Can I Send A 1099 After Jan 31

The January 31st deadline for sending out 1099 forms looms large for businesses across the United States. However, many businesses find themselves scrambling to meet this deadline, raising the pressing question: What happens if you miss it? The answer isn't a simple yes or no, but rather a nuanced exploration of penalties, procedures, and potential mitigation strategies.

This article delves into the implications of filing 1099 forms after the January 31st deadline. We examine the potential penalties imposed by the IRS, explore the steps businesses should take if they miss the deadline, and provide resources to help navigate this complex process.

Understanding the 1099 Filing Deadline

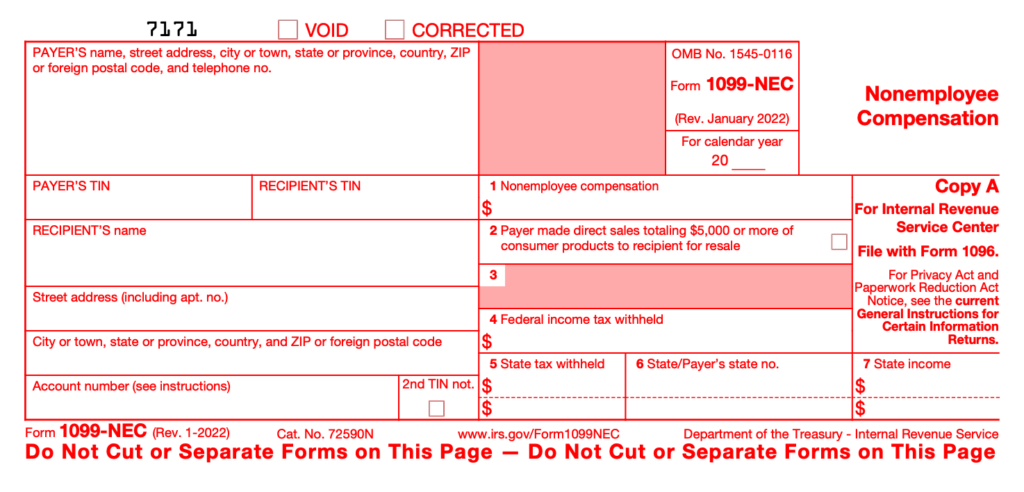

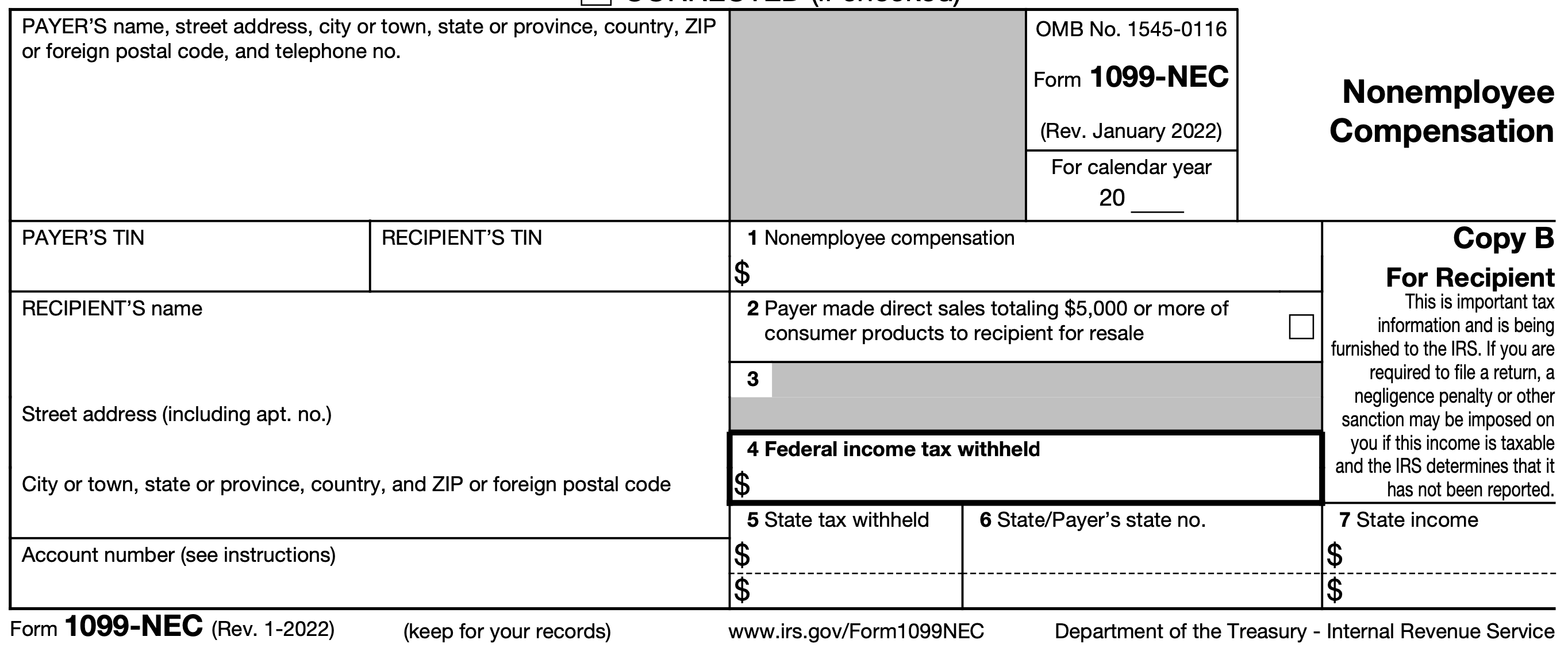

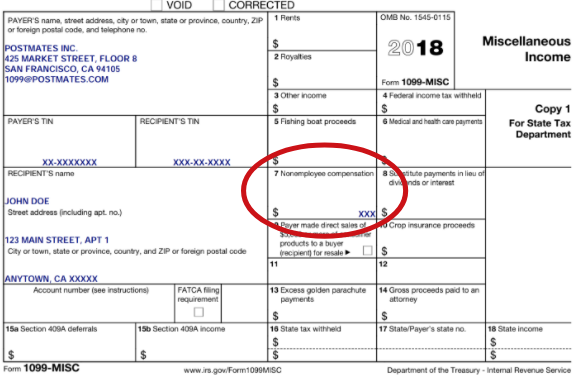

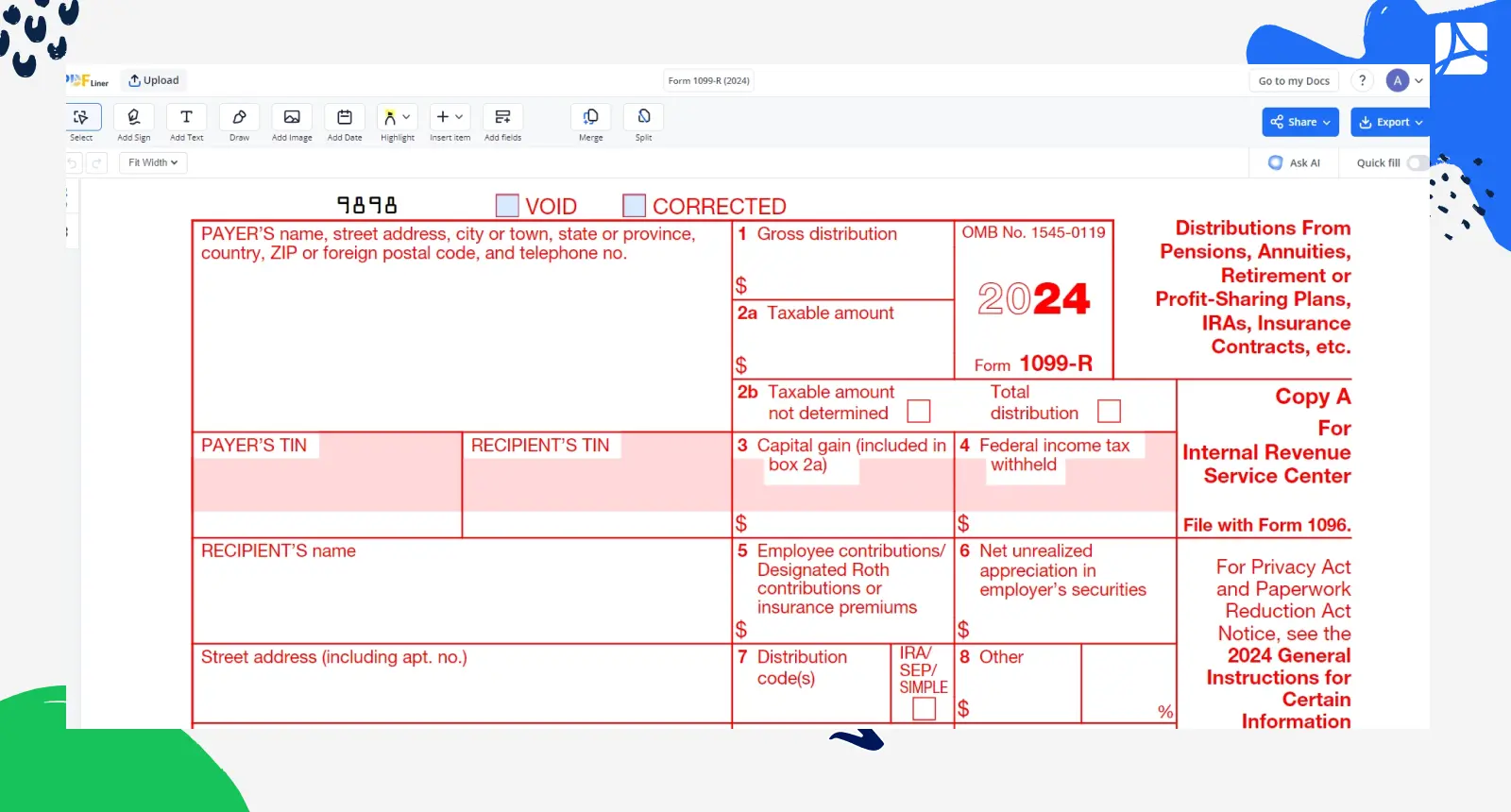

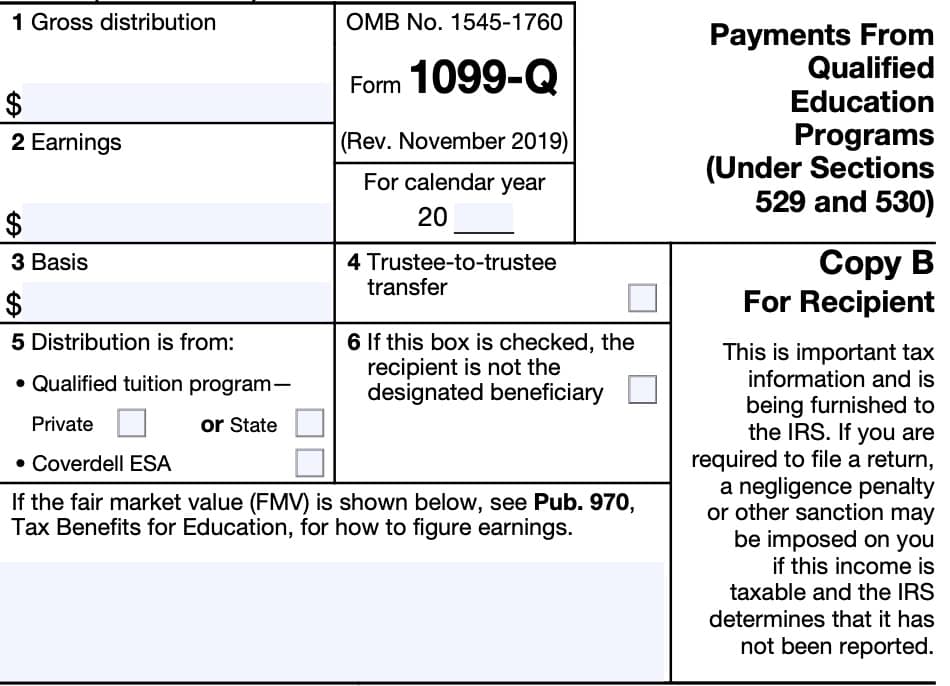

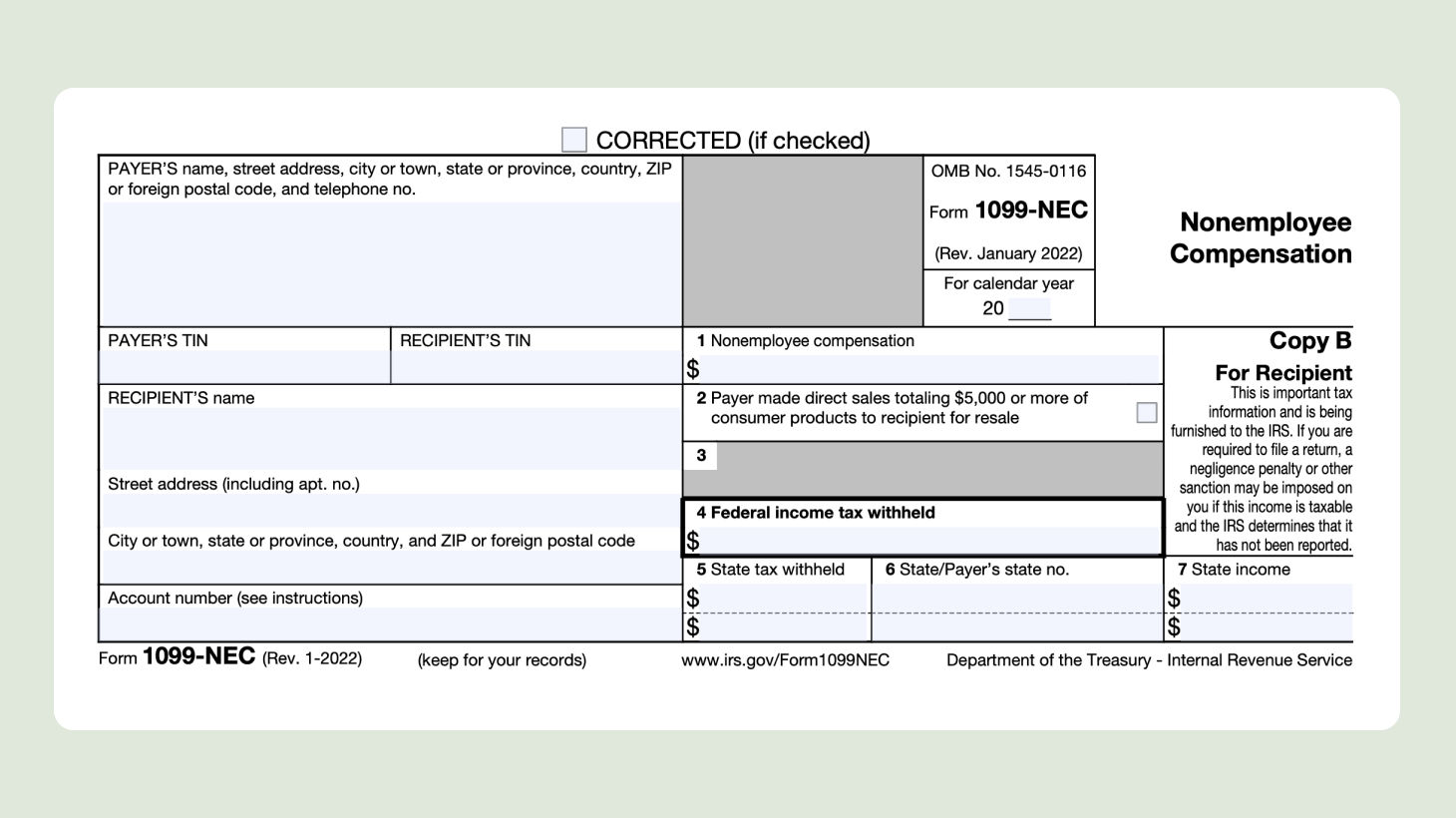

