Can You Borrow Money From Salo Cash Account Online

The rise of digital financial services has brought convenience and accessibility to many, but it also raises critical questions about the functionality and limitations of these platforms. A growing number of users are asking: Can you actually borrow money from a Salo Cash account online? The answer, surprisingly complex, hinges on understanding the evolving business models and regulatory landscapes governing these emerging financial technologies.

This article delves into the specifics of Salo Cash and similar online financial accounts, clarifying whether direct borrowing is currently possible, exploring alternative avenues for accessing credit, and examining the broader implications for consumers navigating the digital finance landscape. We will explore the core functionality of these accounts, analyze publicly available information, and consult expert opinions to provide a comprehensive overview of this crucial aspect of online financial services.

Understanding Salo Cash Accounts

Salo Cash accounts, like many similar platforms, are primarily designed for facilitating digital payments, storing funds, and conducting online transactions. They often offer features such as bill payments, money transfers to other users, and online shopping functionalities. These platforms aim to streamline financial interactions, particularly for users who may be underserved by traditional banking institutions.

The basic function, however, does not inherently include direct lending or borrowing features. Most Salo Cash accounts operate as prepaid or stored-value systems, meaning users can only spend the funds they have already loaded into the account. This fundamental characteristic distinguishes them from traditional bank accounts that offer overdraft facilities or lines of credit.

