Which Of These Is Not A Source Of Market Failure

:max_bytes(150000):strip_icc()/Market-Failure-V3-ab96ad16afee413ea84ce9c9fe30038d.jpg)

The question "Which of these is not a source of market failure?" has sparked intense debate among economists and policymakers, leading to significant implications for economic policy decisions. Identifying genuine sources of market failure is crucial for effective intervention and resource allocation.

This article cuts through the complexities to pinpoint what doesn't qualify as a market failure, focusing on clear economic principles and avoiding common misconceptions.

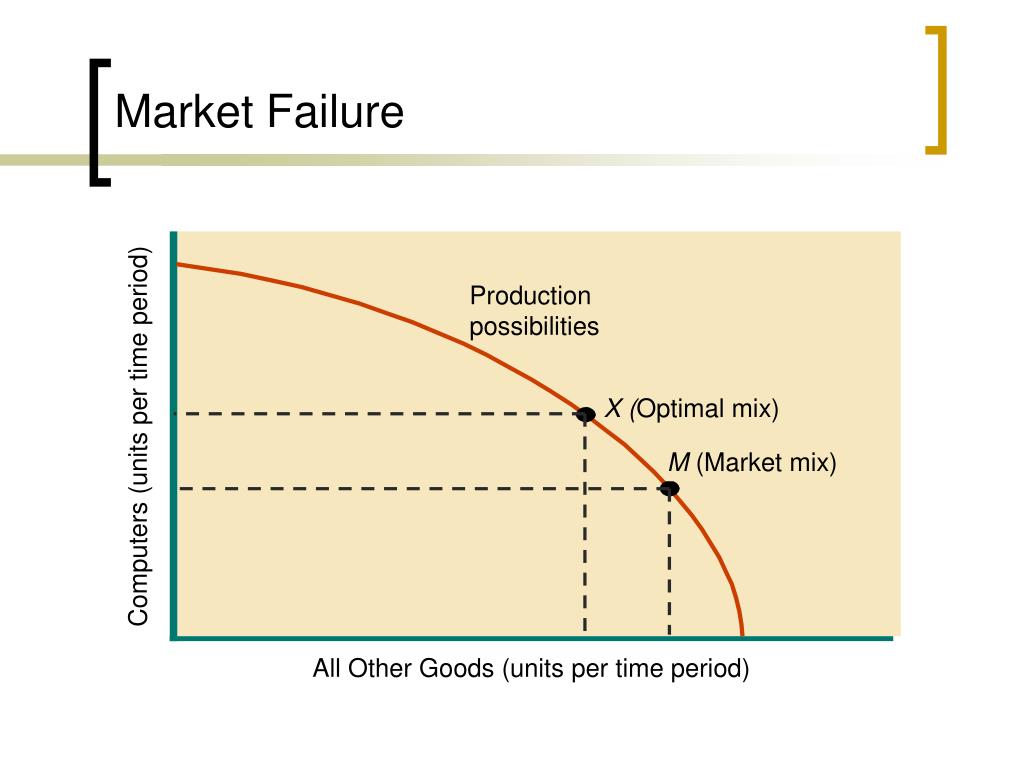

Defining Market Failure

Market failure occurs when the allocation of goods and services by a free market is not Pareto optimal, meaning another allocation exists where participants benefit without making others worse off. This typically leads to economic inefficiency.

Understanding what doesn't cause this inefficiency is just as critical as understanding what does.

