Quicken Accounting Software For Small Business

For decades, small business owners have juggled the daunting task of financial management, often navigating complex spreadsheets and outdated methods. While enterprise-level accounting software dominates the market, the need for accessible and affordable solutions tailored to the specific needs of smaller operations remains critical. Quicken, a long-standing name in personal finance, has increasingly focused on capturing this segment, but questions persist about its suitability and effectiveness compared to other options.

This article examines Quicken Accounting Software for small businesses, analyzing its features, pricing, pros, and cons, while exploring alternative solutions. We will delve into its target audience, integration capabilities, and user experience, providing a balanced perspective on whether Quicken truly provides the robust yet simple accounting solution small businesses need. Our analysis will draw upon user reviews, industry reports, and expert opinions to provide a comprehensive evaluation.

Quicken's Offering for Small Businesses

Quicken offers different versions of its software tailored for varying business needs. Quicken Self-Employed targets freelancers and independent contractors, focusing on income and expense tracking, tax preparation assistance, and basic reporting.

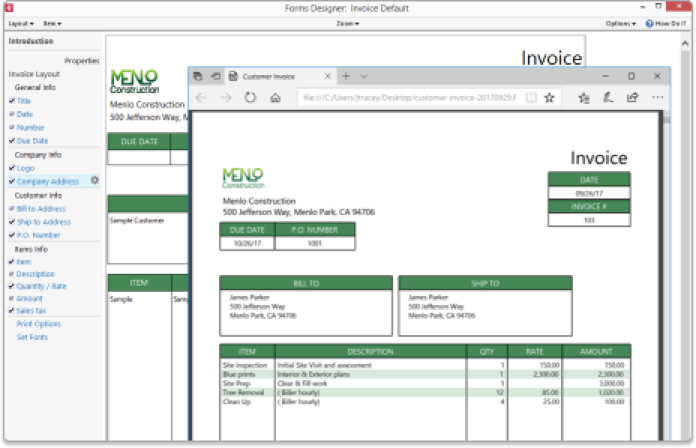

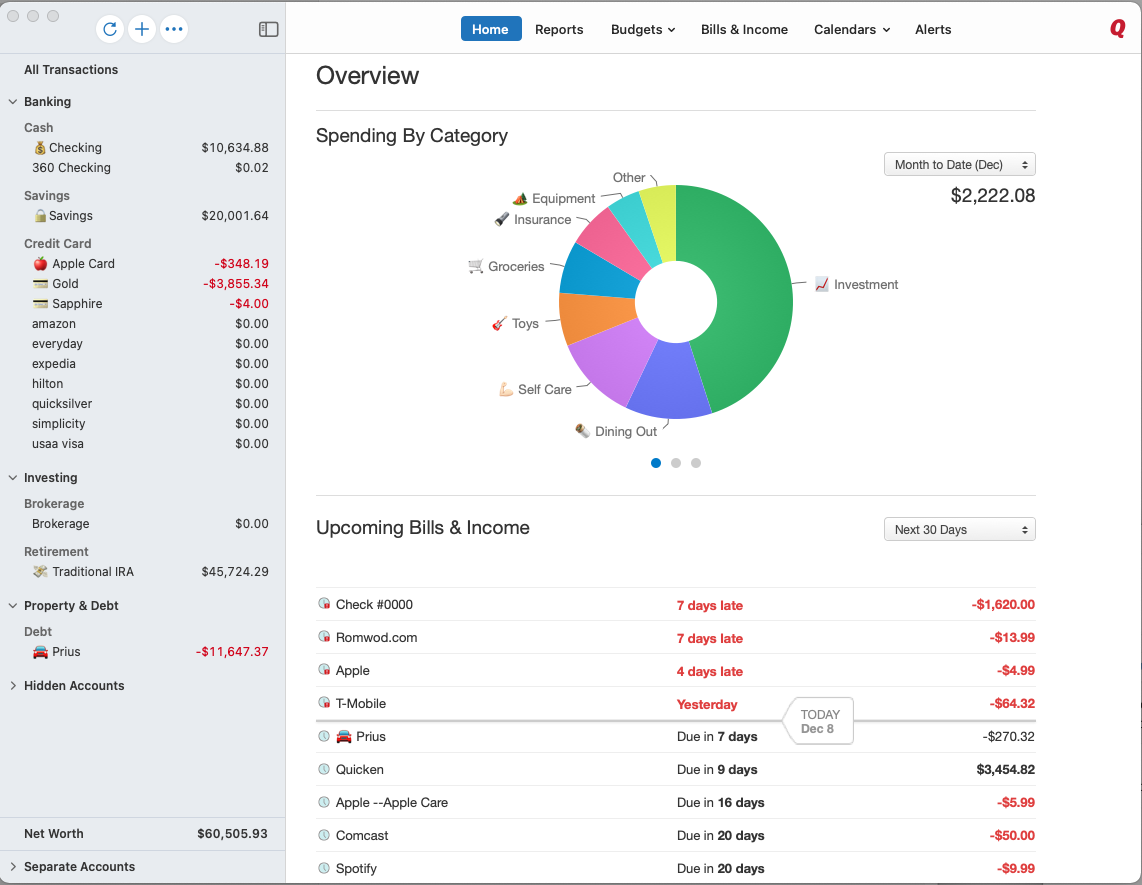

