Can 941 X Be Filed Electronically

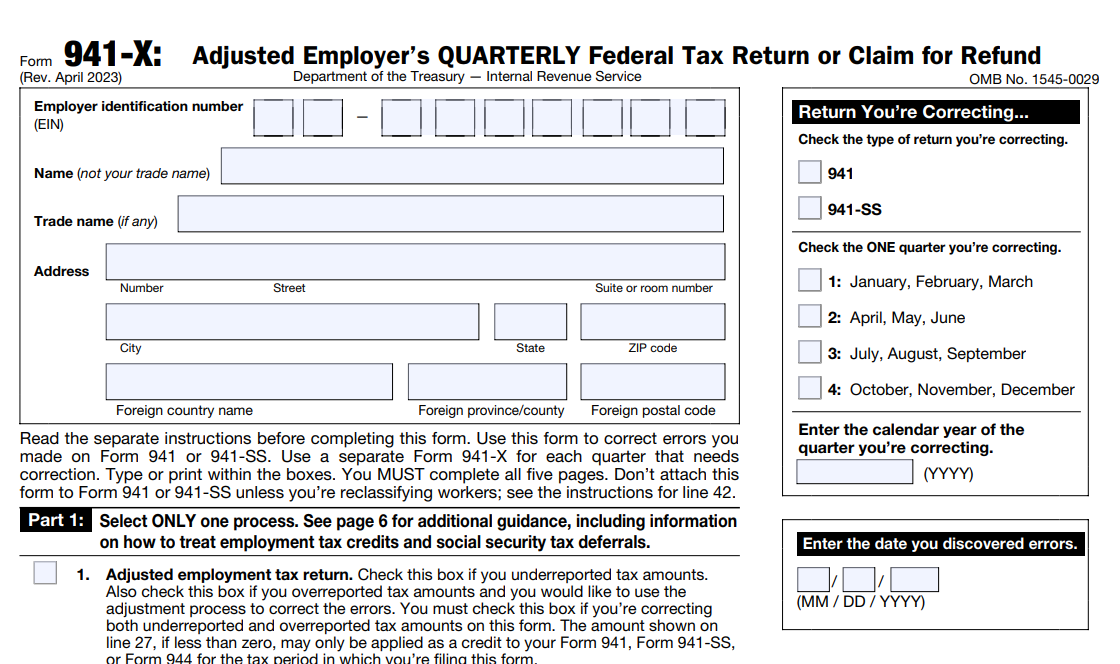

Urgent alert: Employers facing the Q4 2023 deadline for Form 941-X must be aware of critical changes regarding electronic filing. The IRS is mandating e-filing for many, impacting how businesses correct employment tax errors.

This shift necessitates immediate action for businesses previously filing 941-X via paper, demanding a swift understanding of the new rules to avoid penalties.

Mandatory E-filing: Who is Affected?