Current Borrowing Capabilities: A Negative Outlook

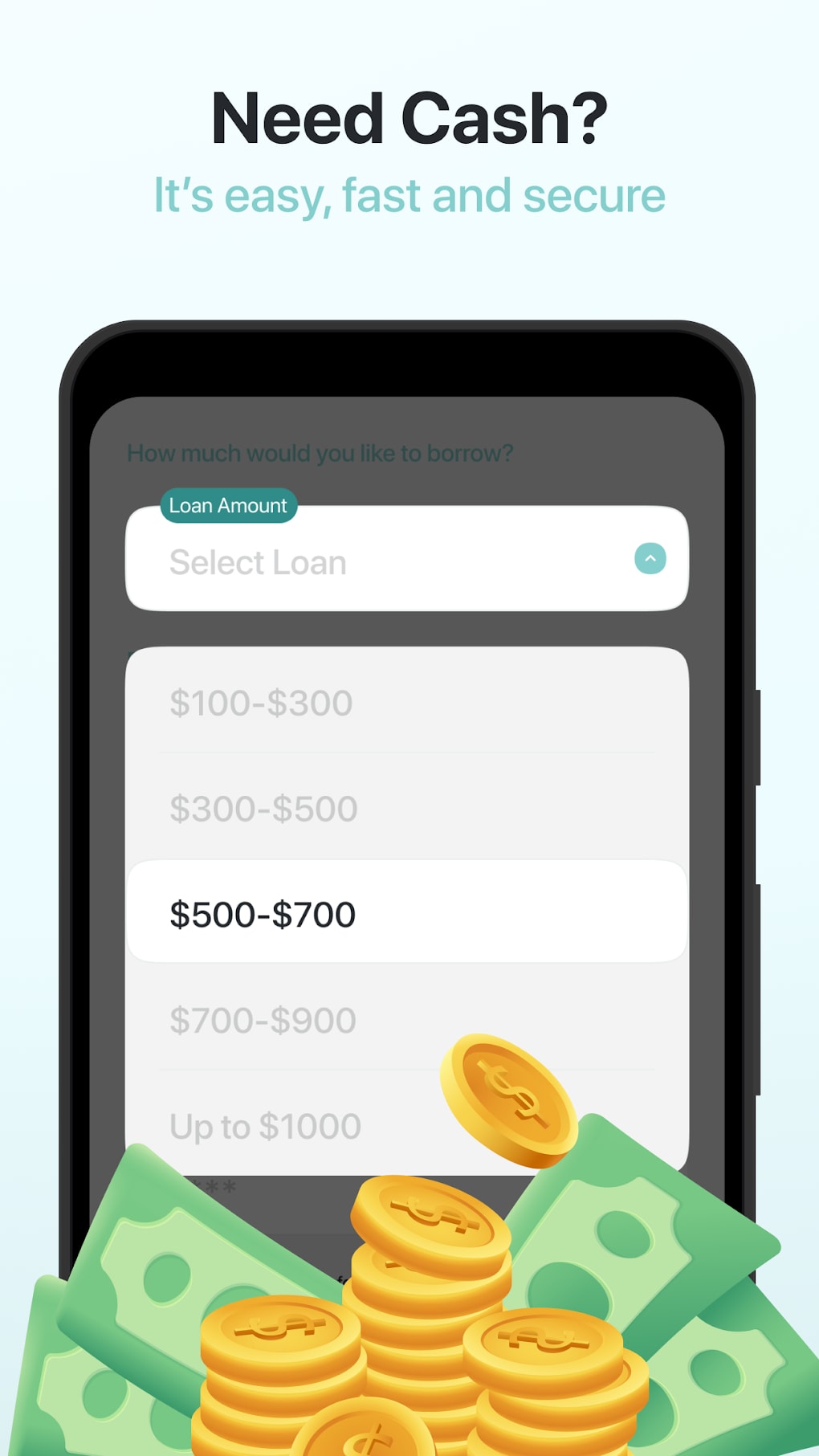

Currently, directly borrowing money from a Salo Cash account is generally not possible. Most Salo Cash systems are not built with credit facilities. Users rely on pre-loaded funds, and the system doesn't extend loans or overdrafts.

There are no public statements from Salo Cash or readily available data suggesting the immediate rollout of borrowing features. The infrastructure and regulatory approvals required for lending operations necessitate significant changes to the platform's existing architecture and compliance framework.

