American Express Merchants Class Action Lawsuit

Imagine a bustling main street, lined with small businesses: a cozy bookstore, a family-run bakery, a vibrant flower shop. Each sale, each swipe of a credit card, represents a vital transaction, a lifeline for these entrepreneurs. But behind the scenes, a quiet battle has been brewing, a David-versus-Goliath struggle against a financial giant, one that has finally reached a turning point.

This article delves into the American Express Merchants Class Action Lawsuit, a long-fought legal battle that has reshaped the landscape of credit card fees for businesses. It explores the history of the lawsuit, the key players involved, and the significant impact it has had on merchants across the United States, offering a comprehensive overview of a complex issue with far-reaching consequences.

The Seeds of Discontent: A History of the Lawsuit

The story begins years ago, with growing discontent among merchants regarding the fees associated with accepting American Express cards. These fees, often higher than those charged by Visa and Mastercard, became a significant burden, especially for smaller businesses operating on tight margins. Many felt they had little choice but to accept Amex due to customer demand, despite the financial strain.

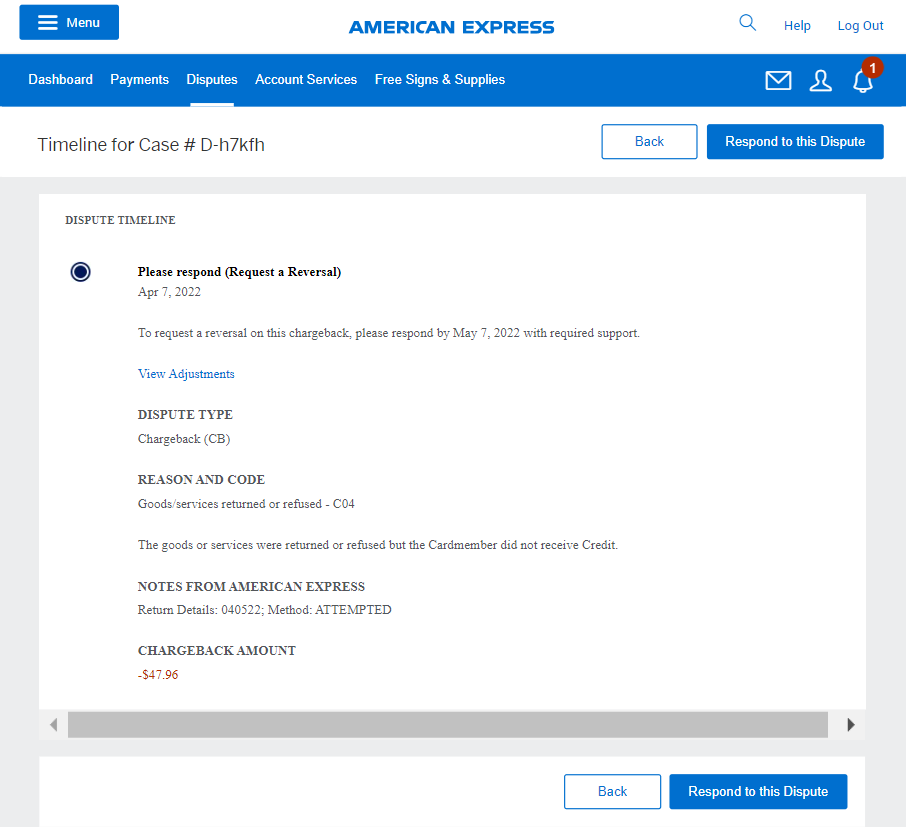

This frustration eventually coalesced into a series of class action lawsuits. Merchants alleged that American Express violated antitrust laws by using its market power to force merchants to accept all Amex cards if they wanted to accept any, a practice known as anti-steering.

These lawsuits claimed that this "all cards accepted" rule stifled competition and kept Amex fees artificially high, ultimately harming both merchants and consumers.

Key Allegations and Legal Battles

The central argument of the plaintiffs revolved around the alleged violation of Section 1 of the Sherman Antitrust Act, which prohibits agreements that restrain trade. The merchants argued that Amex's rules effectively prevented them from offering discounts or surcharges to customers who used other cards with lower processing fees.

The legal battles were complex and protracted, involving extensive discovery, expert testimony, and numerous court filings. American Express vigorously defended its practices, arguing that its business model provided valuable benefits to both merchants and cardholders, including higher spending customers and premium services.

Several cases were consolidated into a single, large class action, further amplifying the voice of the merchants and increasing the pressure on American Express.