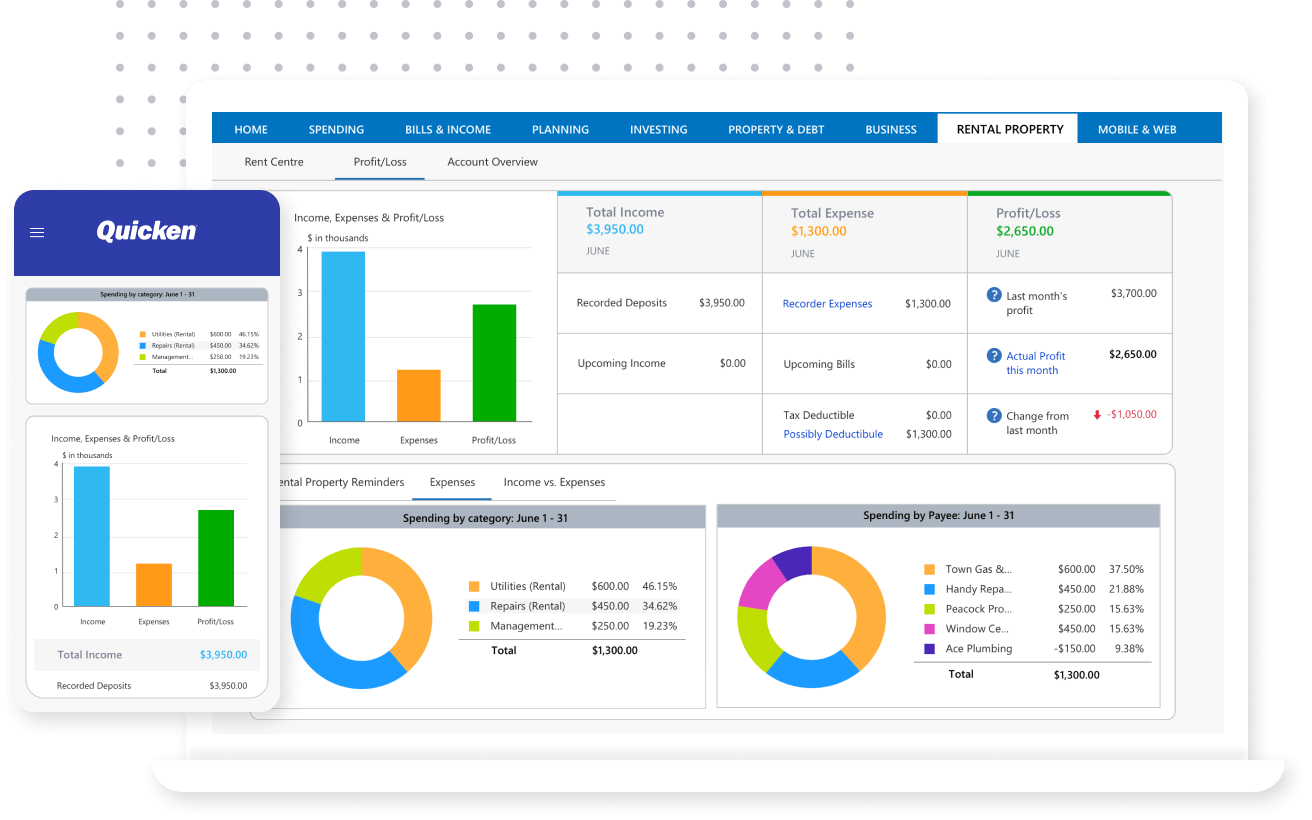

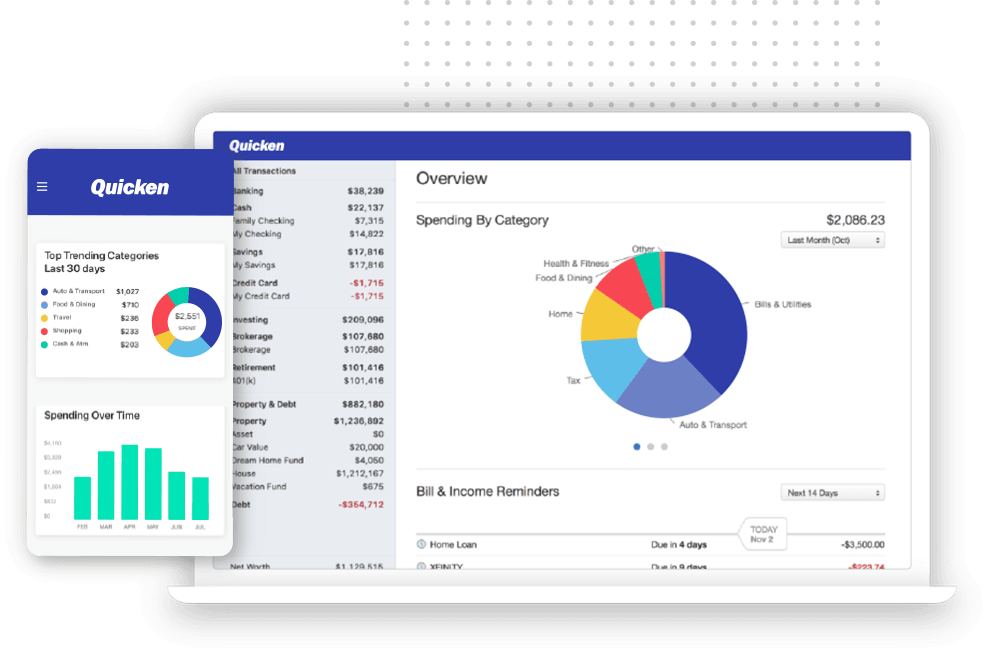

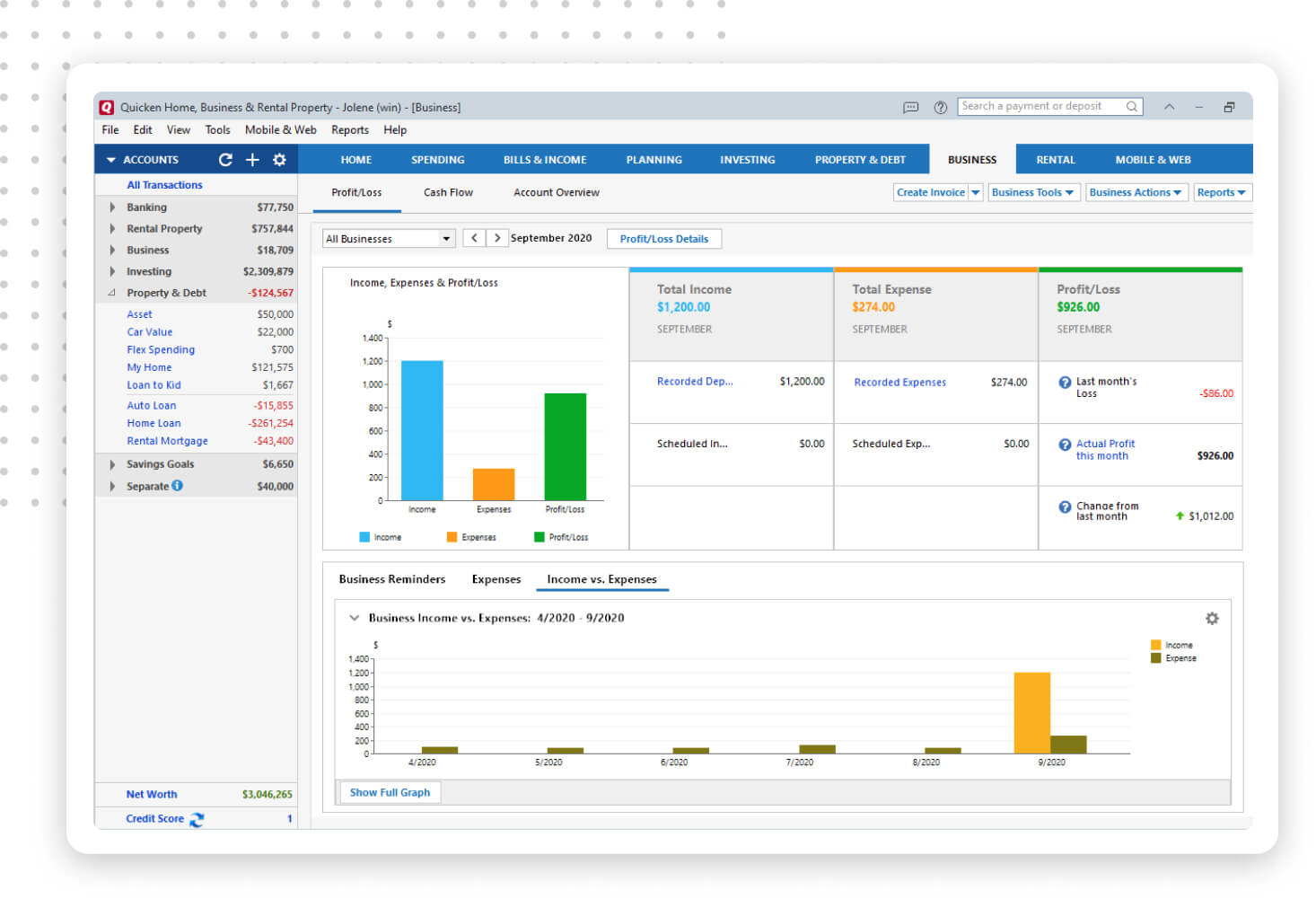

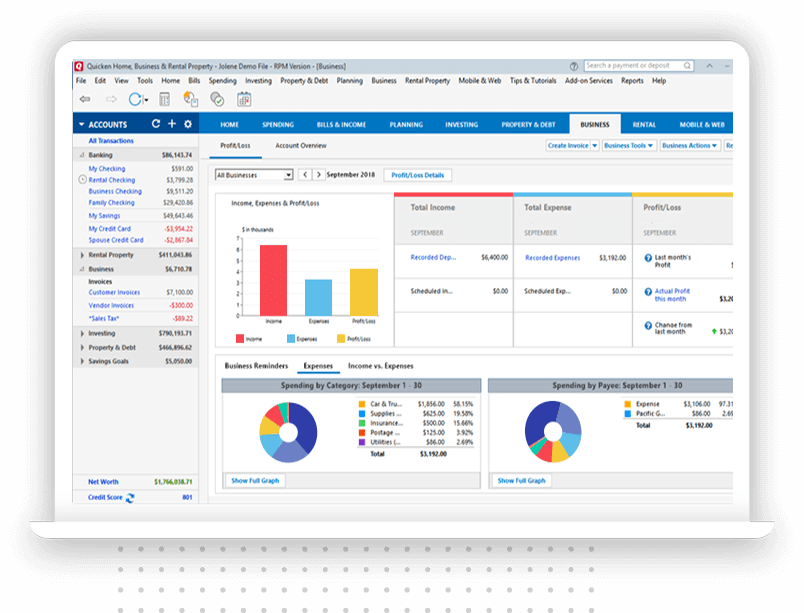

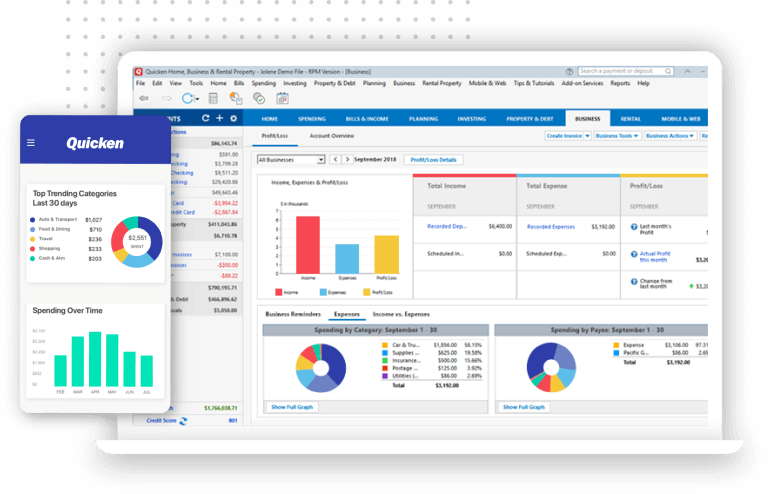

Quicken Home & Business is designed for slightly larger operations, adding features such as invoice creation, bill payment, and more detailed financial reporting. Both versions share a familiar interface with Quicken's personal finance products, aiming for ease of use.