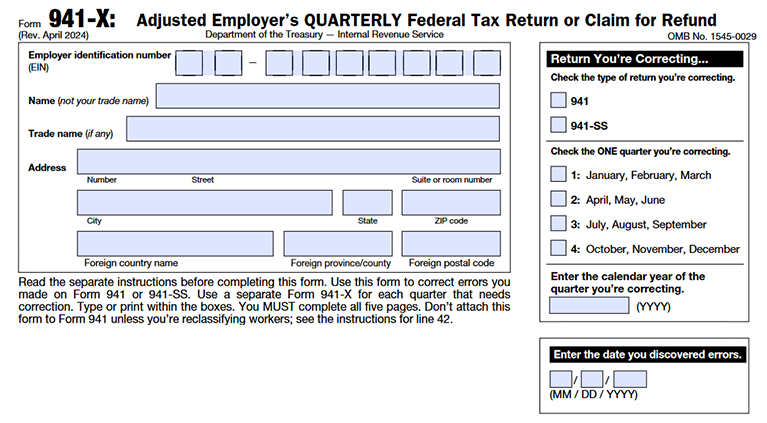

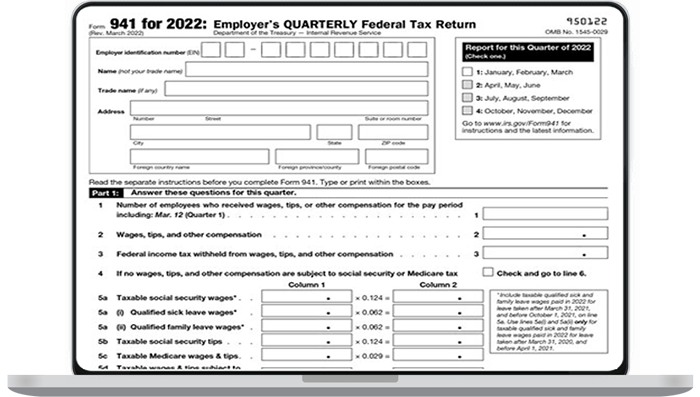

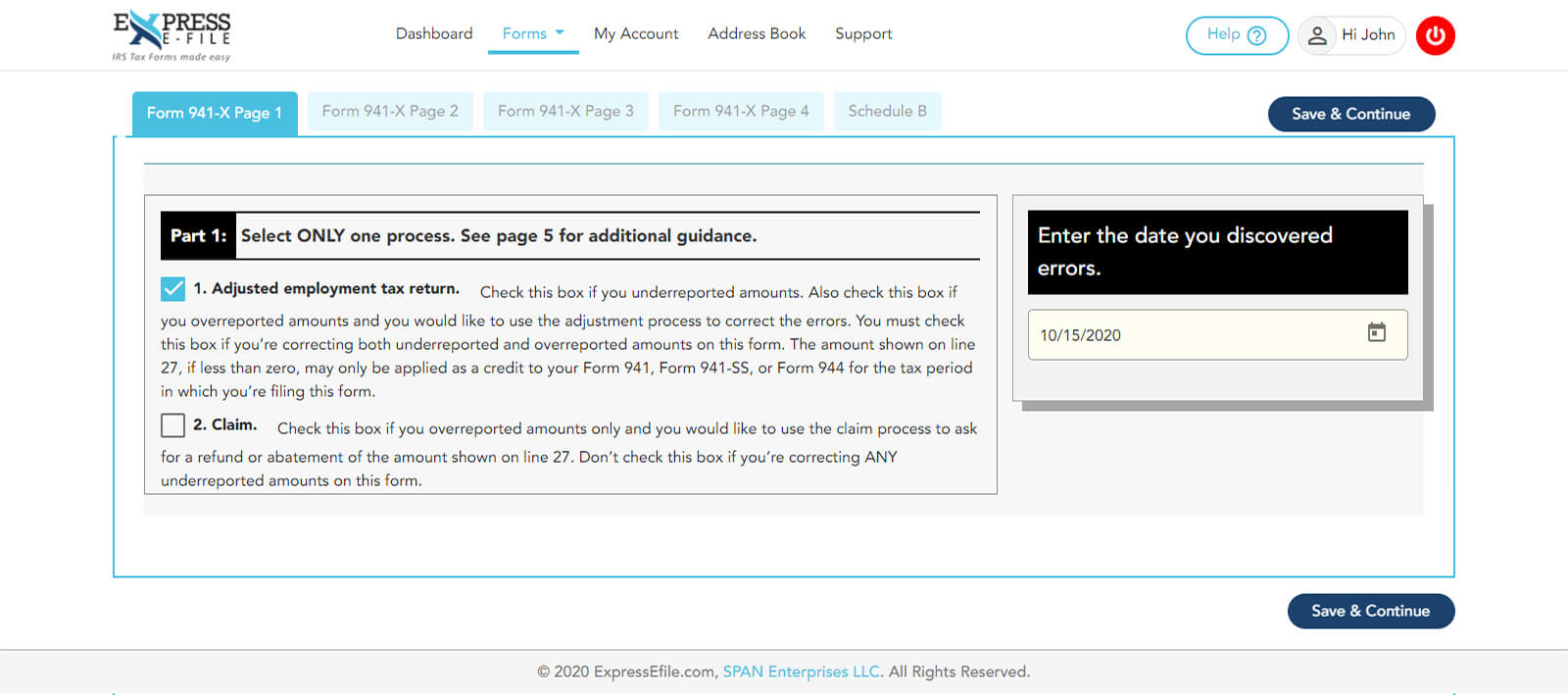

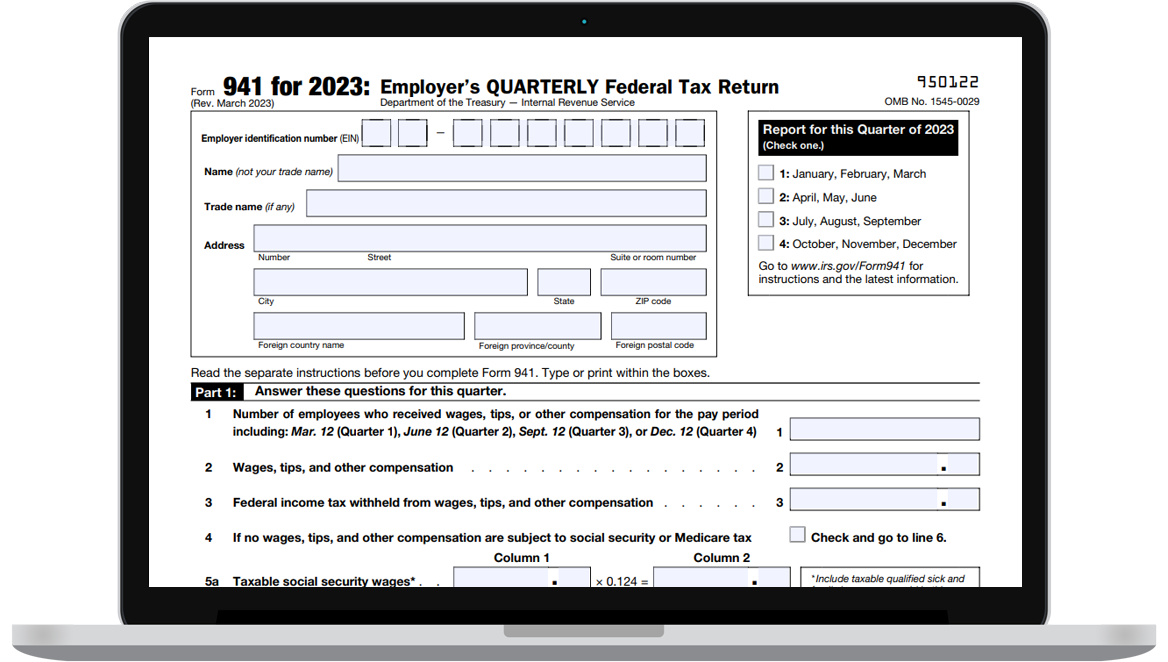

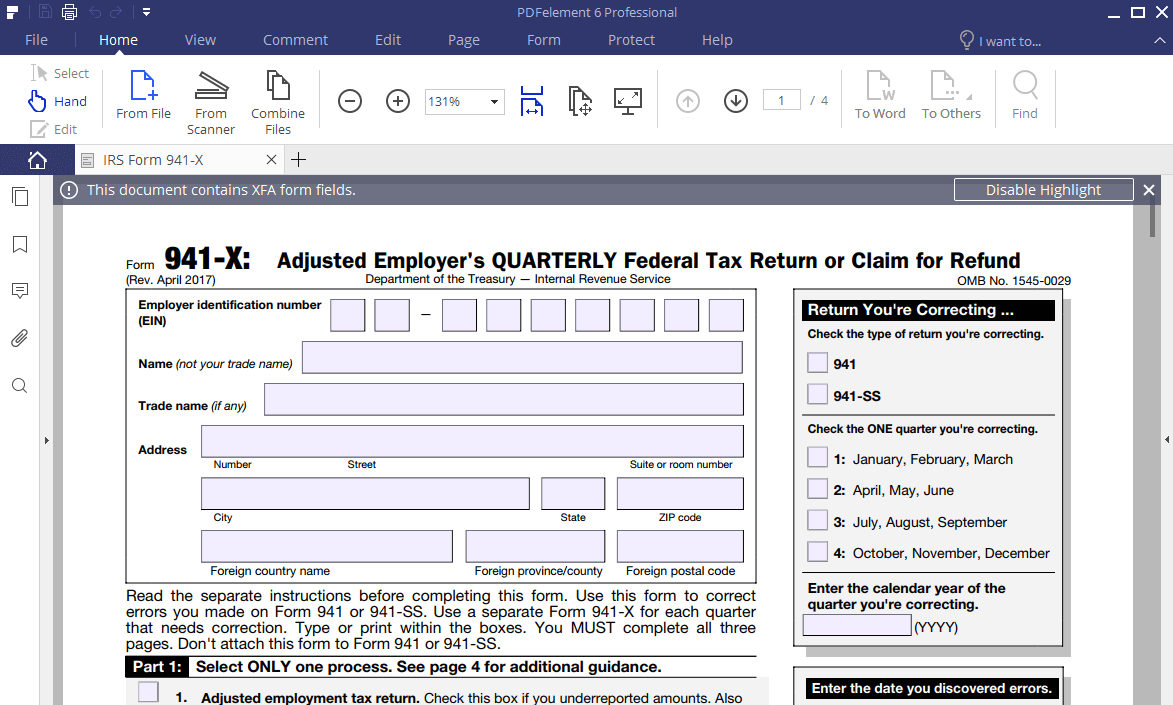

The IRS finalized regulations requiring most employers to electronically file Form 941-X, Adjusted Employer's Quarterly Federal Tax Return or Claim for Refund. This applies if you file at least 10 returns of any type during the calendar year.

Specifically, counting includes information returns such as Form 1099 series, Form W-2 series, and other forms like Form 1095-B. If you exceed this threshold, e-filing 941-X is compulsory.

Penalties may be incurred for failing to comply with the e-filing mandate if your business exceeds the filing threshold. You must file electronically unless an exception applies.

Exceptions to E-filing: Are You Exempt?

Certain exceptions exist that allow for paper filing of Form 941-X. Businesses operating under a religious exemption or facing undue hardship may qualify.

To claim an undue hardship, file Form 8508, Request for Waiver From Filing Information Returns Electronically, with the IRS. This must be approved *before* the filing deadline.

A rejection for hardship relief necessitates immediate compliance with e-filing requirements. It is critical to submit the form well in advance of the deadline to avoid penalties if filing electronically is necessary.

