Can You Request A Credit Line Increase With Fingerhut

For individuals working to build or rebuild their credit, Fingerhut credit accounts can offer a pathway to accessing credit and purchasing everyday items. A common question among Fingerhut account holders is whether they can proactively request a credit line increase to expand their purchasing power. The answer, while not a straightforward "yes" or "no," depends on various factors and understanding Fingerhut's specific policies.

Understanding the possibility of increasing your Fingerhut credit line is crucial for managing your financial options and maximizing the benefits of the account. This article will explore the specifics of requesting a credit line increase with Fingerhut, the factors influencing approval, and alternative strategies for building credit effectively.

Can You Request a Credit Line Increase?

Fingerhut generally does not allow customers to directly request a credit line increase. This policy is in place for various reasons, including managing risk and adhering to internal credit assessment models. Instead, Fingerhut periodically reviews accounts and may automatically offer credit line increases to eligible customers.

These automatic increases are typically based on responsible account usage, on-time payments, and overall creditworthiness. However, the lack of a direct request option can be frustrating for users seeking to increase their spending limit more quickly.

Factors Influencing Automatic Credit Line Increases

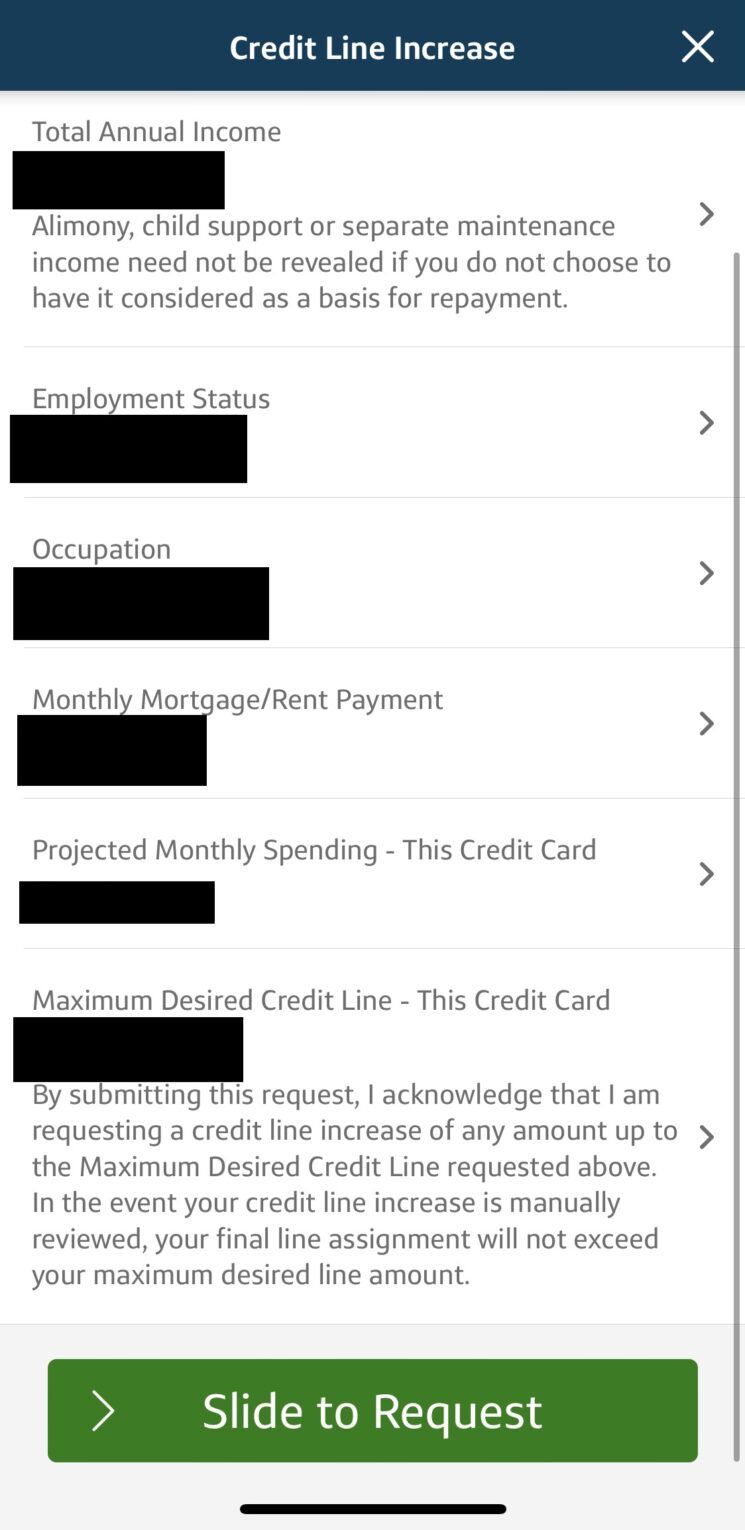

While you can't directly ask for an increase, several factors can influence Fingerhut's decision to offer you one. Payment history is paramount. Consistently making payments on time is crucial for demonstrating responsible credit management.

Credit utilization also plays a role. Keeping your balance low relative to your credit limit shows lenders you aren't over-reliant on credit. A positive change to your overall credit score can also prompt a credit line increase offer.