Key Features and Functionality

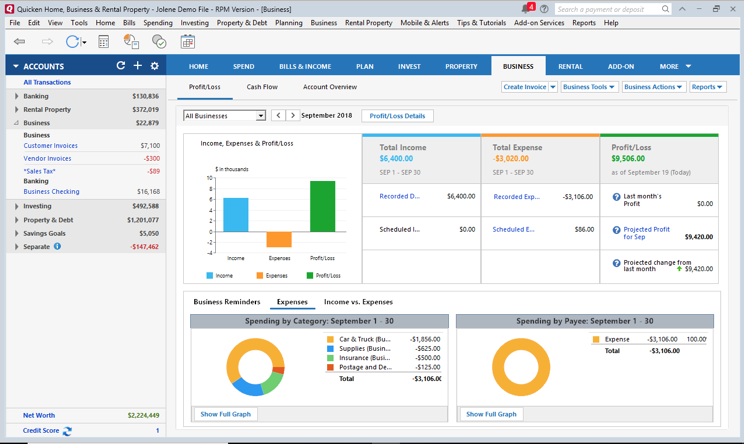

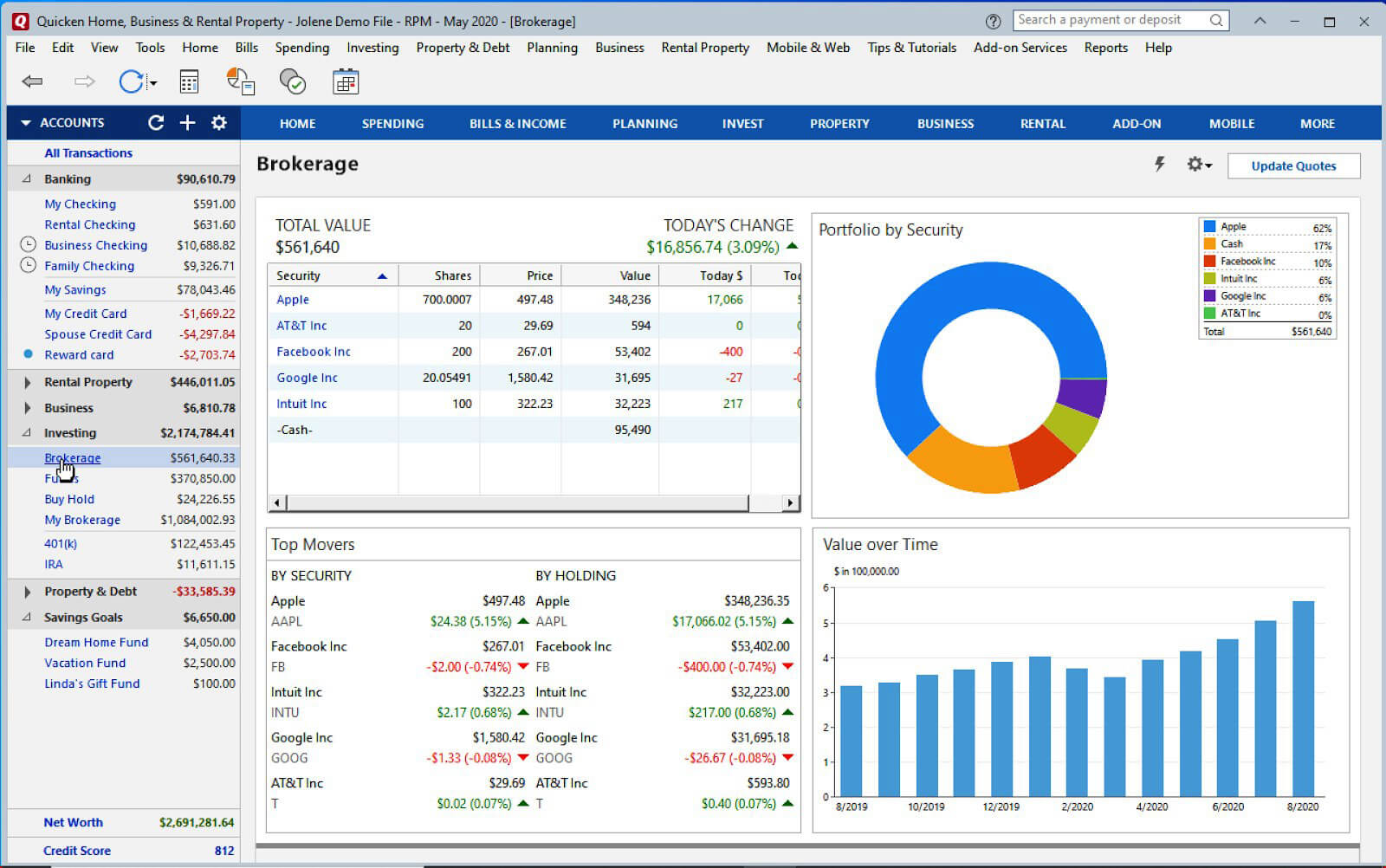

Quicken's strength lies in its user-friendly interface, particularly for those already familiar with its personal finance software. Its key features include income and expense tracking, invoice generation, basic inventory management (in some versions), and integration with bank and credit card accounts. Automatic transaction categorization aims to simplify bookkeeping.

