Can You Buy A Business With No Money Down

Imagine standing at the threshold of your entrepreneurial dream, the keys to a thriving business almost within reach. The aroma of freshly brewed coffee fills the air of the local café you envision owning, or perhaps you see yourself leading a bustling tech startup, innovating for the future. But then reality hits – the upfront capital required feels like an insurmountable wall. Is this dream destined to remain just that, a dream?

The question burning in the hearts of aspiring entrepreneurs is: Can you really buy a business with no money down? The answer, while nuanced, is yes, it's *potentially* possible, but it's not a walk in the park. This article delves into the strategies and considerations necessary to navigate the complex landscape of acquiring a business without significant initial investment.

Understanding Seller Financing

One of the most common routes to acquiring a business with little to no money down is seller financing. This is when the current owner of the business acts as the lender, providing financing to the buyer to purchase the business. Instead of securing a loan from a traditional bank, you make payments directly to the seller over an agreed-upon period.

This approach can be attractive to sellers, especially if they're struggling to find a buyer or are confident in the business's future success. As Forbes points out, it's also a way for them to potentially realize a higher selling price, as they're essentially earning interest on the loan. The structure of seller financing can vary widely, so thorough negotiation is essential.

The Importance of Due Diligence

Before jumping into any deal, rigorous due diligence is absolutely paramount. Examine the business's financials with a fine-tooth comb. Understand its revenue streams, expenses, and profitability.

Consider hiring an accountant and a lawyer experienced in business acquisitions to help you navigate the process. They can identify potential red flags and ensure the terms of the agreement are fair and legally sound, according to a recent report by the Small Business Administration (SBA) on business acquisition best practices.

Leveraging Earnouts

An earnout is another strategy that minimizes upfront costs. This involves paying the seller a portion of the purchase price based on the future performance of the business. Essentially, the seller receives additional payments if the business meets certain agreed-upon milestones after you take over.

This can be particularly appealing to sellers who believe in the long-term potential of the business but are willing to share some of the risk with the buyer. An earnout structure can align the interests of both parties, incentivizing the buyer to grow the business and providing the seller with continued financial rewards.

Building Trust and Rapport

Securing a deal with no money down often hinges on building strong relationships with sellers. Transparency and honesty are essential. Demonstrate your passion for the business and your commitment to its success.

Clearly articulate your vision for the future and how you plan to build upon the existing foundation. A seller is more likely to take a chance on someone they trust and believe will be a good steward of their legacy.

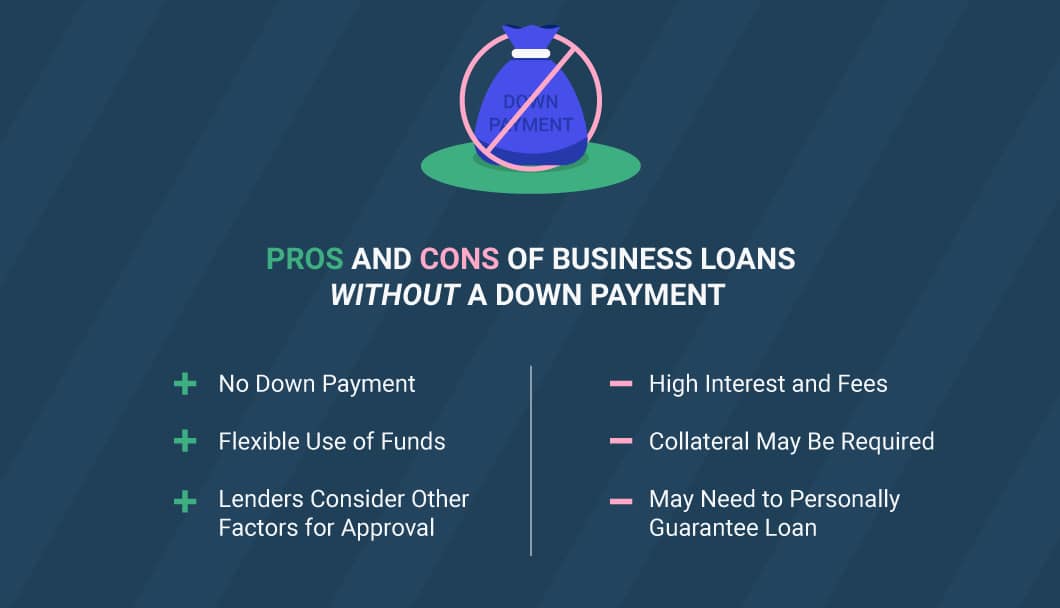

Creative Financing Options

While seller financing and earnouts are common strategies, other creative financing options exist. These might include assuming existing debt or exploring lease-to-own arrangements for equipment or property. Sometimes, even a combination of these methods can unlock opportunities.

It's crucial to remember that acquiring a business with no money down often means accepting a higher risk profile. The loan terms may be less favorable than traditional financing, or the earnout structure could be challenging to achieve.

The Reality Check: Hard Work and Dedication

Ultimately, acquiring a business with minimal upfront investment requires a combination of savvy negotiation, diligent research, and unwavering dedication. It's not a get-rich-quick scheme; it's a path paved with hard work and strategic thinking. You need a robust business plan.

According to a Harvard Business Review study on entrepreneurial success, those who succeed with limited initial capital often possess a strong work ethic, a deep understanding of the industry, and a relentless focus on execution.

The dream of owning a business may seem distant when capital is scarce, but with resourcefulness and a willingness to explore alternative financing options, it can become a tangible reality. It's a testament to the power of creative problem-solving and the enduring spirit of entrepreneurship.