Can You Use Sezzle To Pay Bills

In an era defined by escalating living costs and the ever-present pressure of managing finances, innovative payment solutions are increasingly sought after. Among these solutions, "buy now, pay later" (BNPL) services like Sezzle have gained significant traction, particularly among younger demographics. But can these services, designed primarily for retail purchases, be leveraged to tackle the more fundamental issue of bill payments? This question has become a focal point for consumers grappling with the complexities of modern financial management.

This article delves into the feasibility of using Sezzle to pay bills, exploring the nuances of its functionality, limitations, and the potential workarounds that consumers might consider. The goal is to provide a comprehensive understanding of how Sezzle interacts with the bill payment landscape, offering insights into both its practical applications and potential drawbacks. We will examine official statements, consumer experiences, and expert opinions to offer a balanced perspective on this evolving financial trend.

Sezzle's Core Functionality: Retail Focused

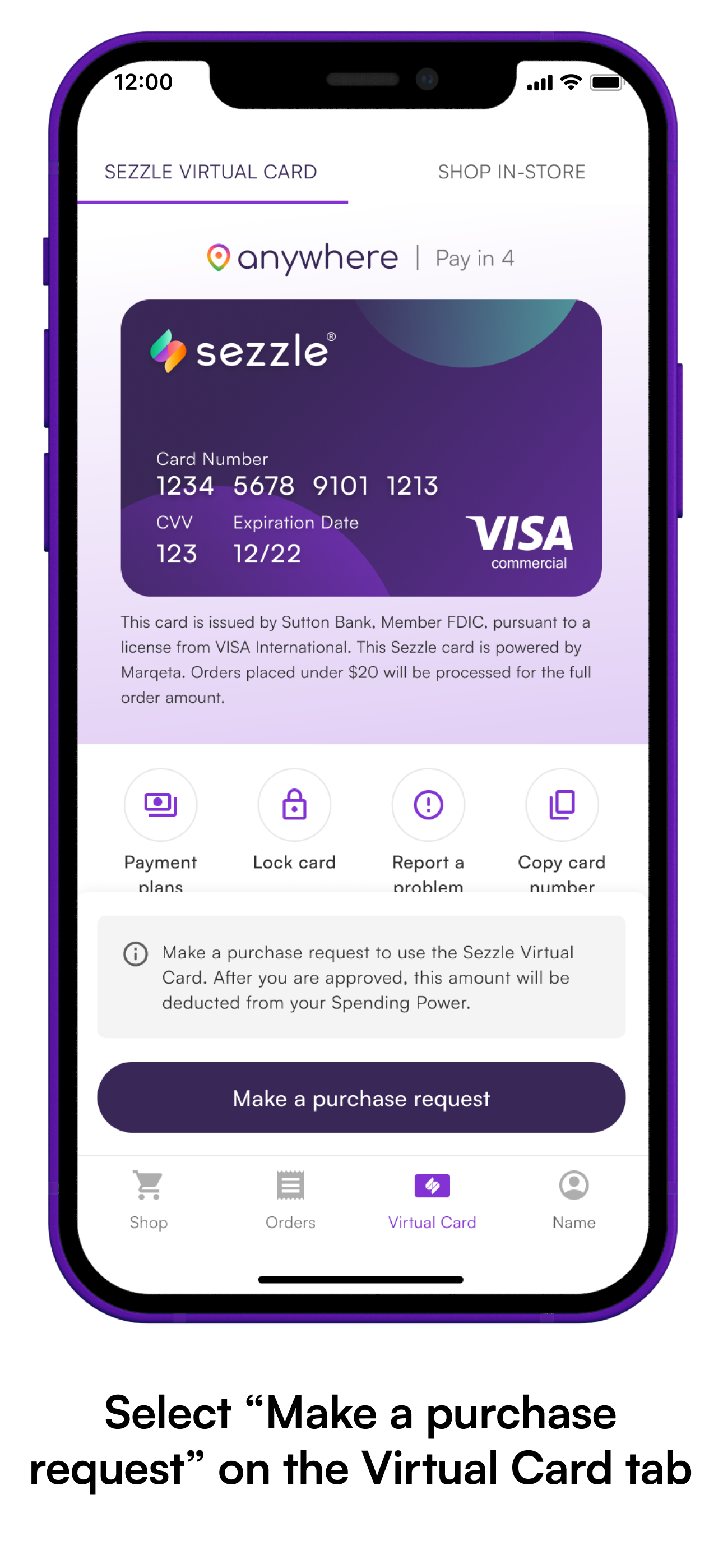

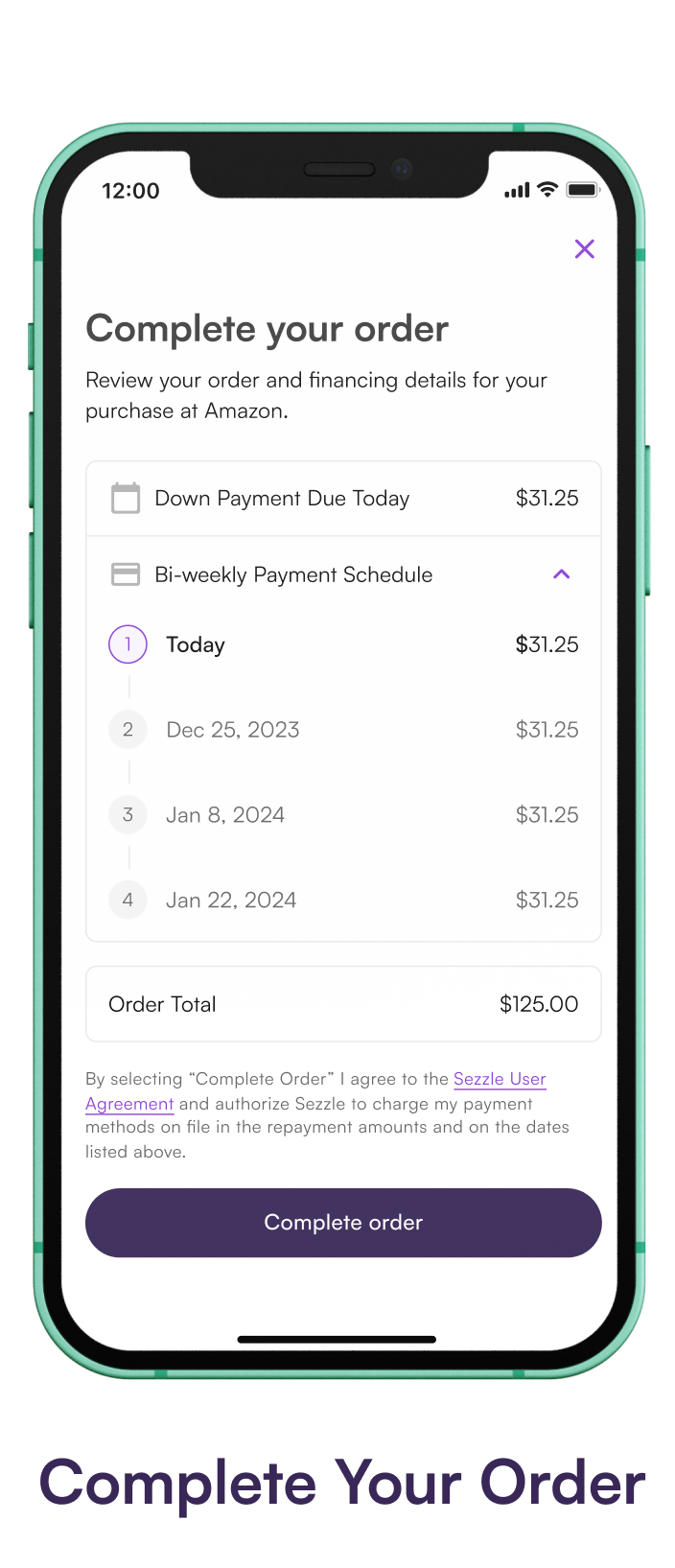

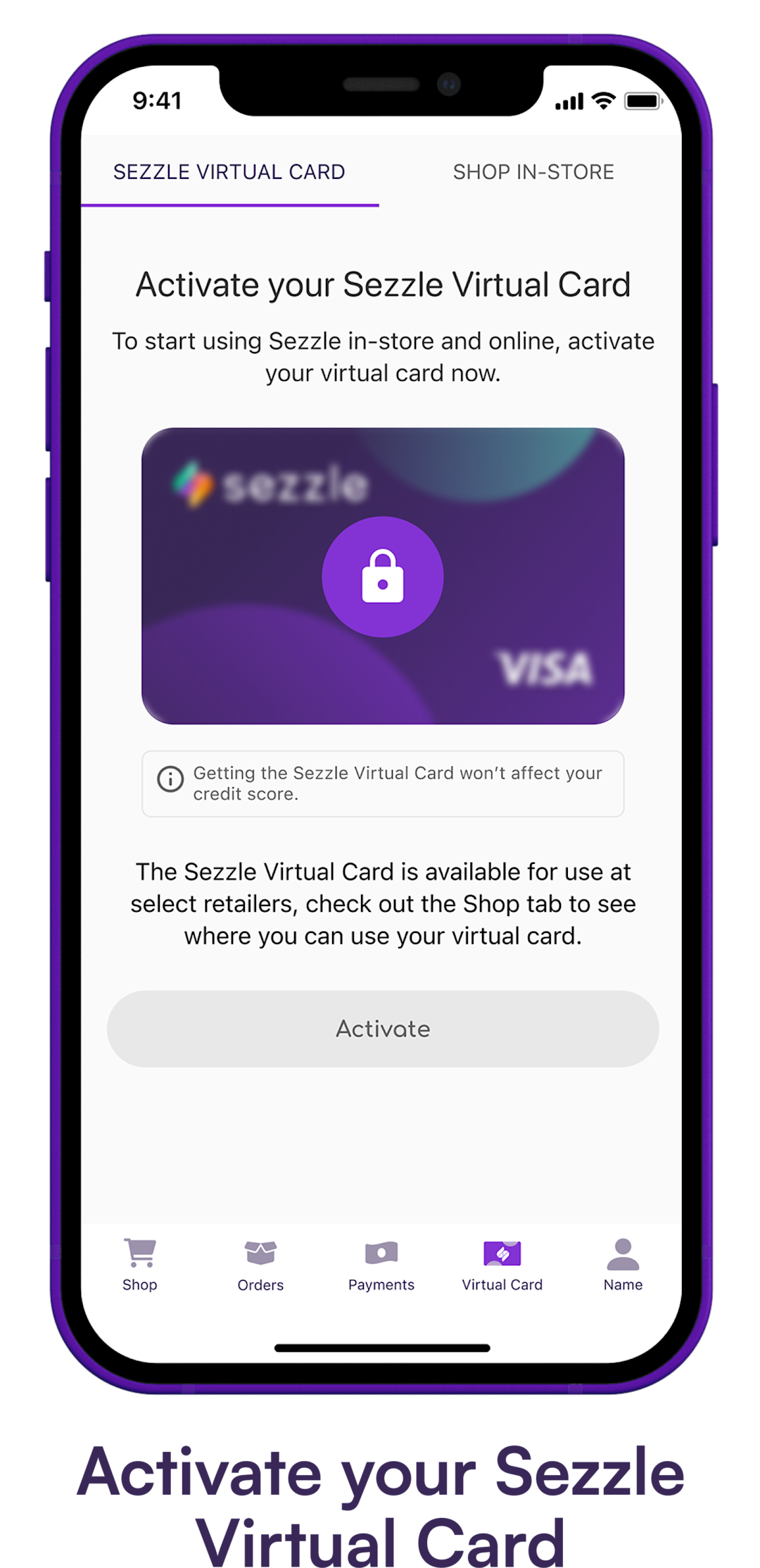

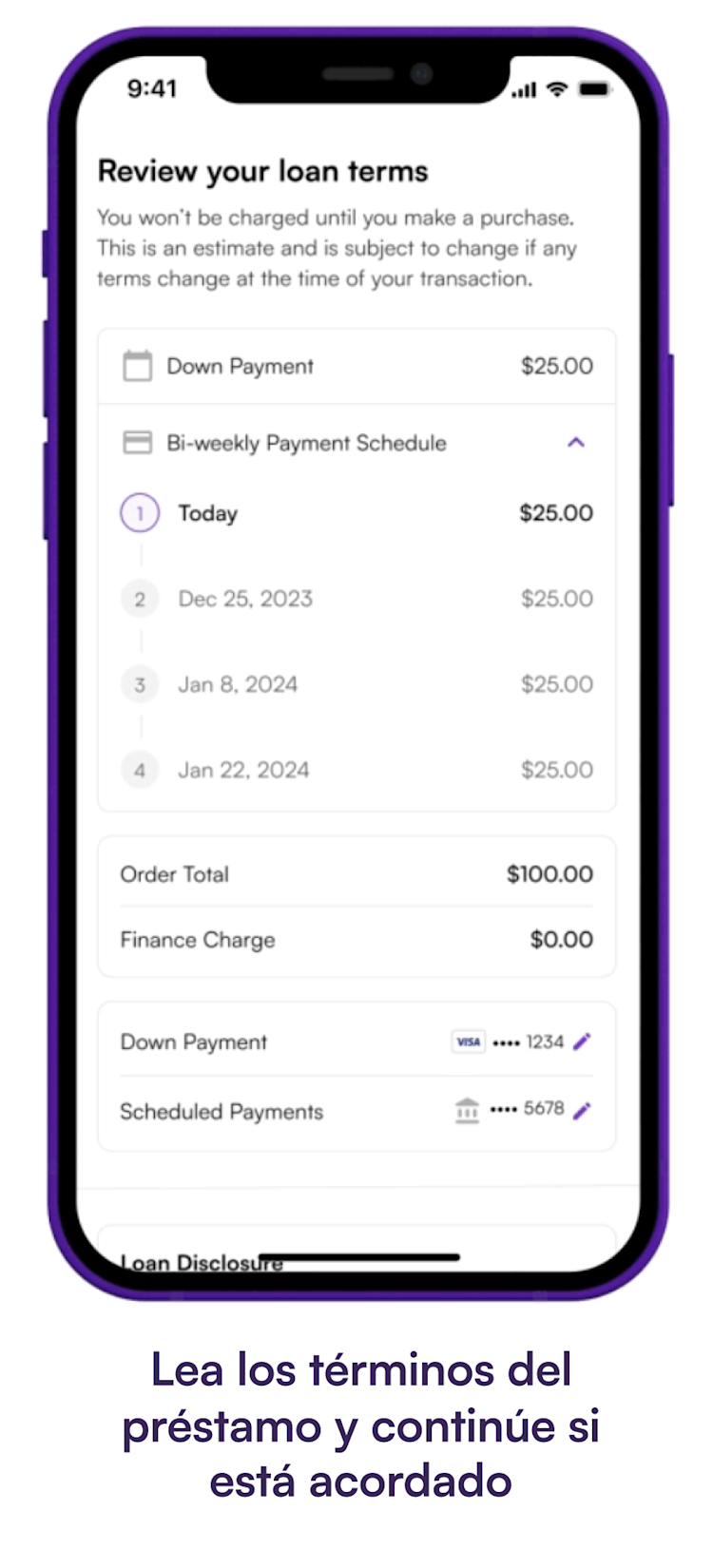

