Can You Use Affirm On Airbnb

Airbnb users, take note: you can now finance your getaways with Affirm. The integration allows travelers to split the cost of their bookings into manageable monthly payments.

This partnership between Airbnb and Affirm aims to make travel more accessible. It lowers the upfront cost barrier, potentially opening doors to more travelers.

Affirm on Airbnb: What You Need to Know

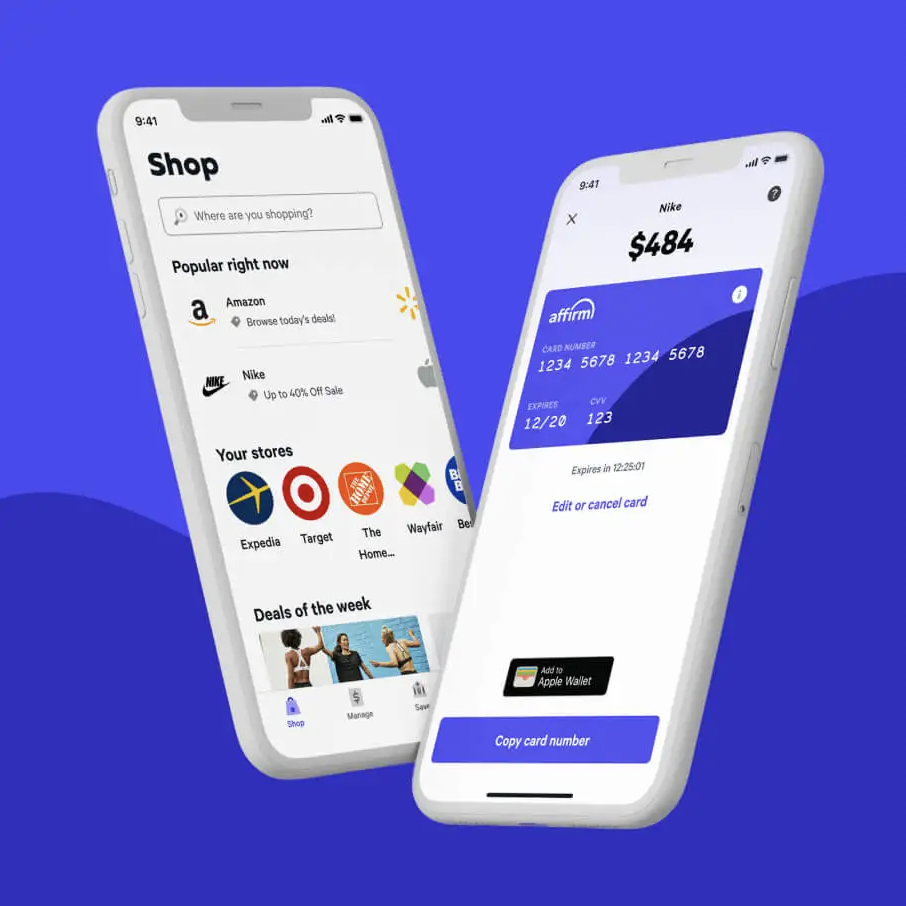

What is Affirm? It is a buy now, pay later (BNPL) service that lets you pay for purchases in installments. These installments typically span over a few months to a year, or even longer.

Who can use it? The option is available to eligible Airbnb users in the United States and Canada. Availability might depend on your creditworthiness and the specific terms offered by Affirm.

How to Use Affirm on Airbnb

The process is straightforward. Start by selecting your desired Airbnb stay.

