Can You Get A Discover Student Card With No Credit

Imagine the buzz of a college campus, the excited chatter of new students mapping out their futures. Amidst the textbooks and dorm room essentials, a small plastic card – a student credit card – represents a first step towards financial independence for many. But what if you’re starting from scratch, a complete blank slate with no credit history? The question lingers: Can you even get a Discover student card with no credit?

The answer, thankfully, is generally yes. Discover has specifically designed its student cards to be accessible to those with limited or no credit history. This feature makes them a popular and valuable tool for college students looking to build a solid financial foundation early on.

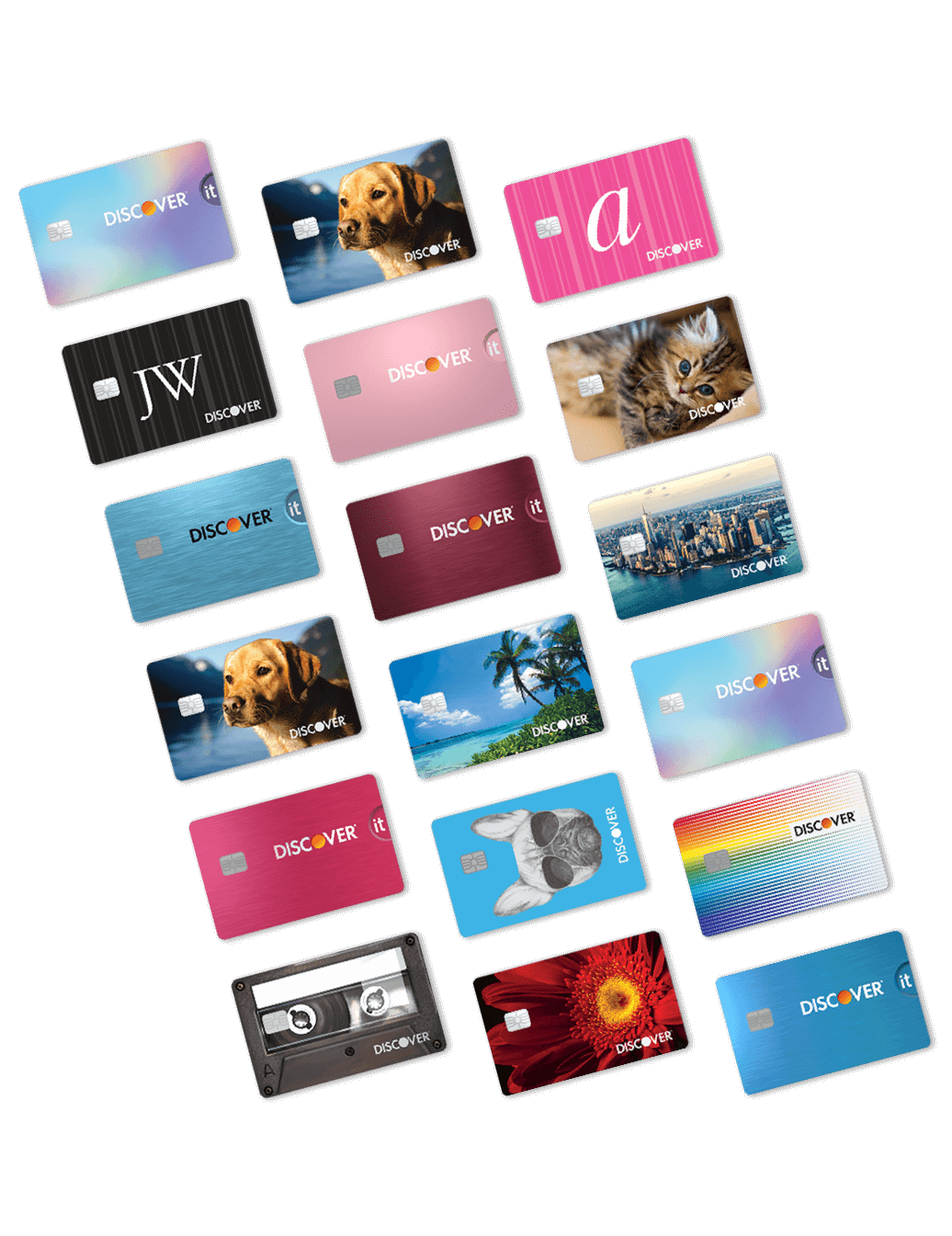

Discover Student Cards: Designed for Beginners

Discover has long recognized the need for accessible credit-building tools for young adults. Unlike many traditional credit cards that require a substantial credit history, Discover student cards are tailored to those just starting out.

These cards often come with features that are beneficial for students, such as cashback rewards on everyday purchases like gas and groceries. Discover also offers tools within its app to track spending and learn about responsible credit card usage.

Why No Credit Isn't Necessarily a Deal-Breaker

Traditional credit card companies rely heavily on credit scores to assess risk. However, Discover acknowledges that a lack of credit history doesn't necessarily equate to irresponsibility.

Instead, they often consider other factors, such as enrollment in a college or university, income (even if it's part-time), and your ability to manage finances responsibly. This inclusive approach opens doors for many students who would otherwise be denied credit.

Building Credit Responsibly

While getting approved for a Discover student card without credit is possible, responsible usage is paramount. Missing payments or carrying a high balance can quickly damage your credit score, negating the benefits of using the card to build credit.

Experts recommend treating a student credit card like a debit card, only spending what you can afford to pay back in full each month. Setting up automatic payments can help avoid late fees and ensure timely payments.

The Long-Term Benefits of Building Credit Early

Establishing a positive credit history during college can have significant long-term benefits. A good credit score can make it easier to secure loans for future needs, such as buying a car or a home.

It can also impact your ability to rent an apartment, get approved for insurance, and even influence potential job opportunities. Starting early with a Discover student card can set you up for financial success down the road.

Navigating the Application Process

Applying for a Discover student card is typically straightforward. Most applications can be completed online in a matter of minutes.

You'll need to provide basic information such as your name, address, date of birth, Social Security number, and student status. Be prepared to also provide information about any income you may have.

It's crucial to be honest and accurate on your application. Misrepresenting information can lead to denial and potentially damage your creditworthiness.

For example, a recent study by the Consumer Financial Protection Bureau (CFPB) highlights the importance of transparent credit card practices and financial literacy among young adults. The CFPB emphasized that accessible credit options, coupled with educational resources, empower students to make informed financial decisions.

Ultimately, obtaining a Discover student card with no credit is an achievable goal for many college students. However, it's just the first step on a longer journey towards financial literacy and responsibility. By using the card wisely and consistently making on-time payments, students can build a strong credit foundation that will serve them well throughout their lives.