Retained Earnings Is Decreased By All Of The Following Except

Imagine a small, sun-drenched bakery, “Sweet Success,” where the aroma of freshly baked bread mingles with the sweet scent of vanilla. Every day, customers line up for their favorite treats, contributing to the bakery’s profits. But where does all that money really go, and how does the bakery keep track of its financial health? Understanding how profits are managed and how they impact the business’s retained earnings is essential for long-term prosperity.

At the heart of financial literacy lies the concept of retained earnings, the accumulated profits a company keeps and reinvests. This article delves into the factors that decrease retained earnings, exploring common culprits like net losses, dividends, and stock repurchases. Crucially, it will identify an *exception*: something that does not diminish this crucial financial reservoir, providing clarity for business owners and investors alike.

Understanding Retained Earnings: The Foundation

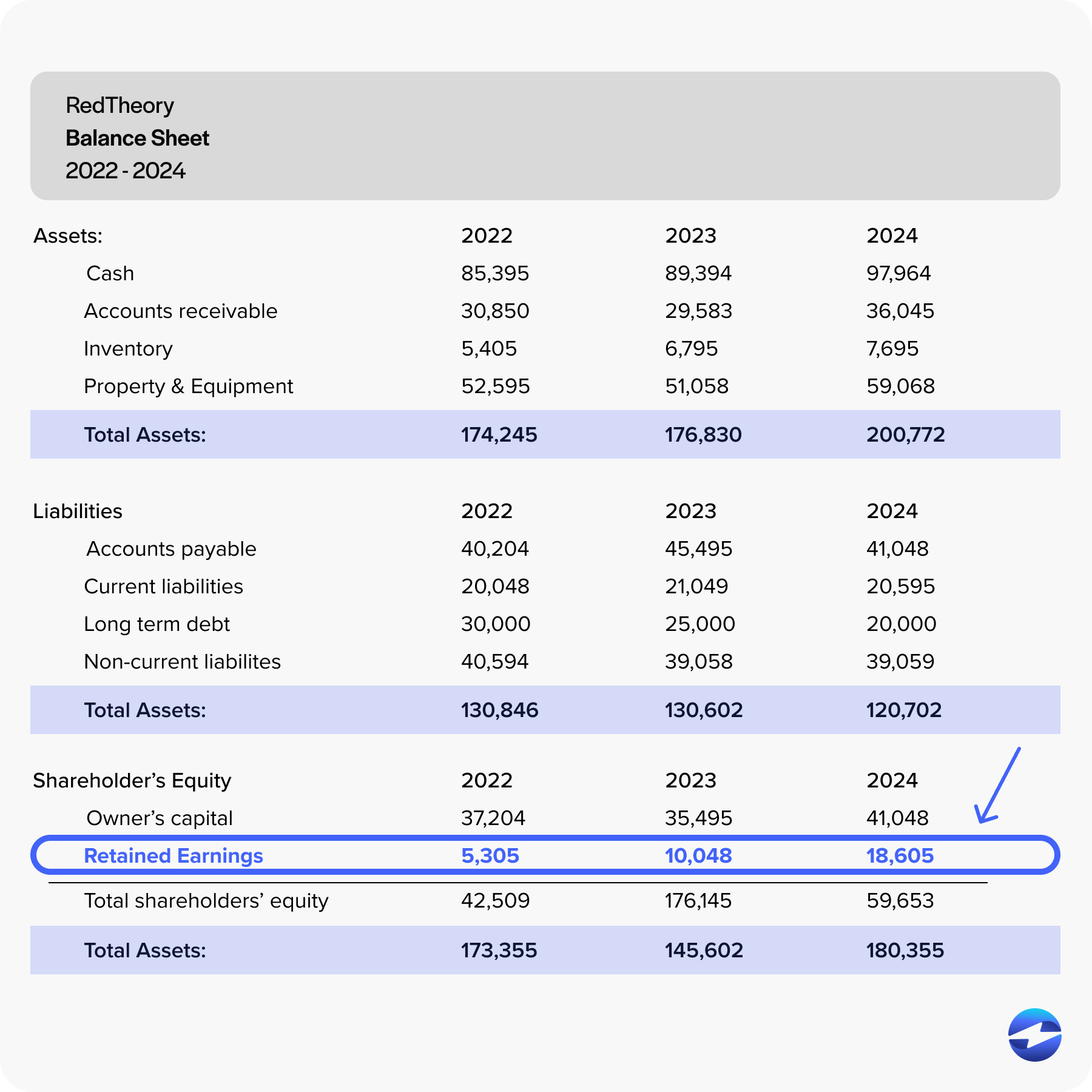

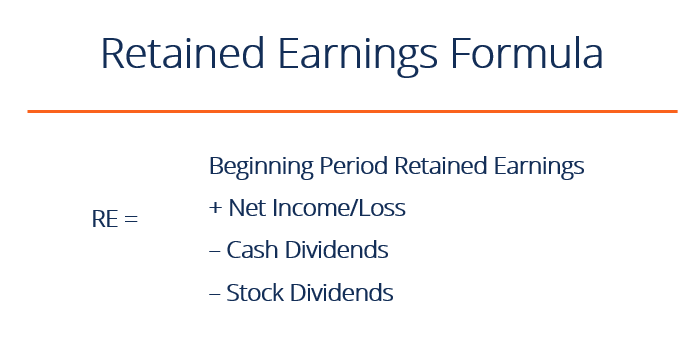

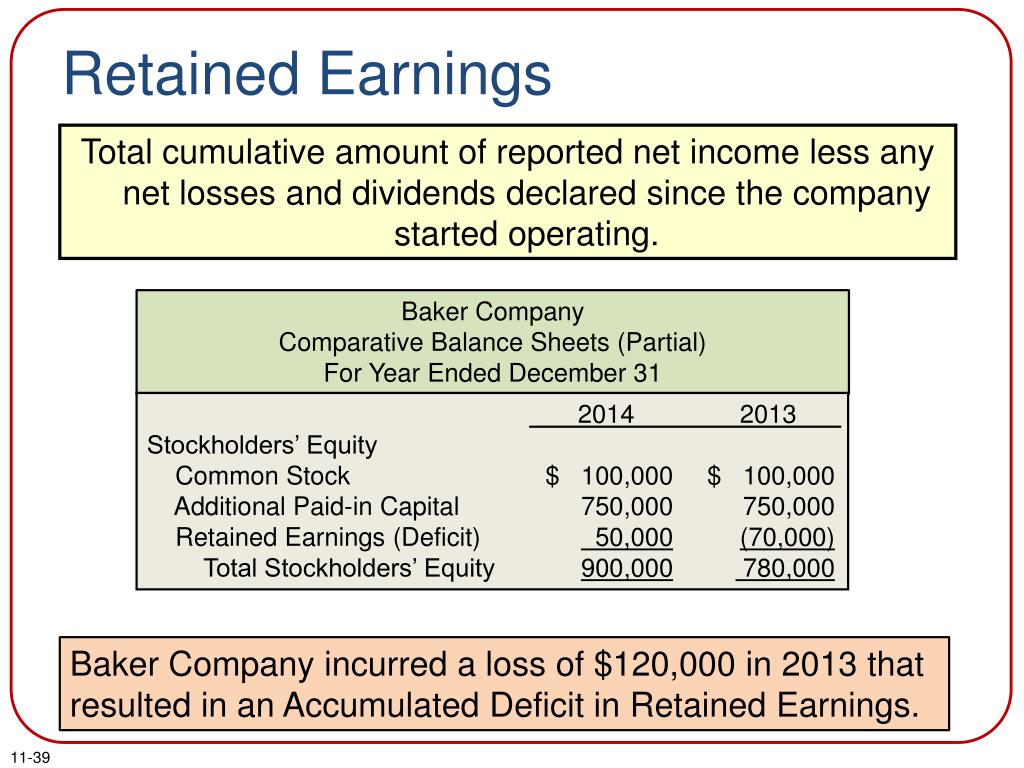

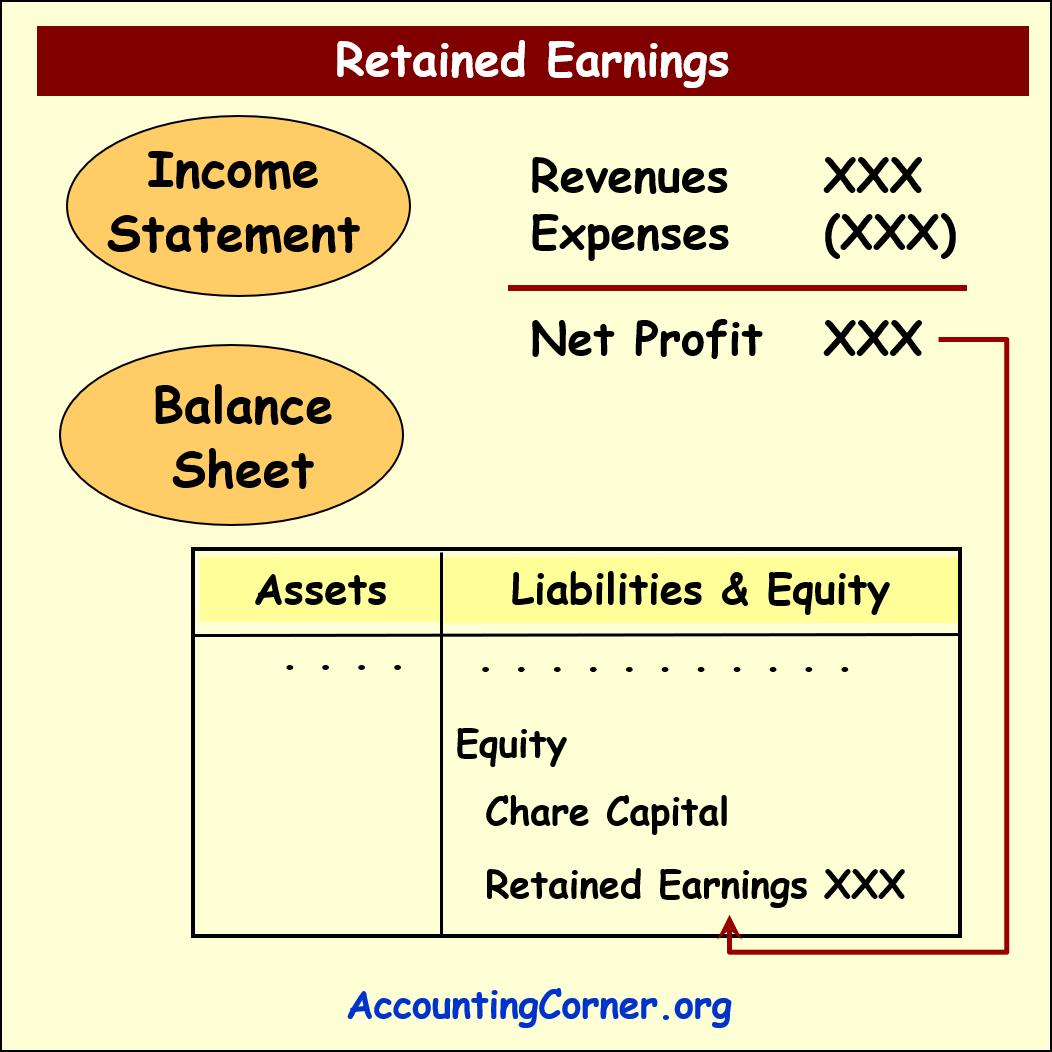

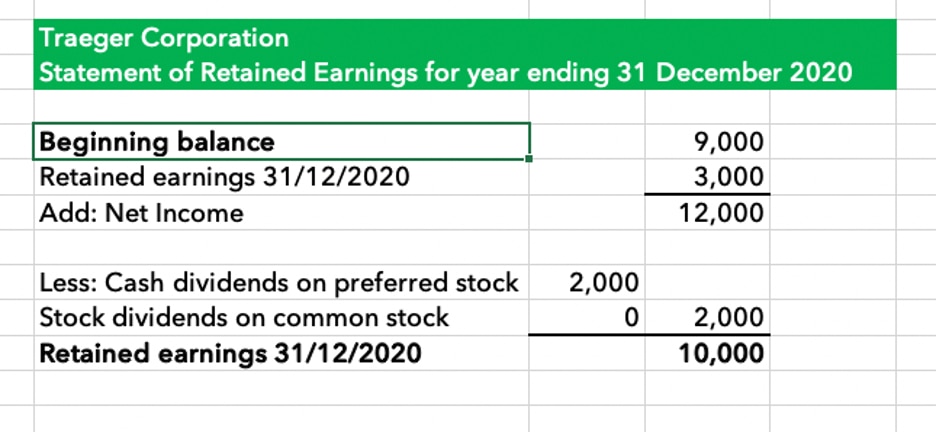

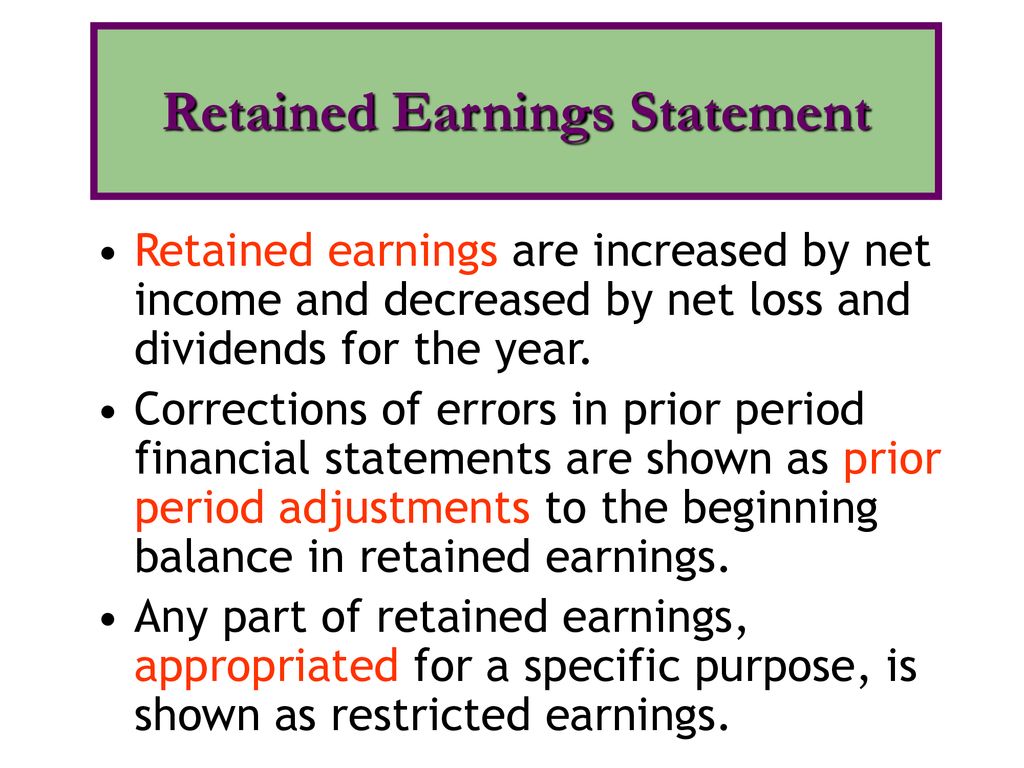

Retained earnings represent the cumulative net income a company has earned over its lifetime, minus any dividends paid out to shareholders or other distributions. It's essentially the portion of a company’s profits that has been saved and reinvested in the business, rather than distributed to owners. This account reflects the accumulated profits kept within the company for future growth and stability.

A healthy balance of retained earnings signals financial stability and the capacity to fund future projects. Companies with substantial retained earnings can finance expansions, research and development, or acquisitions without relying heavily on external funding.

