Why Is Cash Flow Statement Important

Imagine running a small bakery. The aroma of freshly baked bread fills the air, customers line up eager to buy your delicious creations, and the till rings merrily throughout the day. But beneath this surface of success, are you truly making money? Can you pay your suppliers, your employees, and still have enough left over to invest in new equipment or expand your business?

The answer lies not just in your sales figures, but in understanding your cash flow statement. This vital financial document is like the heartbeat of your business, revealing the real movement of money in and out, and ultimately determining your financial health and long-term viability.

The Lifeblood of Business: Understanding Cash Flow

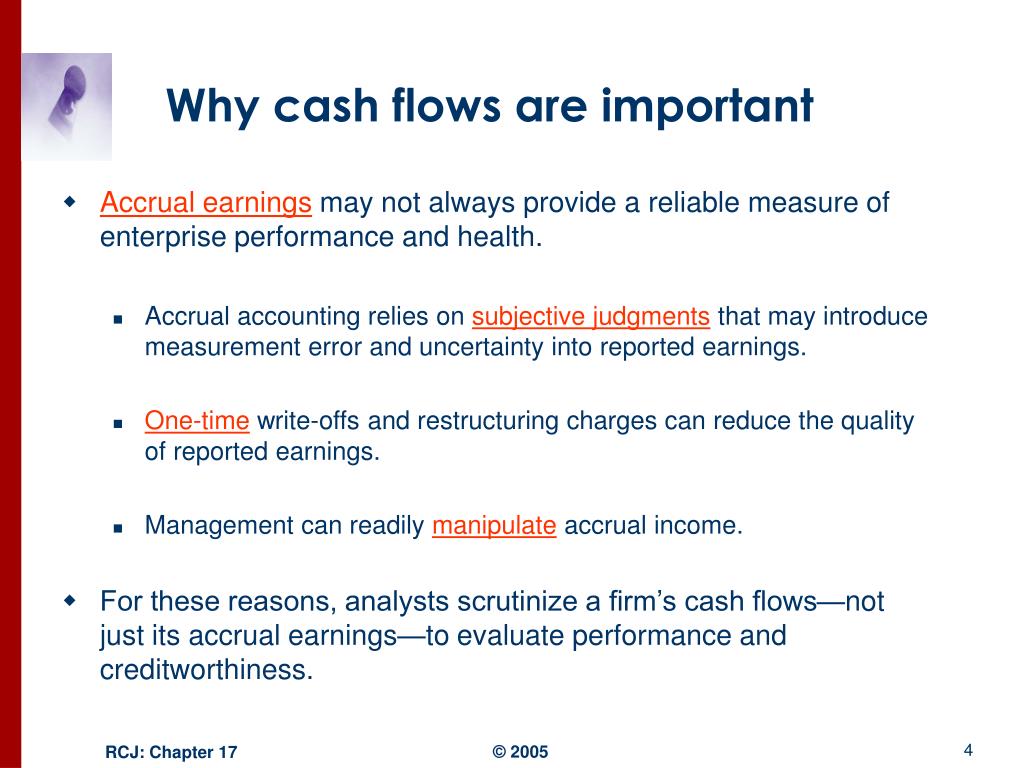

The cash flow statement often gets overshadowed by the more glamorous profit and loss statement (income statement) and the balance sheet. However, it provides a uniquely crucial perspective. While the income statement shows profitability, and the balance sheet presents a snapshot of assets and liabilities, the cash flow statement reveals the actual cash generated and used by the business over a specific period.

Think of it this way: you can have high sales and a positive net income on paper. But if your customers are slow to pay, or you've invested heavily in inventory that isn't selling, you could still face a cash crunch. This is why understanding the cash flow statement is essential for all businesses, regardless of size.

Three Key Components

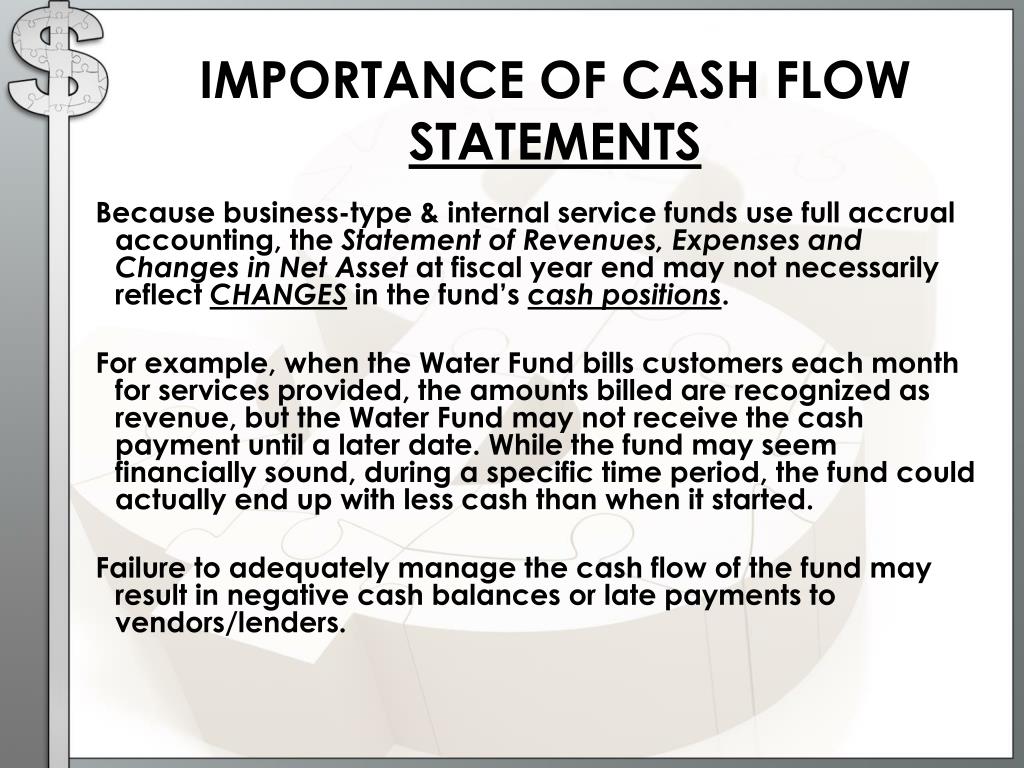

The cash flow statement is divided into three main sections, each offering insights into different aspects of the business.

