Can K 1 Losses Be Carried Forward

Navigating the complexities of tax law can be daunting, especially when dealing with investments structured as partnerships or S corporations. One particularly confusing area revolves around K-1 losses, specifically whether these losses can be carried forward to future tax years.

This article delves into the nuances of K-1 losses, explaining the rules surrounding their deductibility and whether investors can indeed carry them forward. Understanding these rules is crucial for investors seeking to minimize their tax liabilities and ensure compliance with IRS regulations.

Understanding Schedule K-1 and Passive Activity Losses

Schedule K-1 is an IRS form used to report a partner's or S corporation shareholder's share of income, losses, deductions, and credits. It’s essentially a summary of their portion of the entity's financial activity for the year.

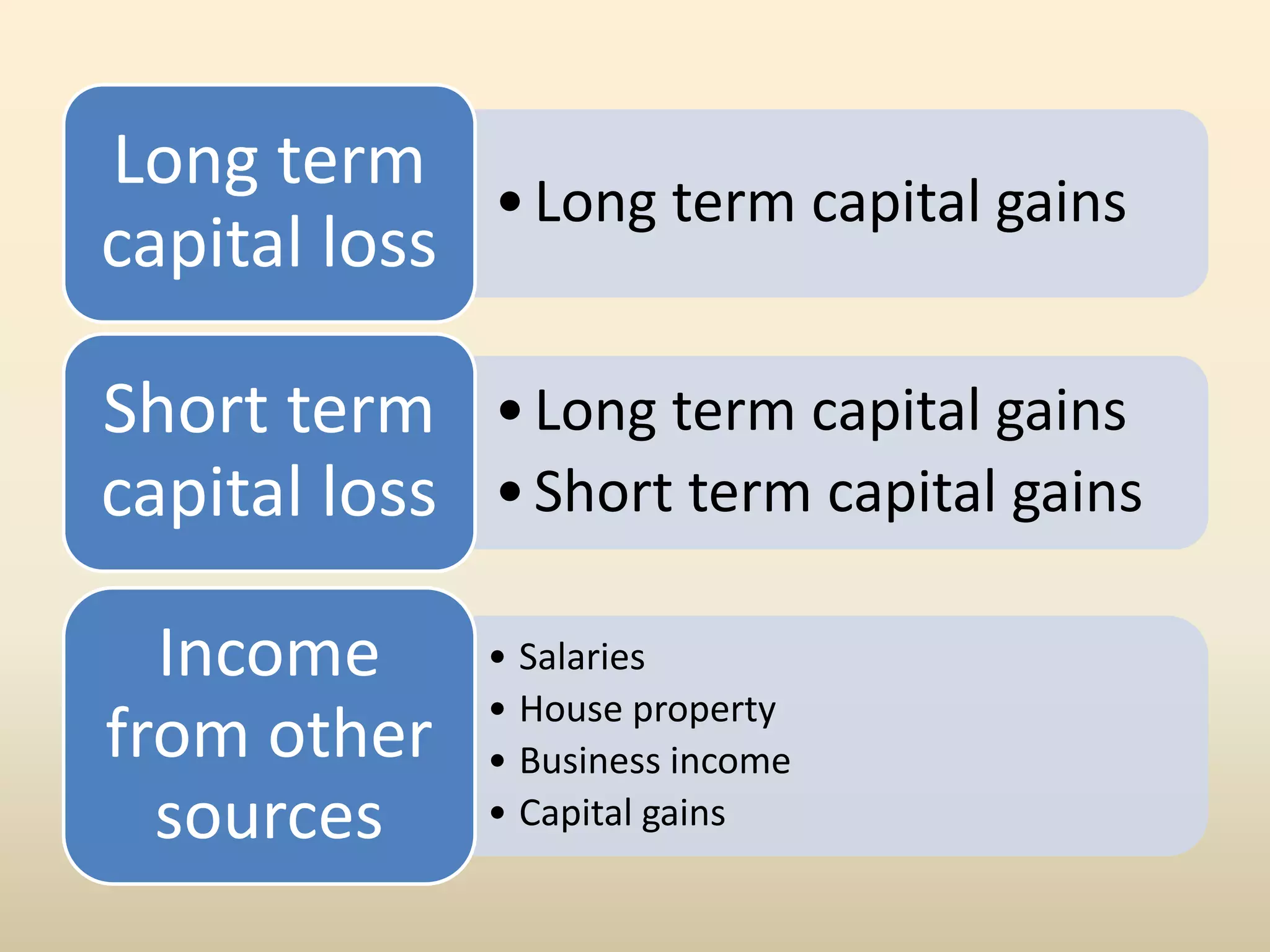

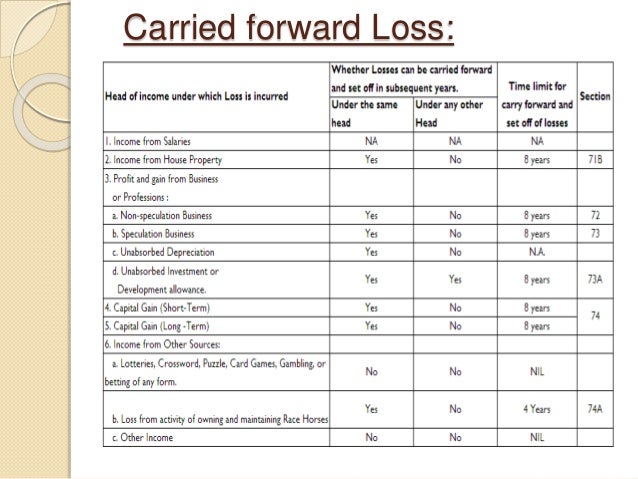

Losses reported on Schedule K-1 can arise from various business activities, but often fall under the category of passive activity losses. Passive activities are defined as those in which the taxpayer doesn't materially participate in the business operations on a regular, continuous, and substantial basis.

Rental activities are generally considered passive, regardless of the taxpayer's level of involvement. This categorization is important because the deductibility of these losses is subject to specific rules.

The At-Risk Rules and Basis Limitations

Before even considering the passive activity loss rules, taxpayers must first clear two hurdles: the at-risk rules and the basis limitations. These rules limit the amount of losses a taxpayer can deduct to the amount they have at risk in the activity or their basis in the partnership or S corporation.

The at-risk amount generally includes the cash and the adjusted basis of other property the taxpayer contributed to the activity, as well as certain amounts borrowed for use in the activity for which the taxpayer is personally liable. If a taxpayer's losses exceed their at-risk amount, the excess losses are suspended and carried forward until the taxpayer has sufficient at-risk amount in future years.

Similarly, a partner's basis in a partnership is generally the amount of money and the adjusted basis of property contributed to the partnership, increased by the partner's share of partnership income and decreased by the partner's share of partnership losses and distributions. Losses exceeding basis are also suspended and carried forward until sufficient basis is restored.

The Passive Activity Loss Rules: Carryforward Provisions

Once a taxpayer has satisfied the at-risk rules and basis limitations, the passive activity loss (PAL) rules come into play. These rules generally prevent taxpayers from deducting passive activity losses against other types of income, such as wages or portfolio income.