E-filing Methods: How to Comply

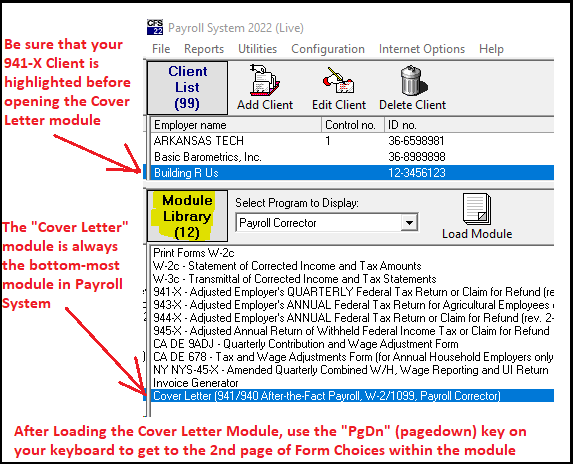

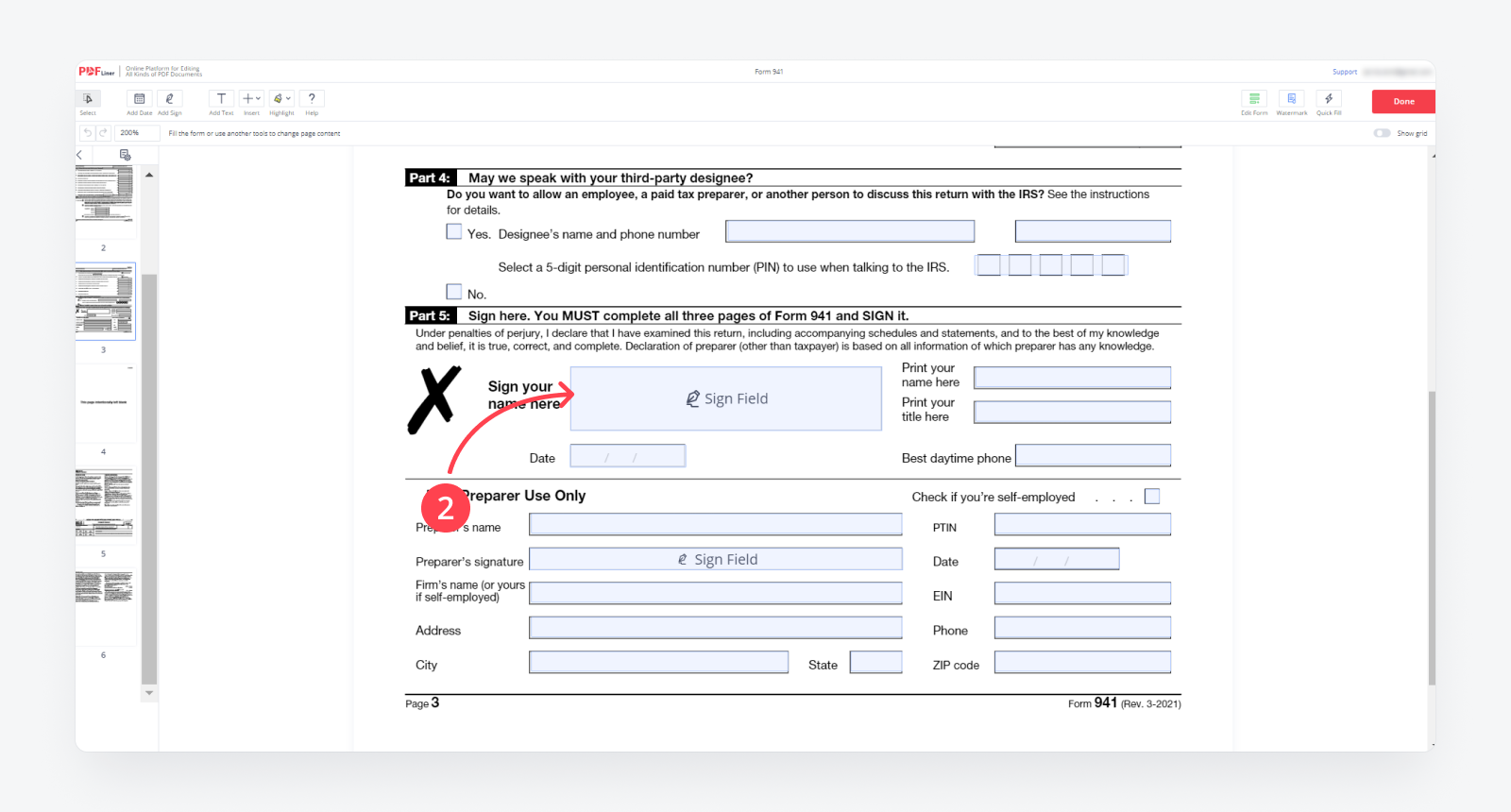

The IRS provides several methods for electronically filing Form 941-X. Employers can use IRS-approved software or enlist the services of an authorized e-file provider.

A list of approved software and providers can be found on the IRS website. Choose a method that best suits your business size and technical capabilities.

Ensure your chosen method supports the latest IRS specifications for 941-X. Carefully review all data before submission to avoid errors that could trigger audits.

