Loans Like Upstart For Bad Credit

In an era where financial stability can feel elusive, particularly for those with less-than-perfect credit scores, alternative lending platforms are gaining traction. Companies like Upstart, which utilize non-traditional data points to assess creditworthiness, are increasingly being seen as options for individuals struggling to access conventional loans. This trend raises important questions about financial inclusion, risk assessment, and the evolving landscape of consumer credit.

The rise of these alternative lenders is significant because it challenges the traditional credit scoring model that often excludes a large segment of the population. These platforms offer a potential pathway to credit for individuals who may be denied by traditional banks due to factors like limited credit history or past financial difficulties. This article will delve into the characteristics of these loans, their potential benefits and drawbacks, and the broader implications for borrowers and the financial industry.

Understanding the Landscape of Bad Credit Loans

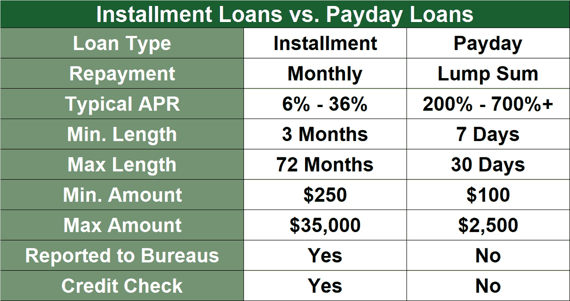

Loans targeted at individuals with bad credit typically feature higher interest rates and fees compared to loans offered to those with good credit. This reflects the increased risk lenders assume when lending to borrowers with a history of payment difficulties or a limited credit track record. While these loans can provide access to much-needed funds, it is essential for borrowers to understand the terms and conditions carefully.

Companies such as Upstart differentiate themselves by employing sophisticated algorithms that consider a wider range of factors beyond traditional credit scores. These factors may include education, employment history, and even area of study. By analyzing these alternative data points, lenders aim to gain a more comprehensive understanding of a borrower's repayment ability.

Key Features of Loans Like Upstart

Upstart and similar platforms offer unsecured personal loans that can be used for a variety of purposes, including debt consolidation, home improvement, and unexpected expenses. Loan amounts typically range from a few thousand dollars to tens of thousands, with repayment terms ranging from three to five years. The application process is usually conducted online, offering a streamlined and convenient experience for borrowers.

Interest rates on these loans are highly variable and depend on individual credit profiles and the loan terms selected. While the availability of loans to individuals with bad credit is a positive development, the higher interest rates can make these loans expensive over the long term. Therefore, borrowers should carefully evaluate their ability to repay the loan before committing.

The Pros and Cons of Alternative Lending Platforms

One of the primary advantages of platforms like Upstart is increased accessibility to credit for individuals who may be shut out by traditional lenders. The use of alternative data points in credit assessment can lead to more inclusive lending practices, potentially benefiting those with thin credit files or past credit challenges. The speed and convenience of the online application process are also attractive to many borrowers.

However, there are also potential drawbacks to consider. The higher interest rates and fees associated with bad credit loans can significantly increase the total cost of borrowing. There is also the risk of predatory lending practices, where lenders offer loans with unfair or unsustainable terms. Borrowers need to carefully compare offers and scrutinize the terms and conditions before accepting a loan.

Potential Impact on Borrowers and the Financial Industry

The rise of alternative lending platforms has the potential to reshape the consumer credit landscape. By expanding access to credit, these platforms can help individuals meet their financial needs and build a positive credit history. This, in turn, can improve their access to other financial products and services in the future.

The increased competition from alternative lenders is also putting pressure on traditional banks and credit unions to innovate and adapt their lending practices. Some institutions are exploring the use of alternative data points in their own credit assessments to reach a broader range of borrowers. The growth of this market will continue to spur new credit risk models.

Navigating the Bad Credit Loan Market

For individuals considering a loan from platforms like Upstart or other lenders catering to borrowers with bad credit, it is crucial to exercise caution and due diligence. Borrowers should thoroughly research and compare offers from multiple lenders, paying close attention to interest rates, fees, and repayment terms. It's equally important to check the lender’s reputation and ensure they're accredited by the Better Business Bureau, for example.

Before taking out a loan, borrowers should assess their ability to repay it responsibly. Creating a budget and evaluating monthly income and expenses can help determine whether the loan payments are manageable. Seeking advice from a financial advisor can also provide valuable guidance and support.

"Borrowers must fully understand the terms before committing to loans," said Sarah Miller, a financial advisor at Credit Solutions Inc. "It's not just about the monthly payment, but the total cost of the loan over its lifetime."

Ultimately, loans from platforms like Upstart can provide a valuable source of funding for individuals with bad credit. However, responsible borrowing requires careful consideration, thorough research, and a clear understanding of the terms and conditions.

The evolution of the credit landscape and the proliferation of alternative lending platforms highlight the need for financial literacy and informed decision-making. As the industry continues to evolve, borrowers must equip themselves with the knowledge and tools necessary to navigate the complexities of the bad credit loan market and achieve their financial goals.