Can I Buy Individual Stocks In My Fidelity 401k

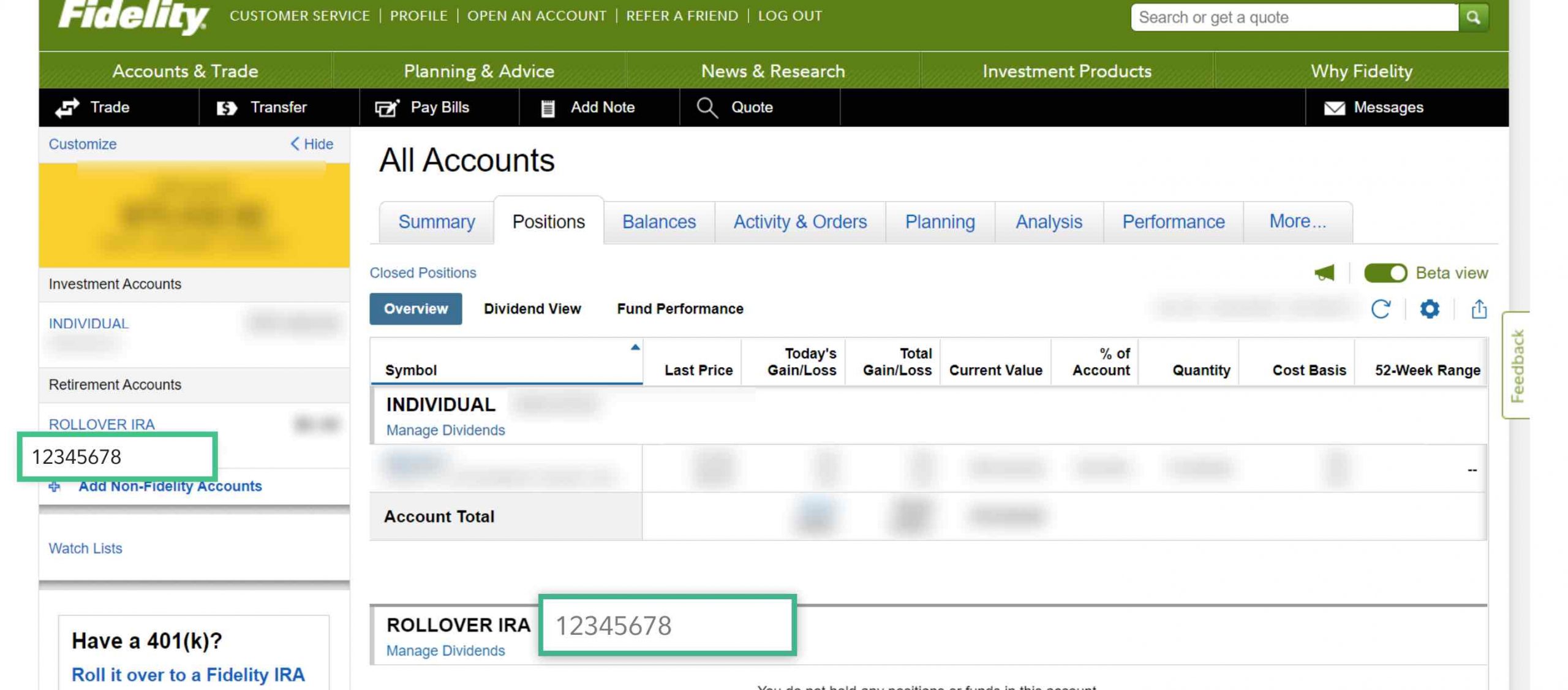

Urgent update for Fidelity 401(k) participants: Direct stock trading is now a reality for some. Fidelity has rolled out BrokerageLink, giving select employees access to individual stocks within their retirement accounts.

This marks a significant shift in 401(k) investment strategy. BrokerageLink allows qualified participants to move a portion of their 401(k) funds into a self-directed brokerage account, offering a broader investment selection.

Who Gets Access?

