An Unrealistic Budget Is More Likely To Result When It

A flawed budget process is setting up numerous municipalities for financial hardship. Experts warn that overly optimistic revenue projections and underestimation of expenditures are creating unsustainable fiscal plans across the nation.

This article examines the key factors contributing to unrealistic budget adoption and the potential consequences for communities and taxpayers.

The Anatomy of an Unrealistic Budget

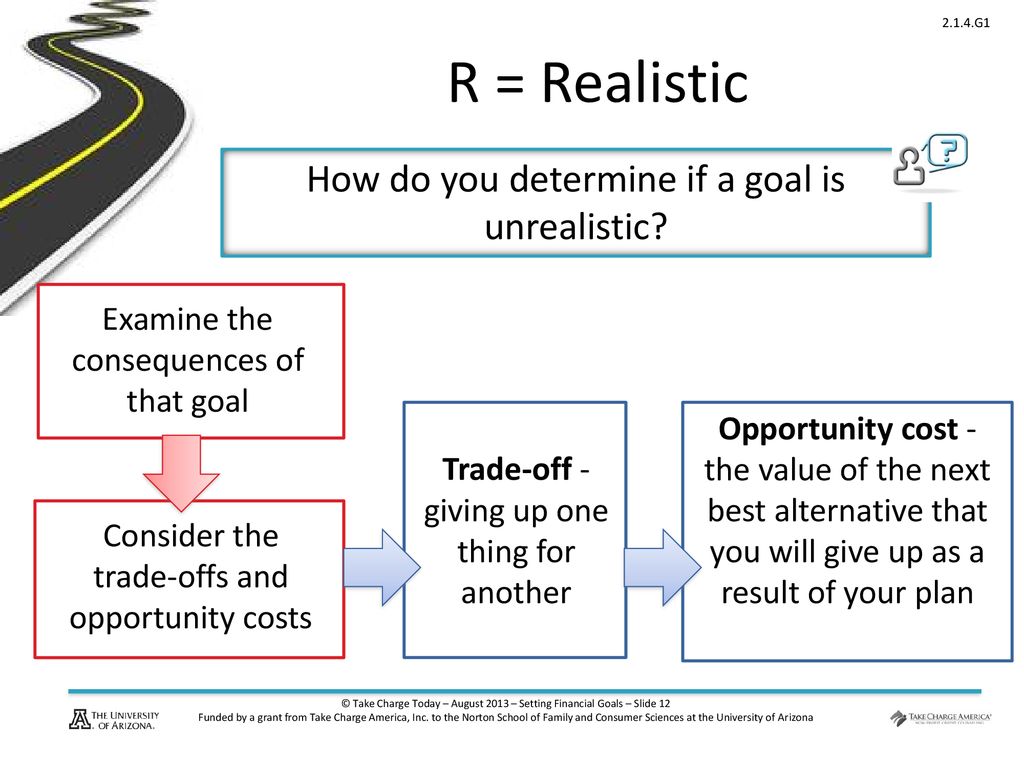

What exactly constitutes an "unrealistic" budget? At its core, it's a financial plan detached from plausible economic realities.

Budgets become unrealistic when they rely on overly optimistic revenue forecasts. This is often fueled by a desire to avoid difficult decisions like raising taxes or cutting services. The National League of Cities frequently cautions against such practices.

Simultaneously, underestimating expenditures is a common tactic. This can involve minimizing projected costs for personnel, infrastructure maintenance, or unforeseen emergencies. The Government Finance Officers Association (GFOA) stresses the importance of accurate cost assessment.

Factors Contributing to Budgetary Fantasies

Several factors contribute to the adoption of unrealistic budgets. One significant driver is political pressure to maintain popular programs without raising taxes.

Elected officials often face pressure from constituents to avoid unpopular choices. This can lead to a reluctance to acknowledge potential budget shortfalls.

A lack of transparency in the budgeting process also plays a role. When budget information is difficult to access or understand, it can obscure potential problems.