The IRS requires businesses to file various 1099 forms to report payments made to independent contractors, freelancers, and other non-employees. These forms are crucial for tax compliance, as they allow the IRS to match income reported by businesses with income reported by individuals.

The standard deadline for filing most 1099 forms with the IRS is January 31st. This applies to 1099-NEC (Nonemployee Compensation) forms filed either electronically or via paper. This deadline allows recipients to accurately prepare and file their income tax returns.

What Happens If You Miss the Deadline?

Missing the January 31st deadline for filing 1099 forms can result in penalties from the IRS. The severity of these penalties depends on how late the forms are filed and whether the failure to file was intentional.

The penalty structure is tiered, meaning that the later you file, the higher the penalty. For example, penalties may be lower if the 1099 is filed within 30 days of the deadline.

However, waiting longer to file significantly increases the penalty per return. Intentional disregard of the filing requirement carries the most substantial penalties.

Penalty Amounts for Late Filing (Subject to Change):

The exact penalty amounts are subject to change, so consulting the IRS website or a tax professional for the most up-to-date information is essential. Penalties are generally calculated per 1099 form not filed correctly.

"Filing information returns helps the IRS detect potential discrepancies and ensure that everyone is paying their fair share of taxes." – IRS Statement

Steps to Take If You Miss the Deadline

If you realize you've missed the January 31st deadline, don't panic. The most important thing is to take immediate action to rectify the situation.

First, file the delinquent 1099 forms as soon as possible. The quicker you file, the lower the potential penalties.

Second, include a statement with your late filing explaining the reason for the delay. This statement may help mitigate penalties, particularly if you can demonstrate reasonable cause for the late filing.

Reasonable Cause and Penalty Abatement

