Which Of The Statements Below Defines An Asset

:max_bytes(150000):strip_icc()/dotdash_Final_Financial_Statements_Aug_2020-01-3998c75d45bb4811ad235ef4eaf17593.jpg)

The ongoing debate surrounding the definition of an asset has sparked renewed interest among financial literacy advocates and economists alike. Conflicting interpretations of what constitutes an asset can lead to confusion in personal finance, investment strategies, and even macroeconomic policies.

At stake is a fundamental understanding of economic value: Does an asset simply provide future economic benefit, or are there more nuanced criteria that need to be considered? This article seeks to clarify the core principles, explore the diverse perspectives, and highlight the implications of accurately defining an asset in today's complex financial landscape.

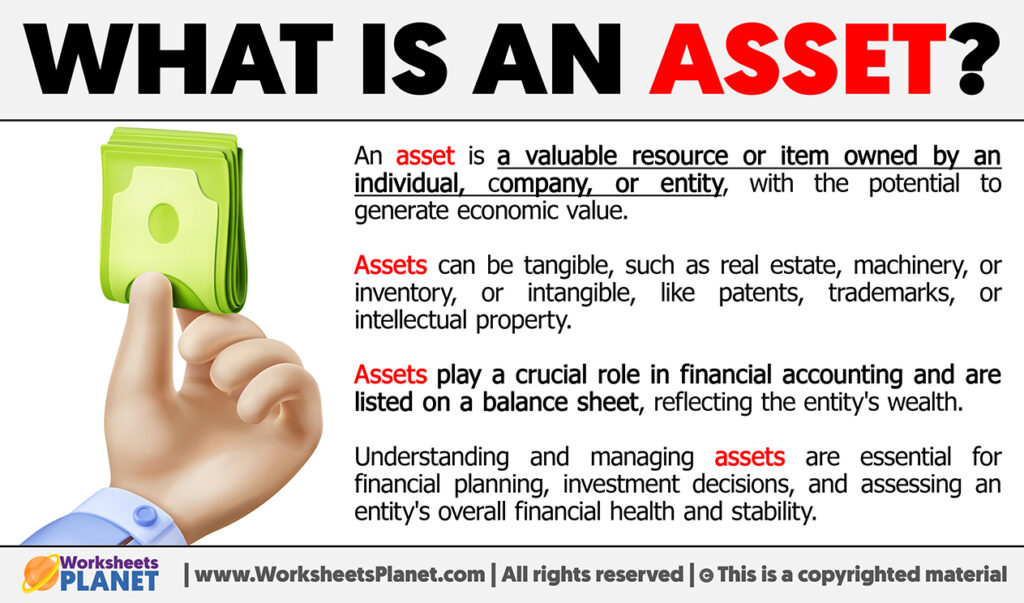

Defining an Asset: Core Principles

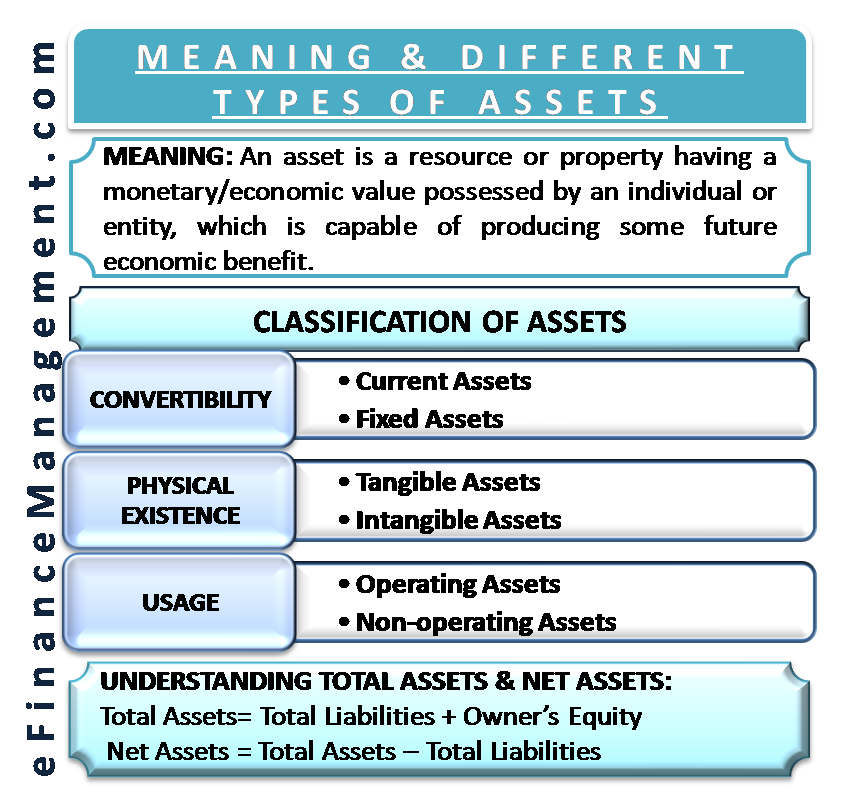

At its most basic, an asset is defined as a resource controlled by an entity as a result of past events and from which future economic benefits are expected to flow to the entity. This definition, often cited from accounting standards such as the International Financial Reporting Standards (IFRS), underscores three critical elements.

Control, past events, and future economic benefits are all crucial. An asset is not merely a thing of value; it must be controlled by the individual or organization claiming it.

Furthermore, the asset must have been acquired through a past event or transaction, and it must have the potential to generate future economic benefits, such as cash flow or increased value.

Competing Interpretations and Nuances

While the core principles seem straightforward, applying them in practice can be complex. Consider the example of human capital: an individual's skills and knowledge can undoubtedly generate future economic benefits.

However, under traditional accounting standards, human capital is not typically recognized as an asset on a company's balance sheet because the company doesn't have sufficient control over the individual. This highlights a key point of contention.

