Can You File Bankruptcy On Titlemax

Facing crippling debt from TitleMax and considering bankruptcy? You might have options. Filing for bankruptcy can potentially discharge or restructure your debt obligations to TitleMax, offering a path toward financial recovery.

Understanding Bankruptcy and TitleMax Loans

Bankruptcy is a legal process offering debt relief. It's crucial to understand how it interacts with secured loans like those from TitleMax.

What is TitleMax?

TitleMax is a title lender, offering short-term loans secured by your vehicle title. The loan amount typically depends on the vehicle's value, not your credit score.

High interest rates and fees are common with TitleMax loans. Failure to repay can lead to repossession of your vehicle.

Can You Include TitleMax Loans in Bankruptcy?

Yes, you can include TitleMax loans in a bankruptcy filing. Both Chapter 7 and Chapter 13 bankruptcy offer pathways to address this type of debt.

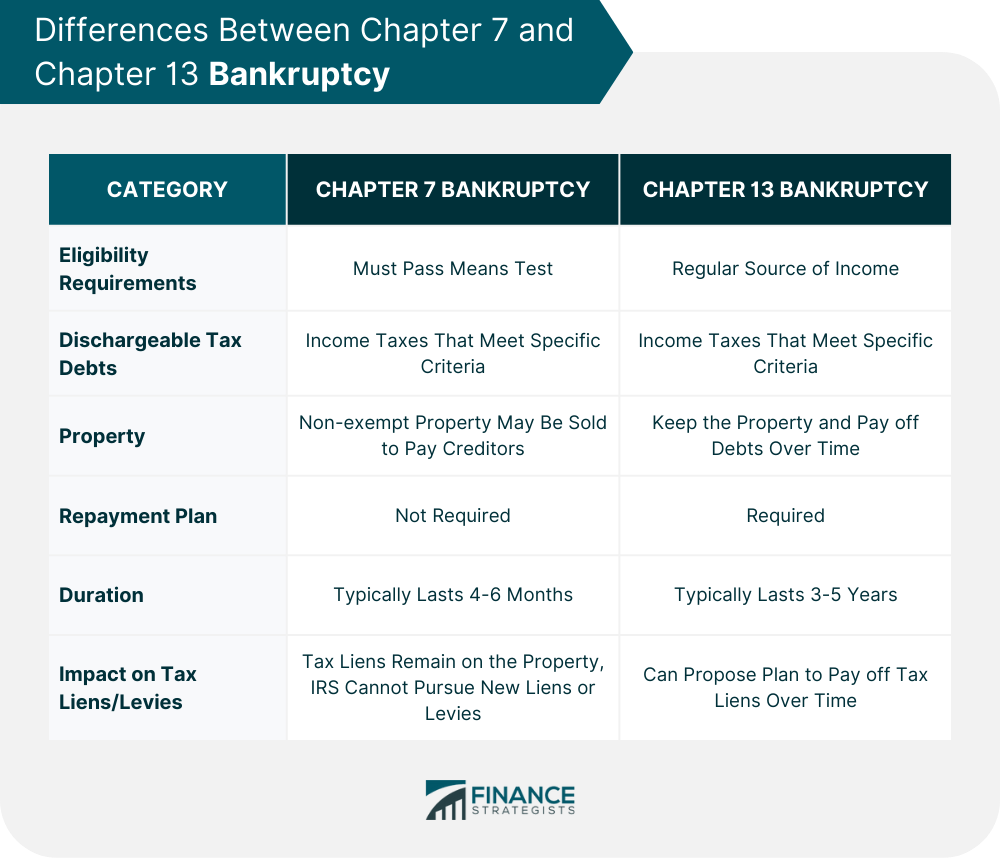

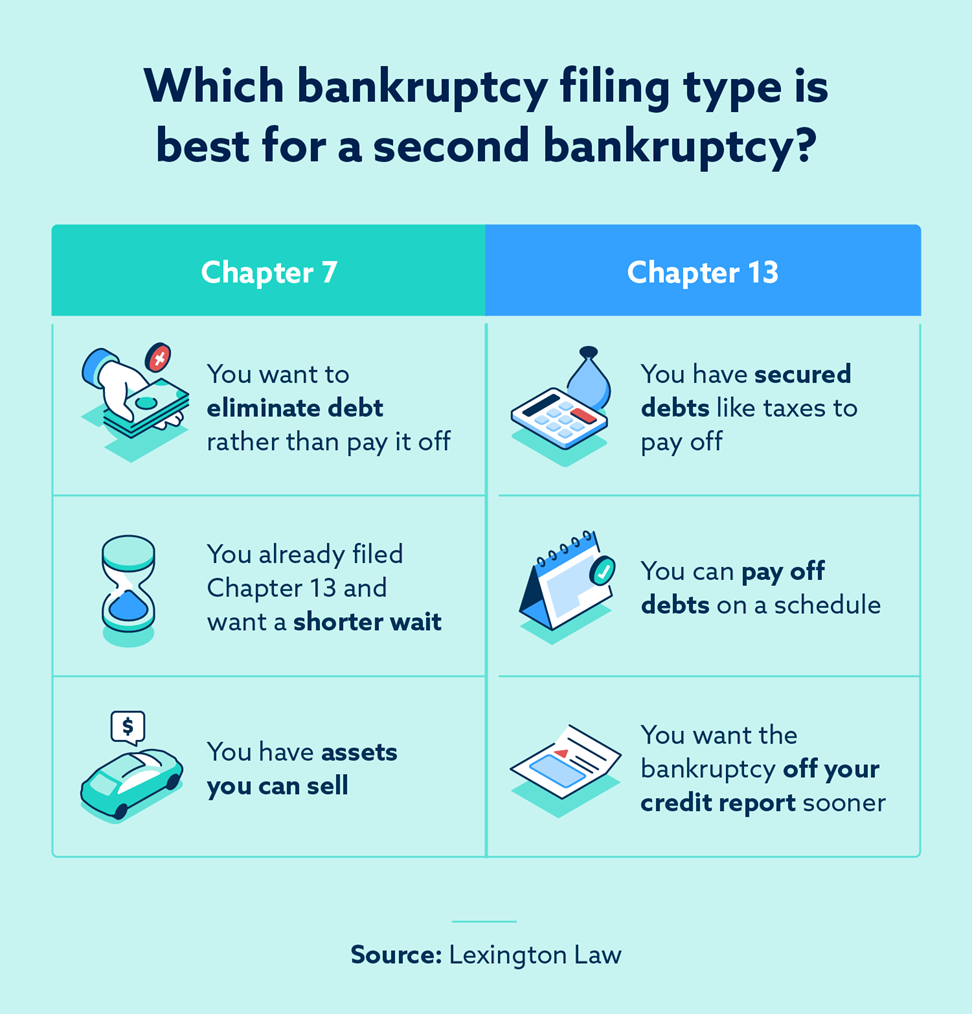

Chapter 7 vs. Chapter 13 Bankruptcy

Chapter 7 bankruptcy involves liquidating non-exempt assets to pay off creditors. It can discharge unsecured debt, and potentially secured debt like TitleMax loans, but often requires surrendering the vehicle.

Chapter 13 bankruptcy involves a repayment plan over three to five years. This allows you to keep your assets, including your car, while catching up on payments.

Chapter 7 and TitleMax: Surrendering the Vehicle

If you choose Chapter 7 and can't afford to keep the vehicle, you can surrender it to TitleMax. This discharges the debt, but you lose your car.

Chapter 13 and TitleMax: The Repayment Plan

Chapter 13 allows you to keep the vehicle if you can include the TitleMax loan in your repayment plan. The plan must be approved by the court.

Often, the loan amount can be "crammed down" to the vehicle's current value, potentially reducing the total debt owed to TitleMax.

The Importance of Legal Advice

Bankruptcy laws are complex, and the specifics vary by jurisdiction. Consult with a qualified bankruptcy attorney for personalized advice.

