Fannie Mae Self Employment Income Calculator

Imagine a crisp autumn morning, the scent of coffee filling the air, and sunlight streaming through the window. You're a freelancer, a small business owner, or maybe a real estate agent, and the dream of owning a home is closer than ever. But there's a hurdle: understanding how your self-employment income will be assessed for a mortgage. The paperwork, the calculations, it can all feel a bit daunting.

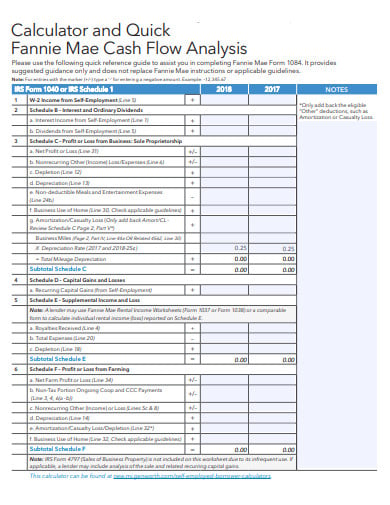

This is where the Fannie Mae Self-Employment Income Calculator comes into play. It's a free, online tool designed to simplify the complex process of determining qualifying income for self-employed borrowers, aiming to make homeownership more accessible and transparent.

Demystifying Self-Employment Income

For years, self-employed individuals have faced unique challenges when applying for mortgages. Unlike those with traditional W-2 income, their income verification process involves more scrutiny of tax returns, profit and loss statements, and other financial records.

Lenders often had varying interpretations of these documents, leading to inconsistent and sometimes unfair assessments. This inconsistency created uncertainty and frustration for self-employed borrowers, making it harder to secure a mortgage.

The introduction of the Fannie Mae Self-Employment Income Calculator was a significant step towards standardizing this process.

The Genesis of the Calculator

Fannie Mae, a government-sponsored enterprise (GSE), plays a vital role in the U.S. housing market. Its mission includes providing liquidity and stability to the market, as well as promoting affordable housing opportunities.

Recognizing the growing number of self-employed workers and the challenges they faced, Fannie Mae developed the calculator to provide a more transparent and consistent method for assessing their income.

The calculator leverages guidelines outlined in Fannie Mae's Selling Guide, ensuring that lenders adhere to consistent standards when evaluating self-employment income.

