How To Change Sales Tax On Square

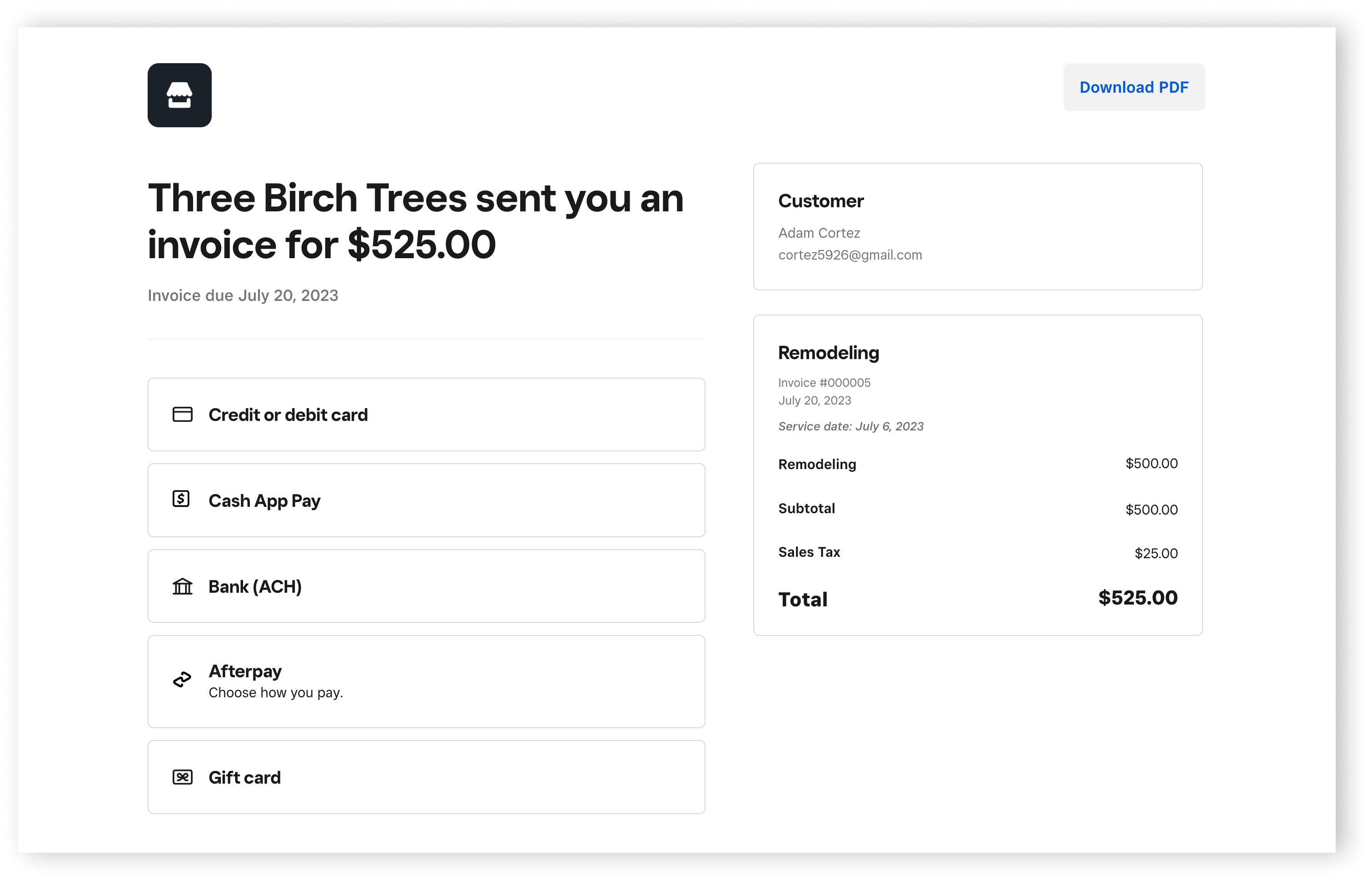

For businesses utilizing Square as their point-of-sale (POS) system, managing sales tax accurately is a crucial aspect of compliance and financial health. Improperly configured sales tax settings can lead to audits, penalties, and inaccurate financial reporting. Understanding how to adjust these settings within the Square platform is therefore essential for business owners and managers.

This article provides a comprehensive guide on how to modify sales tax settings on Square. It outlines the steps necessary to ensure accurate tax collection and reporting, covering various scenarios from adding new tax rates to modifying existing ones and addressing location-specific tax rules. Accurate sales tax configuration is crucial for compliance and financial accuracy.

