Can You Use Sezzle To Pay Rent

The rent is due, and funds are tight. In a world increasingly reliant on flexible payment solutions, many are wondering if Buy Now, Pay Later (BNPL) services like Sezzle can offer a lifeline for housing costs. The answer, however, is complex and fraught with potential pitfalls.

This article delves into the practicality and implications of using Sezzle, or similar BNPL platforms, to cover rent payments. We will explore the current landscape, potential benefits and drawbacks, and expert opinions on whether this is a viable or risky financial strategy. Ultimately, understanding the nuances is crucial for renters facing financial strain.

The Current Landscape: Sezzle and Rent

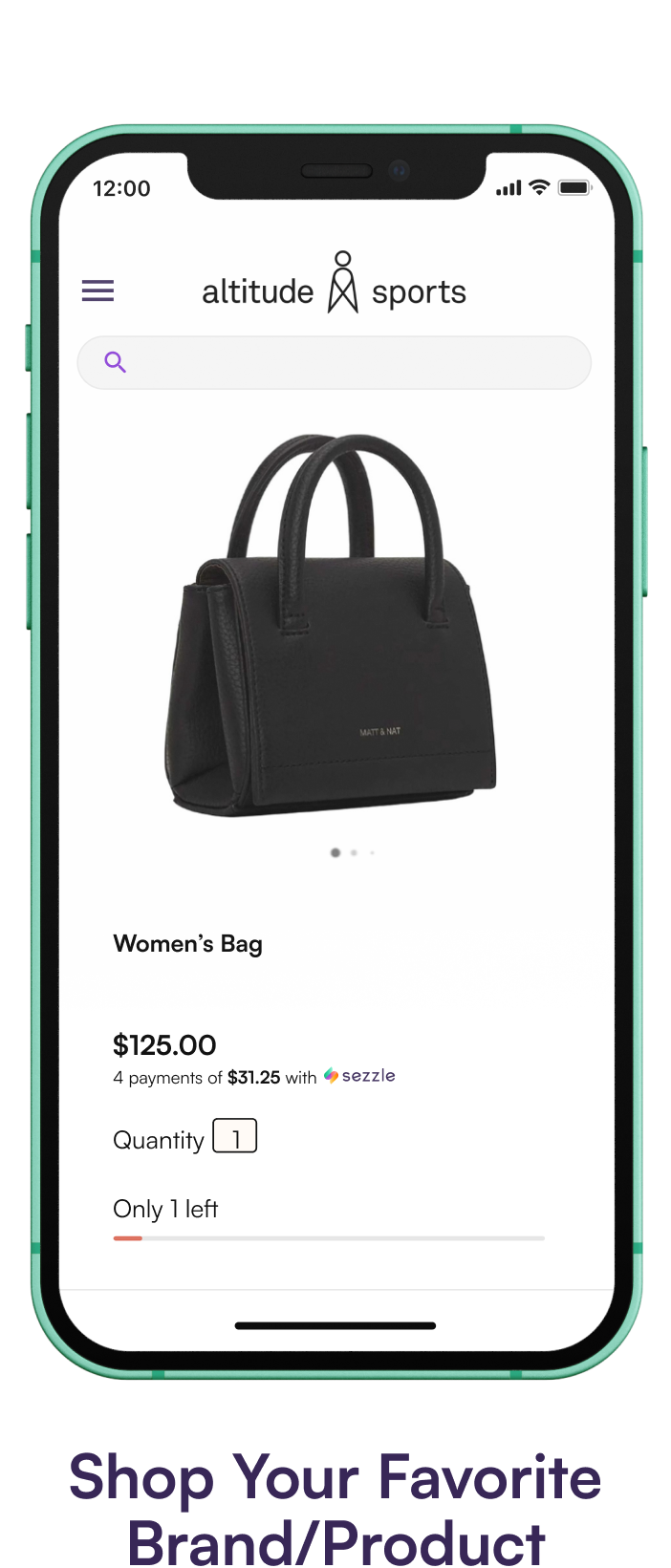

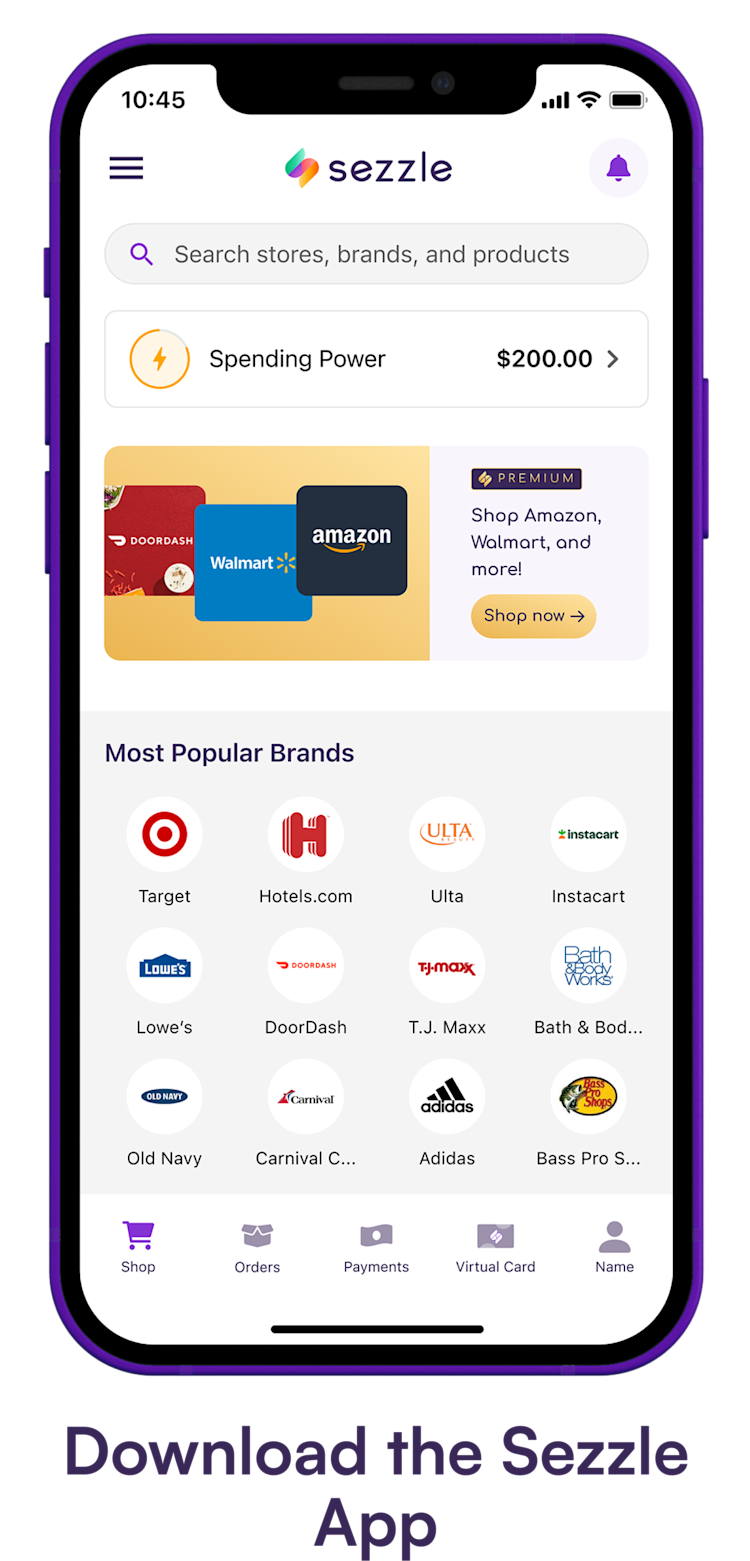

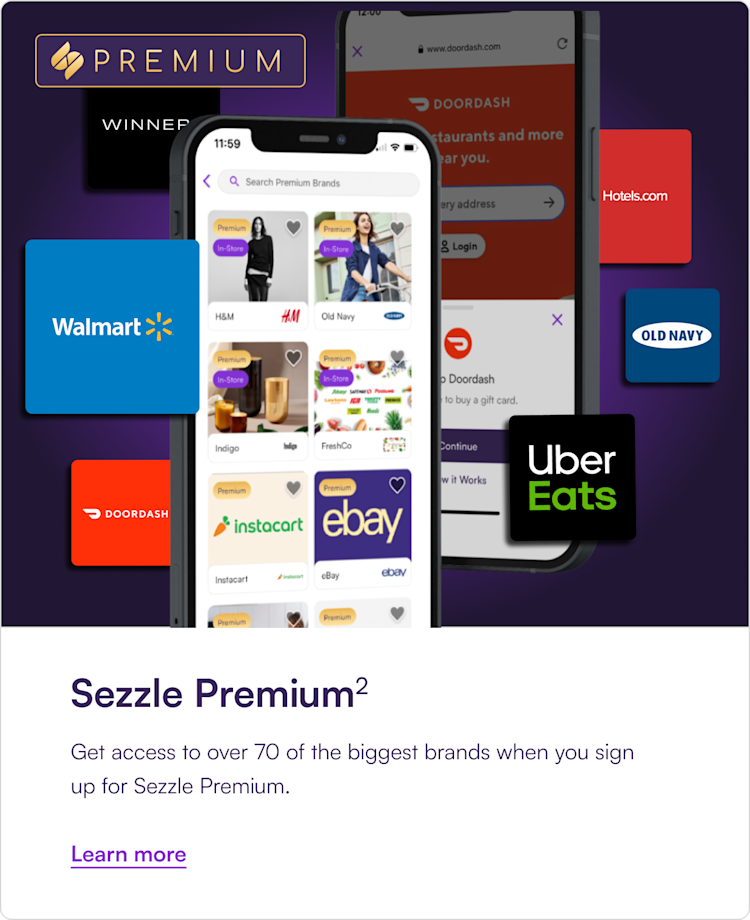

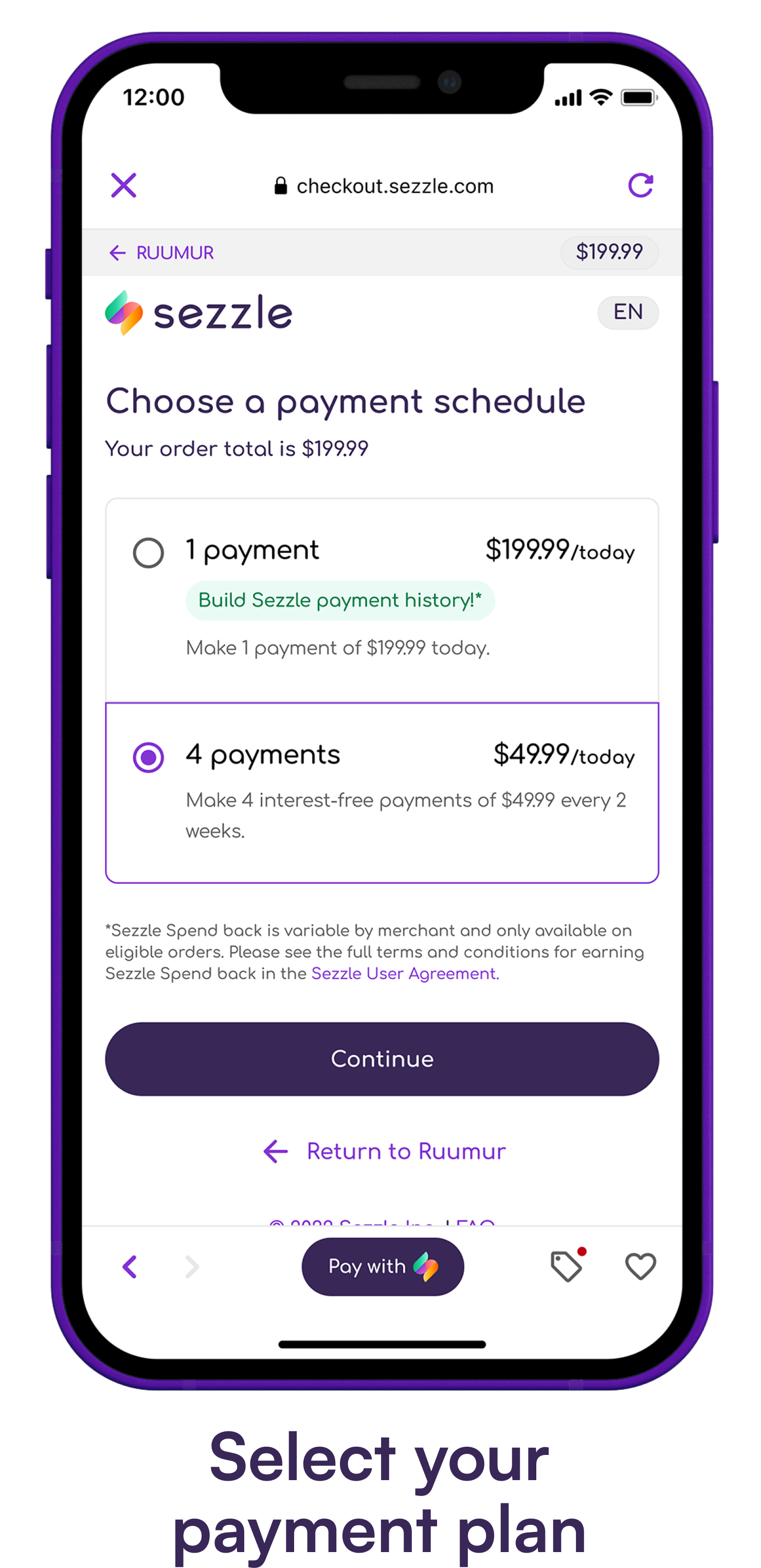

Sezzle, like other BNPL services, typically works by allowing consumers to split purchases into multiple installments, often interest-free if payments are made on time. While widely used for retail goods and services, its direct application to rent is limited. Direct payment of rent through Sezzle is generally not an option.

The reason lies in Sezzle's business model. It partners directly with merchants, receiving a commission on sales generated through its platform. Landlords, typically, are not part of this network.