How the Calculator Works

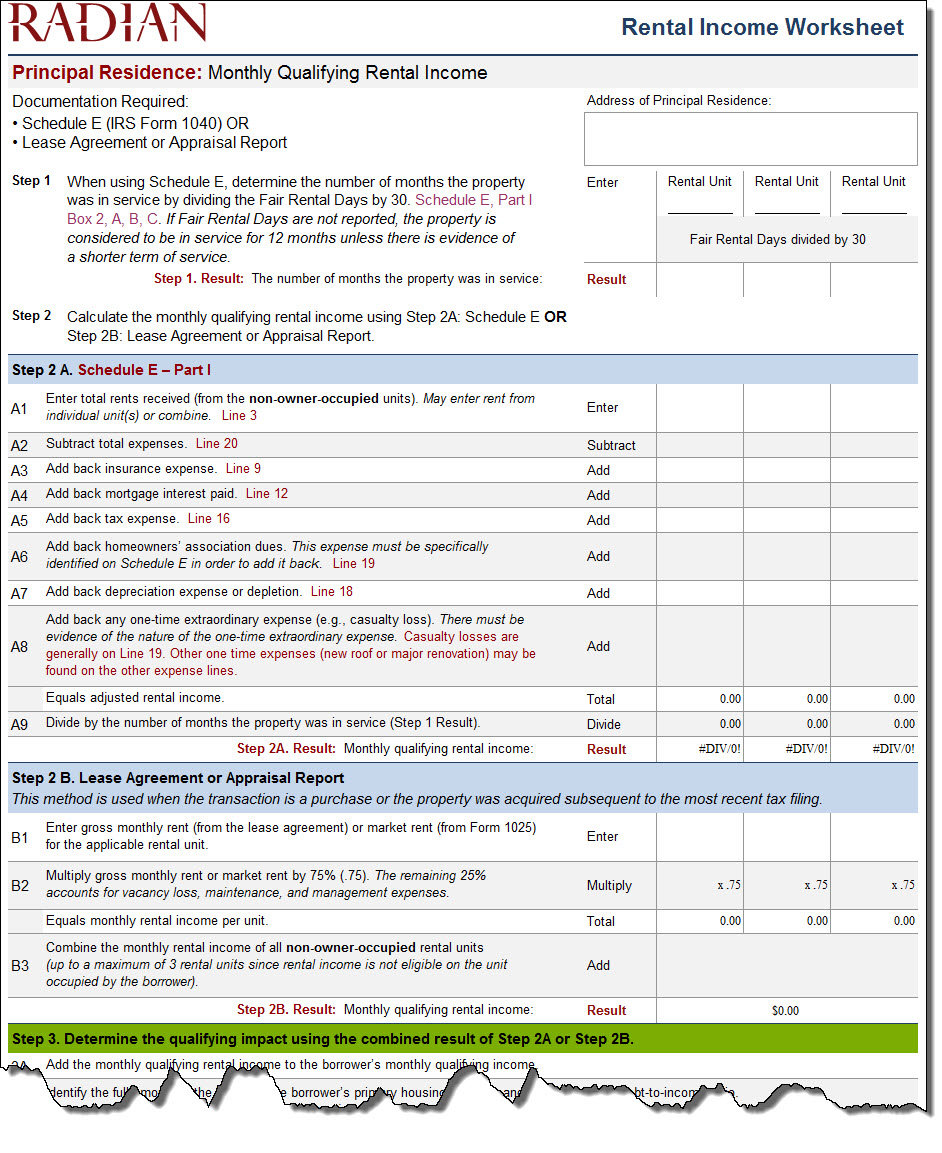

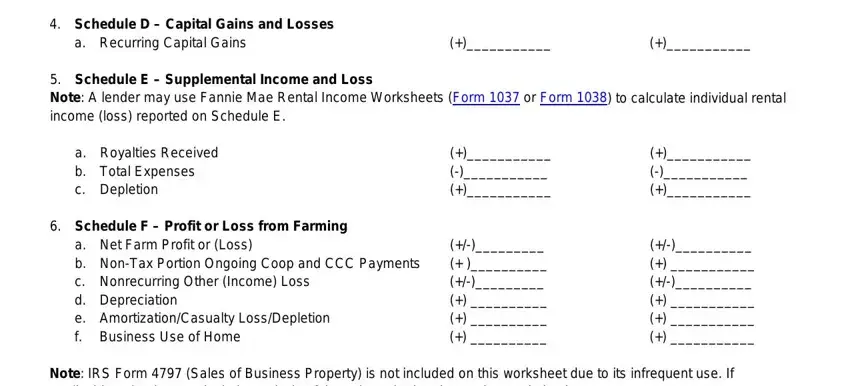

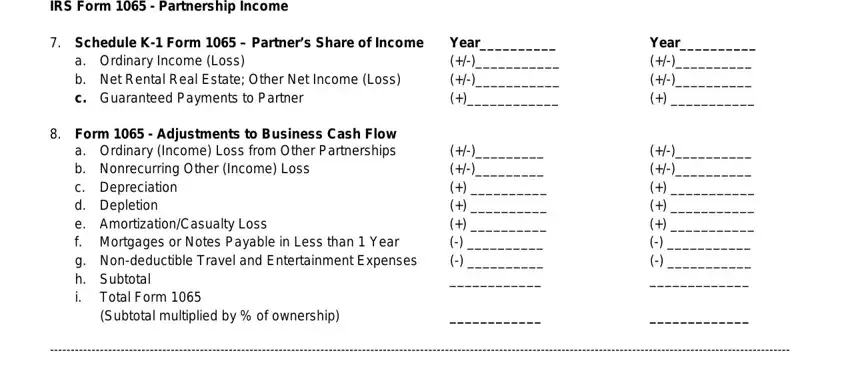

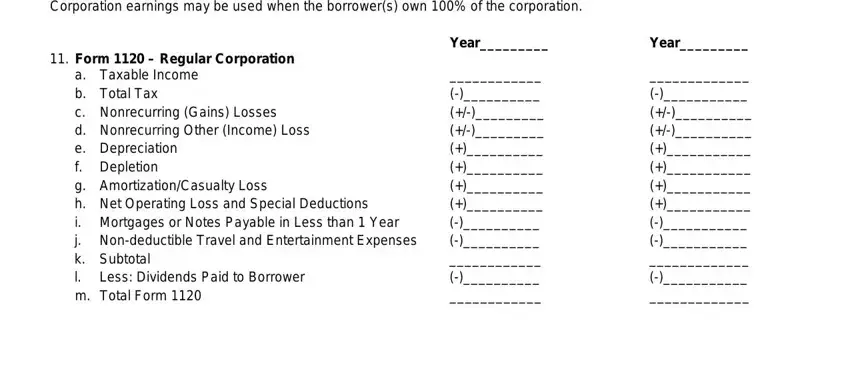

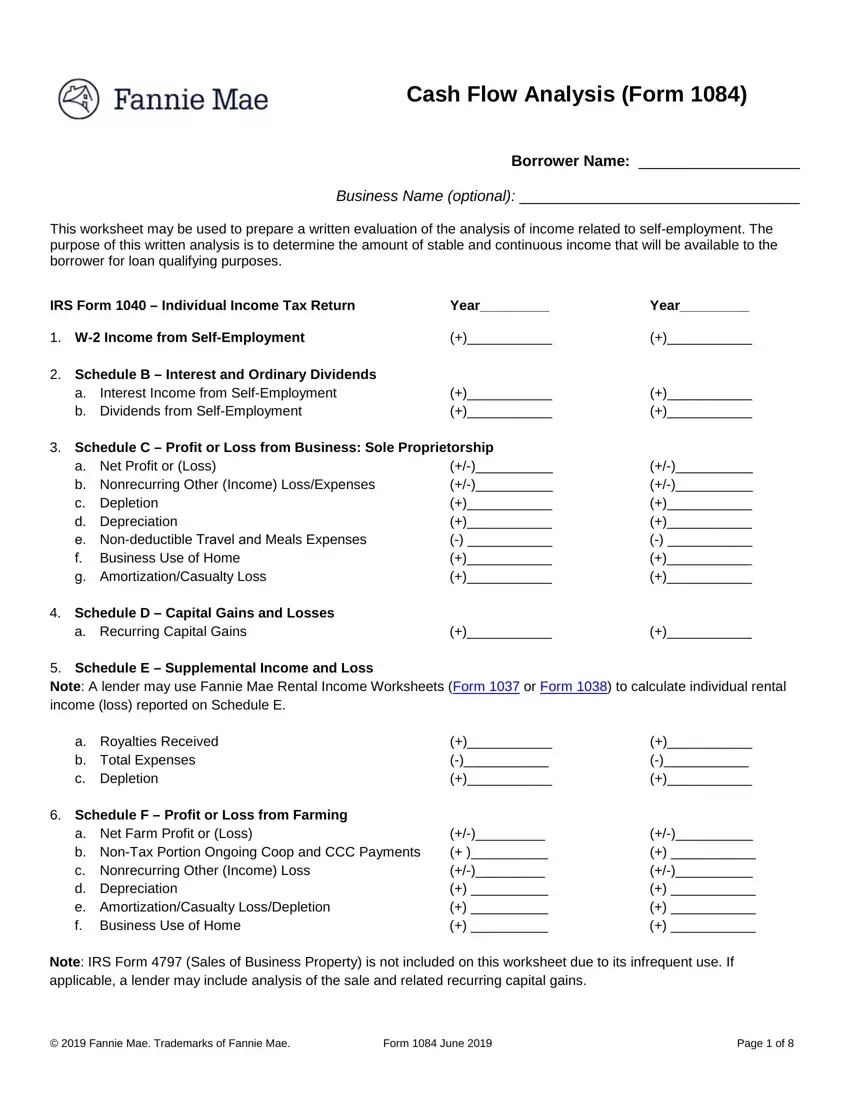

The calculator is designed to be user-friendly, guiding borrowers and lenders through a step-by-step process. It requests information from tax returns and other relevant financial documents to calculate the borrower's qualifying income.

Users input information such as gross income, expenses, depreciation, and depletion, among others. The calculator then applies Fannie Mae's guidelines to determine the borrower's adjusted gross income, which is a crucial factor in mortgage approval.

It automates many of the calculations that lenders previously performed manually, reducing the potential for errors and inconsistencies.

Key Features and Benefits

One of the significant benefits of the calculator is its accessibility. It is available online, free of charge, to both borrowers and lenders.

This transparency empowers borrowers to understand how their income will be evaluated, allowing them to better prepare their mortgage application and address any potential issues proactively.

For lenders, the calculator provides a standardized and efficient tool for assessing self-employment income, improving the consistency and accuracy of their loan underwriting process. It helps reduce the risk of errors and ensures compliance with Fannie Mae's guidelines.

The Impact on Homeownership