Your credit score is a key indicator of your creditworthiness and the risk associated with extending you more credit. Fingerhut also considers the length of time you've had the account. A longer, positive account history often results in more favorable consideration.

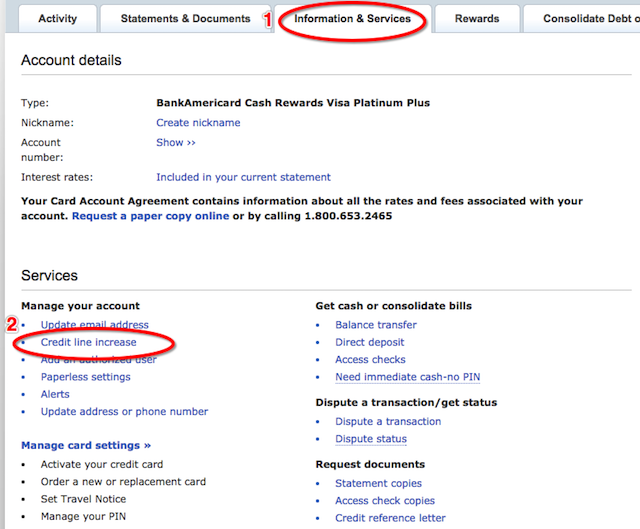

Alternatives to Requesting a Credit Line Increase

Since direct requests are not possible, focusing on building your overall credit profile is the best strategy. Consider opening a secured credit card with a traditional lender, as responsible use can graduate to an unsecured card. Paying all bills on time, including utilities and rent, also helps improve your credit score.

Regularly monitor your credit report for errors and dispute any inaccuracies to ensure an accurate reflection of your credit history. Diversifying your credit mix by adding different types of credit accounts can also positively impact your credit score.

Potential Impact and Significance

The inability to directly request a credit line increase can be a limitation for Fingerhut customers aiming to make larger purchases or improve their credit utilization ratio. This limitation highlights the importance of responsible credit management and exploring alternative credit-building strategies.

It also underscores the need for clear communication from Fingerhut regarding their credit line increase policies. This way, customers have realistic expectations. Understanding the process and focusing on factors within your control is key to maximizing your credit-building potential with Fingerhut and beyond.

By focusing on these strategies, Fingerhut account holders can improve their creditworthiness and potentially receive automatic credit line increases, ultimately achieving their financial goals.

![Can You Request A Credit Line Increase With Fingerhut How to Get A Barclays Credit Line Increase [2020] - UponArriving](https://www.uponarriving.com/wp-content/uploads/2020/07/Barclays-credit-limit-increase-online-960x783.png)