Can You Cash Checks At Casinos

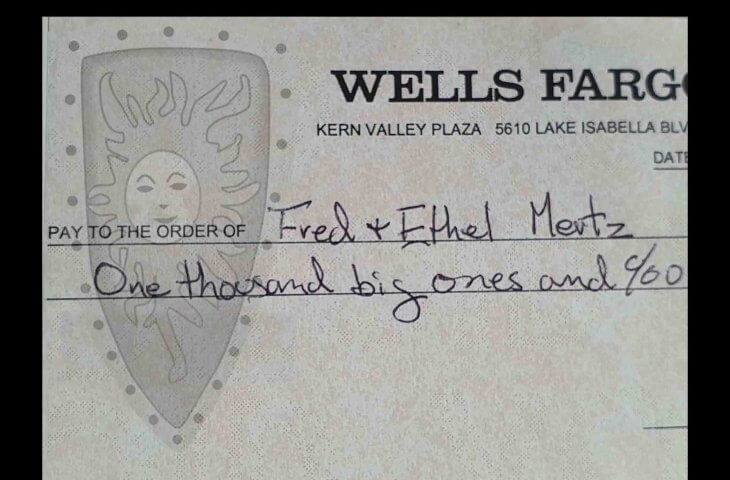

The flashing lights and ringing bells of a casino create an atmosphere of instant gratification, but accessing funds to participate isn't always as seamless. While casinos are known for readily accepting cash and, increasingly, digital payment methods, the question of whether they cash personal checks remains a complex one, varying significantly based on location, casino policy, and individual circumstances.

This article delves into the intricacies of check-cashing at casinos, examining the policies that govern this practice, the potential risks involved, and the alternative options available to patrons seeking to access funds for gaming.

Casino Check-Cashing Policies: A Patchwork Approach

Casino check-cashing policies are not uniform across the industry. Each casino, often governed by state and local regulations, sets its own rules regarding the acceptance of personal checks.

Regulations vary widely. Some casinos may offer check-cashing services as a convenience for their patrons, while others may prohibit the practice entirely due to the inherent risks of fraud and non-payment.

Factors Influencing Check-Cashing Decisions

Several factors influence a casino's decision to cash a check. One crucial element is the casino's internal risk assessment, which considers the potential for bounced checks and the associated administrative burden of pursuing collections.

The amount of the check also plays a significant role. Casinos often have pre-set limits on the value of checks they will cash, and these limits may vary based on a patron's established relationship with the casino, including their gaming history and creditworthiness.

State gaming regulations can also dictate whether check-cashing is permitted and, if so, under what conditions. Some states require casinos to obtain specific licenses or permits to offer check-cashing services, while others impose strict limits on the amount that can be cashed per day or per transaction.

The Risks Associated with Check-Cashing

Check-cashing at casinos is not without its risks, both for the casino and the patron. For the casino, the primary risk is the potential for fraudulent checks or checks that are returned due to insufficient funds.

Casinos often mitigate this risk by requiring patrons to provide identification, such as a driver's license or passport, and by verifying the check writer's identity and bank account information. They may also use check verification services to assess the risk of accepting a particular check.

For the patron, the risks are more related to financial responsibility. Cashing a check at a casino can be a slippery slope for individuals struggling with gambling addiction or those who are prone to overspending.

The easy access to funds can lead to impulsive decisions and potentially unsustainable financial losses.

Alternative Funding Options at Casinos

For patrons who are unable to cash personal checks at a casino, or who prefer not to do so, several alternative funding options are typically available. ATM machines are a common feature in most casinos, allowing patrons to withdraw cash from their bank accounts using debit or credit cards.

However, ATM withdrawals often come with fees, and some banks may impose limits on the amount that can be withdrawn per day.

Many casinos also offer credit card cash advances, which allow patrons to access funds from their credit card accounts. However, cash advances typically come with higher interest rates and fees than regular credit card purchases, and they can quickly add to a patron's debt burden.

Another option is to use a debit card directly at the casino cage to withdraw funds from a bank account. This option may be subject to daily withdrawal limits and fees, but it can be a more convenient alternative to using an ATM.

The Impact on Patrons and the Community

The availability, or lack thereof, of check-cashing services at casinos can have a significant impact on patrons, particularly those who rely on this option to access funds for gaming. For some, it may be a matter of convenience, allowing them to avoid the hassle of carrying large amounts of cash.

For others, it may be a necessity, particularly if they do not have access to other funding options.

The potential impact on the community is more indirect but no less important. Casinos are often significant contributors to local economies, providing jobs and generating tax revenue.

Policies that affect the flow of funds at casinos, such as check-cashing restrictions, can have ripple effects throughout the community, impacting local businesses and government services.

Conclusion

The question of whether one can cash checks at casinos is not a simple one. Policies vary significantly based on location, casino rules, and individual circumstances. Patrons should always inquire about a casino's check-cashing policy before attempting to cash a check.

Understanding the risks and exploring alternative funding options are crucial for responsible gaming. As the gaming industry continues to evolve with the increasing adoption of digital payment methods, the role of check-cashing may diminish. Responsible financial planning and awareness of available alternatives are key to navigating the financial aspects of casino entertainment.