How Do I Check My Checking Account Balance

Imagine the gentle hum of your refrigerator, the soft glow of a lamp illuminating your kitchen table. You're about to pay a bill, maybe treat yourself to that long-awaited new book, or simply ensure you have enough for groceries this week. But a nagging question lingers: “How much is actually in my account?” This feeling of uncertainty is all too familiar, but fortunately, checking your checking account balance has never been easier.

This article will guide you through the various methods available to check your checking account balance, ensuring you stay informed and in control of your finances. We'll explore traditional methods like visiting a bank and using ATMs, as well as modern digital options like online banking and mobile apps. Knowing how to access this information is a cornerstone of responsible financial management.

Traditional Methods: The Familiar Routes

Visiting a Bank Branch

The most traditional method involves a trip to your local bank branch. Speaking directly with a teller provides immediate access to your account information. This can be particularly reassuring for those who prefer a personal touch and face-to-face interaction.

Using an ATM

Automated Teller Machines (ATMs) offer a convenient way to check your balance 24/7. Simply insert your debit card, enter your PIN, and select the “Balance Inquiry” option. Remember to be mindful of potential fees if you’re using an ATM outside of your bank's network.

Modern Convenience: Digital Banking

Online Banking: Your Virtual Branch

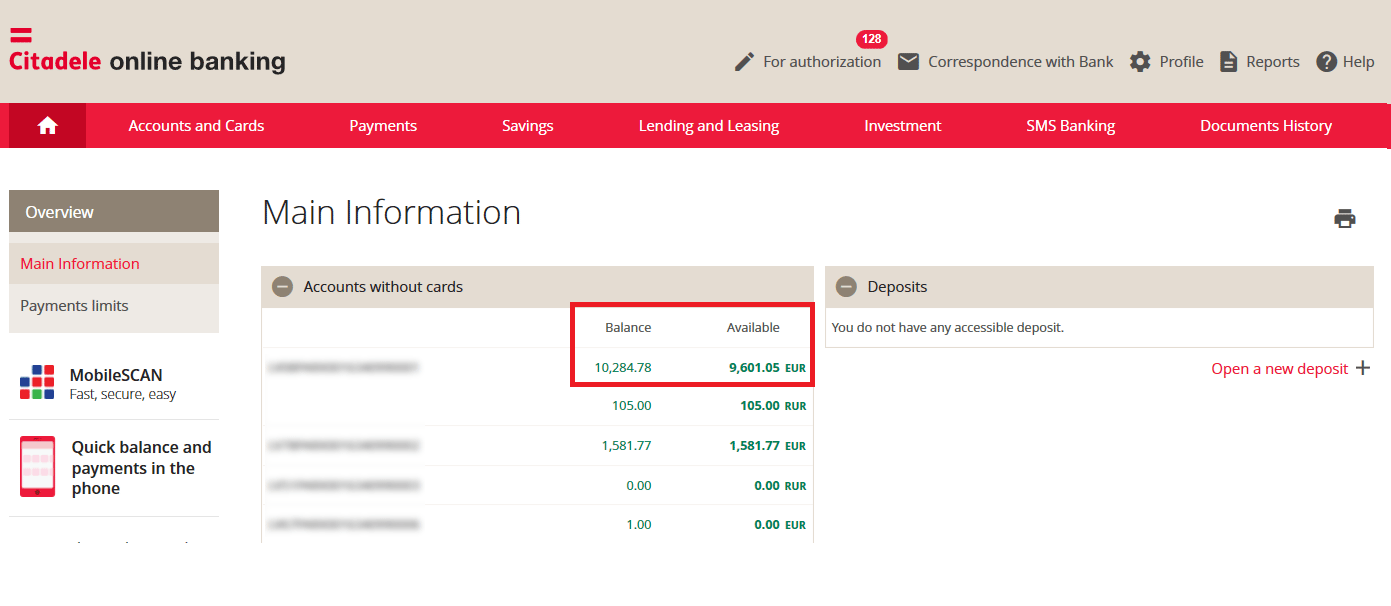

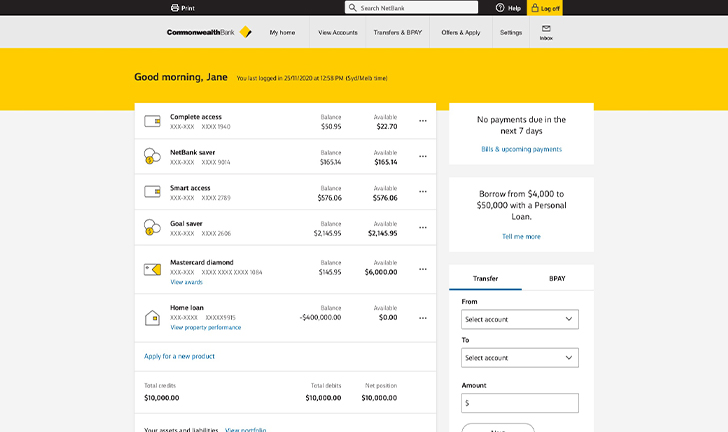

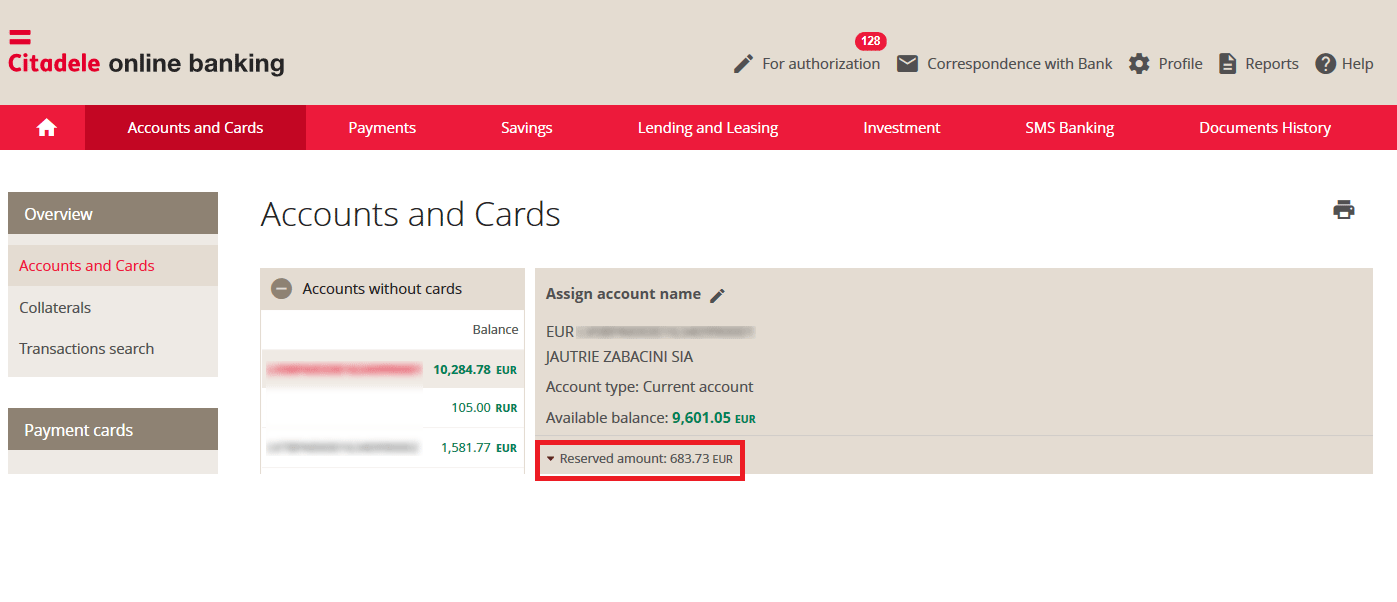

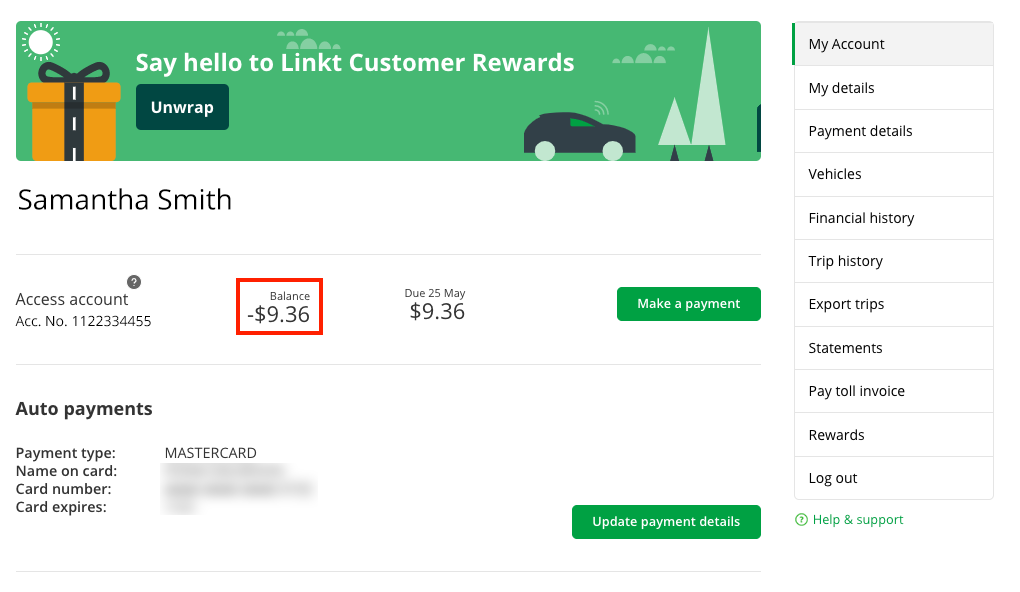

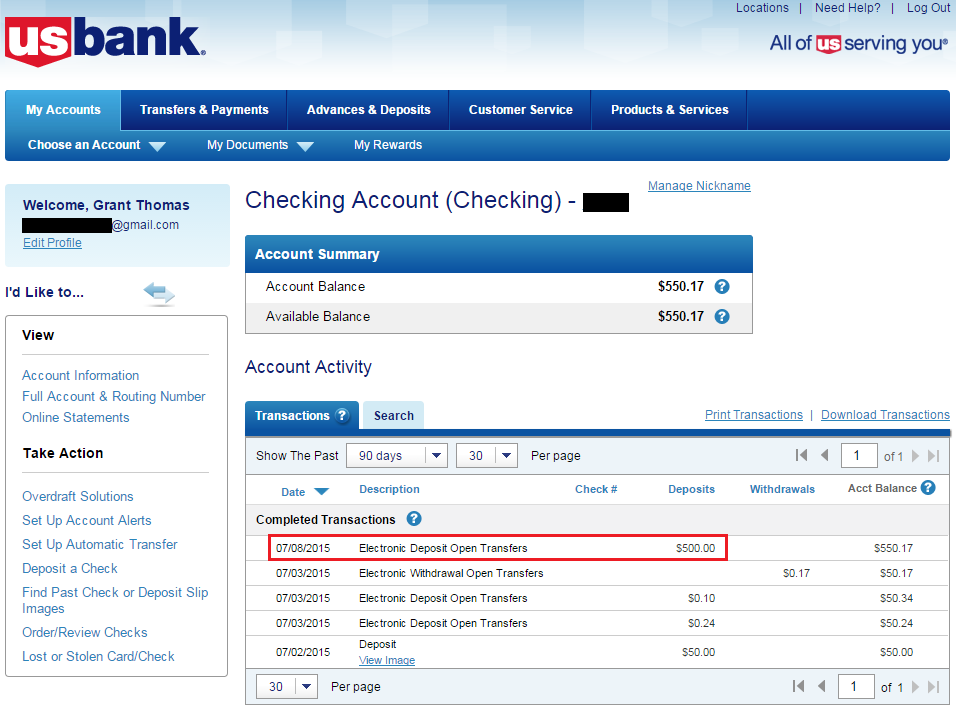

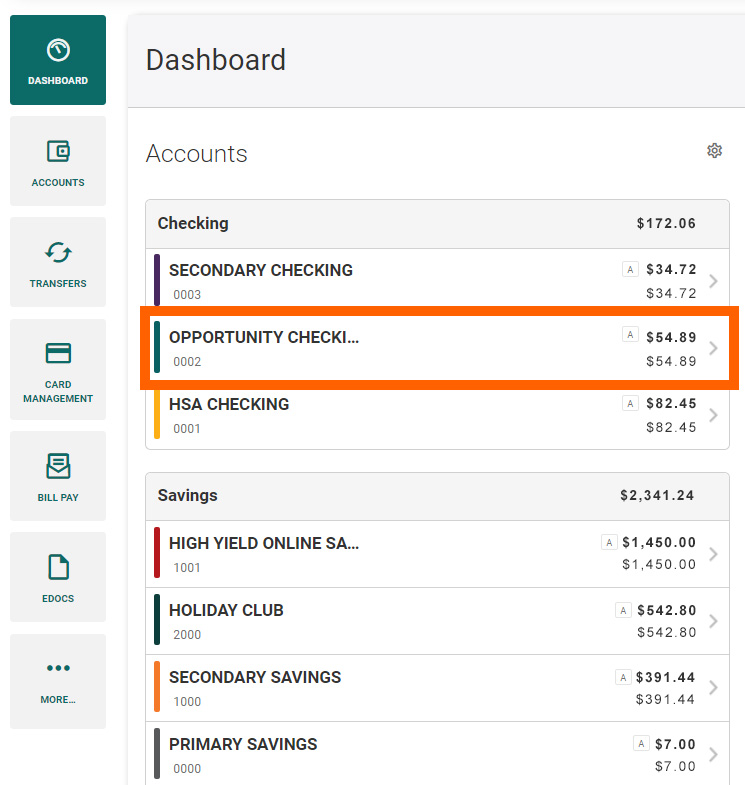

Online banking has revolutionized how we manage our finances. Most banks offer secure websites where you can log in using your credentials. Once logged in, your current balance is typically displayed prominently on the account dashboard.

You can also view transaction history, transfer funds, and set up alerts to stay informed about your account activity. The convenience of accessing your account from anywhere with an internet connection is a major advantage.