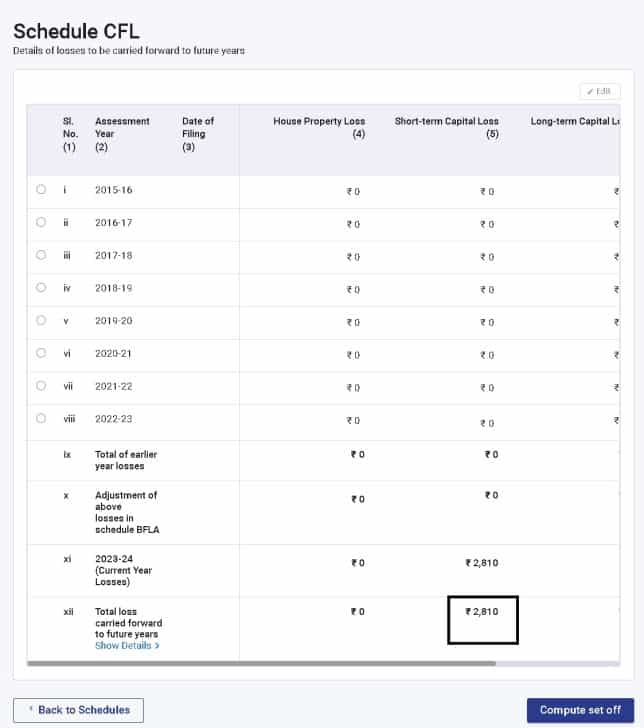

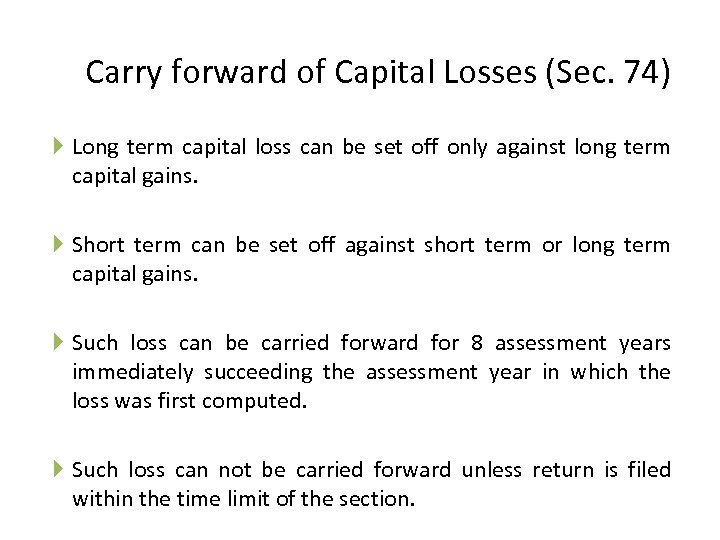

However, the disallowed passive activity losses are not permanently lost. They are suspended and carried forward to future years.

These carryforward provisions are a crucial aspect of the PAL rules, offering taxpayers the potential to deduct these losses in the future, subject to certain conditions.

When Can Carried-Forward Losses Be Deducted?

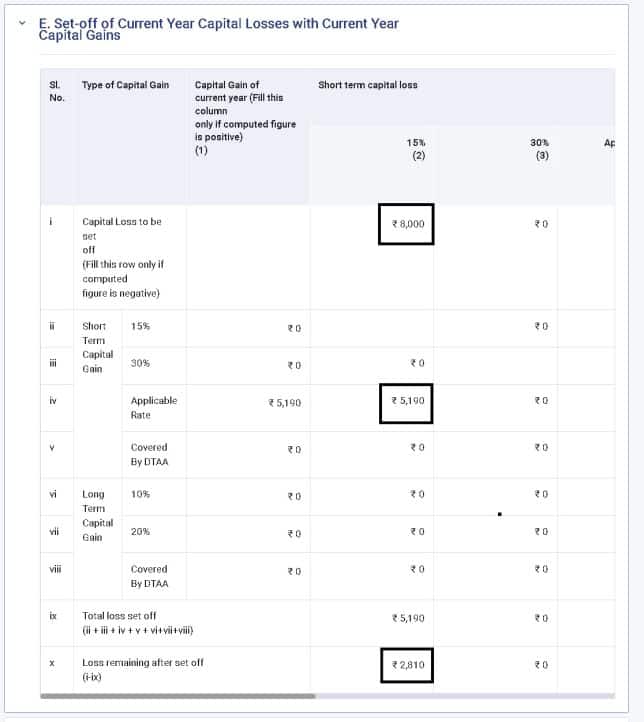

Carried-forward passive activity losses can be deducted in two primary scenarios. The first is when the taxpayer has passive activity income in a subsequent year.

In this case, the carried-forward losses can be used to offset that passive income, reducing the taxpayer's overall tax liability. The second, and often more impactful, scenario is when the taxpayer disposes of their entire interest in the passive activity.

Upon a complete disposition, any suspended passive activity losses associated with that activity become fully deductible, regardless of whether the taxpayer has other passive income.

Illustrative Example

Imagine John invests in a real estate partnership and receives a Schedule K-1 reporting a passive activity loss of $10,000. He doesn’t have sufficient passive income to offset the loss, so it is suspended.

In the following year, the partnership generates passive income of $5,000. John can use $5,000 of his carried-forward loss to offset this income, reducing his taxable income from the partnership to zero.

The remaining $5,000 of suspended loss is carried forward to the next year. If he eventually sells his entire interest in the partnership, the remaining $5,000 loss becomes fully deductible in that year, potentially offsetting other income.

Importance and Impact

Understanding the rules surrounding K-1 losses and carryforward provisions is essential for investors in partnerships and S corporations. These rules can significantly impact their tax liabilities.

Proper planning and record-keeping are crucial to maximize the potential benefits of these provisions and ensure compliance with tax regulations. It also helps the investors to make better decision about future investments.

Consulting with a qualified tax advisor is always recommended to navigate these complex rules and develop a tax strategy tailored to individual circumstances.