Indirect Methods and Workarounds

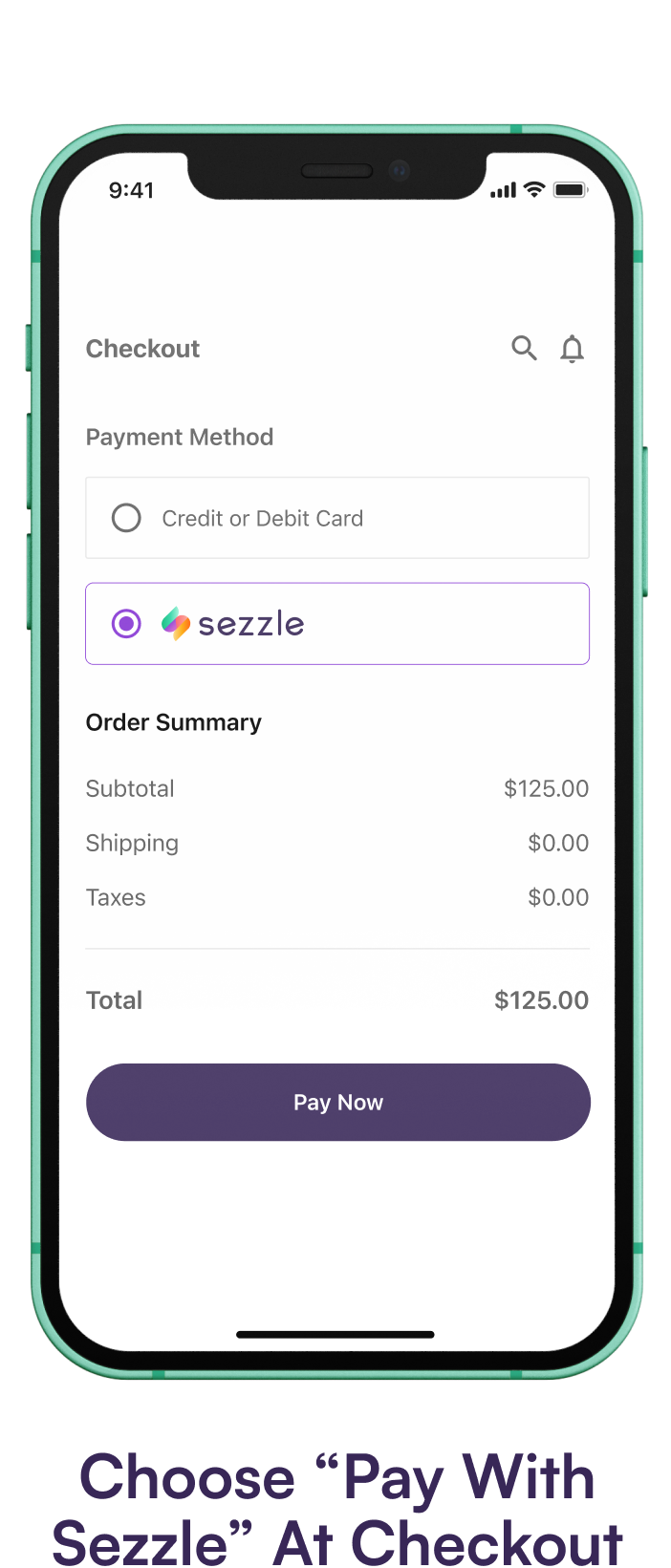

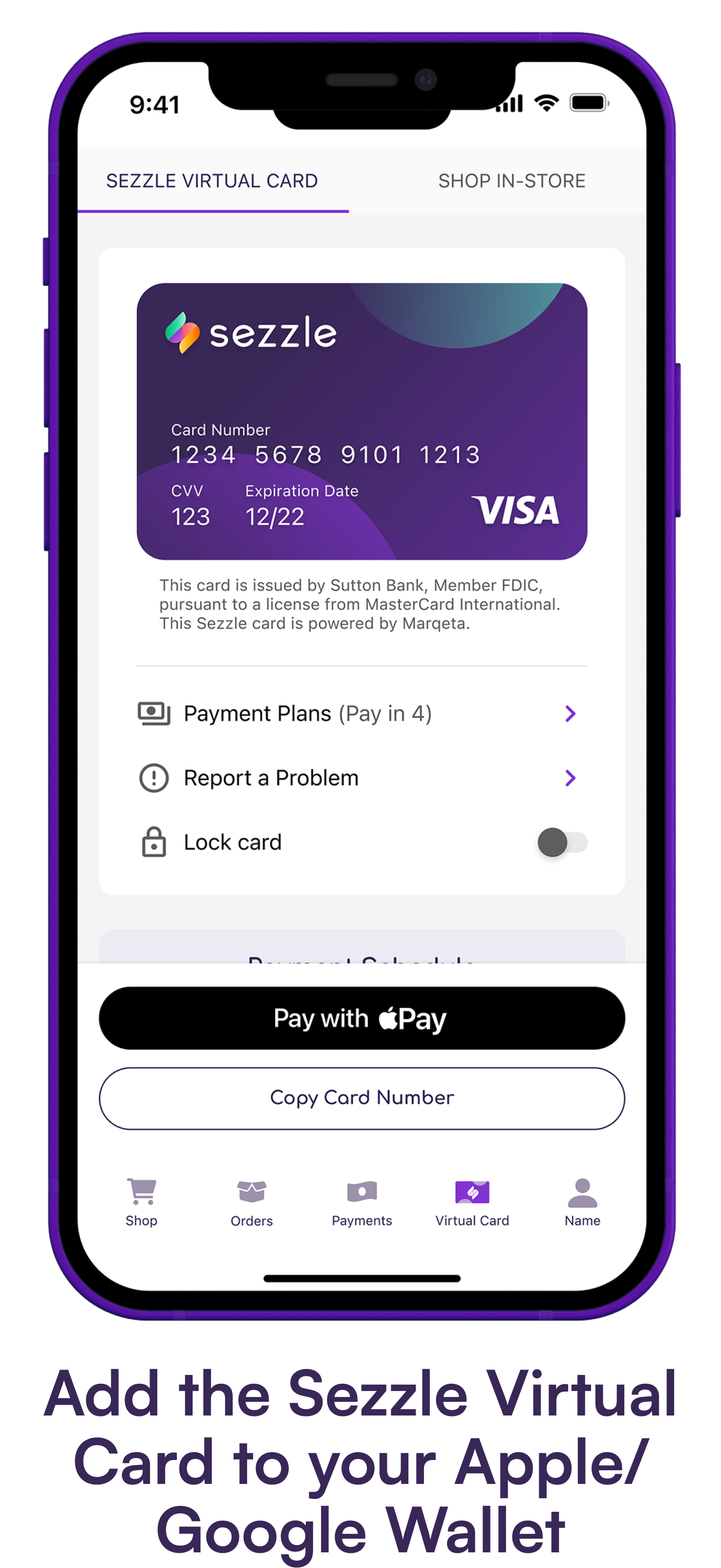

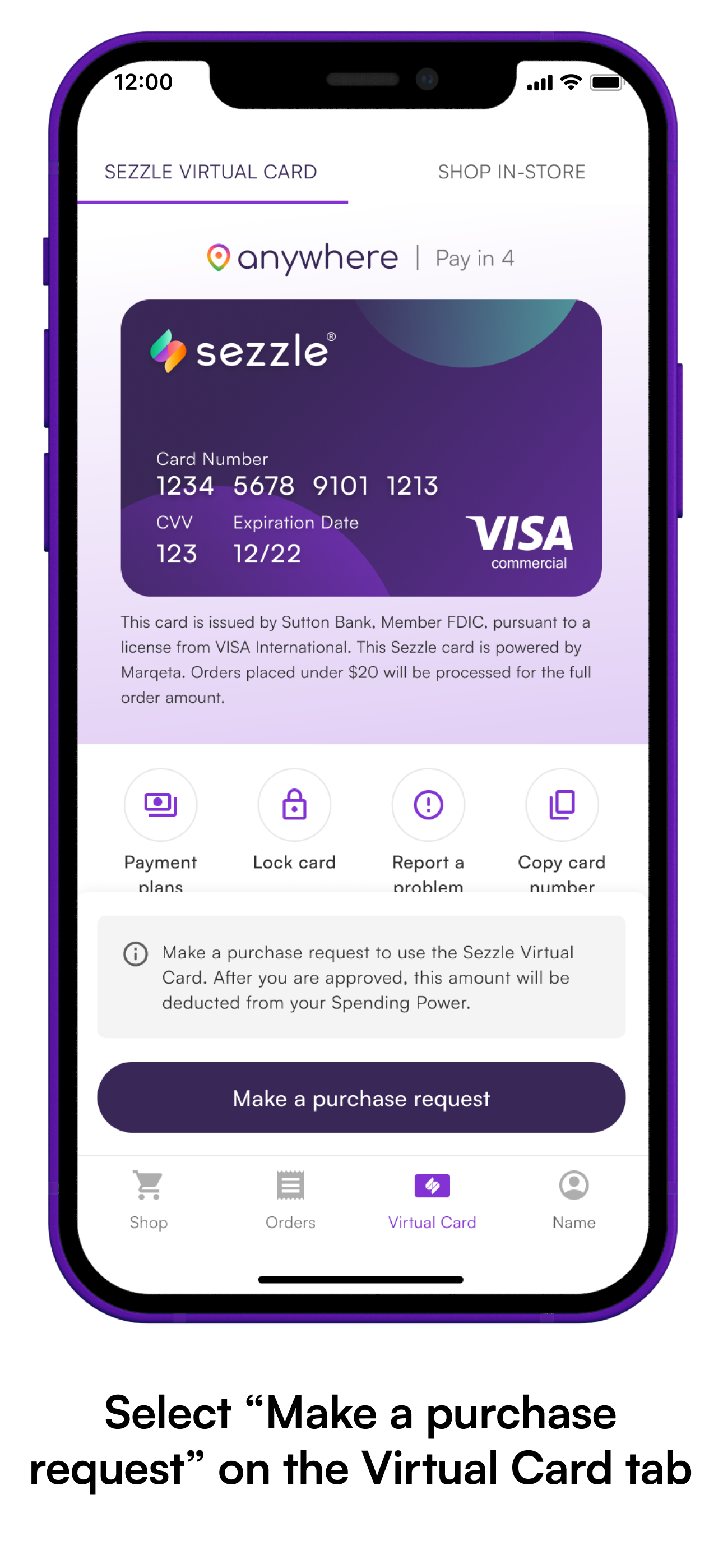

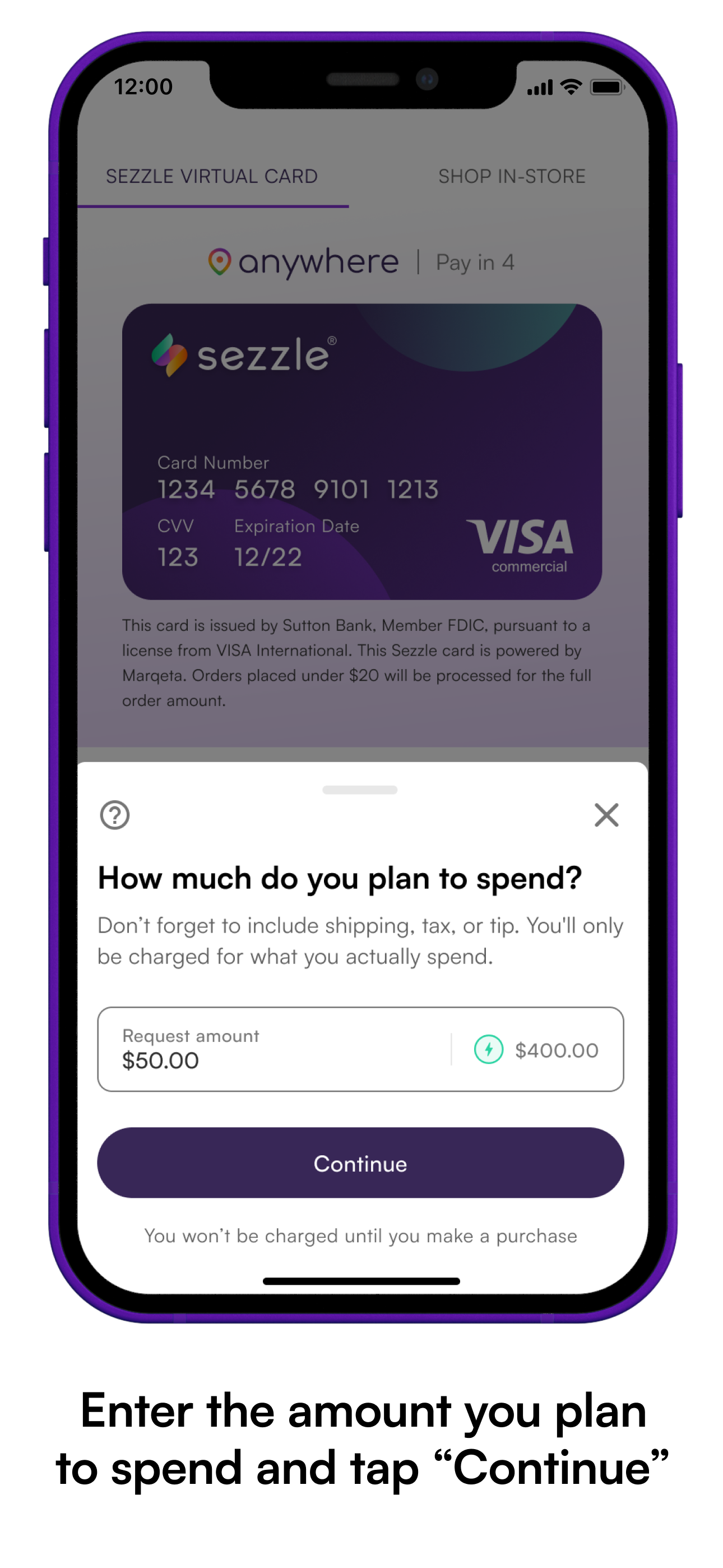

Some individuals explore indirect ways to leverage Sezzle for rent. This often involves using Sezzle to purchase a prepaid debit card or obtain a cash advance, which can then be used to pay rent.

However, these methods frequently come with significant fees and limitations. For instance, many prepaid cards have activation fees, transaction fees, or withdrawal limits. Cash advance services often carry very high interest rates.