Mobile Banking Apps: Banking on the Go

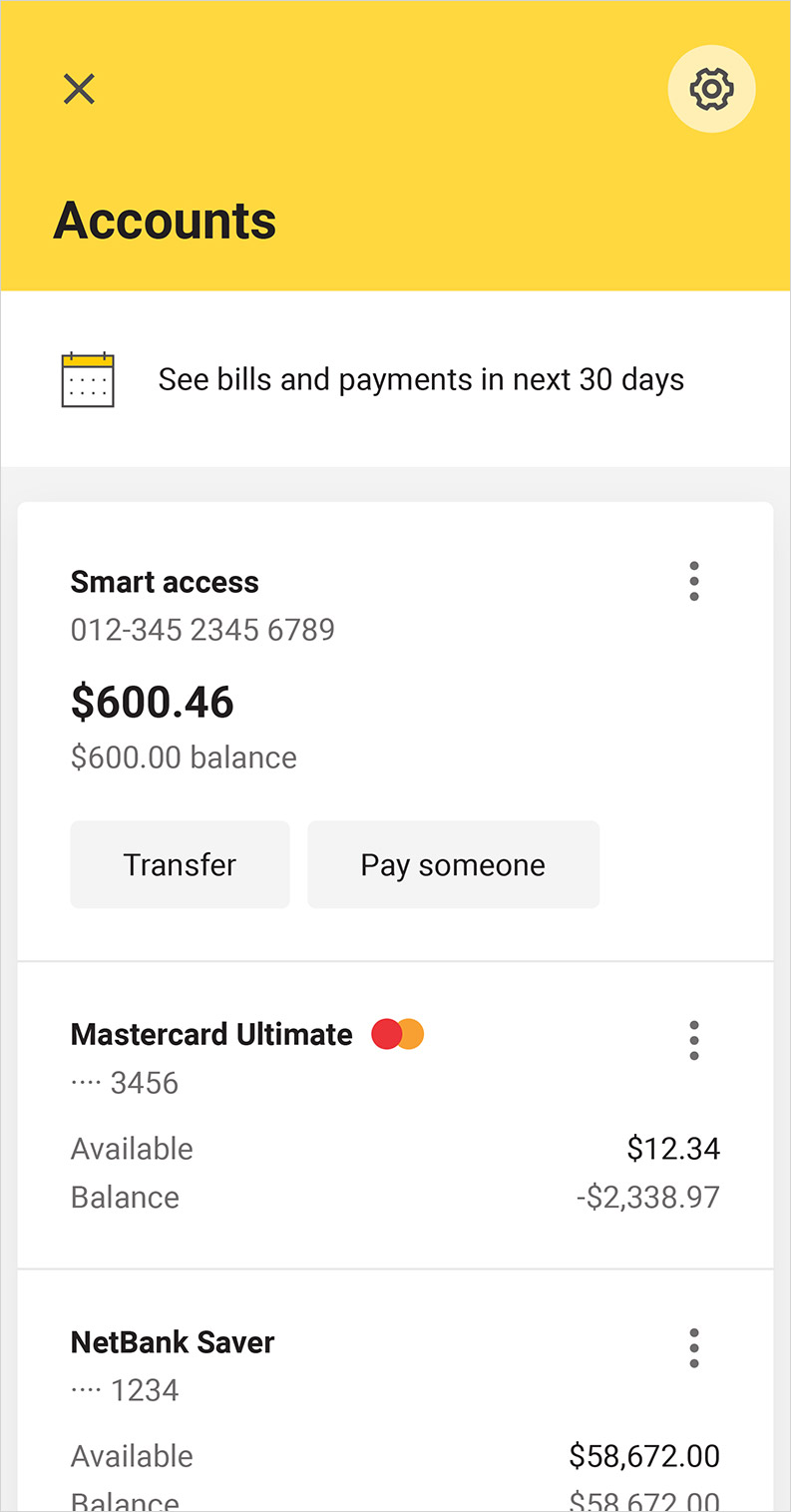

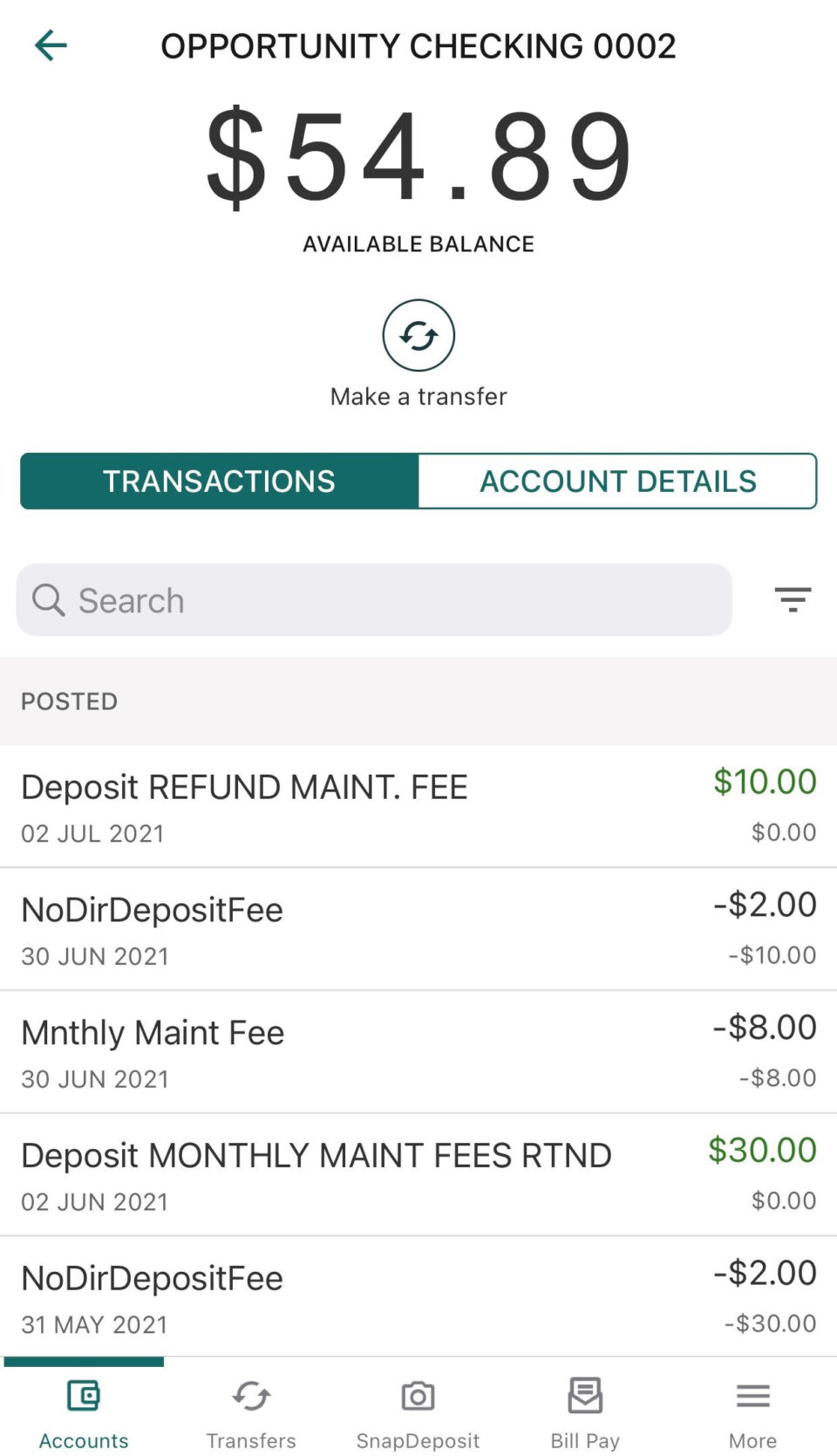

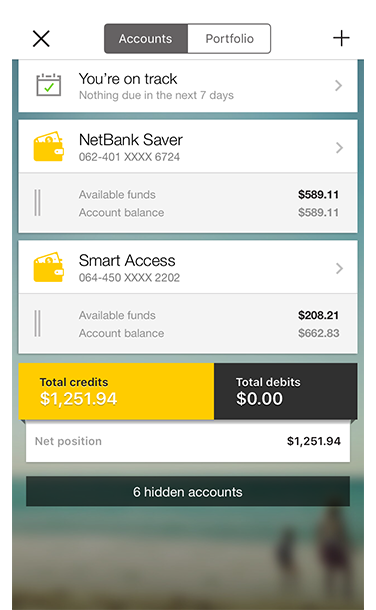

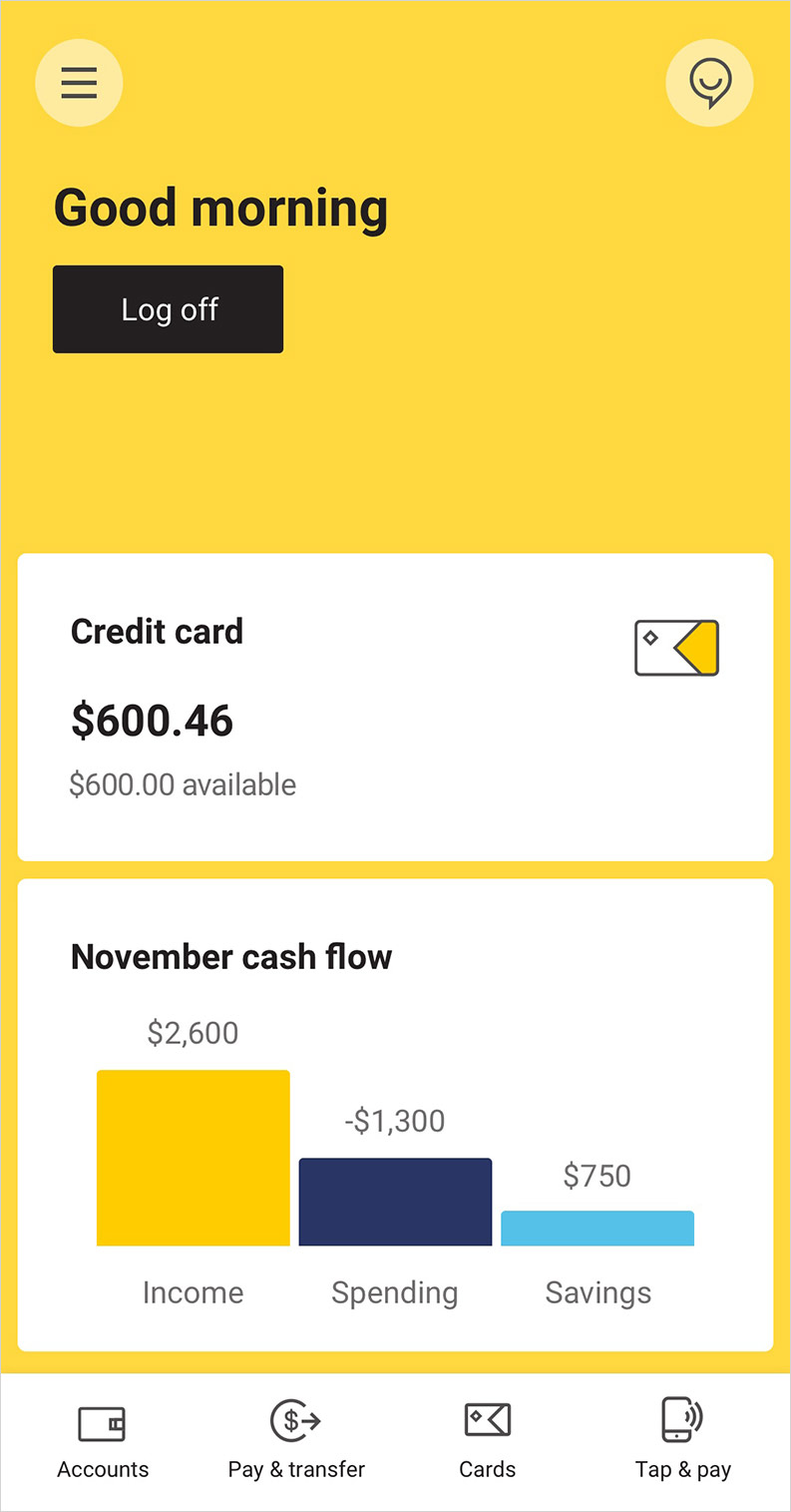

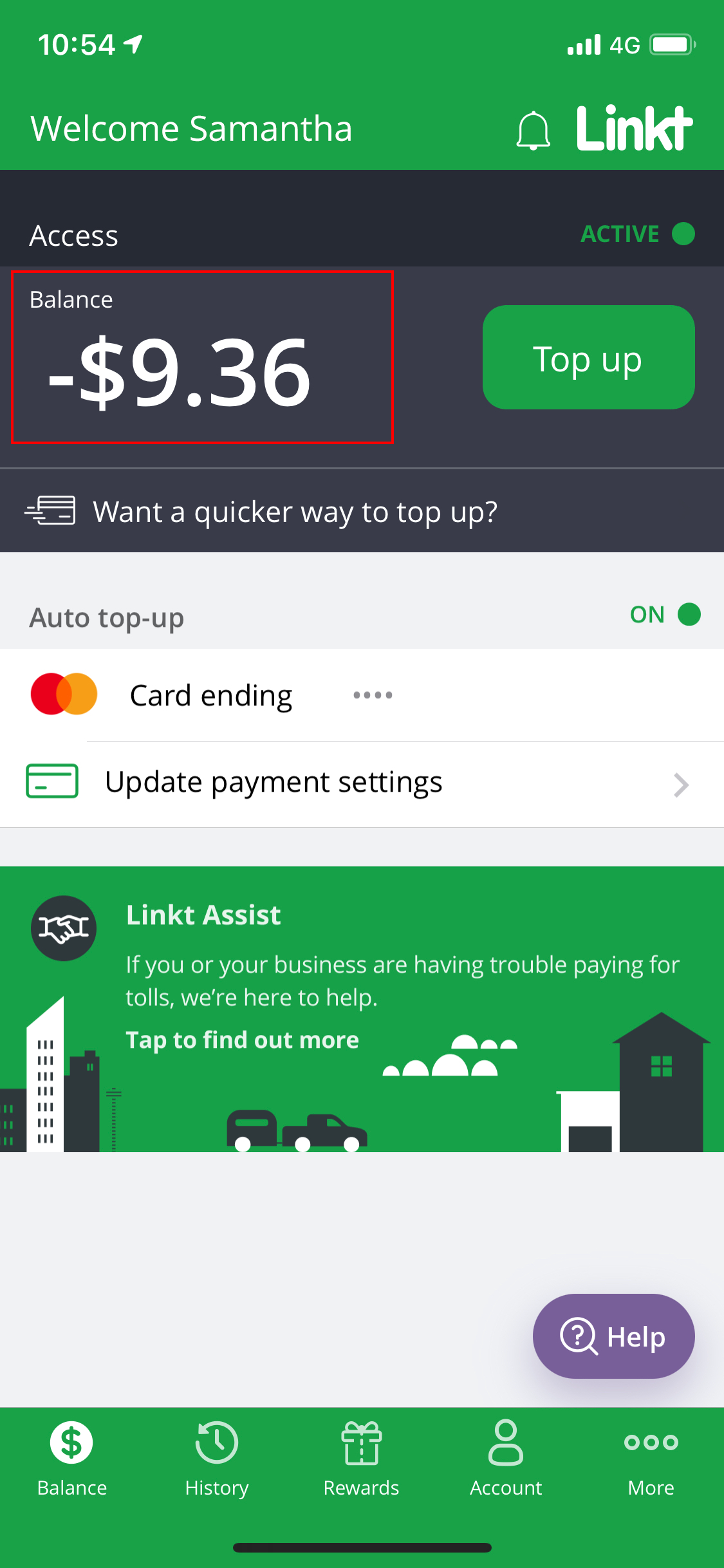

Mobile banking apps take convenience a step further, putting your bank in your pocket. Download your bank's app from the App Store or Google Play Store and log in using your online banking credentials. The app usually provides a clear overview of your account balance, recent transactions, and other important information.

Many apps offer features like mobile check deposit and bill payment, making banking even more accessible. Push notifications can also be set up to alert you of low balances or unusual activity. Mobile apps are increasingly popular for their ease of use and real-time access.

Telephone Banking: A Voice on the Line

For those who prefer to speak with someone but can't visit a branch, telephone banking is an option. Call your bank's dedicated telephone banking line. After verifying your identity using your account number and PIN, you can inquire about your balance and other account details through an automated system or by speaking with a representative.

Ensuring Security: Protecting Your Information

Regardless of the method you choose, security is paramount. Always protect your PIN and password. Avoid using public Wi-Fi for sensitive transactions, and regularly monitor your account for any unauthorized activity.

