Can I Buy A House With A 643 Credit Score

Dreaming of homeownership but haunted by a less-than-stellar credit score? A 643 credit score presents challenges, but it's not an automatic deal-breaker for securing a mortgage.

This article dissects the realities of buying a house with a 643 credit score, offering immediate insights into your options and actionable steps to improve your chances.

The Credit Score Reality Check

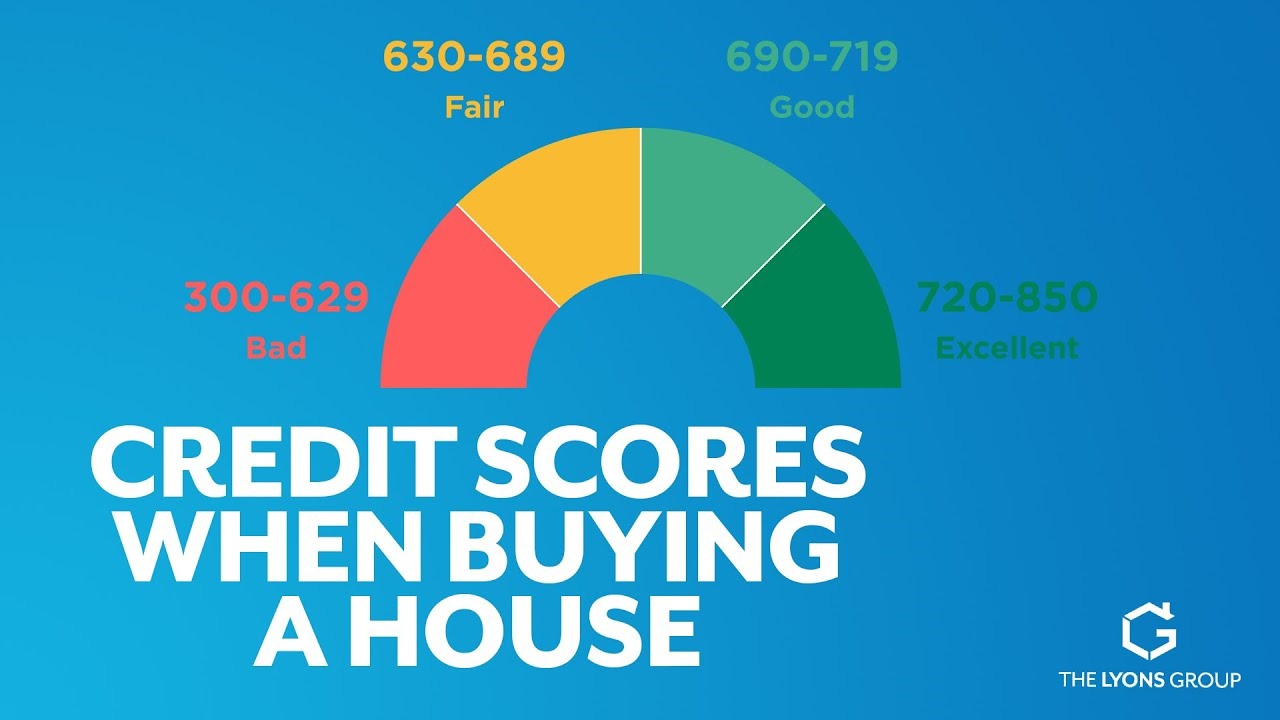

A 643 credit score typically falls within the "fair" range. According to Experian, this score isn't ideal, but it's also not the worst.

While you may face higher interest rates and stricter lending requirements compared to borrowers with excellent credit, mortgage approval is still possible.

What Lenders Look For

Lenders assess more than just your credit score. Debt-to-income ratio (DTI), employment history, and down payment amount play crucial roles.

A lower DTI (ideally below 43%) and a substantial down payment can significantly boost your application's strength. Steady employment history demonstrates financial stability.

Expect lenders to scrutinize your credit report for any red flags like late payments, collections, or bankruptcies.

Mortgage Options to Explore

Several mortgage programs cater to borrowers with less-than-perfect credit. FHA loans are a popular choice, often requiring a minimum credit score of 500-580 depending on the down payment.

VA loans are available to eligible veterans and active-duty military members, sometimes offering more flexible credit requirements. USDA loans, backed by the U.S. Department of Agriculture, assist homebuyers in rural areas.

Conventional loans typically require a higher credit score, but some lenders might work with borrowers in the mid-600s, especially with a strong down payment.

Interest Rates and Costs

Be prepared for potentially higher interest rates. A 643 credit score means you're statistically a higher-risk borrower, leading lenders to charge more to compensate.

Compare interest rates from multiple lenders before making a decision. Even a small difference in interest rate can save you thousands of dollars over the life of the loan.

Don't forget to factor in closing costs, which can include appraisal fees, loan origination fees, and title insurance.

Boosting Your Approval Chances

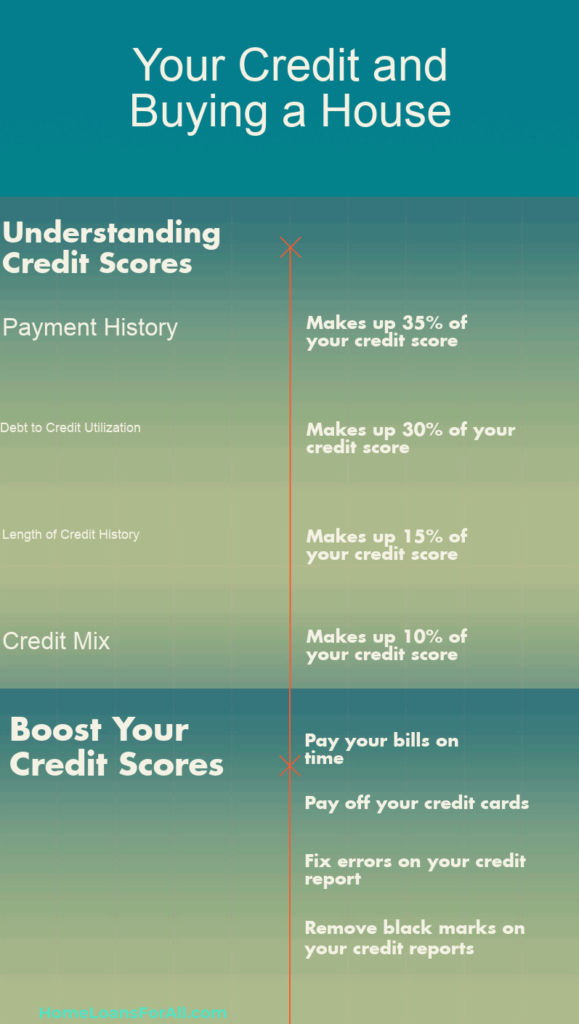

Before applying for a mortgage, take steps to improve your credit score. Pay down existing debt, especially credit card balances, to lower your credit utilization ratio.

Correct any errors on your credit report. Dispute inaccurate information with the credit bureaus (Experian, Equifax, and TransUnion).

Consider getting pre-approved for a mortgage. Pre-approval gives you a clearer understanding of how much you can borrow and strengthens your offer when you find a house.

The Bottom Line

Buying a house with a 643 credit score is challenging but achievable. Focus on improving your credit, exploring different mortgage options, and saving for a down payment and closing costs.

Consult with a mortgage broker or financial advisor to assess your individual circumstances and develop a personalized plan. Further improvements in your credit score could significantly increase your chances of securing a more favorable mortgage rate and terms in the future.