The IRS may waive penalties for late filing if you can demonstrate "reasonable cause." This generally means that you had a legitimate and unavoidable reason for missing the deadline.

Examples of reasonable cause could include a death in the family, a serious illness, or a natural disaster that prevented you from filing on time. The IRS considers each case individually.

To request a penalty abatement, you'll need to submit a written statement explaining the circumstances that prevented you from filing on time. You may also need to provide supporting documentation to substantiate your claim.

Preventing Future Late Filings

The best way to avoid penalties for late filing is to implement systems and processes to ensure timely filing of 1099 forms. Start by gathering necessary information from contractors and vendors early in the year.

Using accounting software that automates 1099 creation and filing can also streamline the process and reduce the risk of errors. Consider outsourcing 1099 filing to a professional tax preparer or payroll service.

Setting reminders and maintaining organized records throughout the year are crucial steps to ensure compliance.

Resources for Businesses

The IRS website (irs.gov) is an excellent resource for information on 1099 filing requirements, penalties, and reasonable cause. They offer publications, FAQs, and online tools to assist businesses.

Consult with a qualified tax professional for personalized advice and guidance. A professional can help you navigate the complexities of 1099 filing and ensure compliance with IRS regulations.

Remember, taking proactive steps to comply with 1099 filing requirements can save your business time, money, and potential headaches in the long run.

Conclusion

While the January 31st deadline for 1099 filing is critical, missing it doesn't necessarily spell disaster. Understanding the potential penalties, taking prompt action to file late forms, and demonstrating reasonable cause can help mitigate the impact.

By implementing robust systems and seeking professional guidance, businesses can minimize the risk of future late filings and maintain compliance with IRS regulations. Remember, proactive tax planning is key to success.