How To Get Cash On Capital One Credit Card

In an era defined by immediate access and seamless transactions, the need for readily available cash remains surprisingly relevant. For Capital One credit card holders, understanding the mechanisms and implications of accessing cash through their cards is crucial. This article delves into the specifics of how to obtain cash advances from a Capital One credit card, highlighting the fees, interest rates, and potential drawbacks associated with this financial tool.

This guide provides a detailed explanation of how to leverage a Capital One credit card for cash access, but underscores the importance of responsible usage. It examines the various methods, including ATM withdrawals and convenience checks, while emphasizing the significance of understanding associated costs and exploring potentially more cost-effective alternatives.

Accessing Cash Through Capital One Credit Cards: Methods and Mechanisms

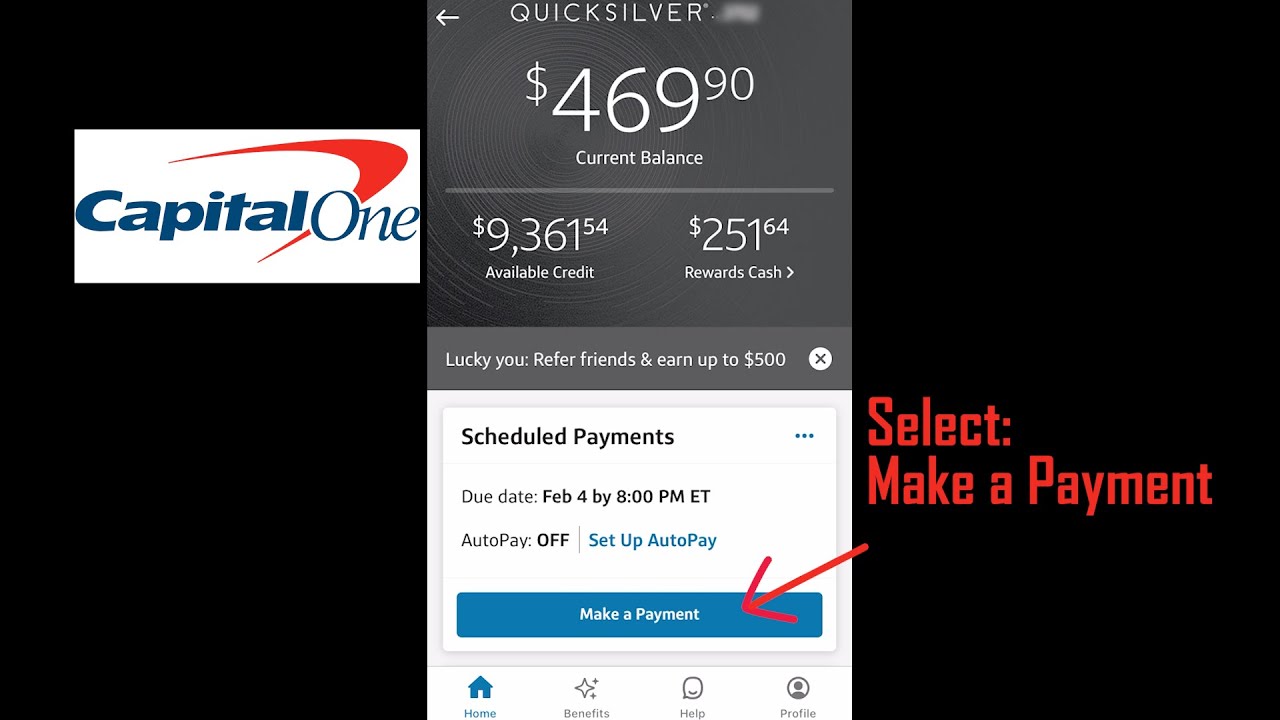

Capital One offers several ways for cardholders to access cash using their credit cards. The most common method is through ATM withdrawals.

Cardholders can visit any ATM that accepts their card's network (Visa or Mastercard) and withdraw cash, up to their card's cash advance limit. Another option involves using convenience checks, which Capital One may send to cardholders periodically. These checks can be written to oneself or another party and cashed or deposited, effectively drawing on the credit line.

Understanding Cash Advance Limits

It's essential to distinguish the cash advance limit from the overall credit limit. The cash advance limit is typically lower than the overall credit limit. Cardholders can find their specific cash advance limit on their credit card statement or by contacting Capital One directly.

Fees and Interest Rates: The Cost of Convenience

Cash advances come with significant costs. Capital One charges a cash advance fee, which is usually a percentage of the amount withdrawn or a flat fee, whichever is greater. This fee can range from 3% to 5% of the cash advance amount, with a minimum fee often applied.

Furthermore, cash advances accrue interest immediately, and this interest rate is typically higher than the purchase APR. Unlike purchases, there is no grace period for cash advances, meaning interest charges begin accruing from the moment the cash is withdrawn. This can quickly escalate the total cost of the cash advance.

Navigating the Fine Print: Terms and Conditions

Capital One's terms and conditions regarding cash advances are crucial to understand. Cardholders should review their cardholder agreement for specific details related to fees, interest rates, and any other applicable charges. Paying attention to these details helps avoid unexpected costs and ensures responsible usage of the credit card for cash access.

Alternatives to Cash Advances: Exploring Other Options

Given the high costs associated with cash advances, exploring alternative options is often advisable. A personal loan from a bank or credit union may offer a lower interest rate than a cash advance. Balance transfers to a card with a lower interest rate could also be a viable strategy, though this typically requires careful planning and may involve balance transfer fees.

Another option is to consider using a debit card for ATM withdrawals, which draws directly from a bank account and avoids accruing interest. Selling unwanted items or seeking assistance from community resources are further alternatives to explore before resorting to a cash advance.

Responsible Usage and Long-Term Financial Health

While cash advances can provide a temporary solution for immediate financial needs, they should be approached with caution. The high fees and interest rates can quickly lead to debt accumulation and negatively impact credit scores. Prioritizing responsible credit card usage, budgeting effectively, and exploring alternative financial solutions are crucial for maintaining long-term financial health.

Capital One, like other credit card issuers, encourages responsible borrowing. Cardholders should only use cash advances when absolutely necessary and prioritize paying them off as quickly as possible to minimize interest charges. Seeking financial advice from a qualified professional can also provide personalized guidance on managing debt and improving financial well-being.

Looking Ahead: Evolving Payment Technologies and Cash Access

The landscape of payment technologies is constantly evolving, with new options emerging that may reduce reliance on cash advances. Mobile payment apps and digital wallets offer alternative ways to access funds and make transactions without incurring the high costs associated with traditional cash advances. As these technologies continue to develop, they may provide more convenient and cost-effective solutions for managing financial needs.