How To Record Personal Money Put Into Business

Many small business owners often find themselves supplementing their business funds with personal money, especially in the early stages. While seemingly straightforward, properly documenting these contributions is crucial for maintaining accurate financial records, ensuring tax compliance, and providing a clear picture of the business's financial health.

This article will explore the proper methods for recording personal money invested in a business, focusing on best practices and potential implications.

Understanding the Significance

Accurate record-keeping of personal investments in a business is essential for several reasons.

It allows for a clear distinction between personal and business finances, a key principle in maintaining the corporate veil if the business is incorporated. Moreover, proper documentation simplifies tax preparation and audits, potentially preventing costly errors and penalties.

Key Methods for Recording Personal Funds

Loan vs. Equity

The first step is determining whether the personal money is being contributed as a loan or as equity.

This decision has significant implications for how the funds are recorded and treated for tax purposes. A loan is essentially money lent to the business that must be repaid, typically with interest.

Equity, on the other hand, represents ownership in the business and does not require repayment.

Recording as a Loan

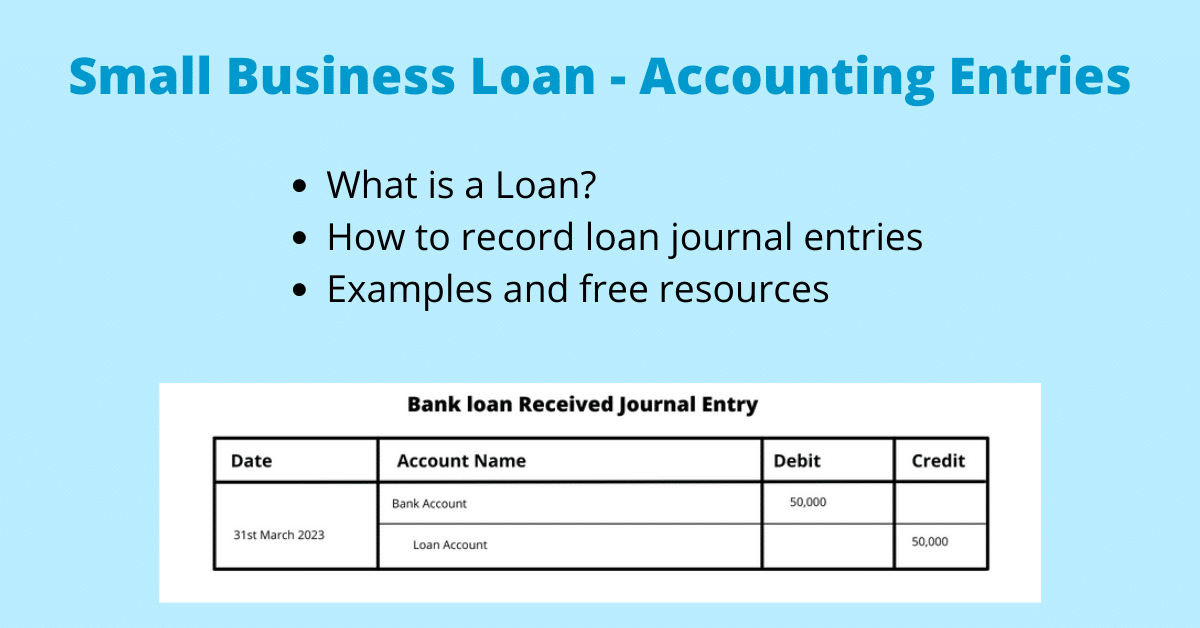

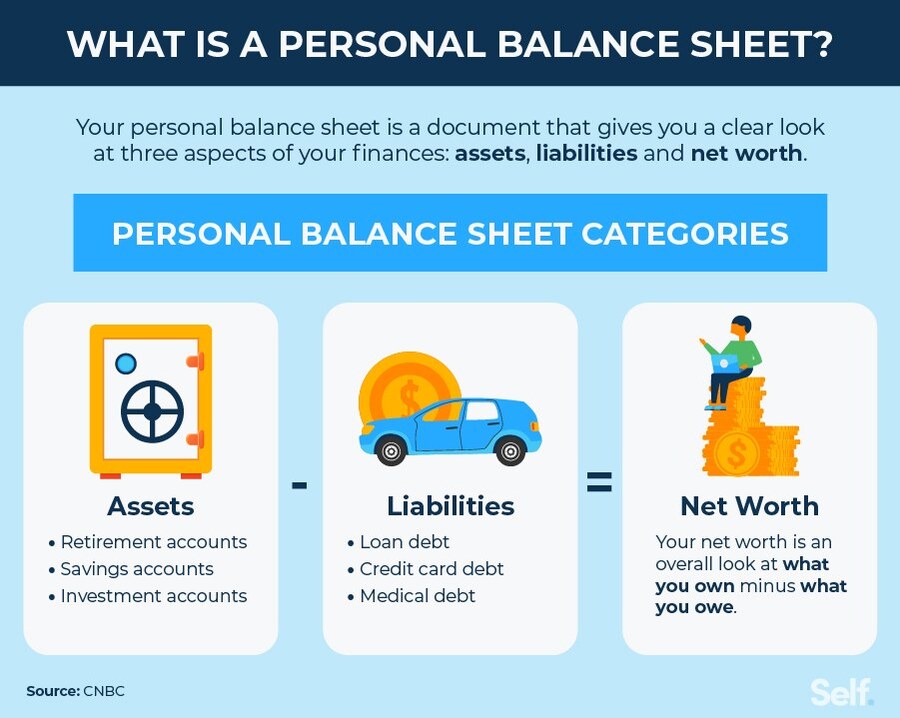

If the personal money is a loan, it should be recorded as a liability on the business's balance sheet.

This requires creating a formal loan agreement that outlines the loan amount, interest rate (if any), repayment schedule, and any collateral. The transaction is then recorded with a debit to the cash account (increasing the business's cash) and a credit to a "Loans from Owners" account (increasing liabilities).

As repayments are made, the cash account is credited (decreasing cash) and the "Loans from Owners" account is debited (decreasing liabilities). Interest payments, if applicable, are recorded as an expense.

Recording as Equity

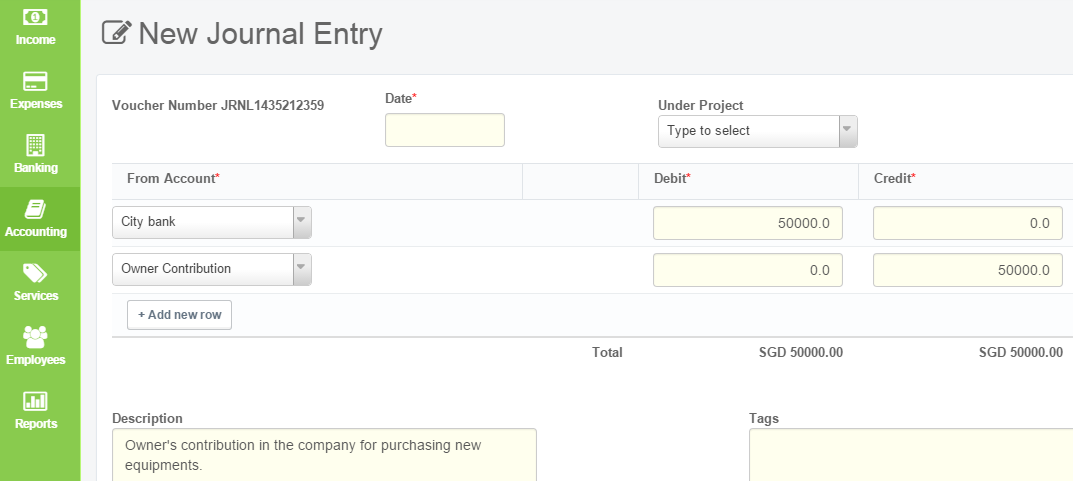

When personal funds are contributed as equity, it increases the owner's investment in the business.

This is recorded by debiting the cash account and crediting an equity account, such as "Owner's Equity" or "Contributed Capital." This increases both the business's assets and its equity, maintaining the accounting equation (Assets = Liabilities + Equity).