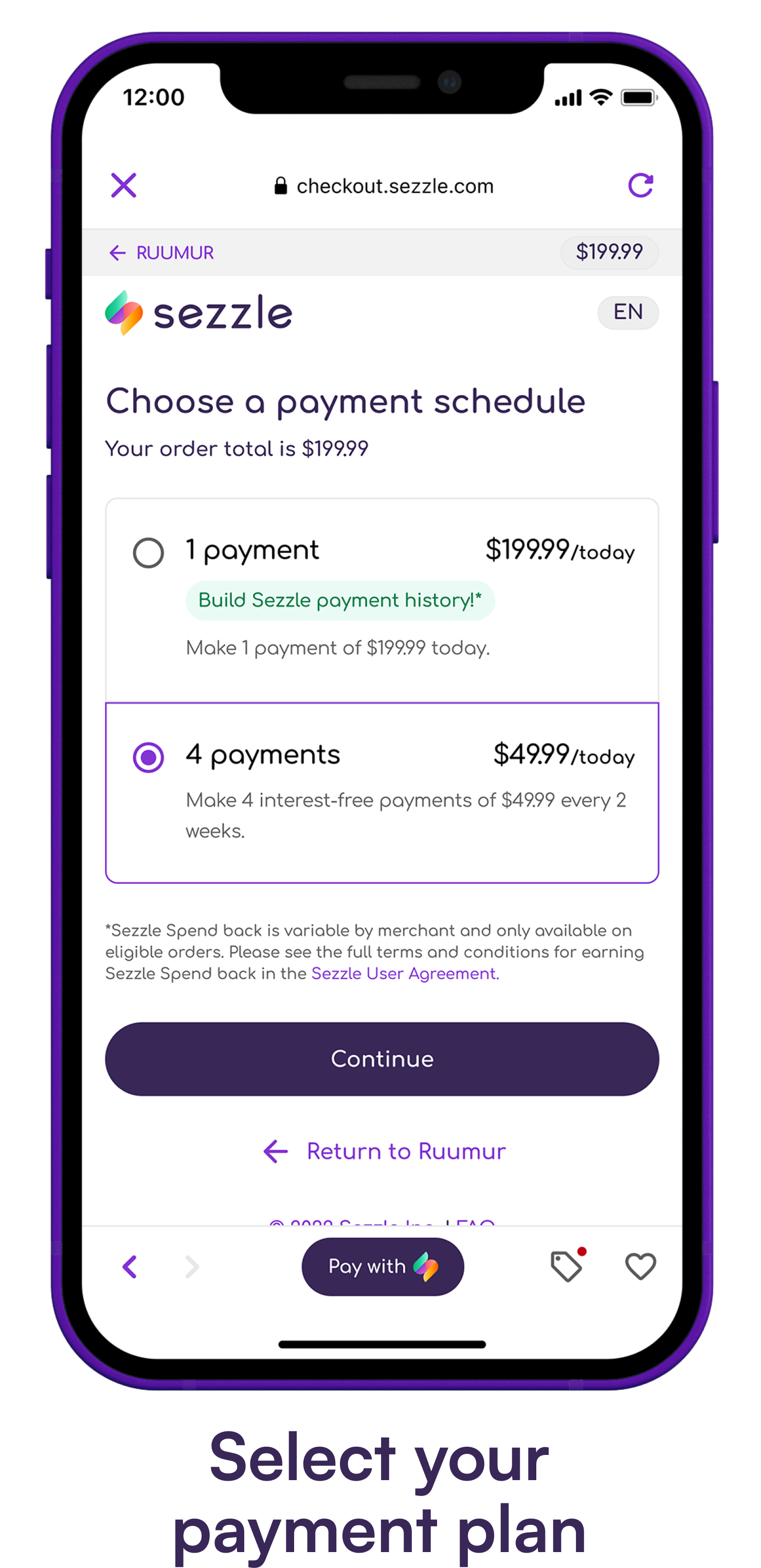

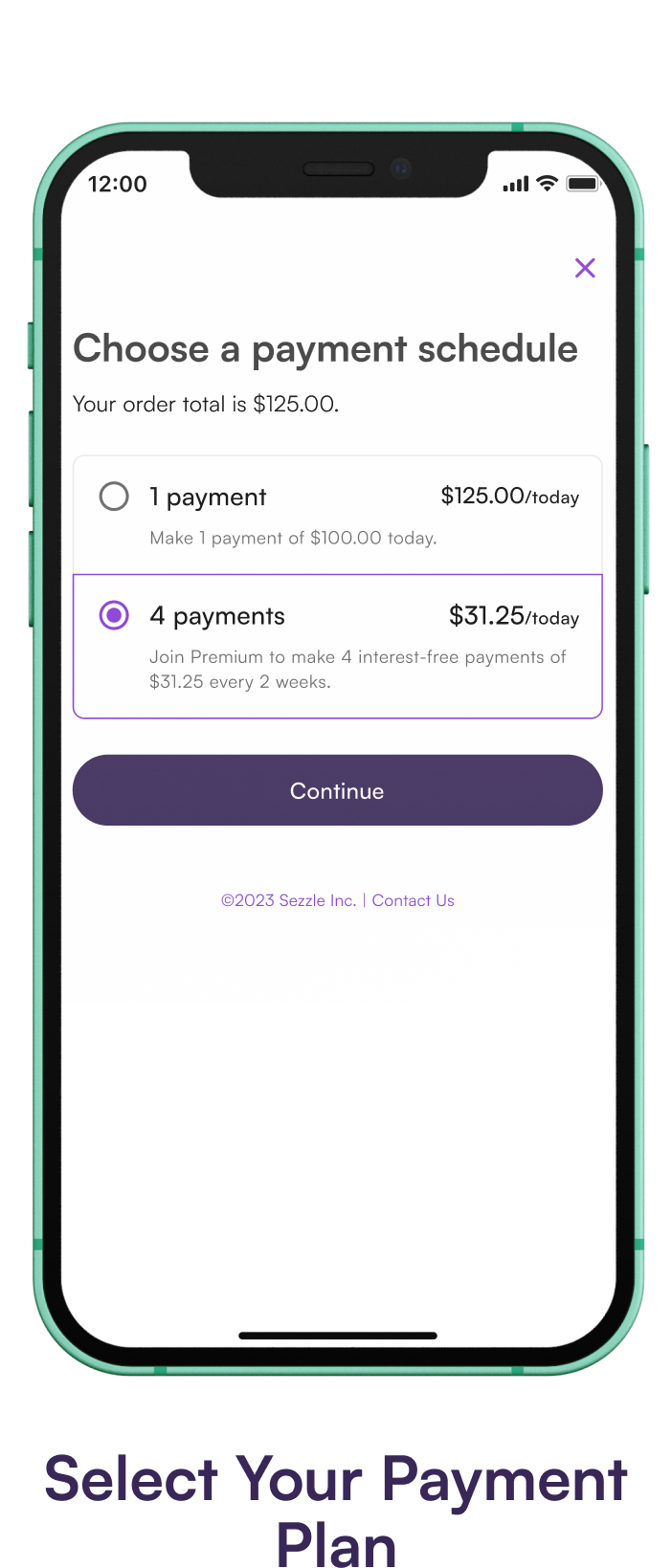

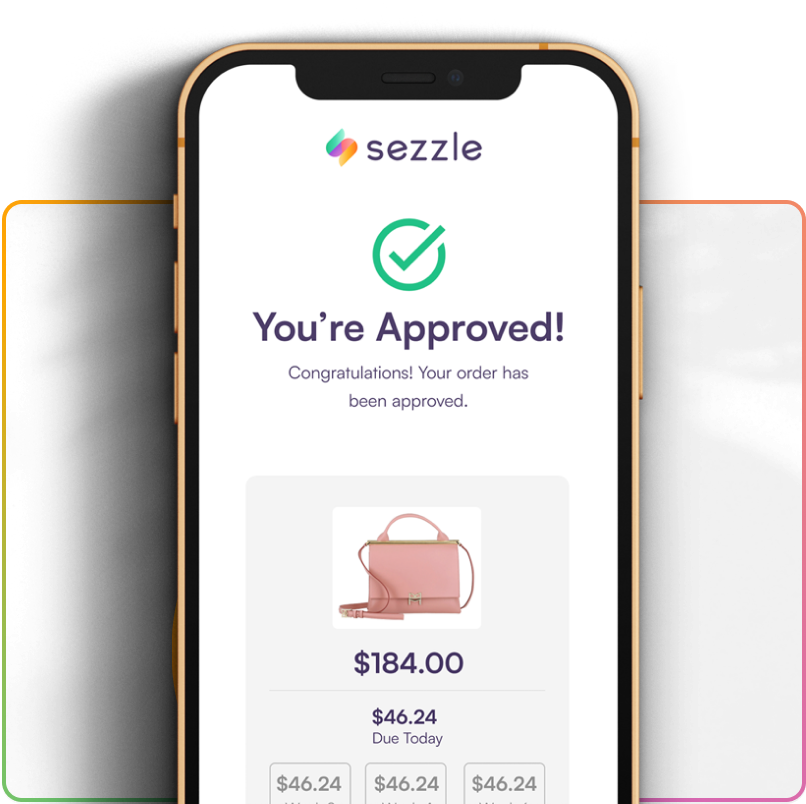

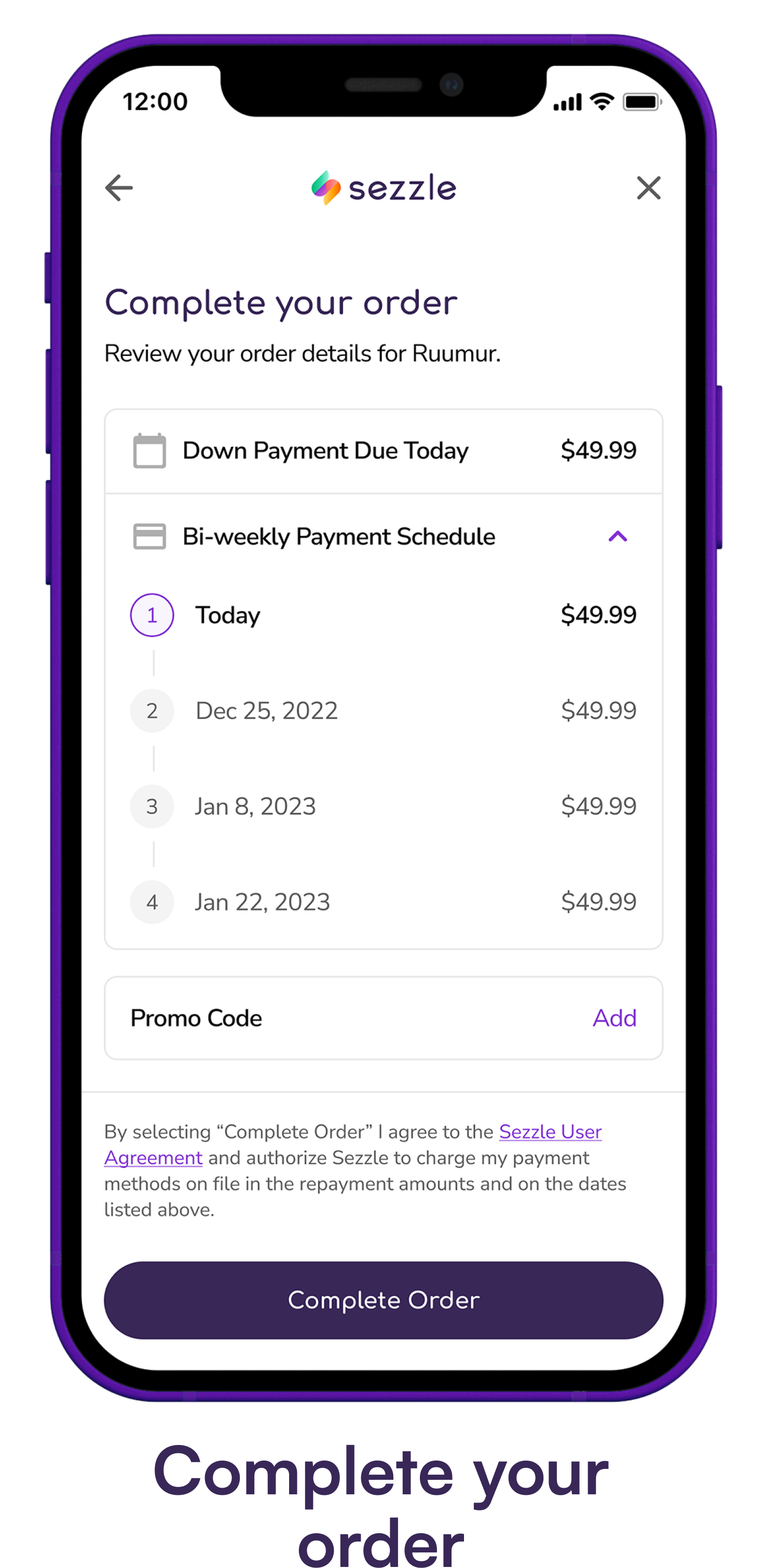

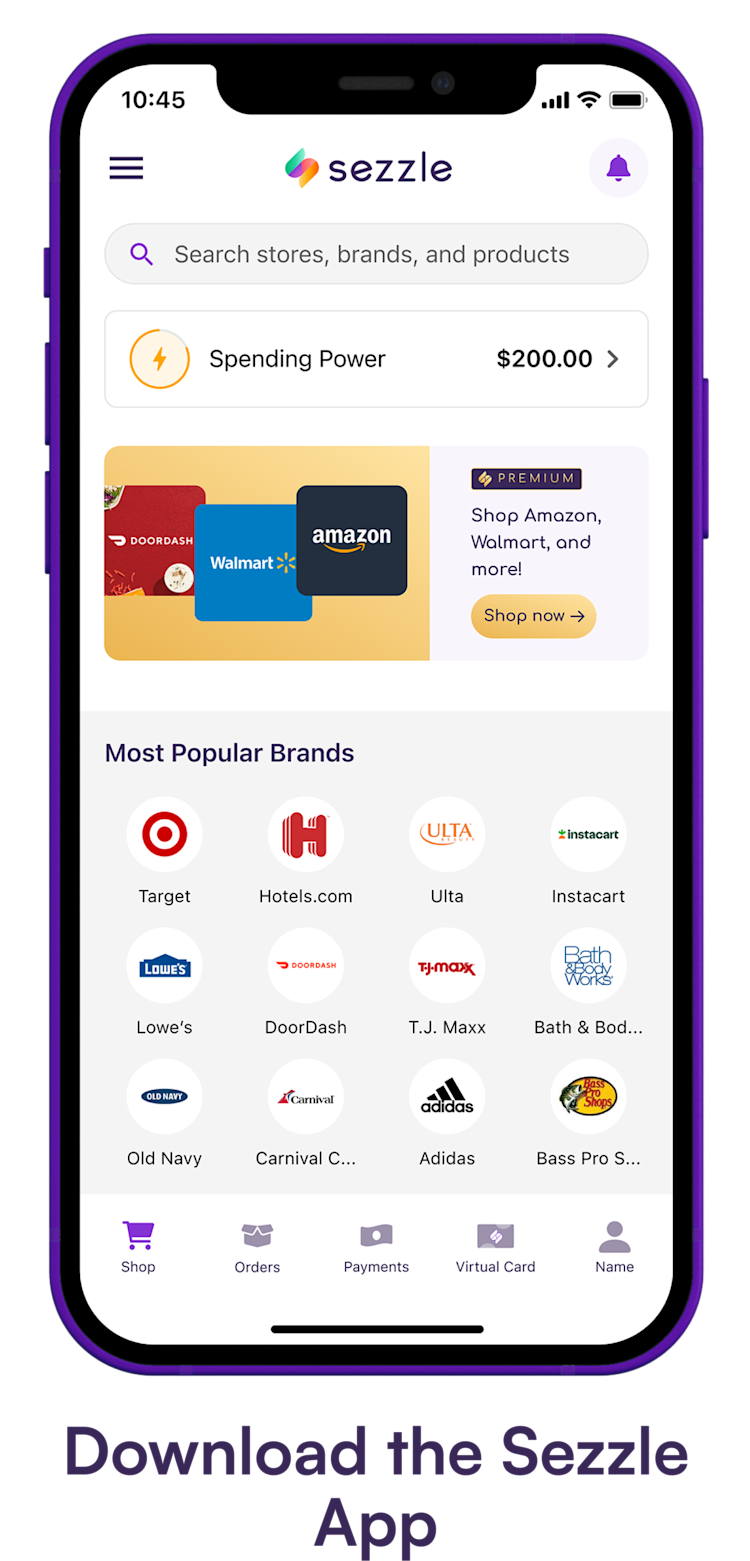

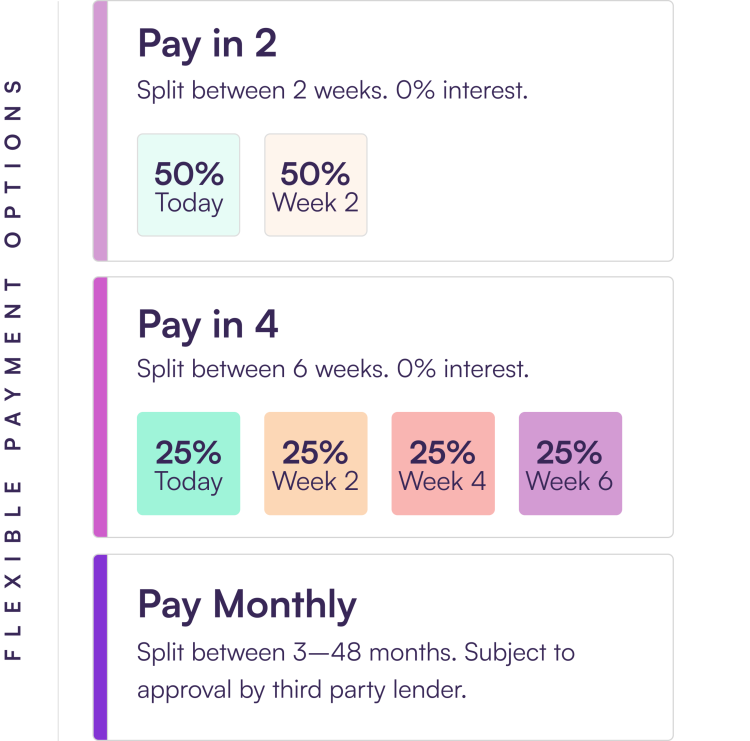

Sezzle, at its core, is designed to facilitate installment payments for online and in-store retail purchases. The platform partners with various merchants, allowing customers to split the cost of their purchases into smaller, more manageable payments, typically spread over six weeks with no interest if payments are made on time. This model has proven particularly appealing for buying clothes, electronics, and other discretionary items.