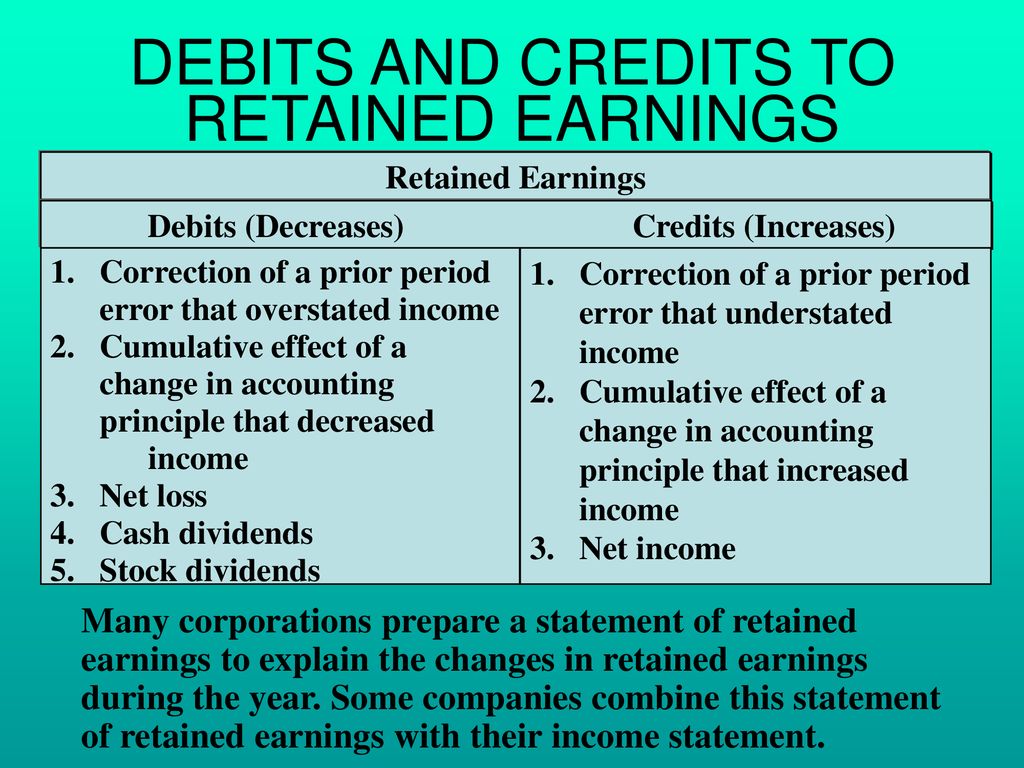

The Factors That Decrease Retained Earnings

Several factors can lead to a decrease in a company's retained earnings. Each factor has a direct impact on the business's financial reserves.

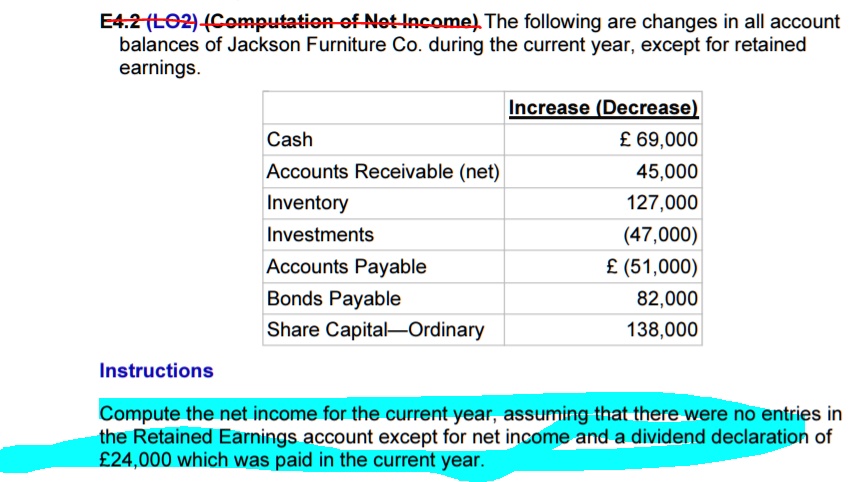

First and foremost is a net loss. When a company’s expenses exceed its revenues, it experiences a net loss, which directly reduces the retained earnings balance. This can result from poor sales performance, increased operating costs, or unexpected economic downturns.

