Can I Get Cash Back With Capital One Credit Card

Capital One cardholders, listen up! You could be leaving money on the table. Let's explore your cash back options with Capital One credit cards and how to maximize your rewards.

Many Capital One credit cards offer cash back rewards, but understanding which cards qualify and how to redeem those rewards is crucial. This guide breaks down the essential details, ensuring you're not missing out on free money.

Capital One Cards Offering Cash Back

Not all Capital One cards are created equal. Several cards offer cash back, each with varying rates and benefits. Knowing the specifics of your card is the first step.

Quicksilver Cards

The Capital One Quicksilver Cash Rewards Credit Card and Capital One QuicksilverOne Cash Rewards Credit Card are popular choices. These cards offer a flat rate of 1.5% cash back on all purchases. It’s straightforward and simple.

Savor Cards

For those who spend heavily on dining and entertainment, the Capital One SavorOne Cash Rewards Credit Card shines. It offers 3% cash back on dining, entertainment, streaming services, and at grocery stores. A great option for foodies and entertainment enthusiasts.

Other Capital One Cash Back Cards

Other cards like the Capital One Venture X Rewards Credit Card also indirectly offer cash back. While marketed for travel rewards, points can be redeemed for cash, providing flexibility. Check the specific terms of your card to confirm.

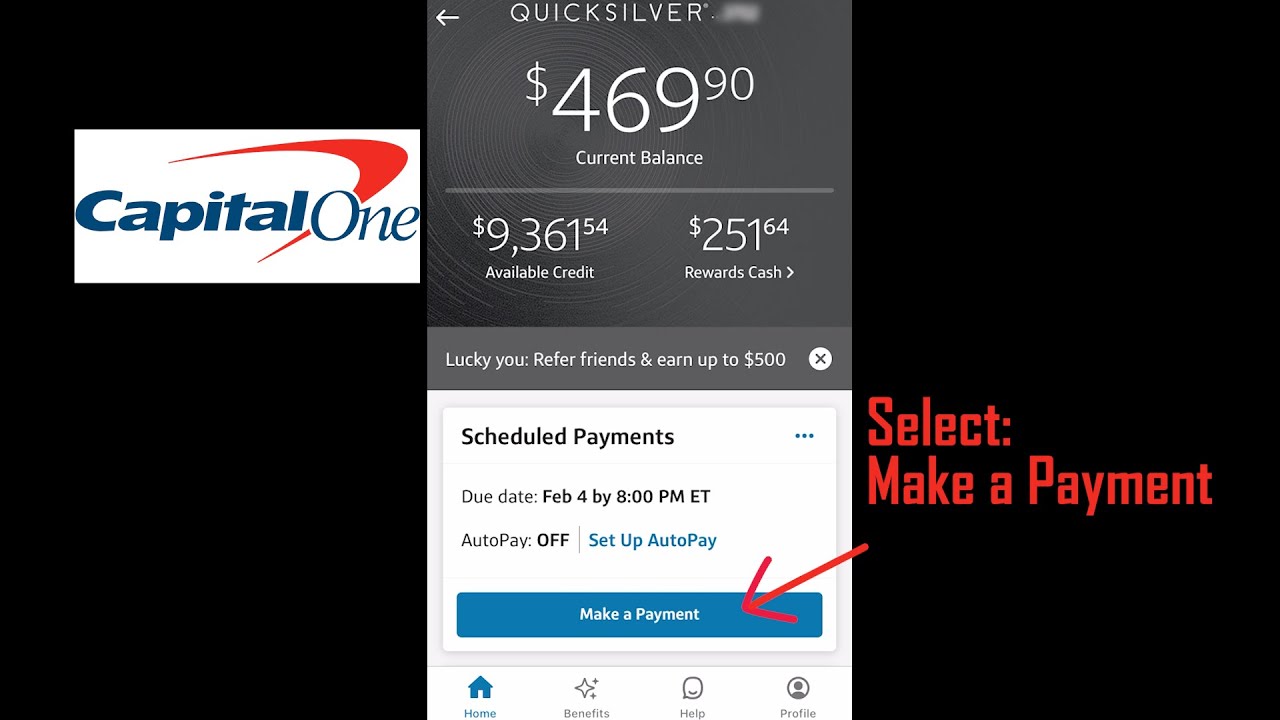

How to Redeem Your Cash Back

Redeeming your cash back is generally straightforward. You can typically do this through the Capital One website or mobile app. Several options are usually available.

Common redemption methods include statement credits, checks, or gift cards. The value of your cash back is typically the same regardless of the method you choose. However, confirm the terms and conditions when redeeming.

Key Considerations

Pay attention to your spending habits when selecting a card. A card with a higher cash back rate in specific categories may be more beneficial than a flat-rate card if you spend heavily in those areas. Maximize those rewards!

Be aware of any spending caps or limitations. Some cards might have restrictions on how much cash back you can earn in certain categories. Read the fine print.

What To Do Next

Log into your Capital One account and review your card's rewards program details. Understand the cash back rate, redemption options, and any associated terms and conditions. Knowledge is power!

If you're not happy with your current card's rewards, consider applying for a different Capital One card that better suits your spending habits. Always compare cards before applying to ensure you are making the right choice.

Keep an eye out for promotions or special offers. Capital One occasionally offers limited-time deals that can boost your cash back earnings. Don't miss out!