The introduction of the Fannie Mae Self-Employment Income Calculator has had a positive impact on the housing market, particularly for self-employed individuals. By providing a clear and consistent method for assessing income, it has helped to level the playing field.

More self-employed borrowers are now able to qualify for mortgages, realizing their dream of homeownership. This, in turn, contributes to the overall health and stability of the housing market.

It fosters a more inclusive environment where individuals with diverse income streams have equal opportunities to access home financing.

Expert Perspectives

Financial advisors and mortgage professionals have generally praised the calculator for its clarity and simplicity.

"The calculator has been a game-changer for my self-employed clients," says Sarah Miller, a Certified Financial Planner. "It provides a clear roadmap of what lenders are looking for, helping them to organize their finances and present a strong mortgage application."

David Chen, a mortgage broker, adds, "The calculator not only streamlines the underwriting process but also enhances transparency. It allows me to have more informed conversations with my clients, setting realistic expectations from the start."

Navigating the Calculator: Tips and Best Practices

While the calculator is designed to be user-friendly, understanding some best practices can maximize its effectiveness.

First, ensure that all financial documents, such as tax returns and profit and loss statements, are accurate and up-to-date. Any discrepancies can lead to inaccurate income calculations and potential delays in the mortgage approval process.

Second, carefully review the instructions and guidance provided within the calculator. Familiarize yourself with the definitions of key terms and the required inputs.

Third, don't hesitate to seek professional assistance from a financial advisor or mortgage broker. They can provide personalized guidance and help you interpret the results of the calculator in the context of your overall financial situation.

Future Enhancements

Fannie Mae is committed to continuously improving the Self-Employment Income Calculator based on user feedback and evolving market conditions.

Future enhancements may include incorporating additional data sources, expanding the range of income types covered, and providing more detailed explanations of the underlying calculations.

These ongoing improvements will ensure that the calculator remains a valuable tool for self-employed borrowers and lenders alike.

Conclusion: Empowering Self-Employed Homebuyers

The Fannie Mae Self-Employment Income Calculator represents a significant advancement in the mortgage industry. It's a tool that not only simplifies a complex process but also empowers self-employed individuals to pursue their homeownership dreams with greater confidence.

By fostering transparency, consistency, and accessibility, the calculator promotes a more equitable and inclusive housing market. It stands as a testament to the ongoing efforts to support and empower self-employed workers across the nation.

As the landscape of work continues to evolve, with more individuals choosing self-employment, tools like this calculator will become increasingly vital in bridging the gap between dreams and reality, one mortgage at a time.