Can Qualified Dividends Be Offset By Capital Losses

Taxpayers facing capital losses must understand how these losses interact with qualified dividends. Crucially, capital losses CAN offset qualified dividends, impacting your overall tax liability.

This article clarifies the rules surrounding qualified dividends and capital losses, detailing how they interact and the implications for your tax bill. Understanding this interplay is essential for effective tax planning and minimizing your tax burden.

The Basics: Qualified Dividends and Capital Losses

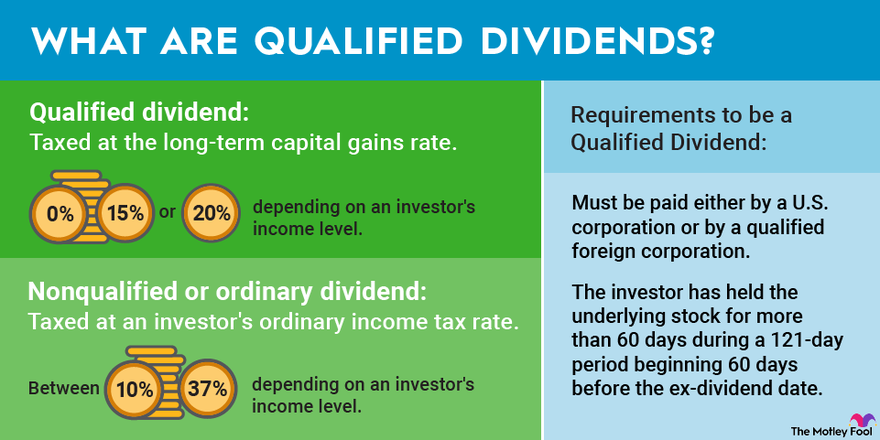

Qualified dividends are certain dividends taxed at lower capital gains rates rather than ordinary income rates. Capital losses occur when you sell an investment for less than you paid for it.

These losses can be used to offset capital gains, and, under specific circumstances, also offset qualified dividends.

Can Capital Losses Offset Qualified Dividends? The Short Answer: Yes

Yes, capital losses can indeed offset qualified dividends. This is a crucial point for investors to grasp. The IRS allows taxpayers to use capital losses to reduce their tax liability on qualified dividends, but there are specific rules governing how this works.

The process begins with offsetting capital gains with capital losses. If capital losses exceed capital gains, the excess loss can then be used to offset up to $3,000 of ordinary income (or $1,500 if married filing separately).

How It Works: A Step-by-Step Guide

First, calculate your total capital gains and total capital losses for the tax year. Next, offset your capital gains with your capital losses. If you have a net capital loss after offsetting gains, you can use up to $3,000 (or $1,500 if married filing separately) of the remaining loss to offset ordinary income.

Important: After offsetting ordinary income, any remaining capital loss can be used to offset qualified dividends. However, the amount of qualified dividends that can be offset is limited to the remaining capital loss after the ordinary income offset.

For example, if you have $5,000 in capital losses and no capital gains, you can offset $3,000 of ordinary income. The remaining $2,000 of capital loss can then be used to offset up to $2,000 of qualified dividends.

Example Scenario

Imagine John has $1,000 in qualified dividends, $2,000 in capital gains, and $6,000 in capital losses. First, John offsets his $2,000 capital gain with $2,000 of his capital losses, leaving him with $4,000 in remaining capital losses.

Next, John can offset $3,000 of his ordinary income with $3,000 of the remaining capital losses. This leaves John with $1,000 in remaining capital losses, which can be used to offset his $1,000 of qualified dividends. Therefore, John will not pay taxes on his qualified dividends in this scenario.

Who Benefits From This Rule?

Investors who experience significant capital losses but also receive qualified dividends can benefit significantly. This is particularly relevant in volatile market conditions.

This rule provides a way to minimize overall tax liability by strategically using capital losses to offset income that would otherwise be taxed at a higher rate.

Important Considerations and Limitations

It's crucial to understand the specific definitions of qualified dividends and capital assets. Not all dividends qualify for the lower qualified dividend tax rate, and not all assets are considered capital assets.

Also, be aware of the $3,000 (or $1,500 if married filing separately) limit on offsetting ordinary income. Capital losses exceeding this limit can be carried forward to future tax years.

Where to Find More Information

Consult IRS Publication 550, Investment Income and Expenses, for detailed information on capital gains, losses, and qualified dividends. Also, consult with a qualified tax advisor or accountant for personalized guidance.

They can help you navigate the complexities of tax law and optimize your tax strategy.

When Does This Apply?

This rule applies to your annual tax return, filed each year. Keep accurate records of your capital gains, losses, and qualified dividends throughout the year to ensure accurate tax reporting.

Why Is This Important?

Understanding the interaction between qualified dividends and capital losses can significantly reduce your tax burden. Failing to take advantage of this rule could result in paying more taxes than necessary.

Proactive tax planning is essential for maximizing your after-tax investment returns. Don't overlook this important aspect of financial management.

Next Steps and Ongoing Developments

Review your investment portfolio and tax situation to determine if you can benefit from offsetting qualified dividends with capital losses. Consult with a tax professional to ensure you are taking full advantage of all available tax benefits.

Tax laws can change, so stay informed about any updates or revisions that may affect your tax planning strategy. Continue to monitor IRS guidance and seek professional advice as needed.

.jpg)