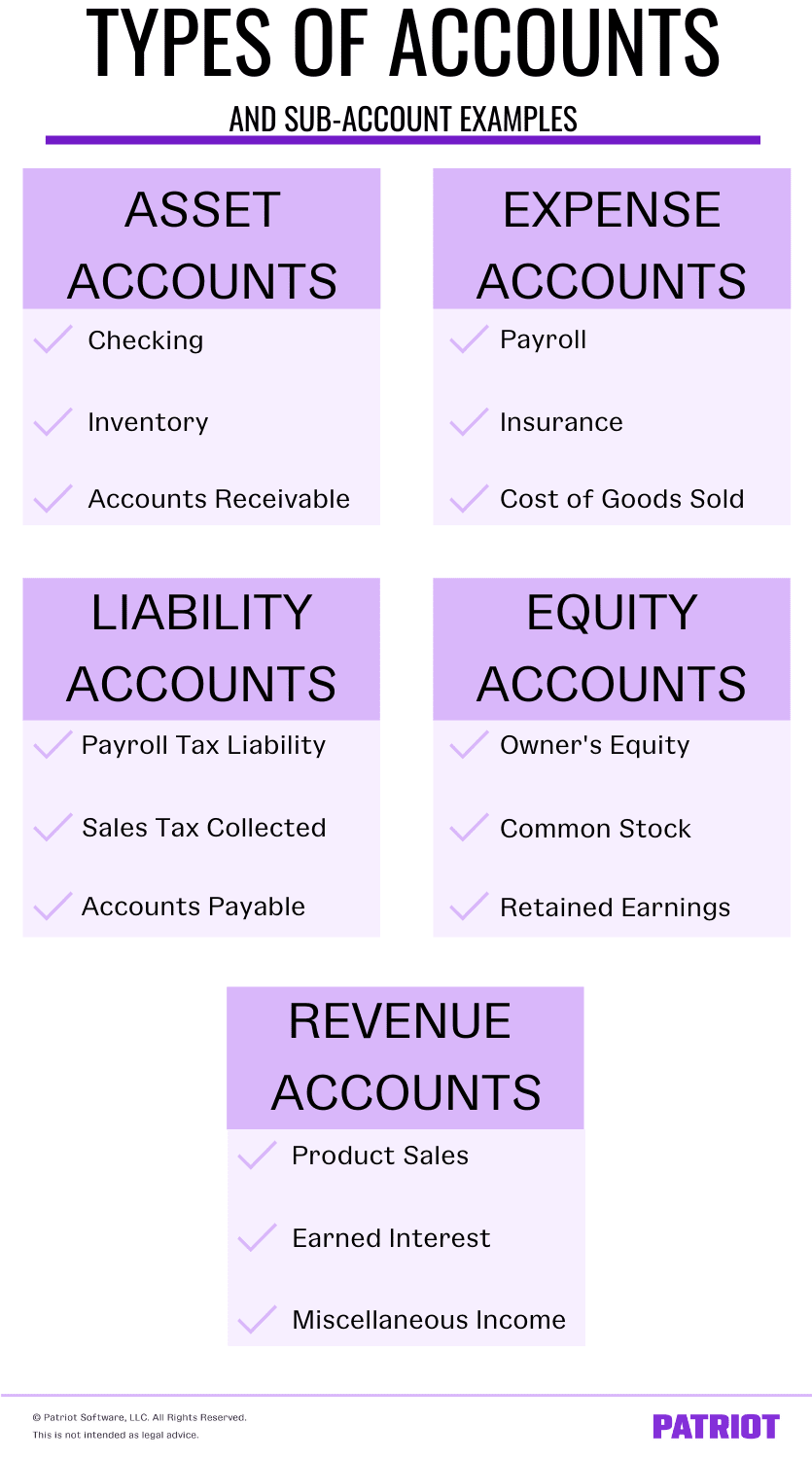

Some argue that the definition of an asset should be broadened to include intangible resources like brand reputation and intellectual property, even if their future economic benefits are less certain.

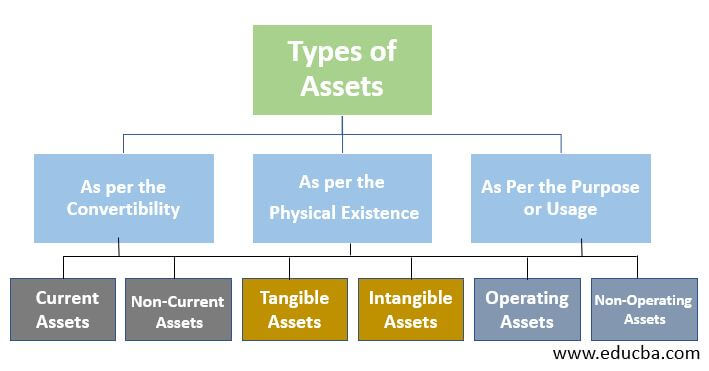

Tangible vs. Intangible Assets

Assets are broadly categorized into tangible and intangible forms. Tangible