Venmo Credit Card Credit Score Requirements

The allure of a sleek, app-integrated credit card is undeniable, especially for the digitally native generation. But for many, the dream of owning a Venmo Credit Card hinges on a critical factor: credit score. Recent data reveals a tightening lending environment, leaving potential applicants wondering just how high their score needs to be to unlock access to this popular card.

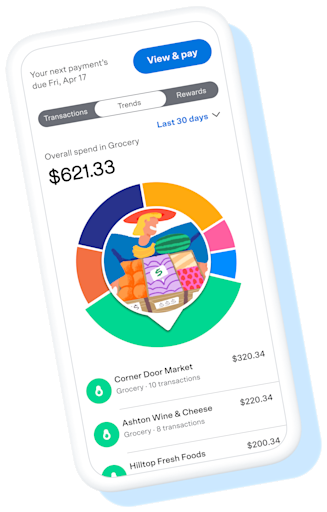

The Venmo Credit Card, offered through Synchrony Bank, provides a seamless connection to the Venmo app, allowing users to track spending, split purchases, and earn rewards effortlessly. This article delves into the specific credit score requirements for the Venmo Credit Card, analyzing publicly available information, expert opinions, and applicant experiences to provide a comprehensive overview of what it takes to qualify. We will also examine alternative options for those who may not currently meet the eligibility criteria.

Credit Score Expectations

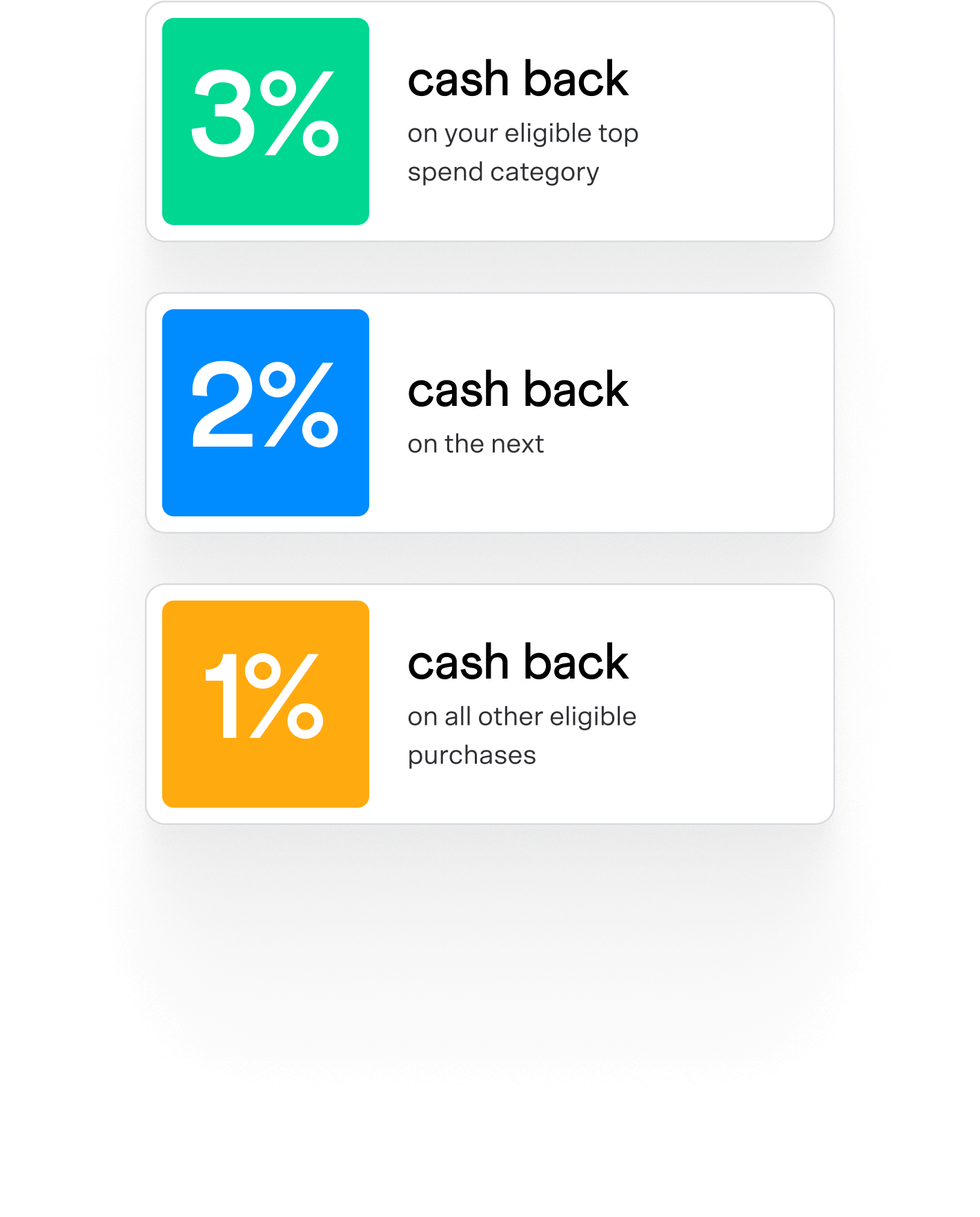

While Venmo and Synchrony Bank don't explicitly publish a minimum credit score requirement, data analysis and user reports suggest a "good" to "excellent" credit score is generally needed. This typically translates to a FICO score of 670 or higher.

Individuals with scores in the "fair" range (580-669) may still be approved, but it's less likely and depends on other factors. These factors can include income, debt-to-income ratio, and overall credit history.

"Credit card issuers like Synchrony Bank look at the entire credit profile, not just the score itself," explains credit analyst, Sarah Miller. "A strong history of on-time payments and low credit utilization can offset a slightly lower score."

Factors Beyond the Score

A high credit score isn't the only determinant. Synchrony Bank assesses the applicant's complete financial picture. Income stability is a critical factor.

A steady income stream indicates the applicant's ability to repay debts. High debt-to-income ratio (DTI) raises red flags.

DTI compares monthly debt payments to gross monthly income. A lower DTI is generally more favorable.

Data Analysis & User Experiences

Online forums and credit card communities are rife with anecdotal evidence. Many users report approval with credit scores in the 700s.

Others with scores in the high 600s mention receiving offers with higher APRs. This indicates a perceived higher risk by the lender.

However, those with scores below 650 often report denials. "I applied with a 640 and was rejected," one user posted on a popular credit card forum.

Alternatives for Building Credit

If your credit score doesn't meet the Venmo Credit Card requirements, several alternatives can help you build or rebuild credit. Secured credit cards are a great starting point.

These cards require a cash deposit as collateral. This reduces the risk for the issuer and makes it easier to get approved.

Credit builder loans are another option. These loans are designed specifically to help individuals establish a positive credit history.

The Future of Credit Access

The lending landscape is constantly evolving. Factors like economic conditions and interest rate hikes can influence credit card approval rates.

It's crucial to monitor your credit report regularly. Address any errors or inaccuracies promptly.

Maintaining responsible credit habits is the key to unlocking access to better financial products. This includes on-time payments, low credit utilization, and avoiding unnecessary debt.

The Venmo Credit Card may not be immediately accessible to everyone. By focusing on credit improvement strategies, aspiring applicants can increase their chances of approval in the future.

![Venmo Credit Card Credit Score Requirements Venmo Credit Card Review: [WHAT YOU NEED TO KNOW]](https://shawnmanaher.com/wp-content/uploads/2022/12/venmo-credit-card-review-1.jpg)