Key Deadlines and Filing Considerations

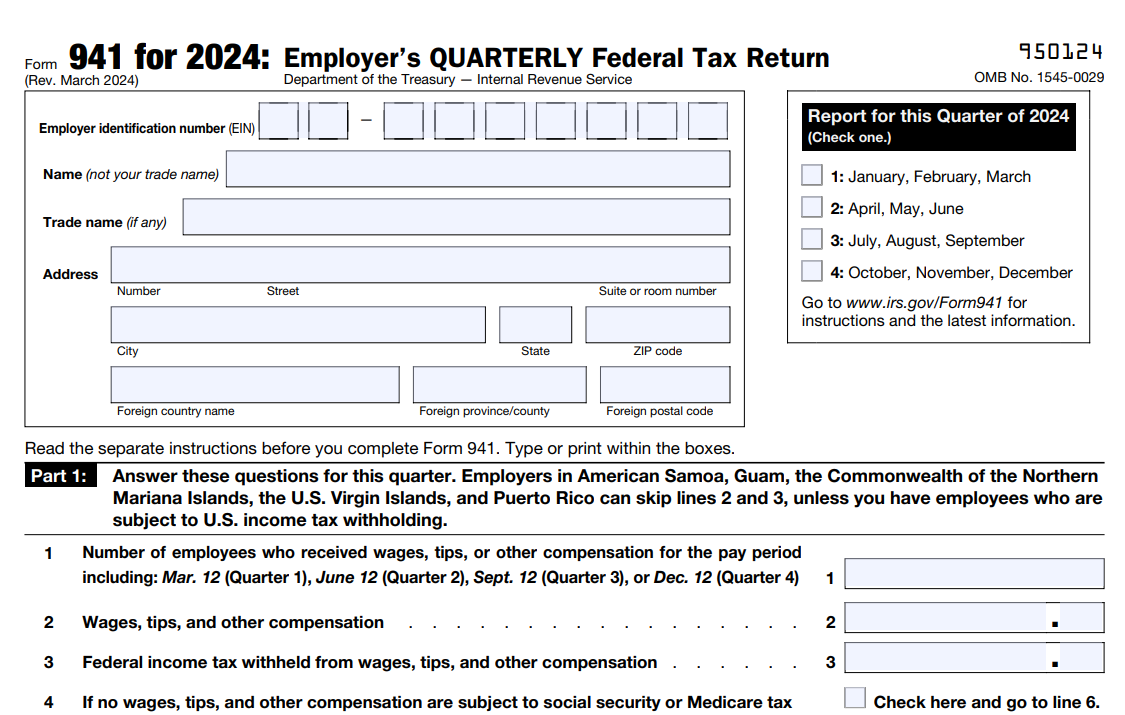

The deadline for filing Form 941-X generally aligns with the deadlines for the corresponding Form 941 quarter being adjusted. Be aware of these dates to avoid late filing penalties.

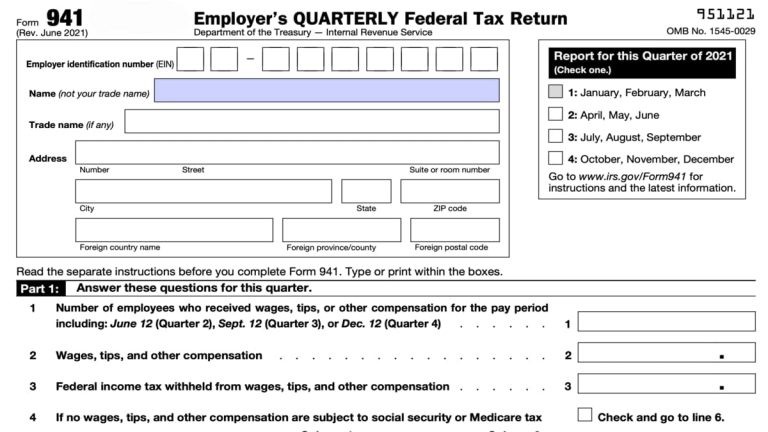

Carefully reconcile your corrected figures with the original Form 941. Ensure accuracy in all data fields, as discrepancies can trigger scrutiny from the IRS.

Keep electronic records of all filed forms and supporting documentation. This is crucial for audit defense and future reference. Consult the IRS website for specific record-keeping requirements.

The Impact on Businesses: A Call to Action

These new e-filing requirements represent a significant shift for many businesses. Immediate action is needed to understand the rules and ensure compliance for the upcoming Q4 2023 filings.

Businesses should assess their filing volume and determine if they are subject to the e-filing mandate. If so, secure appropriate software or engage an e-file provider without delay.

Consult with a tax professional for guidance on navigating these changes. Understanding the complexities of Form 941-X e-filing is crucial for minimizing risk and maintaining compliance with IRS regulations.

Next Steps for Employers

The IRS is expected to release further guidance on these changes in the coming weeks. Stay updated by regularly checking the IRS website and subscribing to IRS e-newsletters.

Consider attending IRS webinars or workshops on employment tax topics. These sessions offer valuable insights and practical advice for complying with federal tax requirements.

Failure to comply with the new e-filing rules could result in penalties. Proactive action is vital to ensure your business remains compliant and avoids potential financial repercussions.

![Can 941 X Be Filed Electronically Form 941 X: Instructions, Purpose, Complete, File [2024]](https://www.realcheckstubs.com/storage/posts/form-941-x-instructions.jpg)