Can You Be An Entrepreneur Without Money

The aroma of freshly brewed coffee swirled through the air, mingling with the scent of ambition. Sarah, hunched over a laptop in a bustling co-working space, was meticulously crafting a business plan. She had passion, drive, and a groundbreaking idea, but her bank account echoed louder than her dreams: nearly empty.

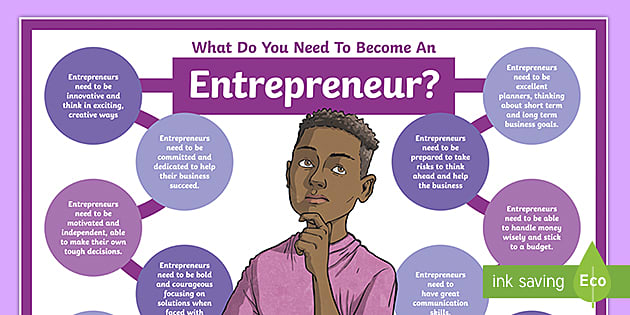

Can someone genuinely become an entrepreneur without significant capital? The answer, while complex, leans towards a resounding yes. It demands resourcefulness, grit, and a shift in perspective, but the path to entrepreneurship is increasingly accessible to those with more ingenuity than investment.

The Rise of the Bootstrapper

Historically, starting a business often required substantial loans or investments. But the digital age has democratized entrepreneurship. The internet provides access to information, tools, and markets previously unavailable to the average person.

Bootstrapping, the practice of building a company from personal finances or operating revenues, is gaining immense traction. It fosters financial discipline and forces entrepreneurs to prioritize efficiency and creativity.

Success Stories of Frugal Founders

Take the story of Melanie Perkins, co-founder of Canva. She started by teaching students design skills, using the profits to gradually develop her online platform. Her initial investment was minimal, but her dedication was boundless.

Similarly, Sara Blakely, the founder of SPANX, began with just $5,000 in savings. She did her own market research, patented her invention, and networked tirelessly to get her product on store shelves. Her self-funded journey is a testament to the power of resourcefulness.

Strategies for Launching Lean

Starting with a Minimum Viable Product (MVP) is crucial. Launching a basic version of your product allows you to gather feedback and iterate without incurring massive development costs.

Leveraging free or low-cost resources is also essential. Social media marketing, content creation, and open-source software can significantly reduce expenses in the initial stages. Networking and building relationships are also critical.

Seeking mentorship from experienced entrepreneurs can provide invaluable guidance and support. Organizations like the Small Business Administration (SBA) offer free counseling and resources to aspiring business owners.

Challenges and Considerations

Bootstrapping isn't without its hurdles. It often requires long hours, personal sacrifices, and a high tolerance for risk. Cash flow management is paramount, and entrepreneurs must be adept at juggling multiple responsibilities.

Furthermore, bootstrapping can limit growth potential. Without external funding, scaling the business may be slower and more challenging. "Access to capital is still a significant barrier for many aspiring entrepreneurs, particularly those from underrepresented backgrounds," according to a recent report by the National Bureau of Economic Research.

However, the benefits of maintaining complete ownership and control often outweigh the limitations. Bootstrapping allows entrepreneurs to stay true to their vision and build a sustainable business on their own terms.

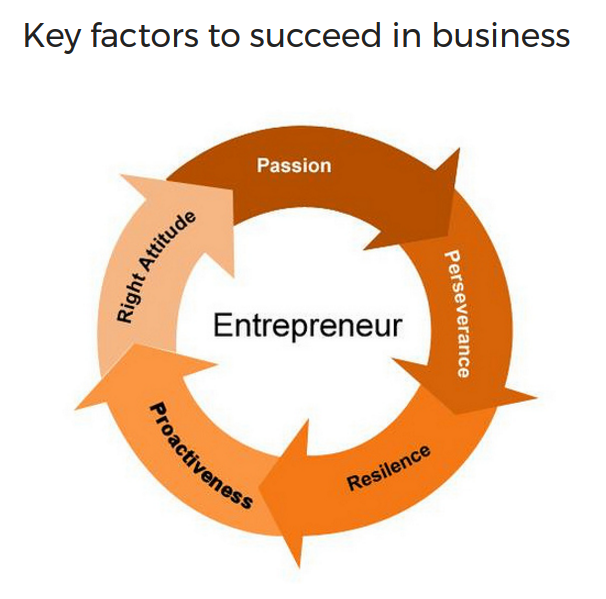

A Shift in Mindset

Ultimately, succeeding as an entrepreneur with limited funds requires a shift in mindset. It's about focusing on what you have rather than what you lack, embracing creativity and resourcefulness, and never giving up on your vision.

It's about being willing to hustle, learn, and adapt. It’s about believing in yourself even when others doubt you. It’s about recognizing that the greatest investment you can make is in yourself.

Sarah looked up from her laptop, a determined glint in her eyes. The road ahead wouldn't be easy, but she was ready to pave it with her own ingenuity and perseverance. The aroma of coffee still lingered, now infused with the scent of possibility.