Potential Benefits and Drawbacks

The primary perceived benefit of using Sezzle for rent is the ability to defer payments and avoid immediate financial strain. This can provide a temporary buffer for individuals facing unexpected expenses or income fluctuations.

However, the drawbacks far outweigh the potential benefits. The fees associated with indirect methods, coupled with the risk of missed Sezzle payments, can quickly lead to a debt spiral.

Furthermore, using BNPL for rent does not address the underlying issue of affordability. It merely postpones the financial burden and potentially exacerbates it with added costs.

Expert Opinions and Financial Advice

Financial experts generally advise against using BNPL services like Sezzle for essential expenses like rent. They emphasize the importance of budgeting and exploring alternative solutions like rent negotiation or government assistance programs.

According to Sarah Chen, a certified financial planner, "Using BNPL for rent is a red flag. It indicates a deeper financial problem that needs to be addressed, not masked with short-term fixes that could make the situation worse."

Furthermore, relying on BNPL for rent can negatively impact your credit score. Missed payments to Sezzle are reported to credit bureaus and can lower your creditworthiness. This can affect your ability to secure future loans, mortgages, or even rent apartments.

Alternatives to Using Sezzle for Rent

Before resorting to BNPL, explore alternatives such as communicating with your landlord. Explain your situation and request a payment plan or a temporary rent reduction.

Government assistance programs offer rental assistance and housing vouchers. These programs provide a more sustainable solution to housing affordability challenges.

Consider seeking guidance from a non-profit credit counseling agency. They can help you develop a budget, manage your debt, and explore resources available in your community.