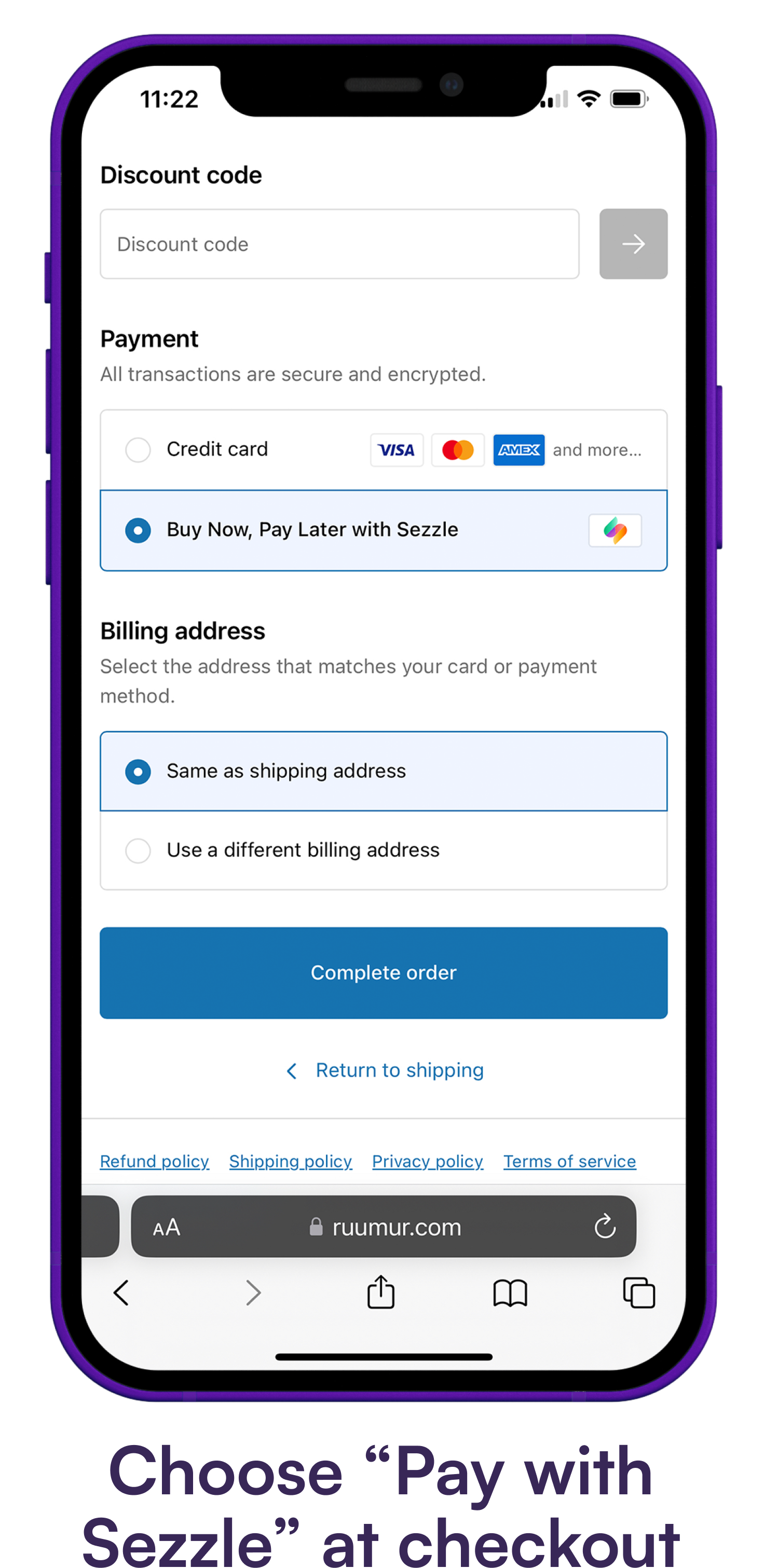

The fundamental mechanism of Sezzle hinges on its integration with participating retailers. When a customer makes a purchase at a partnered store, they can choose Sezzle as their payment option during checkout. Sezzle then pays the merchant upfront, while the customer repays Sezzle in installments.

This structure inherently limits its direct applicability to paying bills. Utility companies, landlords, and other service providers typically don't integrate directly with BNPL services like Sezzle.

Direct Bill Payment: A No-Go Zone?

Currently, Sezzle does not offer a direct mechanism for paying bills such as rent, utilities, or credit card debts. The platform's architecture is built around merchant partnerships, and there isn't a function to directly transfer funds to billers. This limitation stems from the company's business model and the regulatory complexities associated with direct bill payments.

A search on Sezzle's official website and help center confirms this limitation. Their FAQs and user guides explicitly state that Sezzle is intended for purchases at partnered merchants, not for paying recurring bills or transferring money directly to other parties.

Statements from Sezzle representatives consistently reinforce this position. There are no current plans to introduce a direct bill payment feature.

Workarounds and Indirect Approaches

While Sezzle doesn't directly support bill payments, some users have explored indirect methods to potentially leverage the platform for this purpose. These methods are not officially endorsed by Sezzle and often come with caveats and potential risks.

One potential workaround involves using a credit card that offers rewards or cashback, and then using Sezzle to pay off that credit card balance through purchases at Sezzle-partnered retailers. This approach effectively spreads the cost of the bill (indirectly) over time, but it relies on careful management of credit card balances and timely Sezzle payments.