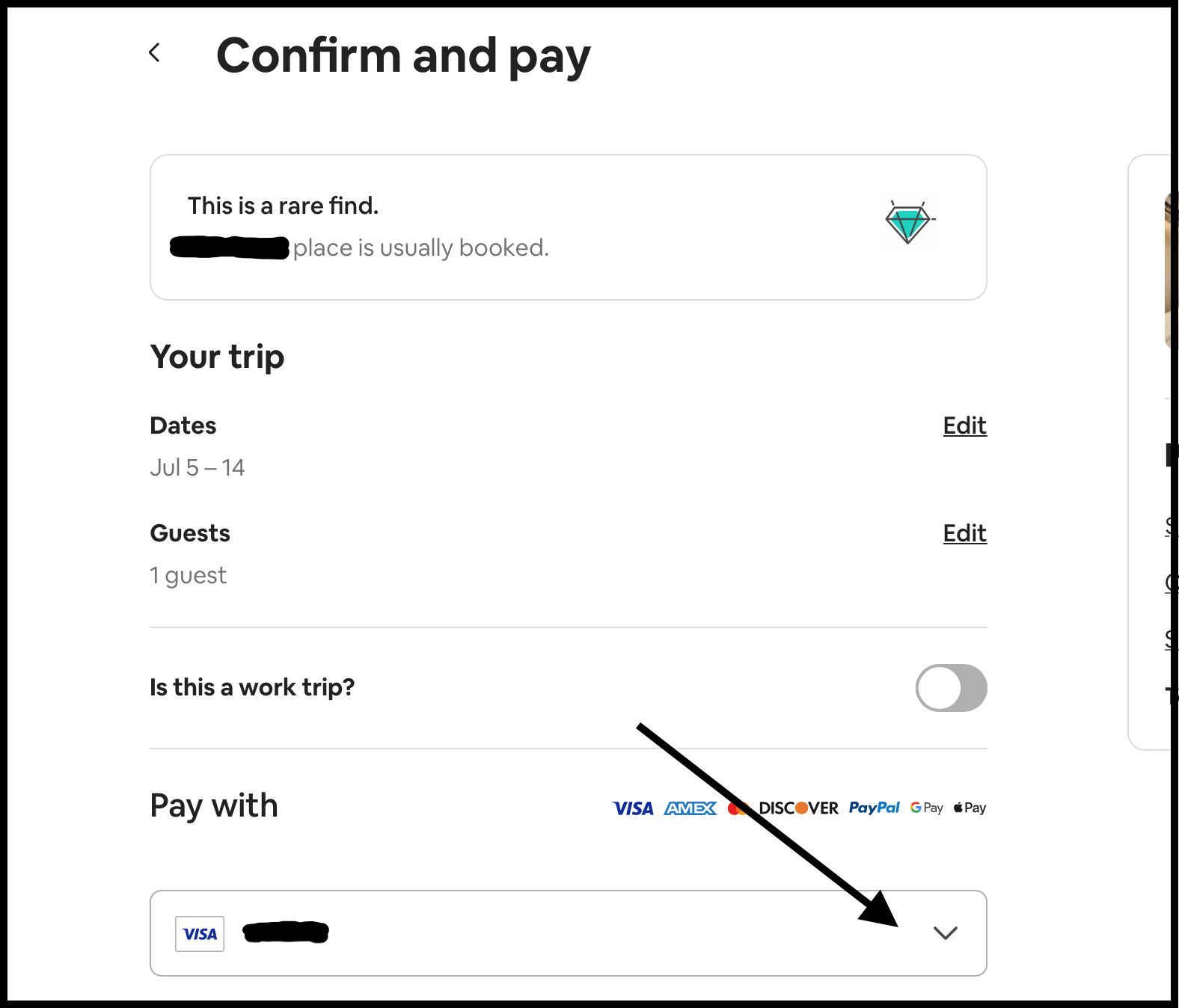

During checkout, if eligible, you'll see Affirm as a payment option. Choosing this will redirect you to Affirm's website.

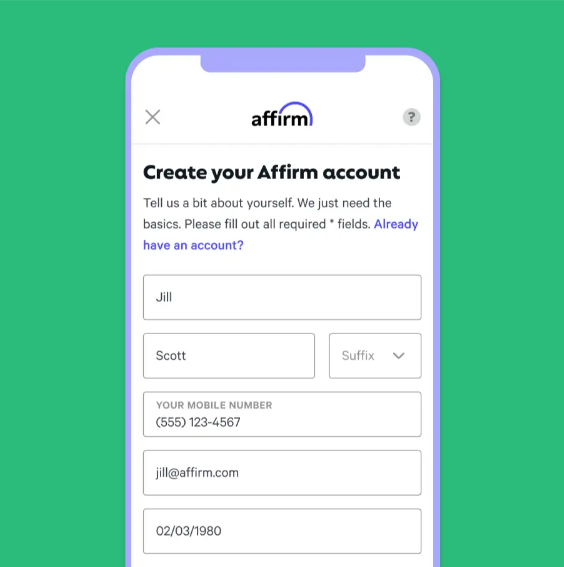

You'll then need to apply for a loan with Affirm. This usually involves a credit check and providing some personal information.