The Settlement: A Turning Point for Merchants

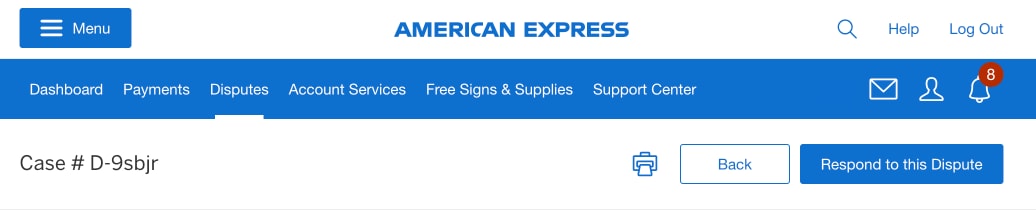

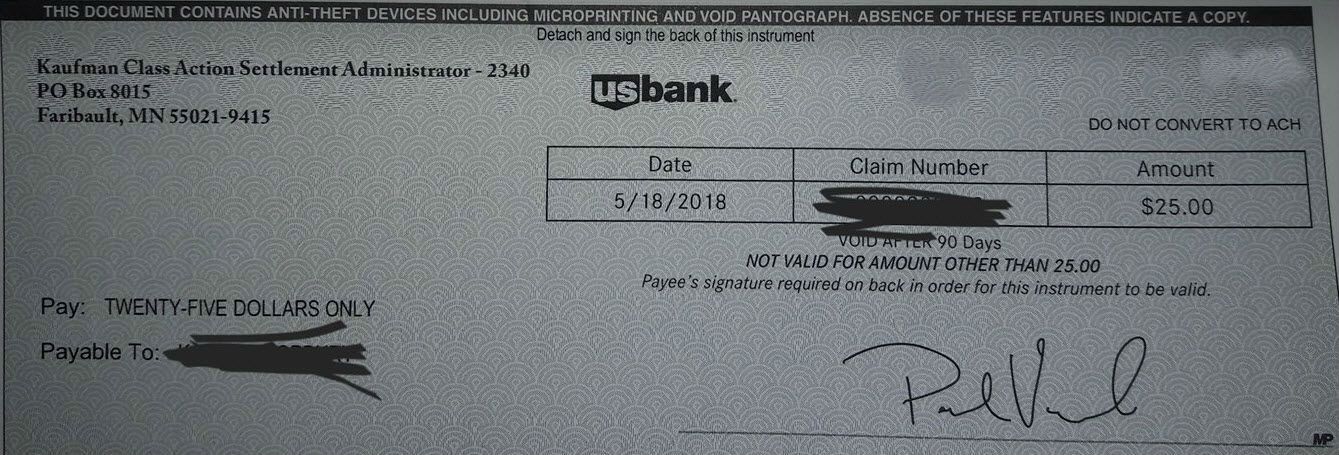

After years of litigation, a significant settlement was reached in the American Express Merchants Class Action Lawsuit. While the details of the settlement varied depending on the specific case and the court's approval, it generally involved Amex agreeing to modify some of its business practices.

One of the most important aspects of the settlement was the increased flexibility for merchants to offer discounts or surcharges based on the type of credit card used. This allowed businesses to incentivize customers to use cards with lower processing fees, potentially saving them significant amounts of money over time.

Furthermore, the settlement often included provisions for enhanced transparency regarding Amex's fees, making it easier for merchants to understand and compare their options.

Impact on Small Businesses and the Payment Landscape

The settlement had a profound impact on small businesses, providing them with greater control over their payment processing costs. By allowing them to steer customers towards lower-fee cards, the settlement helped to level the playing field and increase competition in the credit card industry.

The ability to offer discounts or surcharges empowered merchants to make informed decisions about which payment methods to accept, based on their individual business needs and financial considerations. This newfound flexibility contributed to a more dynamic and competitive marketplace.

According to data from the Merchants Payments Coalition, small businesses save billions of dollars each year due to the ability to steer payments. This highlights the tangible benefits of the settlement for the small business community.

Beyond the Legal Victory: Ongoing Challenges and Future Considerations

While the settlement represented a significant victory for merchants, it is important to acknowledge that challenges remain. The credit card payment landscape is constantly evolving, and businesses must remain vigilant in protecting their interests.

New technologies and payment methods are emerging, and merchants must stay informed about the latest trends and regulations. Continued advocacy and vigilance are essential to ensure a fair and competitive payment environment.

The American Express Merchants Class Action Lawsuit serves as a reminder of the importance of collective action and the power of merchants to stand up for their rights. It also highlights the need for ongoing scrutiny of the credit card industry and a commitment to fostering fair and transparent business practices.

A Reflection on Fairness and the Future

The resolution of this lawsuit underscores the importance of equitable practices in the financial sector. It emphasizes the need for transparency and fairness in the relationship between large corporations and small businesses, the very backbone of the American economy.

This case is not just about dollars and cents; it's about ensuring that entrepreneurs can thrive, innovate, and contribute to their communities without being burdened by excessive fees and anti-competitive practices.

Ultimately, the story of the American Express Merchants Class Action Lawsuit is a testament to the resilience and determination of small business owners, and a hopeful sign that even the most powerful entities can be held accountable for their actions. It's a story that reminds us that when small businesses unite and stand up for what's right, they can create meaningful change and build a more equitable future for all.

.webp)