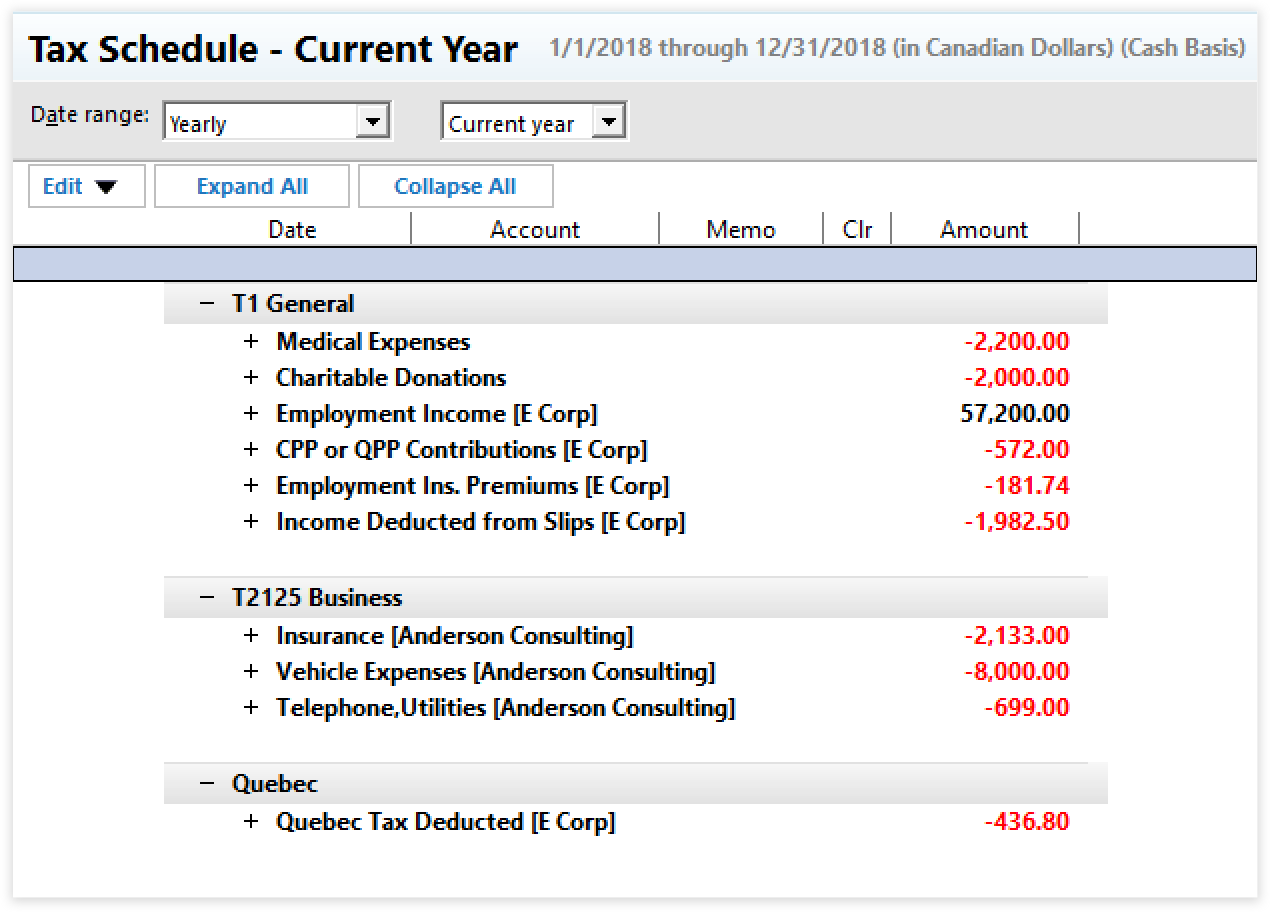

Tax-related features, like estimating quarterly taxes, are also a significant draw for self-employed individuals. The software also allows users to track mileage, a valuable tool for deducting business-related travel expenses.

Pros and Cons of Using Quicken

One of the main advantages of Quicken is its affordability compared to more comprehensive accounting software like QuickBooks or Xero. Its intuitive interface also makes it easier to learn and use, especially for business owners without formal accounting training.

However, Quicken has limitations. It lacks the advanced features needed by growing businesses, such as robust inventory management, payroll processing, and detailed project accounting. Its reporting capabilities are also less extensive than dedicated accounting software.

"For very small businesses with simple needs, Quicken can be a cost-effective solution," states Lisa Smith, a CPA specializing in small business accounting. "However, businesses with complex accounting needs will quickly outgrow its capabilities."

Alternatives to Quicken

Several alternatives to Quicken cater to the small business market. QuickBooks Self-Employed and QuickBooks Online are popular choices, offering more advanced features and scalability.

Xero is another strong contender, known for its cloud-based platform and integrations with various business applications. Less accounting software like Zoho Books and FreshBooks also provide viable options with a range of features and pricing plans.

Choosing the Right Solution