First, there's Cash Flow from Operating Activities. This section focuses on the core business activities – the day-to-day operations that generate revenue. It includes cash received from sales, cash paid to suppliers, salaries, and other operating expenses.

Next, Cash Flow from Investing Activities. This area covers the purchase and sale of long-term assets like property, plant, and equipment (PP&E). It also includes investments in securities.

Finally, Cash Flow from Financing Activities. This section deals with how the business is funded. This includes activities related to debt, equity, and dividends. Borrowing money, repaying loans, issuing stock, and paying dividends all fall under this category.

Why It Matters: Beyond the Bottom Line

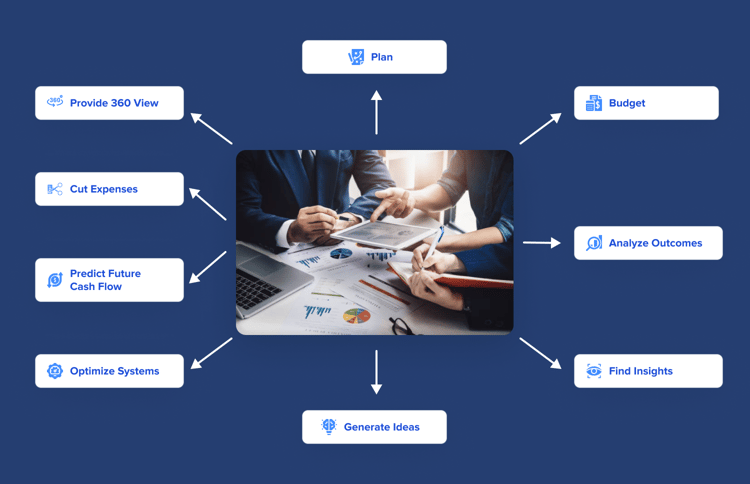

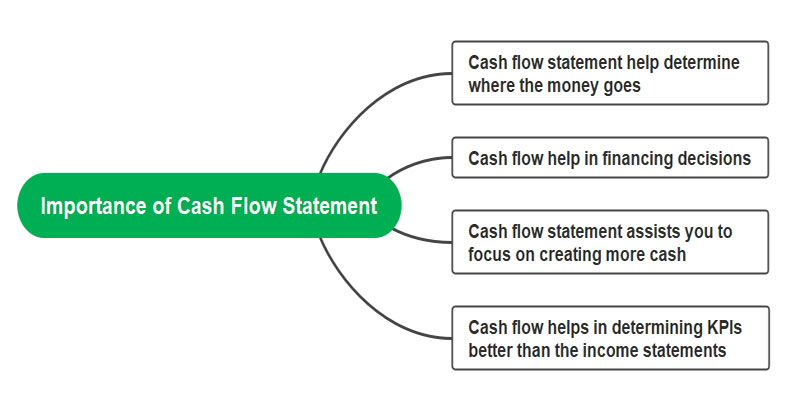

The importance of the cash flow statement extends far beyond simply tracking where the money went. It's a critical tool for decision-making, risk management, and attracting investors.

For example, by analyzing trends in operating cash flow, businesses can identify potential problems early on. Declining operating cash flow might indicate slowing sales, rising costs, or inefficient collection practices. This information allows management to take corrective action before the situation becomes critical.

Furthermore, the cash flow statement helps assess a company's ability to meet its short-term obligations. Can the company pay its bills on time? Can it afford to invest in new opportunities? These are crucial questions that the cash flow statement can answer.

Investors and lenders also rely heavily on the cash flow statement. A company with strong and consistent cash flow is seen as a more attractive investment because it demonstrates financial stability and the ability to generate returns. According to the Securities and Exchange Commission (SEC), publicly traded companies are required to file cash flow statements as part of their regular financial reporting, highlighting its significance in the investment world.

Looking Ahead: A Tool for Growth

In conclusion, the cash flow statement is an indispensable tool for understanding the financial health of a business. It offers insights that other financial statements simply cannot provide.

By carefully analyzing the cash flow statement, business owners and managers can make informed decisions, manage risk effectively, and ultimately steer their companies towards sustainable growth and long-term success. It's more than just numbers; it's the story of your business's financial journey.

So, the next time you're reviewing your financials, don't overlook the cash flow statement. It might just hold the key to unlocking a brighter, more secure future for your business. It truly is the lifeblood.

![Why Is Cash Flow Statement Important What is the Cash Flow Statement? [PDF inside] Parts, Importance](https://educationleaves.com/wp-content/uploads/2023/03/CASH-FLOW-STATEMENT.png)

:max_bytes(150000):strip_icc()/dotdash_Final_Understanding_the_Cash_Flow_Statement_Jul_2020-01-013298d8e8ac425cb2ccd753e04bf8b6.jpg)