Report any suspicious activity to your bank immediately. Banks like Bank of America and Chase offer extensive resources on their websites to help customers protect themselves from fraud.

Conclusion: Staying Informed, Staying Secure

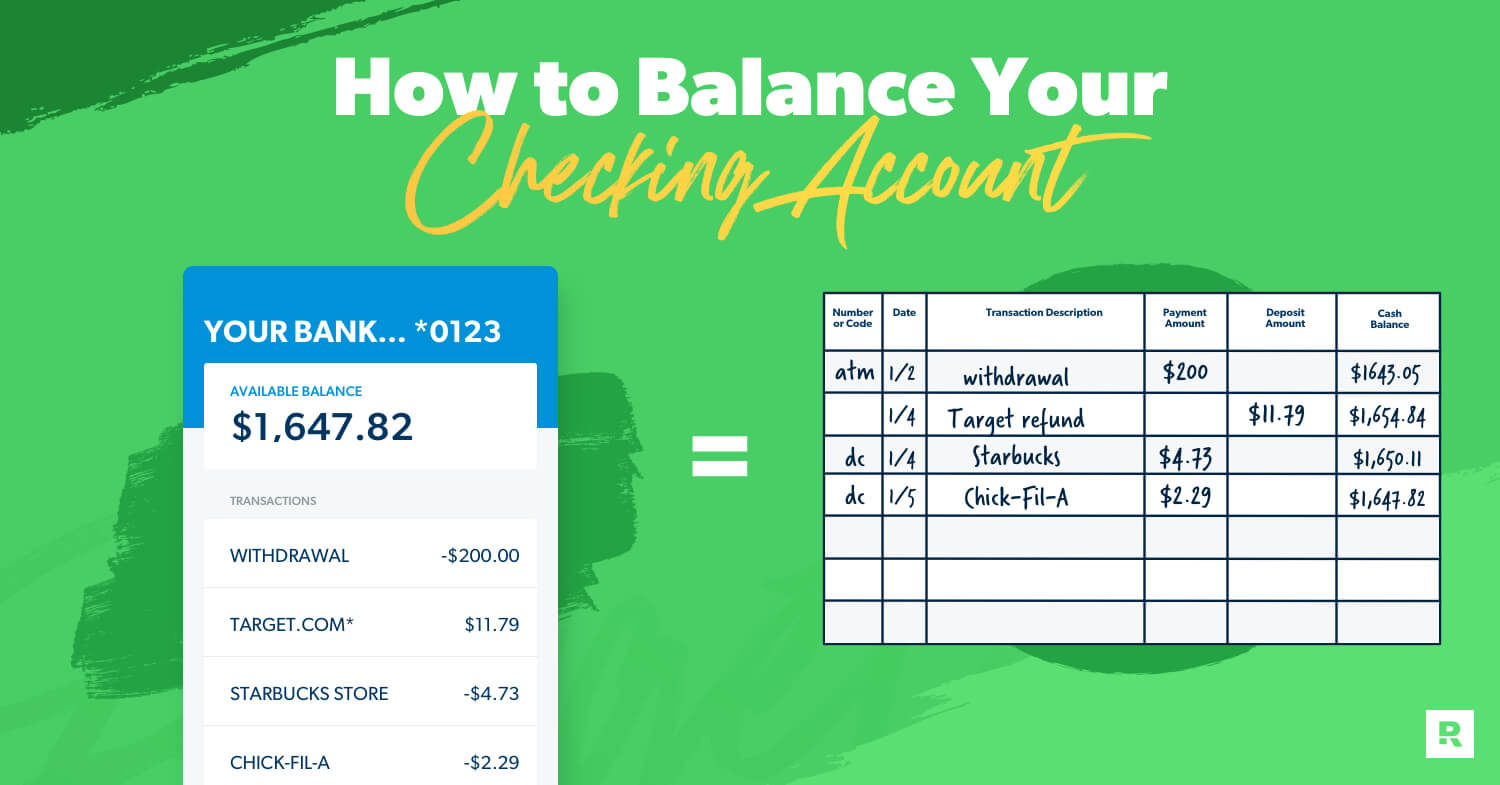

Checking your checking account balance is a simple yet essential practice for maintaining financial well-being. With numerous options available, from traditional branch visits to the convenience of mobile apps, staying informed has never been easier.

By choosing the method that best suits your lifestyle and prioritizing security, you can confidently manage your finances and ensure a clearer understanding of your financial standing. Take control of your finances and embrace the peace of mind that comes with knowing exactly where you stand.