Can I Transfer Someone Else's Credit Card Balance To Mine

A growing number of consumers are asking: Can you transfer someone else's credit card balance to your own? The answer is generally no, with significant financial and legal implications.

This article provides a concise breakdown of the complexities surrounding credit card balance transfers involving different cardholders, focusing on practical implications and alternatives.

The Core Issue: Individual Liability

Credit card debt is inherently tied to the individual who opened the account. Financial institutions extend credit based on an individual's creditworthiness. It cannot be transferred to another person simply because they are willing to accept it.

This is due to consumer protection laws and the original contract signed with the credit card company. Contracts are only binding on the parties that enter them.

Legal and Contractual Barriers

Credit card agreements are between the card issuer and the individual cardholder. Attempting to transfer someone else's debt to your card violates the terms of service. It could lead to penalties or account closure.

Moreover, assuming someone else's debt without proper legal documentation can have negative legal repercussions. You need to have an agreement to be able to do so.

Scenarios Where It Might Seem Possible (But Isn't)

There are scenarios where individuals might mistakenly believe they can transfer balances. One example is within a marriage. Even in marriage, debts remain individually liable unless jointly applied for.

Another situation is when someone is helping a family member consolidate debt. You cannot technically transfer debt. However, you can help pay it off and then make a deal to be paid back.

Alternatives to Direct Balance Transfers

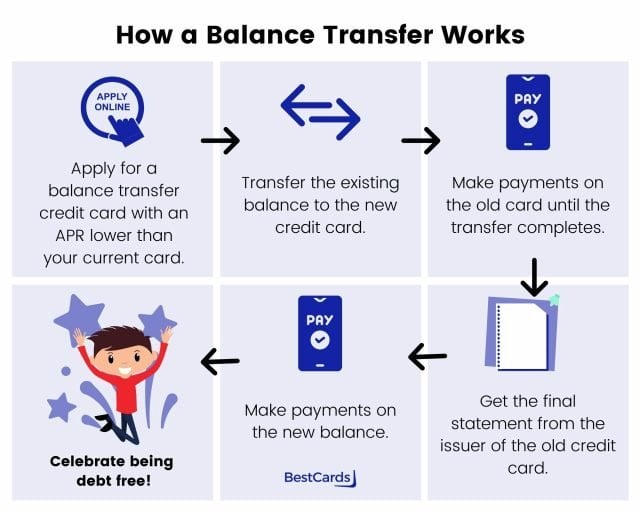

While a direct balance transfer is not possible, there are alternative strategies. You can offer to take out a personal loan and use it to pay off the other person's credit card debt.

The individual burdened by debt will need to obtain a new card and then be able to transfer it over. Another strategy is to help the individual budget better.

Joint Accounts and Authorized Users

Adding someone as an authorized user doesn't transfer debt liability. It only allows them to use the card. The original cardholder remains responsible for all charges.

Joint accounts, while creating shared liability, require a formal application process. Credit card companies would still do a thorough background check.

The Danger of Third-Party Transfer Services

Be wary of services promising to transfer balances between different individuals. These are often scams designed to steal personal information or charge exorbitant fees.

Always deal directly with reputable financial institutions. Never provide sensitive data to unverified third parties.

Practical Implications

Understanding these limitations can save you from legal issues. It can also protect you from potential financial fraud. Debt consolidation should be approached carefully.

Consumers should consult with a financial advisor before making any significant debt-related decisions. A legal consultation may also be necessary.

Next Steps and Ongoing Developments

Regulations surrounding credit card debt are constantly evolving. Staying informed through official financial resources is crucial.

Continue to monitor reputable financial news outlets for updates. This will help protect yourself from misleading information.