Common Sources of Market Failure

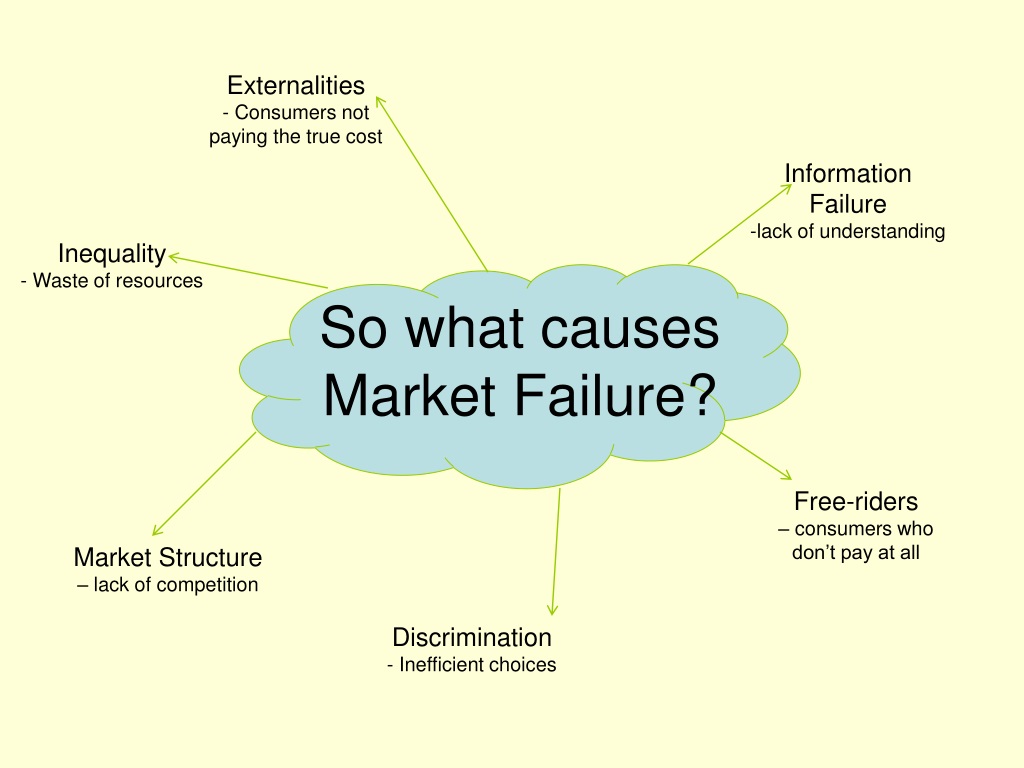

Several factors are widely recognized as sources of market failure. These include externalities, public goods, information asymmetry, and monopoly power.

Externalities arise when the production or consumption of a good affects a third party who is not compensated for the effect. Pollution is a classic example.

Public goods are non-excludable and non-rivalrous, meaning everyone can consume them and one person's consumption does not diminish another's. National defense is a common example.

Information asymmetry occurs when one party in a transaction has more information than the other. This can lead to adverse selection and moral hazard.

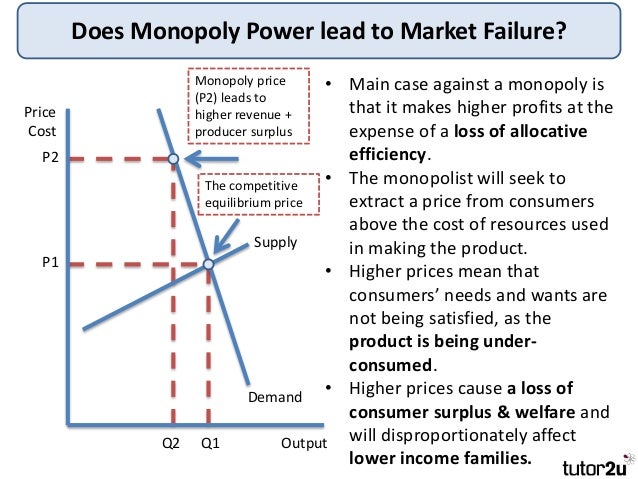

Monopoly power arises when a single firm controls a significant portion of the market, leading to reduced output and higher prices. This deviates from competitive market outcomes.

The Non-Source: Consumer Preferences

Crucially, consumer preferences, in and of themselves, are not a source of market failure. This is a key point often overlooked.

A market that efficiently caters to consumer preferences, even if those preferences seem unconventional or unpopular, is not necessarily failing. The market is simply responding to demand.

For example, if consumers demand sugary drinks, the production and sale of these drinks, even if deemed unhealthy by some, does not inherently constitute a market failure. The issue might be related to information asymmetry (consumers not fully understanding the health risks) or externalities (healthcare costs borne by society), but the preference itself is not the root cause.

Why Consumer Preferences Are Distinct

The distinction is rooted in the principle of consumer sovereignty. In a free market, consumers are assumed to be rational actors making choices based on their own utility functions.

Interfering with these choices solely based on normative judgments about the "correctness" of those preferences can lead to economic distortions and reduced welfare.

Government intervention based on paternalistic views, where authorities believe they know what is best for consumers better than the consumers themselves, can be problematic.

Data and Evidence

Economic literature consistently emphasizes that market efficiency is defined relative to consumer demand. Numerous studies demonstrate that interventions distorting market responses to consumer demand typically generate welfare losses. A 2019 study by the National Bureau of Economic Research (NBER) found that taxes imposed on specific goods based solely on policymakers' preferences, rather than correcting for externalities, led to significant deadweight losses.

Empirical evidence also shows that attempts to "correct" consumer preferences often face unintended consequences. For example, banning certain products can create black markets and lead to even more harmful outcomes.

Implications and Next Steps

Understanding that consumer preferences themselves are not a source of market failure is vital for informed policy decisions. Instead of attempting to dictate what consumers should want, policymakers should focus on addressing genuine market failures such as externalities and information asymmetry.

Future research should focus on better identifying and quantifying the actual sources of market failure to ensure that interventions are targeted and effective. Further investigation into the impact of behavioral economics on consumer decision-making can also provide valuable insights.

The debate surrounding market failure will continue, but clarifying the role of consumer preferences is a crucial step towards more efficient and welfare-enhancing economic policies.