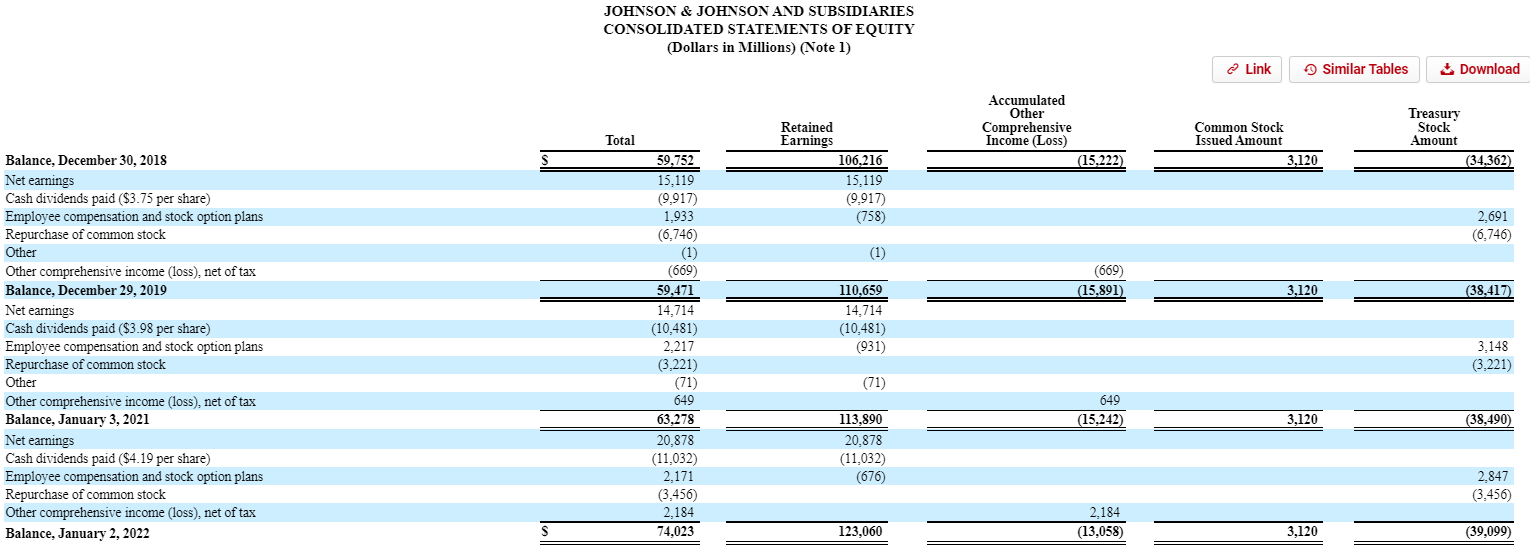

Dividends, payments made to shareholders from a company’s profits, are another primary factor in decreasing retained earnings. While dividends are a key incentive for investors, they directly reduce the amount of profit held back for reinvestment.

Stock repurchases, also known as share buybacks, occur when a company buys back its own shares from the open market. This reduces the number of outstanding shares and can boost earnings per share, but it also uses up cash, thus decreasing retained earnings.