The Fine Print and Potential Risks

It's crucial to understand Sezzle's terms and conditions. Late payment fees can quickly accumulate and impact your ability to repay the debt.

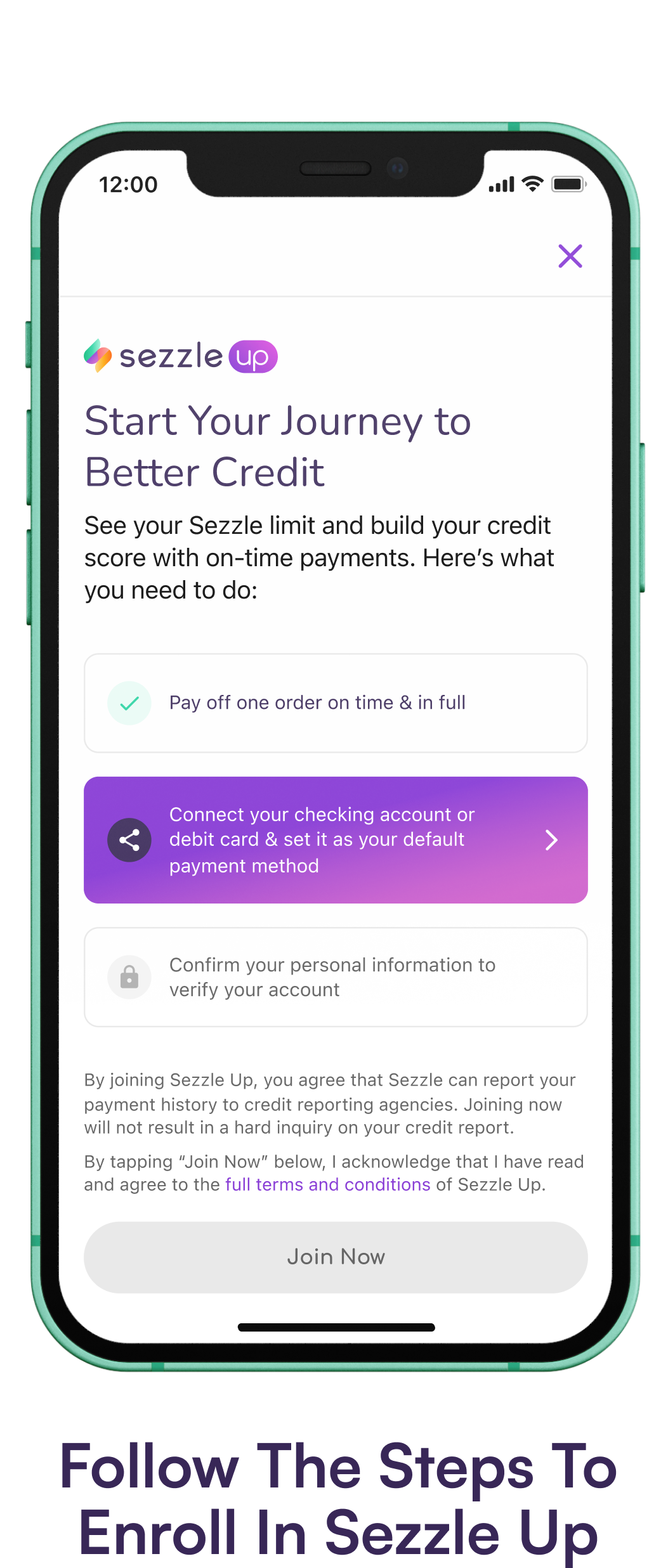

Sezzle might run a soft credit check when you sign up. Although it does not directly impact your credit score, it does allow them to track your payment history.

Using Sezzle to pay for a cash advance that you subsequently use for rent can carry high APRs. This can greatly increase the total amount you owe.

Forward-Looking Conclusion

While the appeal of using Sezzle to pay rent is understandable, it's a risky strategy with potentially severe consequences. The fees and interest associated with indirect methods, coupled with the risk of damaging your credit score, make it an unsustainable solution.

Instead, focus on exploring alternative solutions like communication with your landlord, government assistance programs, and credit counseling. Addressing the underlying financial challenges is crucial for long-term housing stability.

Ultimately, responsible financial management is key. Avoid quick fixes that could lead to further financial distress. Prioritize budgeting, saving, and seeking professional advice to navigate housing affordability challenges effectively.