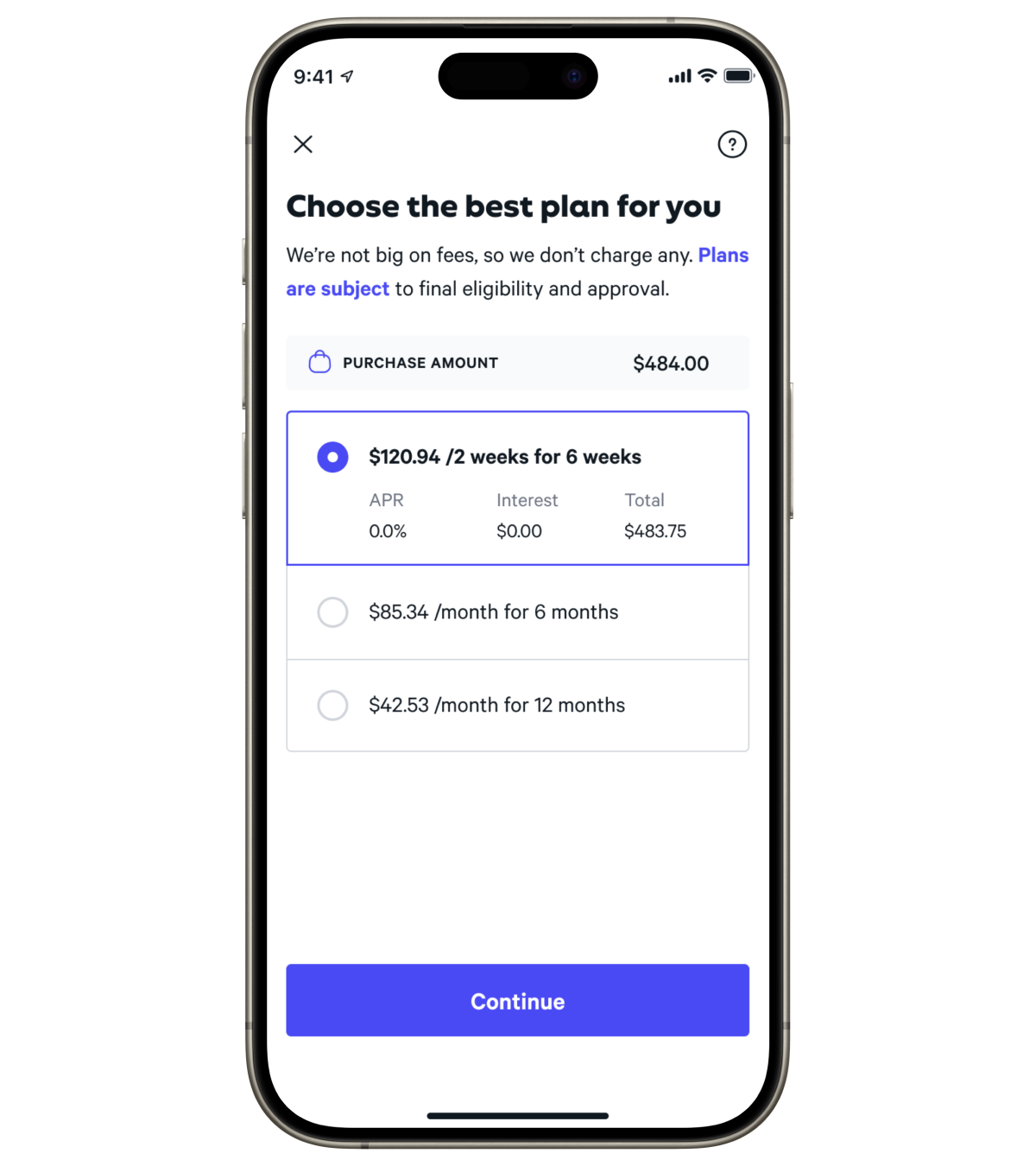

If approved, you'll see your loan terms: the interest rate, monthly payment amount, and loan duration. Review these carefully before accepting.

Once you agree to the terms, Affirm pays Airbnb, and you repay Affirm directly in monthly installments.

Key Considerations

Interest Rates: Affirm charges interest, which varies depending on your credit score and the loan terms. Be sure to calculate the total cost of your booking with interest before committing.

Credit Impact: Applying for and using Affirm can affect your credit score. Responsible repayment can improve your score, while missed payments can negatively impact it.

Eligibility: Not all Airbnb bookings are eligible for Affirm financing. Check the payment options during checkout to confirm availability.

"Our goal is to empower travelers to explore the world without breaking the bank," says an Airbnb spokesperson.

This echoes Affirm's mission to provide transparent and flexible payment options.

The Fine Print

It's crucial to understand the terms and conditions before using Affirm. Read the fine print carefully, paying close attention to late payment fees and potential penalties.

Affirm typically offers various loan durations. Choose one that fits your budget and repayment capacity.

Be mindful of your spending habits when using BNPL services. Overspending can lead to debt accumulation and financial strain.

Alternatives to Affirm

Consider other financing options if Affirm's terms are not suitable. These could include using a credit card with travel rewards or saving up for your trip in advance.

Some travel agencies offer their own payment plans. Explore these options to compare terms and find the best fit for your needs.

Recent Trends in Travel Financing

The integration of BNPL services into travel platforms like Airbnb reflects a growing trend. Travelers are increasingly seeking flexible payment options to manage the cost of their trips.

This trend is driven by factors such as rising travel costs and a desire for more accessible travel experiences. BNPL services can make travel more attainable for those on a budget.

However, it's important to use these services responsibly and avoid overextending yourself financially.

Ongoing Developments

Airbnb and Affirm continue to refine their partnership. Expect to see potential updates to the program's terms and eligibility requirements in the future.

Keep an eye out for promotions and special offers related to Affirm financing on Airbnb. These can help you save money on your bookings.

Stay informed about the latest developments by visiting the Airbnb and Affirm websites regularly.

Conclusion

The availability of Affirm on Airbnb presents a new way to finance travel. But users should carefully assess their financial situation before using this option.

Monitor your account and credit report after using Affirm. This will help you track your payments and identify any potential issues early on.

Stay tuned for updates as the Airbnb and Affirm partnership evolves. The future of travel financing is constantly changing.