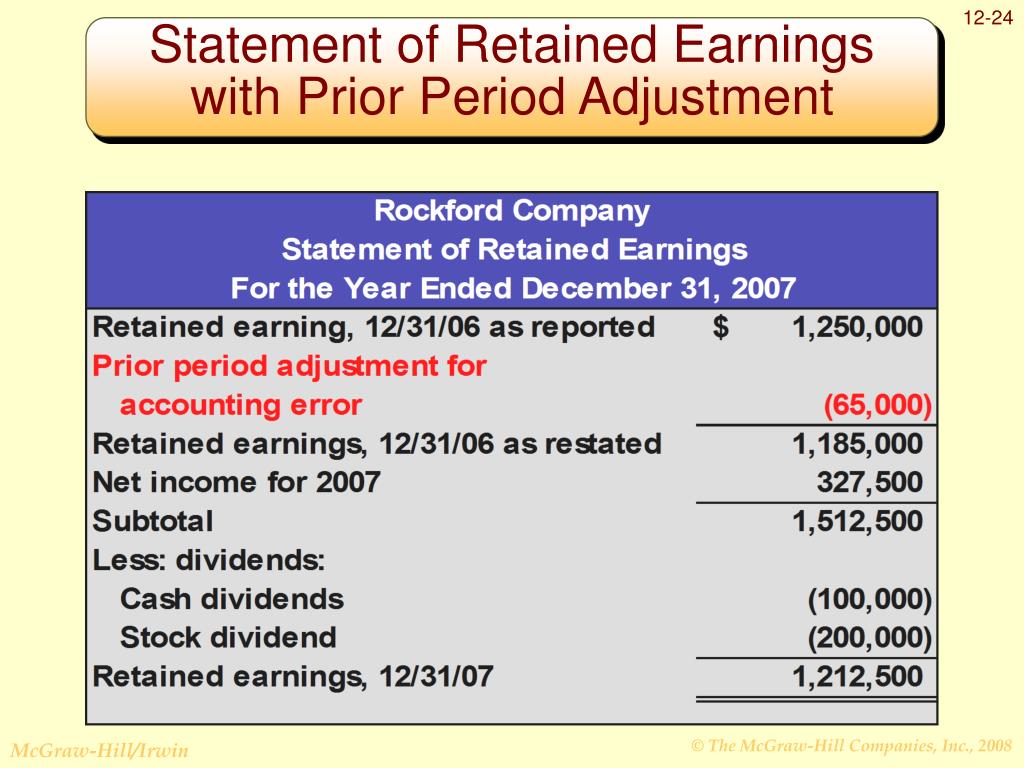

Accounting adjustments, such as prior period adjustments, can also affect retained earnings. If a company discovers errors in previous financial statements, correcting these errors might require adjustments to retained earnings.

The Exception: A Factor That Does NOT Decrease Retained Earnings

Now, let's consider the exception: a factor that doesn't decrease retained earnings. This is where understanding accounting nuances becomes crucial.

Issuing stock, the act of a company selling new shares of its stock to investors, does *not* decrease retained earnings. Instead, it increases a company's cash and equity (specifically, common stock or paid-in capital), boosting the company's overall financial resources without affecting the accumulated profits already held back.

When a company issues new stock, it receives cash from investors in exchange for ownership in the company. This influx of cash strengthens the company's balance sheet and provides additional funds for operations and investments. Retained earnings remains untouched during this process.

Why Issuing Stock Doesn’t Affect Retained Earnings

Issuing stock impacts the equity section of the balance sheet, specifically the common stock and additional paid-in capital accounts. Common stock represents the par value of the shares issued. Additional paid-in capital represents the amount investors paid above the par value.

The process of issuing stock generates fresh capital. This has no direct effect on the accumulated profits that make up retained earnings.

Real-World Examples and Implications

Consider a tech startup, “Innovate Solutions,” eager to expand its research and development capabilities. Faced with a choice, the company could either use its retained earnings or issue new stock to fund its projects.

Opting to issue new stock, Innovate Solutions successfully raises $1 million from investors. This money is then allocated to fund its R&D efforts. The company’s retained earnings balance remains intact, allowing it to maintain a buffer against unforeseen financial challenges while still investing in growth.

Conversely, if Innovate Solutions had chosen to use its retained earnings, it would have decreased the amount of accumulated profits available for other purposes. This would affect the company's flexibility in the long run.

The Significance of Retained Earnings Management

Effective management of retained earnings is crucial for long-term financial health. Balancing dividend payouts with reinvestment in the business is a delicate art.

Companies that prioritize reinvestment in growth projects tend to experience higher long-term returns. This also enhances shareholder value, while companies that distribute a large portion of their profits may struggle to fund future expansions or weather economic downturns.

Smart management of retained earnings allows companies to maintain a robust financial position. This enables them to seize growth opportunities and adapt to changing market conditions.

Conclusion: A Path to Sustainable Growth

Understanding the factors that affect retained earnings – net losses, dividends, stock repurchases – is paramount for making informed financial decisions. Recognizing that issuing stock stands apart as an exception provides a crucial perspective for businesses aiming to grow sustainably.

Just like “Sweet Success” bakery meticulously tracks its profits, businesses must thoughtfully manage their retained earnings. This balance strengthens their financial foundation and cultivates a recipe for enduring success. By carefully balancing dividends with reinvestment, companies can ensure they have the resources needed to innovate, expand, and thrive for years to come.

.jpg)