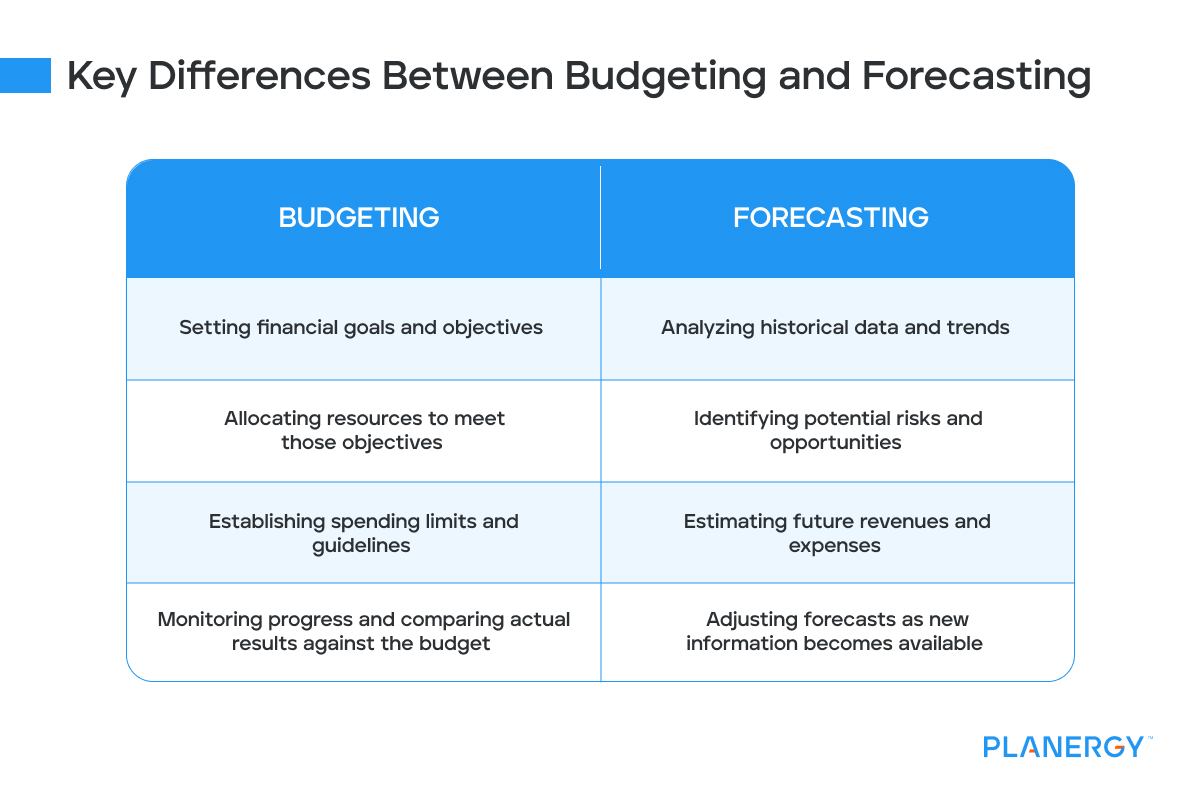

Inadequate data and analysis also contribute to flawed projections. Without reliable economic forecasts and accurate historical data, budgeting becomes guesswork.

The Consequences of Unrealistic Budgets

The consequences of adopting an unrealistic budget can be severe. Short-term, it may provide a temporary illusion of fiscal stability.

However, in the long run, it inevitably leads to budget deficits. These deficits can force drastic cuts to essential services like education, public safety, and infrastructure.

Borrowing becomes necessary to cover shortfalls, increasing debt burden. This adds further strain on future budgets and potentially leading to fiscal crisis.

Detroit's 2013 bankruptcy, while complex, highlighted how long-term reliance on unrealistic revenue projections and deferred maintenance contributed to a monumental financial collapse.

Who is Affected?

The consequences of unrealistic budgets are felt most acutely by residents. Reduced services directly impact their quality of life.

Taxpayers ultimately bear the burden of covering budget deficits. This can take the form of increased taxes, fees, or reduced property values.

Municipal employees also face potential job losses or wage freezes. Uncertainty can destabilize their lives and reduce morale.

According to the Center on Budget and Policy Priorities, these impacts disproportionately affect low-income communities.

Where is this Happening?

This isn't an isolated problem; it's a widespread phenomenon. Municipalities across the country are grappling with the challenges of creating realistic budgets.

States with volatile revenue streams, such as those heavily reliant on oil or tourism, are particularly vulnerable. Economic downturns can swiftly expose flaws in their budget projections.

Even seemingly stable communities can fall victim to unrealistic budgeting. Mismanagement and lack of oversight can erode financial stability over time.

When is this Happening?

The problem is particularly acute during times of economic uncertainty. Periods of recession, inflation, or rapid technological change make accurate forecasting even more difficult.

The COVID-19 pandemic highlighted the vulnerability of many municipal budgets. Unexpected revenue declines forced many cities to make difficult decisions.

The current inflationary environment poses a significant challenge. Rising costs for goods and services are straining budgets across the board.

How can this be avoided?

Adopting more realistic budgeting practices is essential. The GFOA advocates for transparent and data-driven budgeting processes.

Independent budget reviews can provide an objective assessment. Engaging external experts can help identify potential problems early on.

Building reserves for unforeseen circumstances is crucial. A healthy "rainy day fund" can cushion the blow of unexpected economic shocks.

Focus on long-term fiscal sustainability, not just short-term political gains. Prudent financial management requires discipline and a willingness to make tough choices.

Next Steps and Ongoing Developments

Several organizations are working to promote better budgeting practices. The GFOA offers training and resources for municipal finance officers.

The National League of Cities advocates for policies that support fiscal responsibility at the local level.

Ongoing monitoring of municipal finances is essential. Early detection of budget problems can prevent them from escalating into full-blown crises.