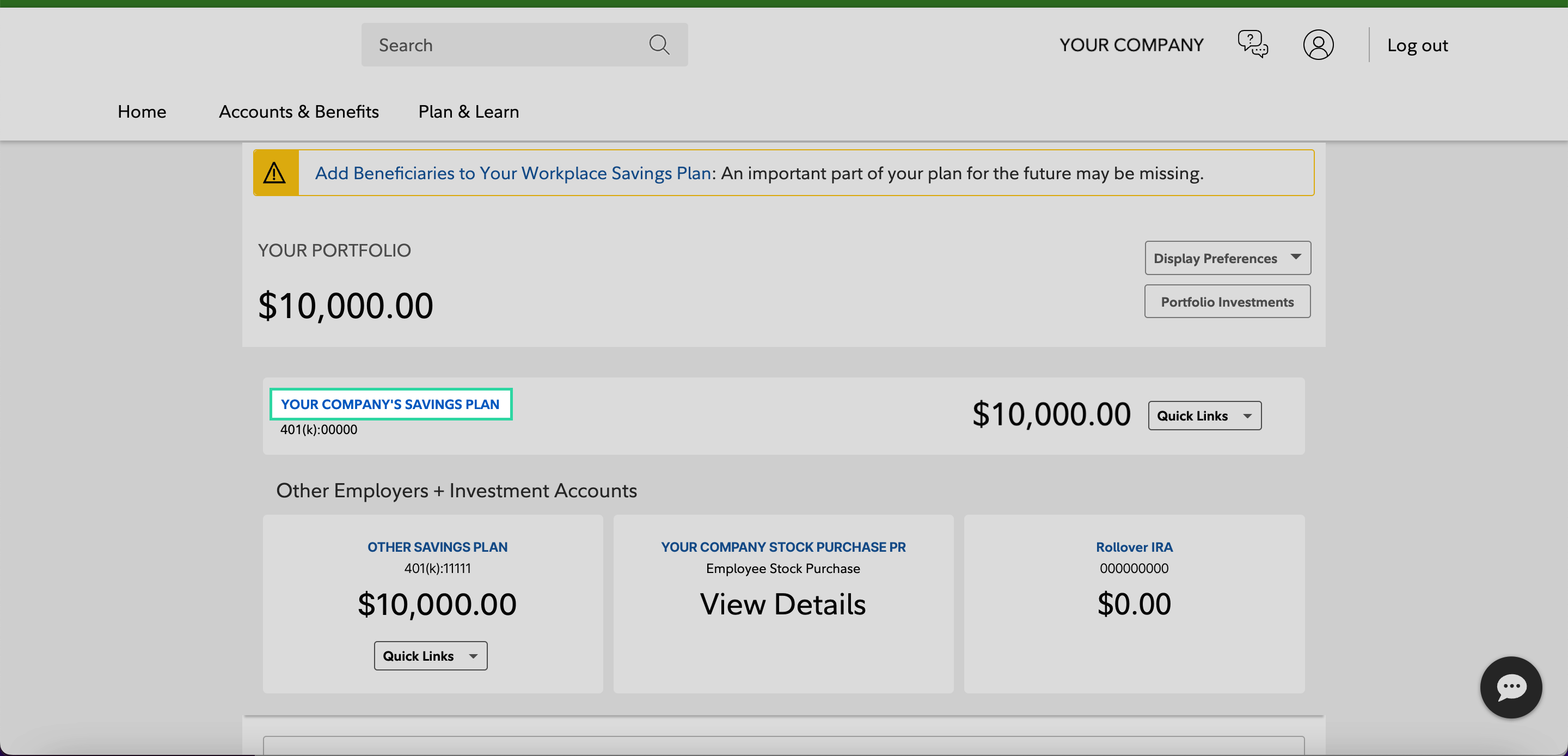

Not all Fidelity 401(k) participants are eligible immediately. Eligibility depends on your employer's plan provisions.

Check with your HR department or review your plan documents to determine if BrokerageLink is available to you. Employers must opt-in to offer BrokerageLink within their 401(k) plans.

What Can You Trade?

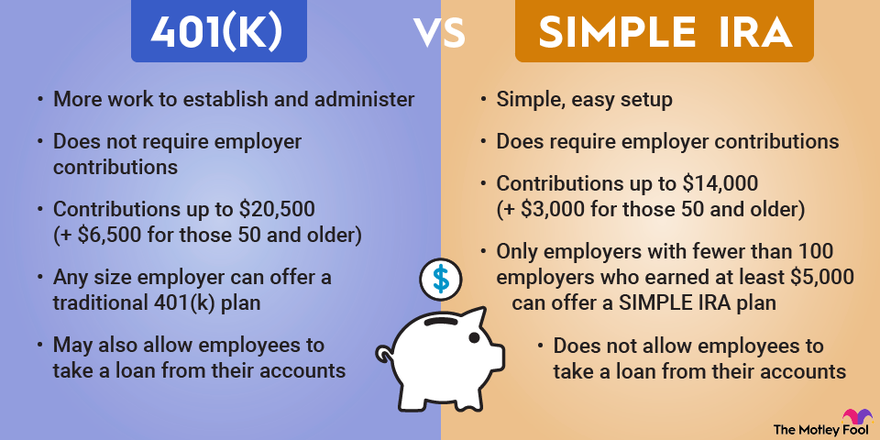

BrokerageLink expands your investment options dramatically. Beyond the standard mutual funds and ETFs typically offered in 401(k)s, you can now trade individual stocks and bonds.

Some plans may restrict certain investments. Be sure to review the BrokerageLink guidelines for your specific plan to understand any limitations.

Where and When Is This Available?

BrokerageLink is accessed through Fidelity's online platform. It is currently available to employees whose employers have chosen to incorporate it into their 401(k) plan.

The rollout is ongoing, and more companies are expected to adopt BrokerageLink. The exact launch date for your specific company depends on your employer’s decisions.

How Does It Work?

Eligible employees can allocate a portion of their existing 401(k) funds to BrokerageLink. This allocation is subject to plan-specific restrictions and guidelines.

Once funds are transferred, you can begin trading within the BrokerageLink account. Trading is self-directed, meaning you are responsible for making all investment decisions.

Important Considerations

Direct stock trading carries increased risk. Unlike diversified mutual funds, individual stocks can experience significant price fluctuations, potentially leading to losses.

BrokerageLink accounts may have different fee structures. Understand the costs associated with trading and account maintenance before making any investment decisions.

Potential Downsides

You are responsible for your investment decisions. Do your research before buying or selling stocks, and consider consulting with a financial advisor before making significant changes to your investment strategy.

BrokerageLink accounts are for experienced investors. Make sure you can stomach risk.

Potential Upsides

The possibility to grow your wealth is now greater. With the right stocks and bonds you can make greater gains than typical bonds.

It is very convenient since BrokerageLink accounts are linked with Fidelity. You don't have to create a new account.

Next Steps

Contact your HR department or Fidelity directly to confirm your eligibility for BrokerageLink. Carefully review your plan documents and the BrokerageLink guidelines before making any decisions.

Consider consulting with a qualified financial advisor. They can help you assess your risk tolerance and develop an appropriate investment strategy for your BrokerageLink account.

Stay informed about any updates to your employer's 401(k) plan. Monitor your investments regularly and adjust your strategy as needed.

This is a developing story, and further details will be provided as they become available. Check back for updates.