Texas Car Title And Payday Loan Locations

Across Texas, storefronts offering car title and payday loans are a familiar sight, often clustered in low-income communities and areas with limited access to traditional banking services.

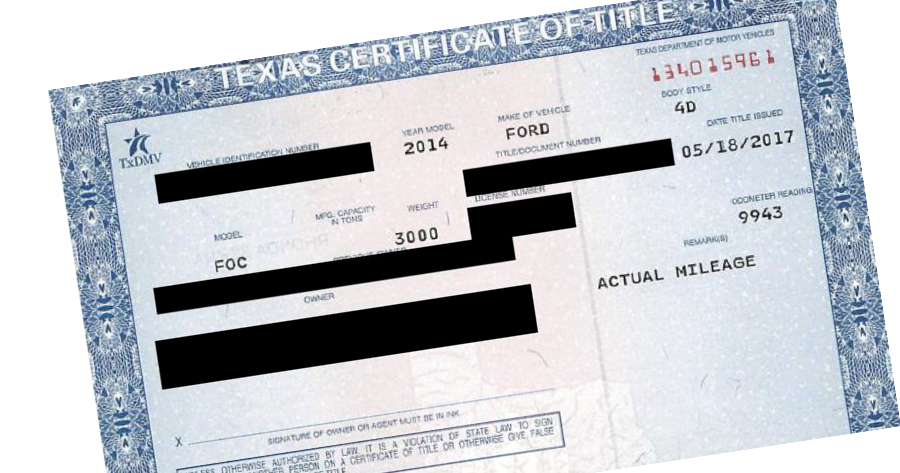

These establishments provide short-term, high-interest loans secured by a borrower's vehicle title or a promise to repay from their next paycheck. But their prevalence has sparked ongoing debate regarding their impact on vulnerable Texans.

The Landscape of Car Title and Payday Lending in Texas

The Office of Consumer Credit Commissioner (OCCC) regulates car title and payday lenders in Texas.

Data from the OCCC shows a significant presence of these lenders, with hundreds of licensed locations operating throughout the state.

These lenders offer quick access to cash, often without the stringent credit checks required by banks and credit unions.

How Car Title and Payday Loans Work

Car title loans allow borrowers to use their vehicle as collateral for a loan. The amount borrowed typically depends on the vehicle's value, but interest rates can be exceptionally high.

Payday loans, on the other hand, are short-term loans designed to be repaid on the borrower's next payday.

These loans also carry substantial fees and interest rates, often leading to a cycle of debt for borrowers who cannot afford to repay the loan on time.

"The problem is not just the initial loan, but the difficulty in repaying it. Many borrowers end up rolling over the loan multiple times, incurring additional fees and interest each time," explains Ann Baddour of Texas Appleseed, a non-profit advocacy organization.

Concerns and Criticisms

Consumer advocacy groups and community organizations have raised serious concerns about the predatory nature of car title and payday lending.

Critics argue that the high interest rates and fees trap borrowers in a cycle of debt, leading to financial hardship, repossession of vehicles, and even bankruptcy.

A report by the Center for Responsible Lending found that Texas has some of the highest payday and car title loan fees in the nation.

The Regulatory Environment

Texas regulations on car title and payday loans are less restrictive compared to some other states.

The state does not cap interest rates, allowing lenders to charge triple-digit APRs.

Efforts to implement stricter regulations, such as interest rate caps, have faced resistance from the lending industry.

The Human Impact

The impact of car title and payday loans extends beyond financial statistics. For many Texans, these loans represent a desperate attempt to cover unexpected expenses or make ends meet.

Loss of transportation through vehicle repossession can affect a borrower’s ability to work, access healthcare, and provide for their families.

“I took out a loan to pay for my mother’s funeral. I ended up paying more in fees than the original loan amount," shares Maria Rodriguez, a San Antonio resident who experienced the downside of payday lending.

Community-Based Solutions

In response to the challenges posed by predatory lending, some communities are exploring alternative financial services.

Credit unions and non-profit organizations are offering small-dollar loans with reasonable interest rates and repayment terms.

Financial literacy programs are also being implemented to help individuals make informed decisions about borrowing and managing their finances.

The Future of Car Title and Payday Lending in Texas

The debate surrounding car title and payday lending in Texas is ongoing.

Advocates for stricter regulations continue to push for reforms that would protect consumers from predatory lending practices.

The outcome of this debate will have a significant impact on the financial well-being of vulnerable Texans who rely on these loans as a last resort.

Legislative sessions bring renewed focus on this issue, with stakeholders on both sides actively lobbying for their respective positions.

Whether Texas will join other states in enacting stronger consumer protections remains to be seen, but the need for solutions is clear.