Can You Get Multiple Payday Loans

Financial desperation can lead individuals down a perilous path, often resulting in the question: Can you get multiple payday loans? The answer is complicated and fraught with risk, potentially trapping borrowers in a cycle of debt.

This article breaks down the legality, dangers, and alternatives surrounding the practice of taking out multiple payday loans simultaneously. Understanding the risks and regulations is crucial for anyone considering this option.

The Reality of Multiple Payday Loans

The legality of holding multiple payday loans depends heavily on state regulations. Some states explicitly prohibit it, while others have no restrictions or limitations.

States like California, for example, allow borrowers to have multiple outstanding payday loans, but there are limitations on the total amount borrowed. According to the California Department of Financial Protection and Innovation (DFPI), a single payday loan cannot exceed $300.

In contrast, other states have implemented databases that track payday loan activity. This helps lenders identify borrowers who already have outstanding loans and prevent them from taking out additional ones.

Understanding State Regulations

Checking your state's specific regulations is the first crucial step. The Consumer Financial Protection Bureau (CFPB) provides resources and information on payday lending laws across the country.

Search online for "[Your State] Payday Loan Laws" to find the most up-to-date information. Be aware that these laws can change, so it's essential to verify the information from a reliable source.

Remember, ignorance of the law is not an excuse. Borrowers are responsible for understanding and adhering to their state's regulations.

The Dangers of the Debt Trap

Taking out multiple payday loans significantly increases the risk of falling into a debt trap. The high interest rates and short repayment periods make it difficult to break free.

The Pew Charitable Trusts have conducted extensive research on payday loans, highlighting the excessive fees and the extended periods borrowers remain in debt. Their studies show that the average borrower is in debt for five months of the year because of payday loans.

The interest rates on payday loans can be astronomically high, sometimes exceeding 300% APR. This means that for every $100 borrowed, you could end up paying back $300 or more.

How the Cycle Works

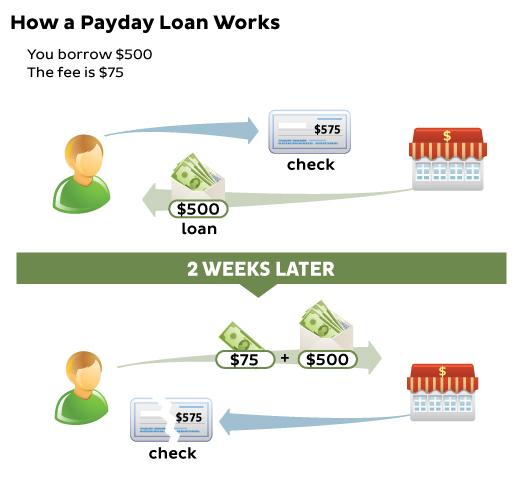

The typical scenario involves a borrower taking out a loan to cover an immediate expense. When the repayment date arrives, they are unable to pay back the full amount due to the exorbitant interest and fees.

This leads to either rolling over the loan (extending the repayment period but incurring more fees) or taking out another loan to cover the first. This cycle can repeat indefinitely, creating a spiral of debt.

Borrowers often end up paying far more in fees and interest than the original amount borrowed. The short-term relief provided by a payday loan quickly turns into a long-term financial burden.

Alternatives to Payday Loans

Before resorting to multiple payday loans, explore alternative options. There are often more sustainable solutions available, even in urgent situations.

Consider options like credit union loans, personal loans from banks, or borrowing from friends and family. These alternatives typically have lower interest rates and more manageable repayment terms.

Explore programs offering financial assistance or short-term help. Local charities, non-profits, and government agencies may have programs that can help you cover your expenses.

Seeking Financial Guidance

If you are struggling with debt, seek guidance from a qualified financial advisor. They can help you create a budget, manage your debt, and develop a plan for long-term financial stability.

Organizations like the National Foundation for Credit Counseling (NFCC) and the Financial Counseling Association of America (FCAA) offer free or low-cost credit counseling services.

These counselors can provide unbiased advice and help you navigate your financial challenges. Don't hesitate to reach out for help – it's a sign of strength, not weakness.

Ongoing Developments and Next Steps

The regulation of payday loans is an ongoing process, with states and the federal government continually evaluating and adjusting their laws.

The CFPB continues to monitor the payday lending industry and enforce regulations to protect consumers. Keep an eye on their website for updates and announcements.

Stay informed about the latest developments in payday loan regulations and seek financial advice before making any decisions. Protecting your financial well-being is paramount.