Can You Get A Payday Loan From 2 Different Places

In a world where financial emergencies can strike unexpectedly, the allure of quick cash from payday loans is undeniable. But what happens when one loan isn't enough? The question of whether you can obtain payday loans from multiple lenders simultaneously is a complex one, fraught with potential risks and varying regulations.

This article delves into the realities of taking out multiple payday loans, exploring the legal frameworks, the potential consequences for borrowers, and the safeguards in place to prevent unsustainable debt accumulation.

The Legality of Multiple Payday Loans

The legality of obtaining payday loans from multiple sources is not universally consistent. It largely depends on the specific regulations in place within a particular state or jurisdiction.

Some states explicitly prohibit borrowers from taking out multiple payday loans simultaneously. These states typically have databases that payday lenders are required to check before issuing a loan.

These databases allow lenders to see if a potential borrower already has an outstanding payday loan, preventing them from issuing a new one.

States With Restrictions

Several states have implemented regulations aimed at limiting the practice of multiple payday loans. For example, states like Florida, Illinois, and Michigan have databases that track payday loan activity.

Lenders in these states are required to consult these databases to verify a borrower's eligibility before disbursing funds.

If the database indicates an existing outstanding loan, the lender is prohibited from issuing another one.

States Without Restrictions

In contrast, some states lack comprehensive regulations regarding multiple payday loans. In these states, it may be technically legal to obtain loans from multiple lenders concurrently.

However, even in the absence of legal prohibitions, taking out multiple payday loans can lead to a precarious financial situation.

Borrowers can quickly become trapped in a cycle of debt, struggling to repay multiple high-interest loans.

The Risks of Borrowing From Multiple Payday Lenders

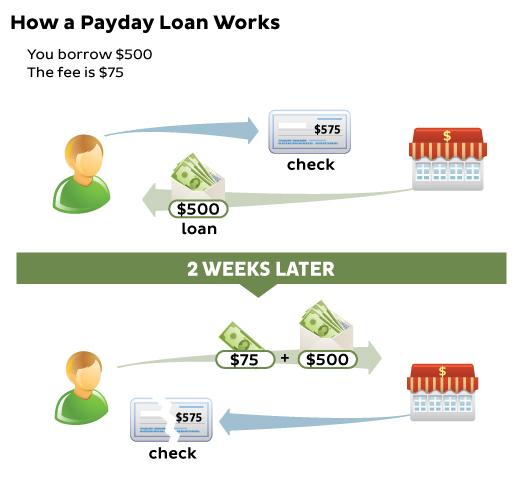

The most significant risk associated with taking out multiple payday loans is the potential for debt accumulation. Payday loans are characterized by their high interest rates and short repayment periods.

When a borrower takes out multiple loans, the burden of repayment can become overwhelming, making it difficult to meet financial obligations.

Fees and Interest: Each payday loan comes with its own set of fees and interest charges. These costs can quickly add up, especially when a borrower is juggling multiple loans.

Default and Penalties: Missing payments on even one payday loan can result in penalties and late fees. Defaulting on multiple loans can have a severe impact on credit scores.

Debt Cycle: The high cost of payday loans often leads borrowers to take out new loans to cover existing debts, perpetuating a cycle of borrowing and repayment.

"Taking out multiple payday loans can seem like a solution to immediate financial problems, but it often leads to a more complex and difficult financial situation in the long run," warns Sarah Johnson, a financial advisor at Clear Path Financial Solutions.

Safeguards and Consumer Protection

Recognizing the potential for harm, various consumer protection agencies and organizations advocate for responsible lending practices and stricter regulations.

The Consumer Financial Protection Bureau (CFPB) has been actively involved in researching and regulating the payday lending industry.

While the CFPB's stance on payday lending has shifted over time, its initial efforts focused on implementing rules to protect borrowers from predatory lending practices.

Alternatives to Payday Loans

Borrowers facing financial difficulties should explore alternatives to payday loans whenever possible. These alternatives may offer more favorable terms and lower interest rates.

Personal Loans: Banks and credit unions offer personal loans with lower interest rates and longer repayment periods than payday loans.

Credit Card Advances: While not ideal, a cash advance on a credit card may be a less expensive option than a payday loan, provided it is repaid promptly.

Credit Counseling: Nonprofit credit counseling agencies can provide valuable assistance to borrowers struggling with debt. They can help create a budget, negotiate with creditors, and develop a debt management plan.

Assistance Programs: Various government and community assistance programs offer financial aid to individuals and families in need. These programs may provide assistance with housing, food, and other essential expenses.

Conclusion

While obtaining payday loans from multiple lenders may be legally permissible in some states, it is generally not advisable. The risks associated with multiple loans, including high fees, escalating debt, and potential credit damage, outweigh the short-term benefits.

Borrowers facing financial challenges should carefully consider all available options and seek advice from reputable financial advisors or credit counseling agencies. Prioritizing financial literacy and responsible borrowing habits is crucial for avoiding the payday loan trap.

Ultimately, the decision to take out a payday loan, whether single or multiple, should be made with a thorough understanding of the terms, risks, and potential consequences involved.