Buying A New Car After Total Loss Bad Credit

The twisted metal and shattered glass are gone, but the financial wreckage of a totaled car lingers, especially for those with already-bruised credit scores. Replacing essential transportation becomes an urgent necessity, yet the path to a new vehicle is fraught with challenges when bad credit collides with the need for a new loan.

This article examines the difficulties faced by individuals with bad credit attempting to purchase a car after a total loss. It delves into the higher interest rates, stricter loan terms, and limited vehicle options that define this challenging financial landscape. We will also explore strategies for securing financing, rebuilding credit, and making informed decisions to avoid further financial hardship, drawing on expert advice and industry data to provide a comprehensive overview.

The Double Whammy: Total Loss and Bad Credit

A total loss car accident can send anyone's finances spiraling. For those with pre-existing credit issues, the situation is significantly compounded.

A low credit score signals increased risk to lenders, resulting in higher interest rates and potentially smaller loan amounts. This means more money spent on interest over the life of the loan and potentially limited choices in the type of vehicle you can afford.

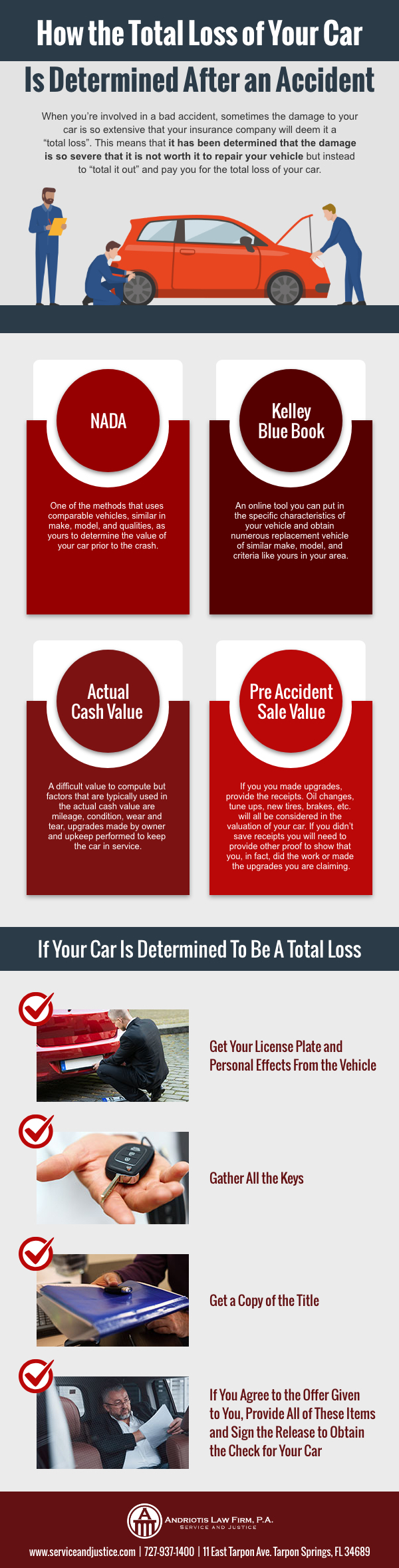

Insurance Settlements: A Starting Point, Not a Solution

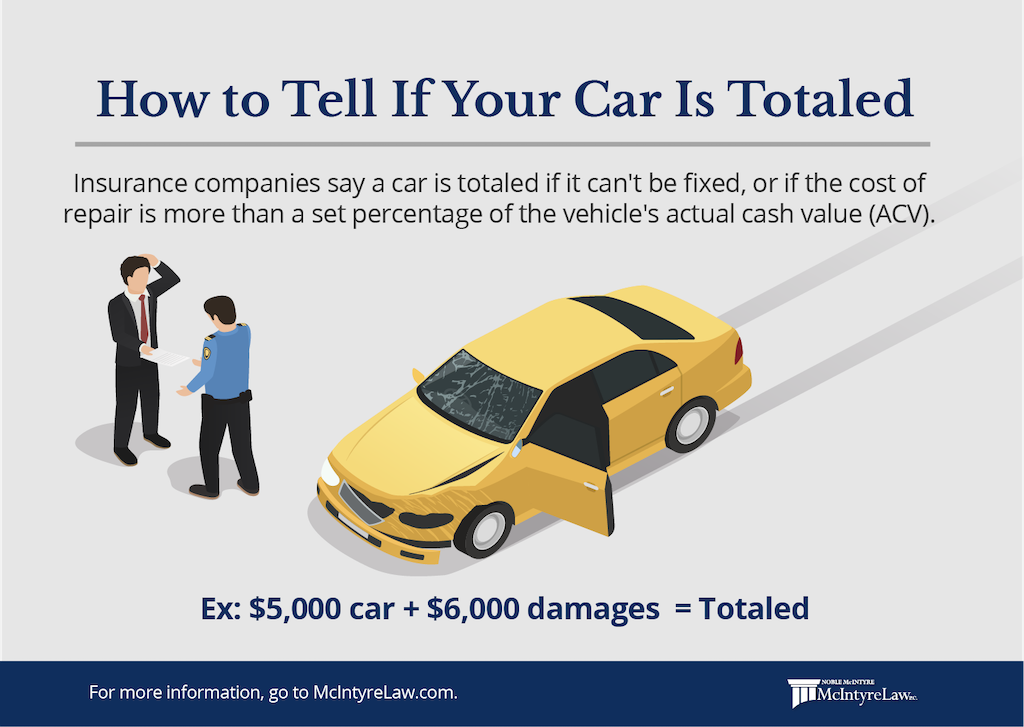

While an insurance settlement offers some relief after a total loss, it rarely covers the full cost of a replacement vehicle, especially factoring in rising car prices.

Kelly Blue Book data shows that average used car prices remain elevated compared to pre-pandemic levels, requiring many to seek additional financing to bridge the gap.

The settlement might be further reduced by outstanding loan balances on the totaled vehicle, leaving even less for a down payment on a new car.

Navigating the Loan Application Process

Securing a car loan with bad credit requires careful preparation and a realistic understanding of available options.

Experian reports that average interest rates for borrowers with subprime credit scores are significantly higher than those with excellent credit.

Consider these strategies to improve your chances of approval and secure more favorable terms.

Shop Around and Compare Offers

Don't settle for the first offer you receive. Compare rates and terms from multiple lenders, including banks, credit unions, and online lenders specializing in bad credit car loans.

Websites like Bankrate and NerdWallet allow you to compare rates from different lenders side-by-side, streamlining the process.

Increase Your Down Payment

