Can You Pay Yourself A Salary In An Llc

Imagine you've nurtured a small business from a seed of an idea into a flourishing sapling. You're putting in long hours, wearing multiple hats, and finally, you're seeing some profit. But a nagging question lingers: how do you, the driving force behind it all, actually pay yourself? The answer, like many aspects of running a business, depends on the structure you've chosen.

The core question is whether or not you can pay yourself a salary as a business owner operating as an LLC, and if so, what is the best approach. While a sole proprietorship or partnership usually involve withdrawals, an LLC offers more flexibility, but also requires a clear understanding of tax implications and legal requirements.

Understanding LLCs and Owner Compensation

A Limited Liability Company (LLC) is a business structure that offers its owners (members) protection from personal liability for business debts and obligations. This means your personal assets are generally shielded if the business incurs debt or faces a lawsuit.

However, when it comes to owner compensation, LLCs don't follow the traditional employer-employee model in the same way as, say, a corporation. According to the Small Business Administration (SBA), the way you compensate yourself depends on how your LLC is taxed.

The Pass-Through Taxation Model

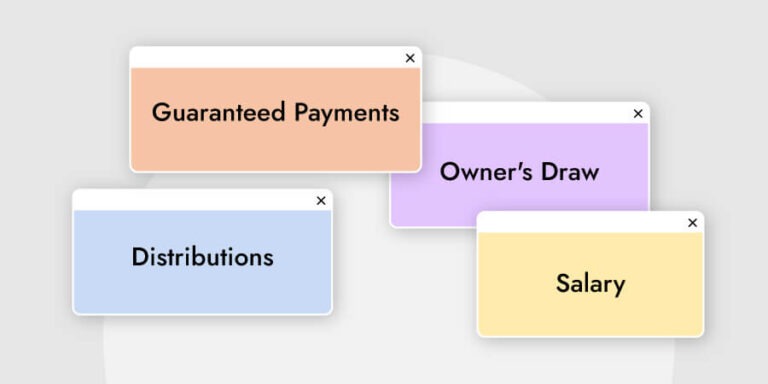

Most LLCs are taxed as pass-through entities. This means the business's profits and losses are "passed through" to the owners' personal income tax returns. You don't receive a traditional salary with payroll taxes withheld.

Instead, you typically take owner's draws or distributions from the business profits. These draws aren't subject to employment taxes (Social Security and Medicare) at the business level, but you will be responsible for self-employment taxes on your share of the business's profits.

According to the Internal Revenue Service (IRS), you'll need to file Schedule SE (Self-Employment Tax) with your Form 1040 to calculate and pay these taxes. It's important to keep accurate records of your income and expenses to ensure accurate tax reporting.

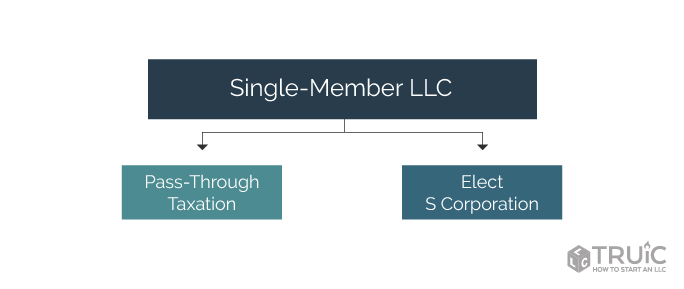

Electing to be Taxed as a Corporation

LLCs have the option to elect to be taxed as either an S-Corporation (S-Corp) or a C-Corporation (C-Corp). This election can have significant implications for how you're compensated and taxed.

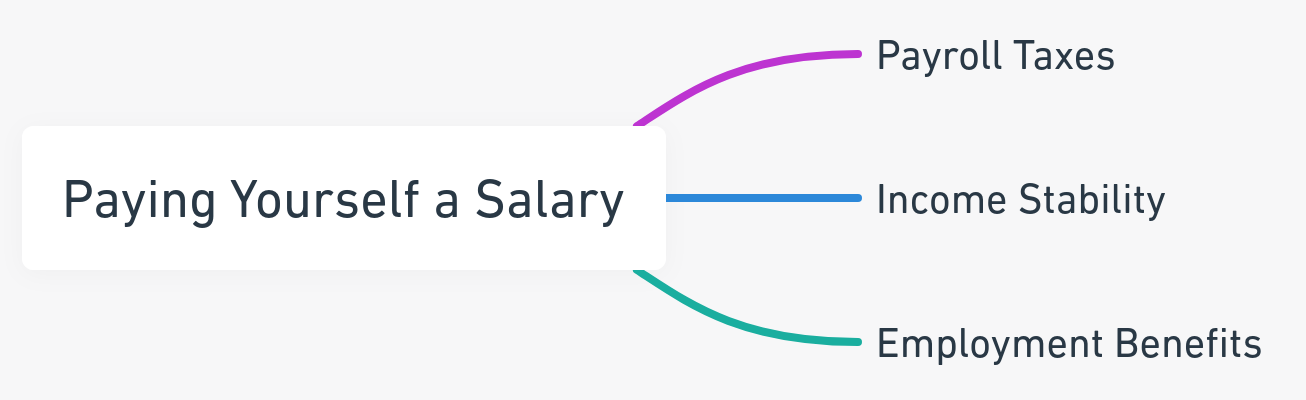

If you elect to be taxed as an S-Corp, you can pay yourself a "reasonable salary" as an employee of your LLC. This means you'll be subject to payroll taxes (Social Security, Medicare, and potentially unemployment taxes) on your salary, just like any other employee.

The benefit is that only the salary is subject to these employment taxes. Any remaining profits are distributed to you as a shareholder and are only subject to income tax, potentially reducing your overall tax burden. However, the IRS closely scrutinizes S-Corp salaries to ensure they're "reasonable" for the work performed.

Determining a Reasonable Salary

What constitutes a reasonable salary? The IRS defines it as the amount you would have to pay someone else to perform the same job. Factors to consider include your skills, experience, the nature of your work, and industry standards.

Benchmarking against similar roles in your industry can help you determine an appropriate salary. Websites like Salary.com and Payscale.com can provide valuable data.

Paying yourself an unreasonably low salary to avoid employment taxes can raise red flags with the IRS and could result in penalties. Therefore, consulting with a tax professional is always recommended.

Legal and Financial Considerations

Regardless of how you choose to compensate yourself, it's crucial to maintain meticulous financial records. This includes tracking all income, expenses, and owner's draws or salary payments.

Having a separate business bank account is essential for maintaining clear financial boundaries between your personal and business finances. This separation strengthens the limited liability protection offered by your LLC.

Furthermore, it's wise to consult with a legal professional to ensure your compensation structure complies with all applicable state and federal laws. They can also help you draft an operating agreement that clearly outlines the responsibilities and compensation of each member of the LLC.

The Path Forward

Deciding how to pay yourself from your LLC is a critical decision with significant tax and legal implications. Carefully consider your options, understand the rules, and seek professional advice to make the best choice for your individual circumstances.

With careful planning and sound financial management, you can confidently navigate the complexities of LLC compensation and reap the rewards of your entrepreneurial efforts. Remember, understanding the options is crucial in establishing a stable financial future for both yourself and your business.