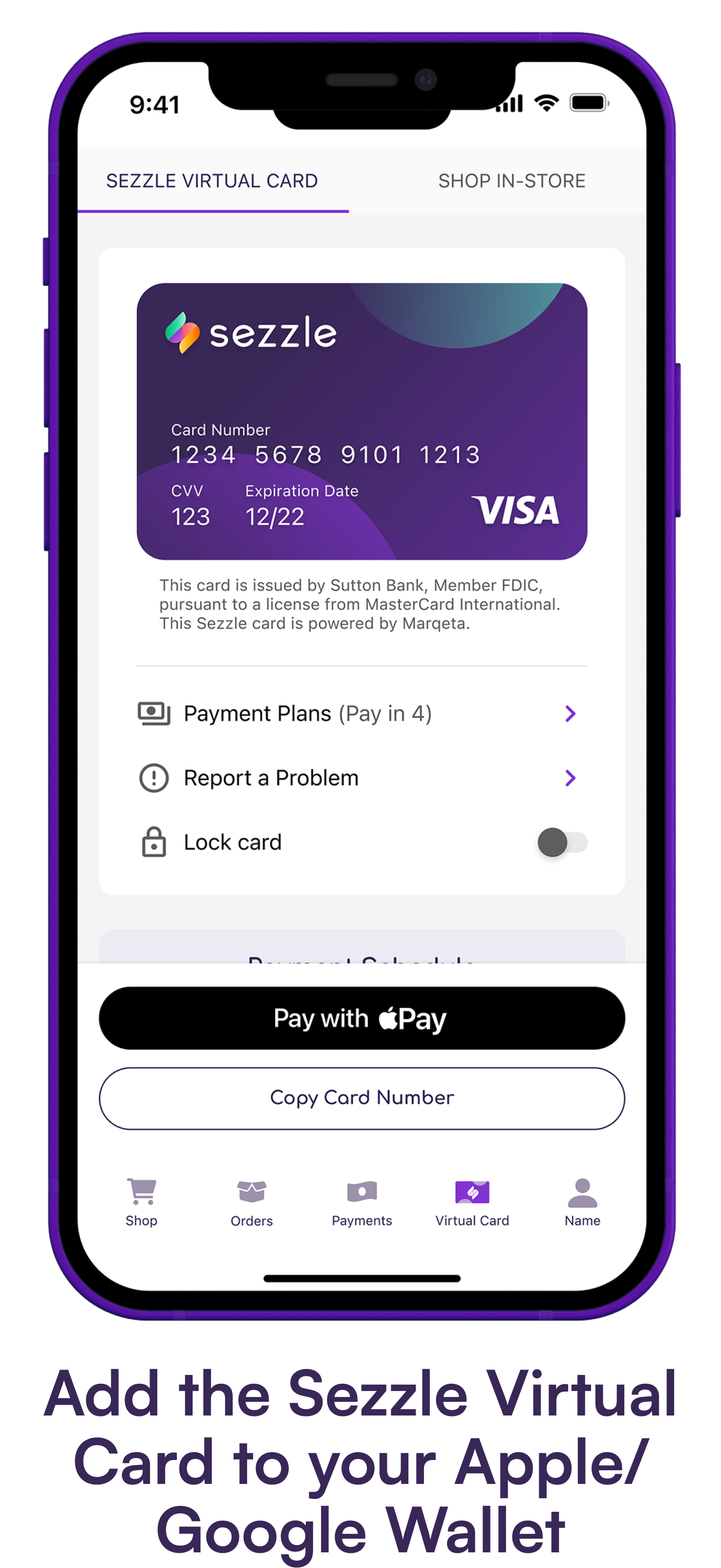

Another strategy, though less common, involves purchasing prepaid debit cards or gift cards from Sezzle-partnered retailers and then using those cards to pay bills online. However, this method often incurs fees associated with purchasing and activating the prepaid cards, potentially offsetting any perceived benefits.

The Risks and Drawbacks

It's crucial to acknowledge the potential risks associated with these indirect approaches. Relying on Sezzle to manage bill payments through workarounds can create a complex financial juggling act, increasing the risk of missed payments and late fees.

Furthermore, using credit cards to pay bills, even indirectly through Sezzle, can lead to higher interest charges if balances are not paid off in full each month. This defeats the purpose of using Sezzle to avoid interest and can create a cycle of debt.

The fees associated with prepaid cards also erode the potential cost savings. A seemingly convenient solution can quickly become more expensive than traditional payment methods.

Expert Perspectives and Financial Advice

Financial experts generally advise caution when considering using BNPL services like Sezzle for bill payments. While these services can offer short-term flexibility, they are not designed for managing recurring expenses and can lead to financial instability if not used responsibly.

According to the Financial Consumer Agency of Canada (FCAC), consumers should carefully evaluate their ability to repay BNPL debts before making a purchase. Overreliance on BNPL services can create a false sense of affordability and lead to overspending.

Moreover, financial advisors emphasize the importance of budgeting and prioritizing essential expenses like rent and utilities. Instead of relying on BNPL services, individuals should explore alternative options such as negotiating payment plans with billers or seeking assistance from non-profit credit counseling agencies.

The Future of BNPL and Bill Payments

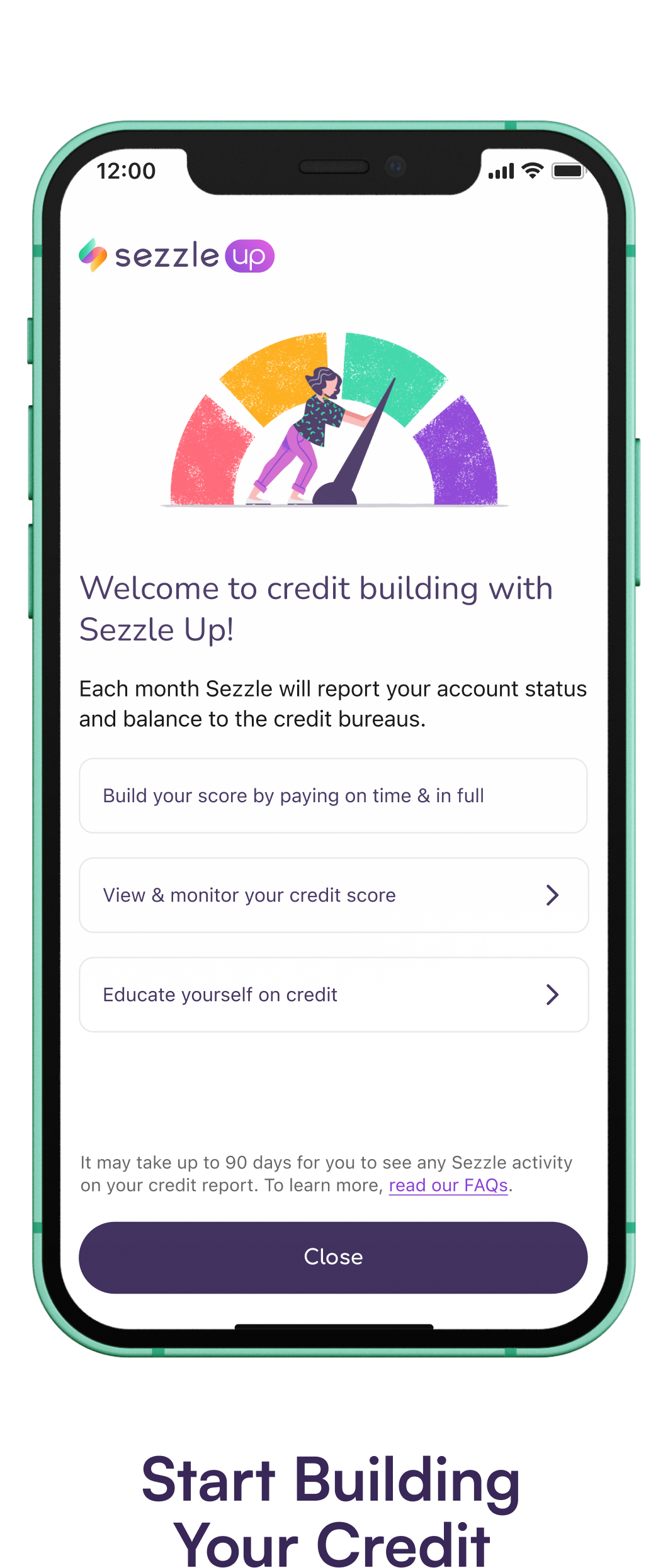

While Sezzle currently doesn't offer direct bill payment options, the BNPL landscape is constantly evolving. The increasing demand for flexible payment solutions may eventually lead to the development of platforms that directly integrate with billers.

However, any future expansion into the bill payment sector would likely require significant regulatory oversight to protect consumers and ensure responsible lending practices. Concerns about debt accumulation and the potential for predatory lending remain paramount.

For now, Sezzle remains primarily a retail-focused payment solution. Consumers seeking assistance with bill payments should explore more traditional and sustainable financial strategies, prioritizing budgeting, saving, and responsible credit management.