A larger down payment reduces the loan amount, lowering the risk for the lender and potentially securing better interest rates.

Even a small increase in your down payment can significantly impact your monthly payments and overall loan cost.

Consider a Co-Signer

A co-signer with good credit can vouch for your ability to repay the loan, increasing your chances of approval and potentially securing better terms.

Be aware that the co-signer is equally responsible for the loan, so choose someone you trust and who understands the risks involved.

Beyond the Loan: Making Smart Vehicle Choices

Choosing the right vehicle is just as important as securing financing. Opting for a more affordable and reliable model can save you money in the long run and reduce the risk of future mechanical issues.

Consumer Reports provides reliability ratings for various makes and models, helping you identify vehicles with a lower risk of breakdowns.

Consider purchasing a certified pre-owned (CPO) vehicle, which typically comes with a warranty and has undergone a thorough inspection.

Rebuilding Credit After a Total Loss

A total loss can negatively impact your credit score, but it also presents an opportunity to rebuild your credit through responsible financial management.

Making timely payments on your new car loan is crucial for improving your credit history.

Consider using a secured credit card or credit-builder loan to further establish a positive payment history and demonstrate your creditworthiness to lenders.

Monitor Your Credit Report Regularly

Check your credit report regularly for errors and inaccuracies that could be negatively impacting your score.

You are entitled to a free copy of your credit report from each of the three major credit bureaus (Equifax, Experian, and TransUnion) annually at AnnualCreditReport.com.

Dispute any errors you find with the credit bureaus to ensure your credit report accurately reflects your financial history.

The Road Ahead: Financial Planning and Prevention

Buying a car after a total loss with bad credit is undoubtedly challenging, but with careful planning and proactive financial management, it is possible to secure reliable transportation and rebuild your credit.

Focus on improving your credit score, saving for a down payment, and making informed vehicle choices to minimize your financial burden.

Consider increasing your insurance coverage in the future to avoid being underinsured in the event of another accident. Remember, consulting with a financial advisor can provide personalized guidance tailored to your specific circumstances.

:max_bytes(150000):strip_icc()/can-i-keep-my-total-loss-car-527114_V1-e901dc89329741e9ab8be7eaf152ee9f.png)