The best accounting software depends on the specific needs of the business. Factors to consider include the size of the business, the complexity of its accounting requirements, the budget, and the level of accounting expertise of the user.

Businesses needing advanced features like payroll, inventory management, or detailed reporting are better served by alternatives like QuickBooks Online or Xero. For very small businesses with basic needs, Quicken might suffice, but a transition plan should be in place as the business grows.

Future Trends in Small Business Accounting Software

The future of small business accounting software is moving towards greater automation, cloud-based solutions, and artificial intelligence integration. Expect to see increased automation of tasks like bank reconciliation, invoice processing, and expense tracking.

Cloud-based platforms will continue to gain popularity, offering greater accessibility and collaboration. AI-powered features will provide real-time insights and predictions to help small business owners make better financial decisions.

While Quicken has carved out a niche in the small business market, its long-term viability depends on its ability to adapt to these changing trends. Investing in cloud capabilities, enhancing automation, and integrating AI will be crucial for Quicken to remain competitive and meet the evolving needs of small business owners. Only then can it truly provide the robust and reliable accounting solution that small businesses deserve.

![Quicken Accounting Software For Small Business Quicken Home and Business 2011 [Old Version] : Amazon.ca: Software](https://images-na.ssl-images-amazon.com/images/G/01/software/detail-page/B004BEC5NQ-1.jpg)