The specific equity account used might depend on the legal structure of the business (e.g., partnership, LLC, corporation).

Documentation is Key

Regardless of whether the funds are treated as a loan or equity, thorough documentation is paramount.

This includes maintaining detailed records of all transactions, including dates, amounts, and descriptions. For loans, the formal loan agreement should be kept on file.

Bank statements showing the transfer of funds from the owner's personal account to the business account are also essential. These records provide an audit trail and support the accuracy of the financial statements.

Software and Professional Assistance

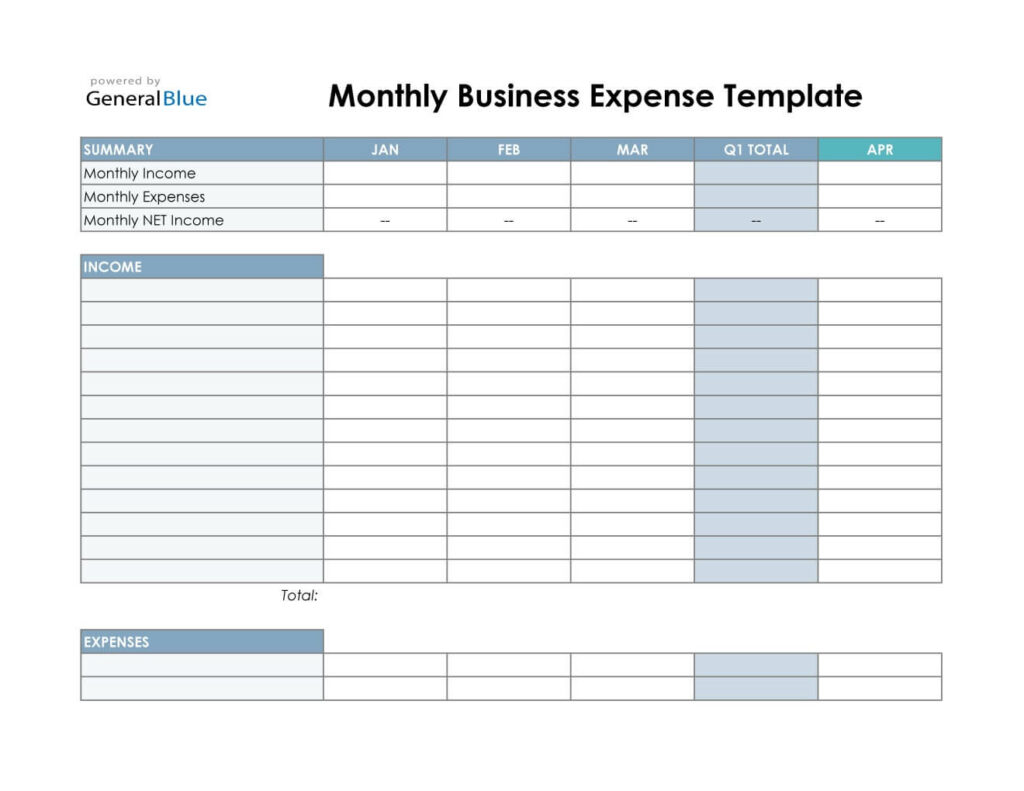

Several accounting software packages are available to help business owners manage their finances and record personal investments.

Popular options include QuickBooks, Xero, and Zoho Books. These programs offer features for tracking transactions, generating financial reports, and managing accounts.

For businesses with complex financial situations or limited accounting knowledge, seeking professional assistance from a Certified Public Accountant (CPA) or a bookkeeper is advisable.

Potential Impact and Benefits

By diligently recording personal money put into the business, owners gain a clearer understanding of their company's financial performance.

This allows for informed decision-making, better financial planning, and easier access to funding from external sources. Furthermore, accurate records enhance the business's credibility with lenders, investors, and other stakeholders.

In conclusion, proper recording of personal money invested in a business is a fundamental aspect of sound financial management. By understanding the difference between loans and equity, maintaining thorough documentation, and leveraging available resources, business owners can ensure accurate financial records, tax compliance, and a clear path to long-term success.