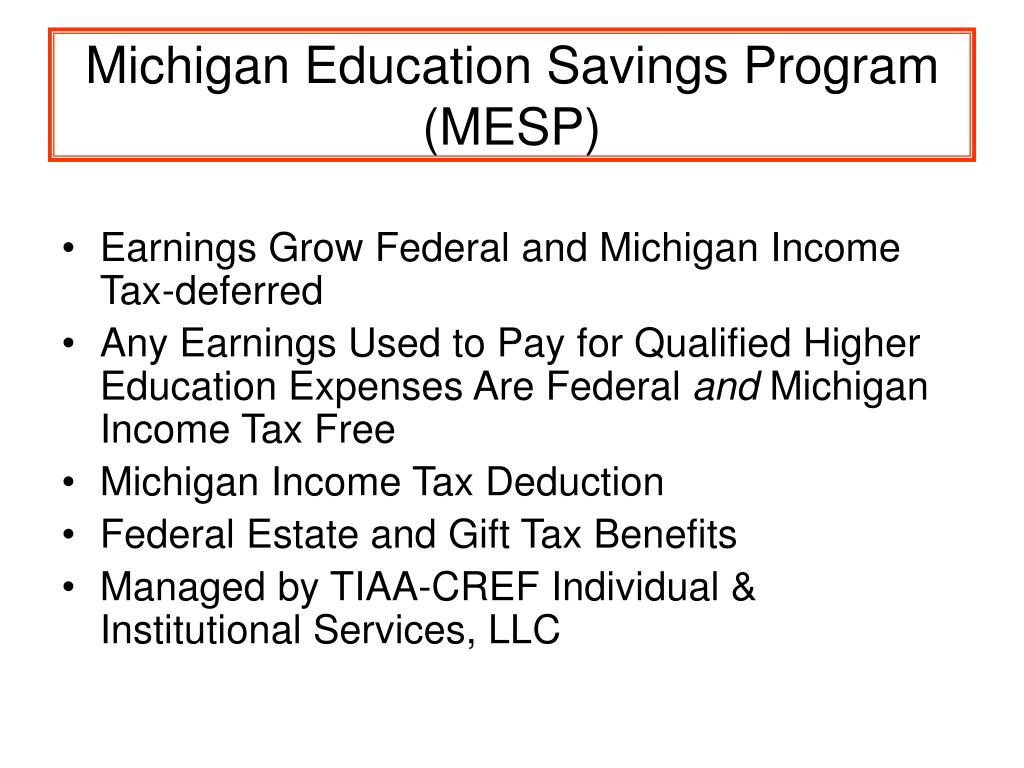

The MESP is a state-sponsored 529 savings plan authorized under Section 529 of the Internal Revenue Code. It allows earnings to grow tax-free. Withdrawals are also tax-free when used for qualified education expenses.

These expenses include tuition, fees, books, supplies, and equipment required for enrollment or attendance at an eligible educational institution. Room and board also qualify, subject to certain limitations.

Key Features and Benefits

One of the key benefits of the MESP is its tax advantages. Contributions may be deductible from Michigan income taxes, up to certain limits, for Michigan taxpayers.

The earnings grow tax-free at the federal level. Withdrawals are also tax-free when used for qualified education expenses, providing significant long-term savings.

The MESP offers a variety of investment options to suit different risk tolerances and investment goals. These range from more conservative options, like savings portfolios, to more aggressive options, like stock index portfolios.

Families can choose the investment strategy that best aligns with their individual circumstances and financial objectives. These strategies also consider the beneficiary's age and the time horizon before college enrollment.

Who Can Participate?

The MESP is open to any U.S. citizen or resident alien with a valid Social Security number or Individual Taxpayer Identification Number. This accessibility makes it a valuable tool for families of all income levels.

Accounts can be opened with a relatively low initial contribution, making it easier for families to start saving early. Anyone can contribute to an MESP account, including grandparents, other relatives, and friends.

Impact on Michigan Families

The rising cost of college can be a significant barrier for many Michigan families. The MESP helps to reduce that burden. It empowers families to proactively plan and save for their children's education.

By utilizing the MESP, families can potentially reduce their reliance on student loans. This mitigates the long-term financial strain associated with debt.

According to the Michigan Department of Treasury, the MESP has helped countless families across the state afford higher education. This is achieved through the strategic utilization of its tax advantages and diverse investment options.

"The Michigan Education Savings Program is an invaluable resource for Michigan families," said State Treasurer Rachael Eubanks in a recent statement. "We encourage all families to explore the benefits of the MESP and take advantage of this opportunity to invest in their children's future."

Furthermore, the MESP isn't solely for traditional four-year colleges. It can also be used for vocational schools and other eligible educational institutions.

This flexibility makes it a versatile savings tool that meets a variety of educational paths and career aspirations. It allows families to cater to their children's unique talents and choices.

Getting Started

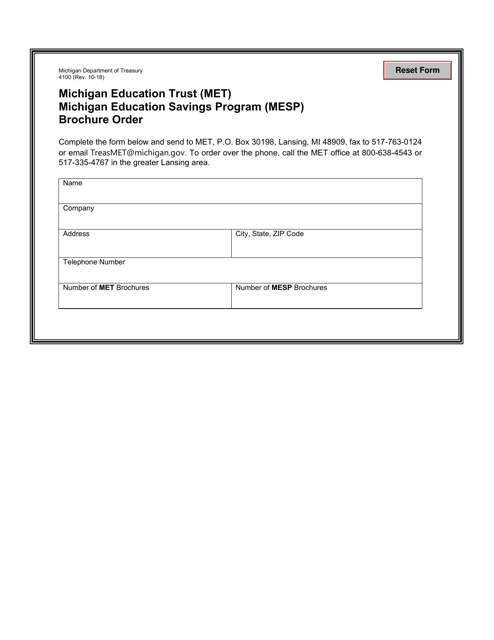

Opening an MESP account is a straightforward process. Interested individuals can visit the official MESP website. They can also request information through the mail.

The website provides comprehensive details about the program, investment options, and enrollment procedures. Potential participants can also use online tools to estimate potential savings based on different contribution levels and investment strategies.

The MESP offers a valuable opportunity for Michigan families to invest in education. By leveraging the program's tax advantages and flexible investment options, families can take a significant step towards securing their children's future.

The program empowers residents to navigate the rising cost of education. It provides a path towards achieving their educational goals.