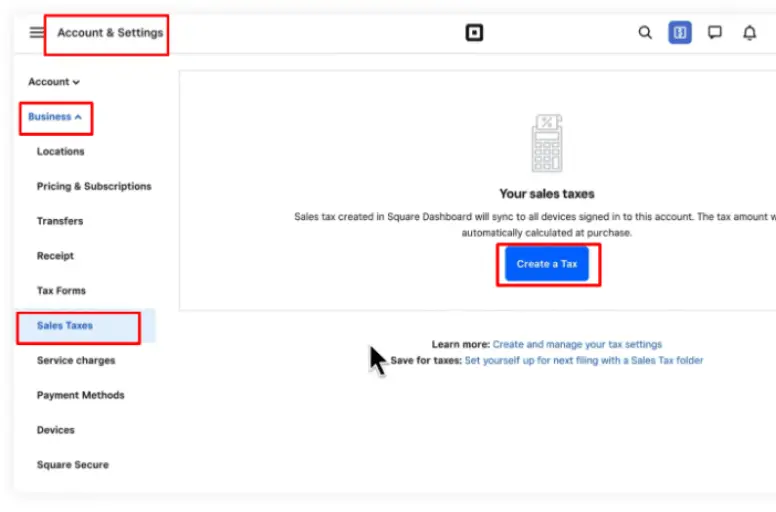

Navigating the Square Dashboard

The primary method for managing sales tax within Square is through the online Square Dashboard. Accessing the dashboard requires logging in with your Square account credentials.

Once logged in, navigate to the "Items" section. This is typically found on the left-hand navigation menu.

Adding a New Sales Tax Rate

To add a new sales tax rate, first, locate and click on the "Taxes" tab within the "Items" section. This will display your current sales tax settings.

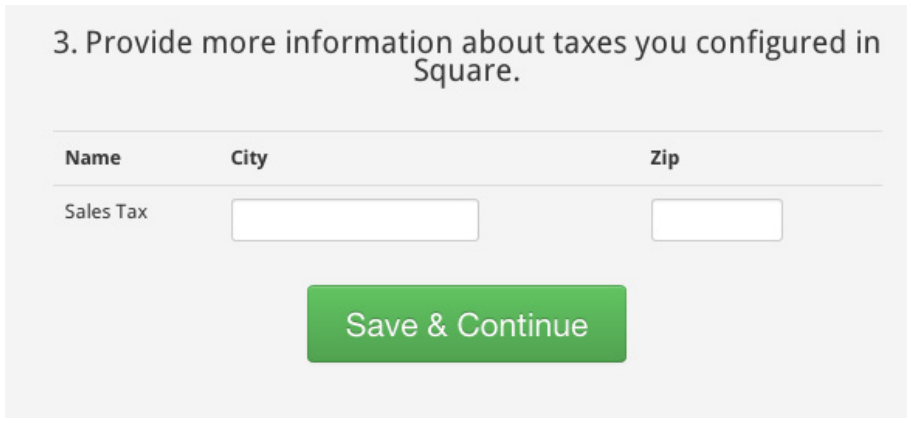

Next, click the "Create Tax" button. This will open a form where you can input the details of the new tax rate.

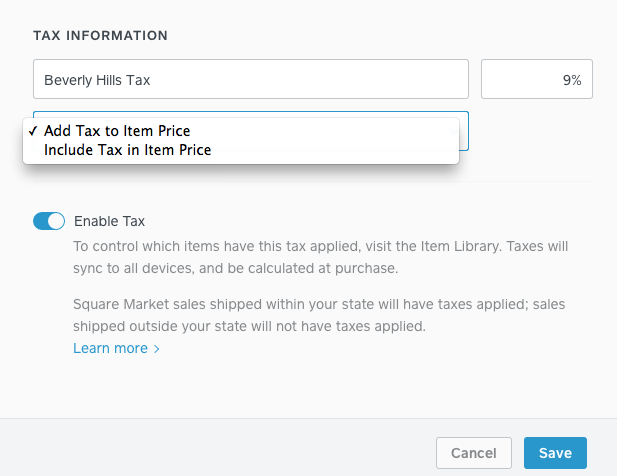

Enter the name of the tax (e.g., "State Sales Tax") and the tax rate as a percentage (e.g., 6.25). You can also choose whether the tax is "Additive" or "Inclusive". Additive taxes are added on top of the item price, while inclusive taxes are already included in the listed price. Select "Save" to finalize the new tax rate.

Modifying an Existing Sales Tax Rate

To change an existing sales tax rate, navigate to the "Taxes" tab within the "Items" section of your Square Dashboard. A list of existing tax rates will be displayed.

Click on the tax rate you wish to modify. This will open an edit window where you can change the name or percentage of the tax.