Exploring Alternatives: Indirect Access to Credit

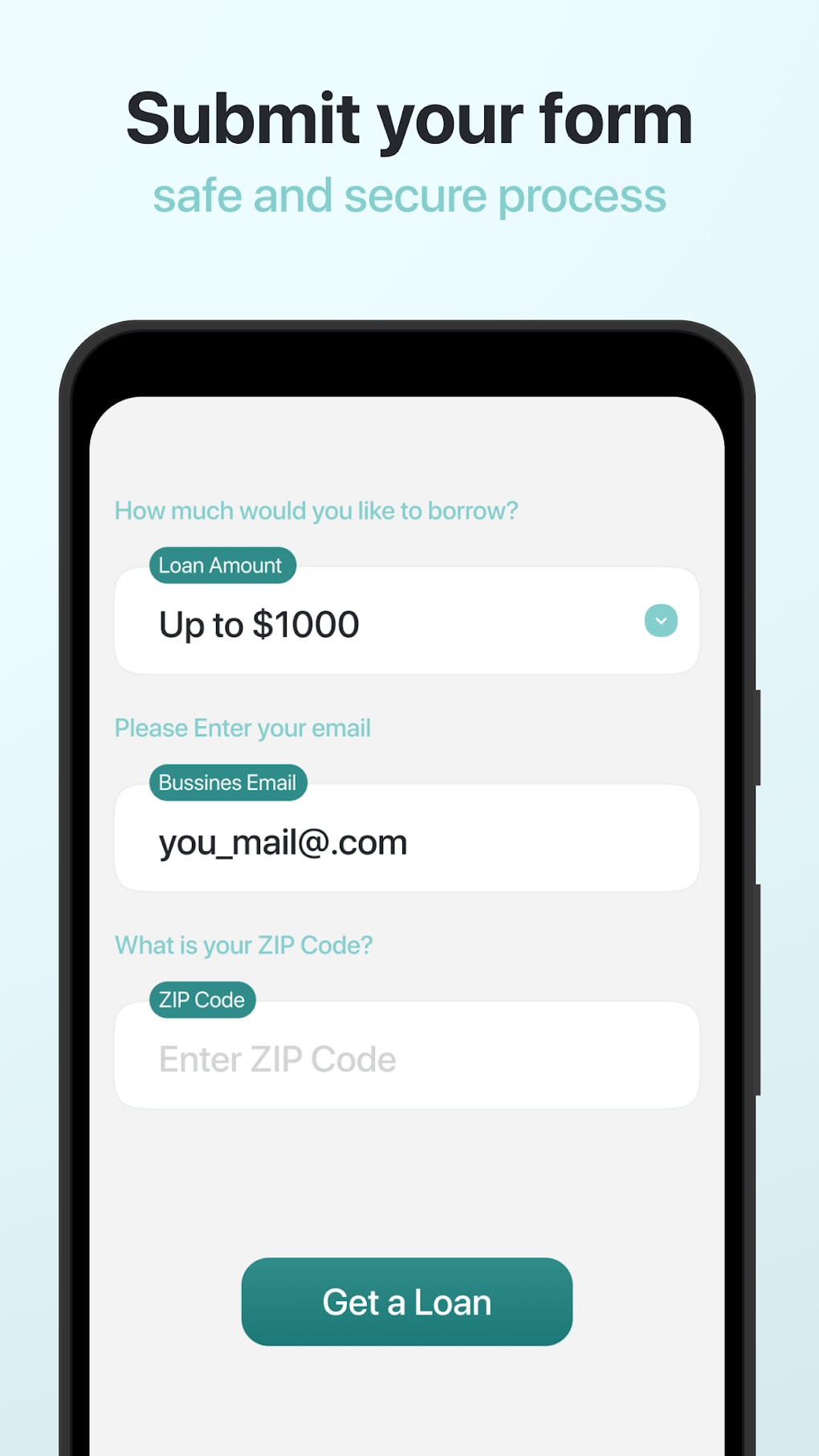

While direct borrowing might be unavailable, some users can access credit indirectly. This might involve linking a credit card to the Salo Cash account. The credit card then serves as a funding source if the Salo Cash balance is insufficient.

However, this approach relies on the user's existing creditworthiness and the terms of their credit card agreement. Salo Cash itself does not provide the credit, but rather facilitates the use of an external credit line.

The Regulatory Landscape and Future Possibilities

The regulatory environment plays a pivotal role in shaping the features and services offered by digital financial platforms. Financial regulations often dictate stringent requirements for lending activities. Companies need to comply with laws surrounding interest rates, credit risk assessment, and consumer protection.

As regulatory frameworks evolve to accommodate the growth of fintech, the possibility of Salo Cash and similar platforms offering lending products in the future cannot be entirely ruled out. However, such developments would require significant investment, regulatory approvals, and a robust risk management infrastructure.

The Importance of User Awareness

It is crucial for users to understand the limitations of Salo Cash accounts and similar platforms. Relying solely on these accounts without considering alternative credit options can lead to financial strain in times of emergency. Users should always consult official terms and conditions and avoid misinformation circulated online.

Before making financial decisions, thoroughly research all available options. Consult with financial advisors and compare terms from various providers. Responsible financial planning is paramount when utilizing any digital financial service.

Expert Perspectives and Industry Trends

Financial analysts suggest that the trend towards integrated financial services will likely continue. This may eventually lead to more fintech platforms offering lending products.

However, the specific timeline and implementation strategies remain uncertain. Compliance with regulations, robust risk management, and consumer protection will be key considerations. Fintech companies are constantly testing the waters and implementing new features.

"The future of fintech is undoubtedly intertwined with lending, but responsible innovation requires a careful balance between convenience and risk," stated Dr. Anya Sharma, a leading expert in digital finance. "Platforms like Salo Cash need to prioritize consumer education and transparency to ensure users understand the implications of accessing credit through these channels."

Conclusion: Navigating the Digital Finance Landscape

As of now, directly borrowing money from a Salo Cash account online is generally not possible. Users should explore alternative options, such as credit cards or personal loans, if they require access to credit. Users should understand the nature of these financial tools and make informed decision.

The future of digital finance is dynamic. While direct lending from Salo Cash might not be a current reality, the industry is continuously evolving. Users should stay informed about platform updates and regulatory changes to make sound financial decisions in this ever-changing landscape.