An attorney can assess your financial situation and determine the best course of action. They can help you navigate the process of filing bankruptcy and dealing with TitleMax.

Potential Risks and Considerations

Filing bankruptcy has a significant impact on your credit score. It remains on your credit report for several years.

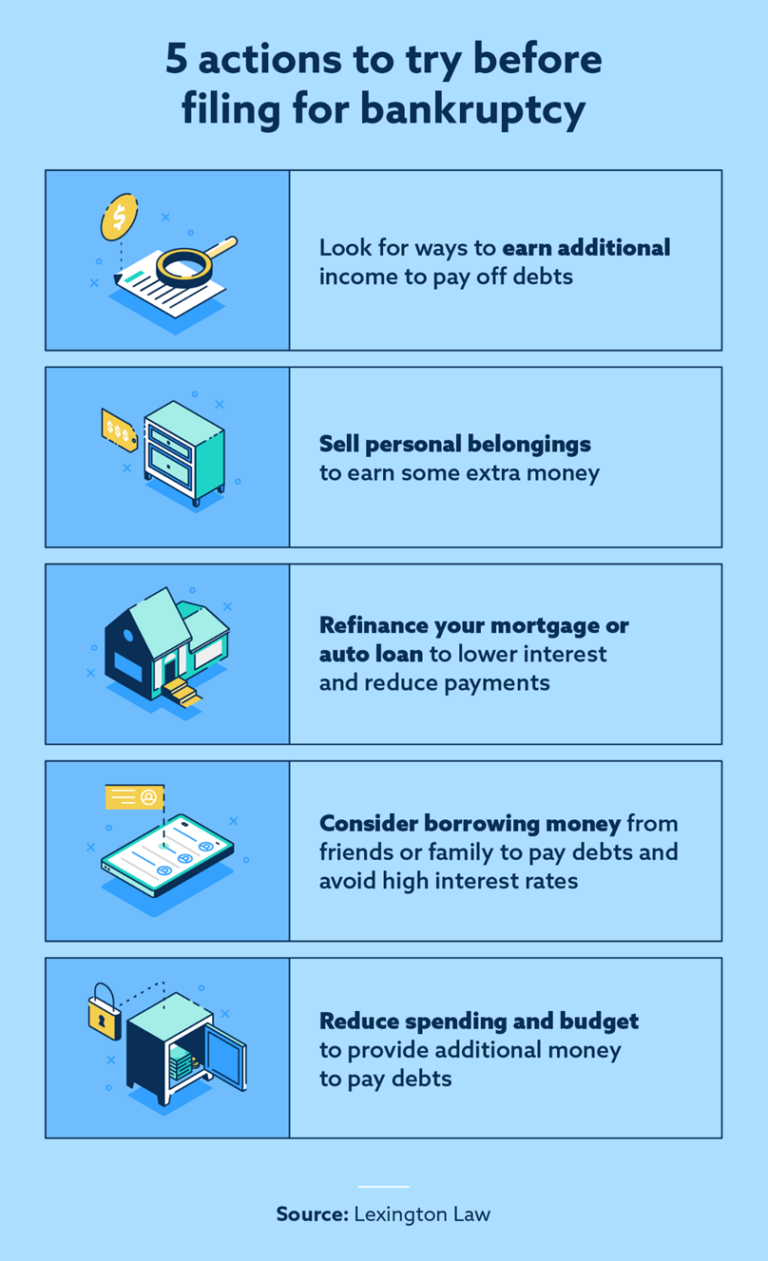

It's important to carefully consider the long-term consequences. Explore all available options before making a decision.

Where to Find Help

The U.S. Department of Justice offers resources on bankruptcy. Numerous non-profit organizations provide free or low-cost financial counseling.

State bar associations can provide referrals to qualified bankruptcy attorneys in your area.

Next Steps

If you are struggling with TitleMax debt, seeking legal counsel is crucial. Exploring bankruptcy options may offer a path toward a fresh financial start.

Don't delay; act now to understand your rights and protect your financial future.