Make the necessary adjustments and click "Save" to apply the changes. These changes will be reflected in future transactions.

Applying Sales Tax to Items

Once the tax rates are created, you need to apply them to your items. Go to the "Items" tab within the "Items" section of your Square Dashboard.

Select the item you want to apply the tax to. In the item details, find the "Taxes" section and check the box next to the relevant tax rate to apply it.

You can apply multiple tax rates to a single item if necessary. Save the changes to the item, and the selected tax rates will be automatically applied during checkout.

Location-Specific Sales Tax

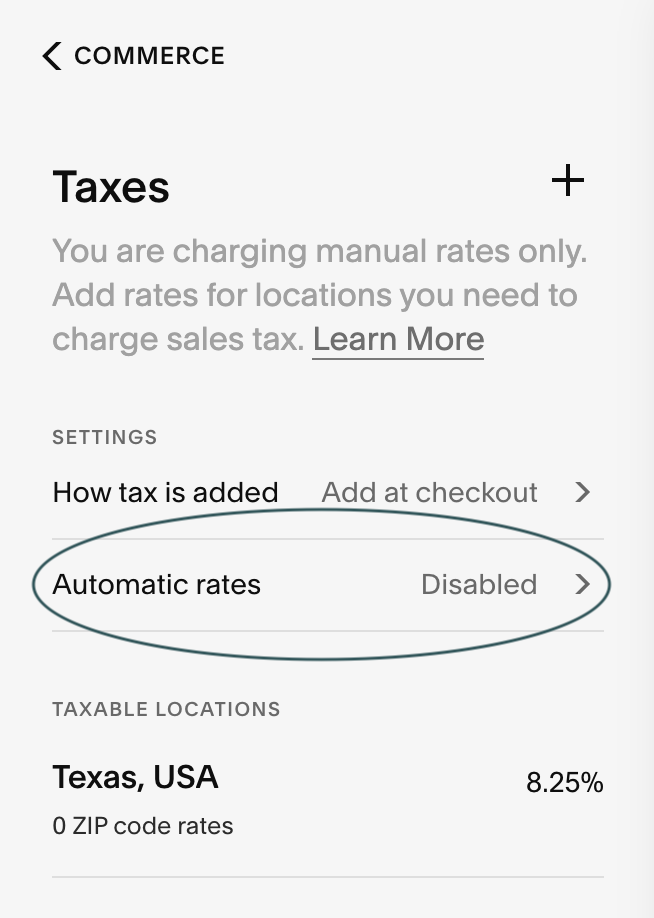

For businesses with multiple locations, Square allows you to set up location-specific sales tax rates. This is particularly important if your different locations are in different tax jurisdictions.

To manage location-specific taxes, navigate to "Settings" from your Square Dashboard, then select "Locations." Choose the location you want to configure. In the location settings, you'll find a "Taxes" section where you can set up the applicable tax rates for that specific location.

Ensure that each location has the correct tax rates assigned to avoid discrepancies during tax reporting. Proper configuration of location-specific taxes is vital for businesses operating in multiple tax jurisdictions.

Using the Square App

While the online Square Dashboard offers the most comprehensive control, you can also manage basic sales tax settings within the Square app on your mobile device.

Open the Square app and tap the menu icon (usually three horizontal lines). Go to "Settings," then "Taxes."

From here, you can add new tax rates or modify existing ones. Changes made in the app will sync with your Square account across all devices.

Troubleshooting Common Issues

One common issue is incorrect tax application during checkout. This usually occurs when items are not properly assigned to the correct tax rates.

Double-check that all your items have the correct tax rates selected in the "Items" section of your Square Dashboard. Also, ensure that you haven't accidentally applied the wrong tax rate during a transaction.

Another issue arises when sales tax reporting is inaccurate. Verify that all your tax rates are configured correctly, including the percentage and whether they are additive or inclusive. If the issue persists, contact Square support for assistance.

The Importance of Accurate Sales Tax Configuration

Maintaining accurate sales tax settings on Square is crucial for several reasons. First and foremost, it ensures compliance with state and local tax laws.

Accurate tax collection and reporting prevent potential audits, penalties, and legal issues. Proper configuration also leads to accurate financial reporting, providing a clear picture of your business's financial health.

Finally, accurate sales tax settings build trust with your customers. Customers appreciate transparency and expect businesses to collect and remit taxes correctly.

Conclusion

Managing sales tax on Square requires careful attention to detail. By following the steps outlined above, business owners can ensure that their Square POS system is properly configured to collect and report sales taxes accurately.

Regularly review your sales tax settings, especially when tax rates change in your jurisdiction. Accurate sales tax management contributes to compliance, financial health, and customer trust.