assets have a physical presence, such as real estate, equipment, and inventory.

Intangible assets, on the other hand, lack physical substance but still hold significant value. Examples include patents, trademarks, and copyrights.

The valuation and recognition of intangible assets often present a challenge due to their subjective nature.

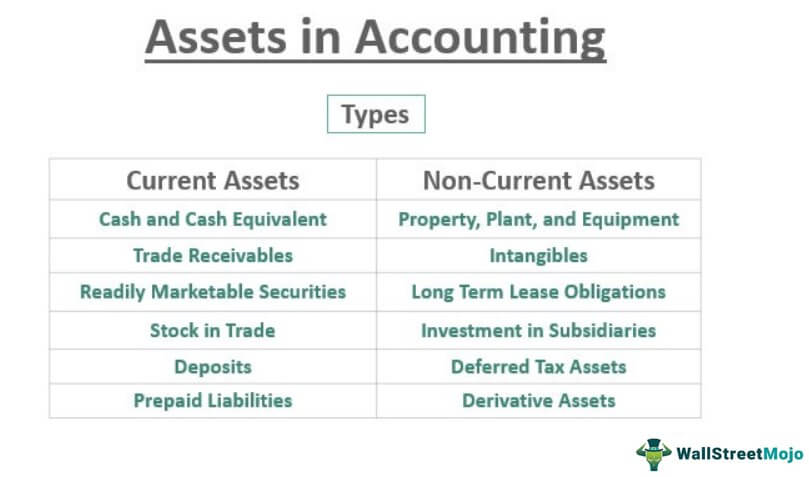

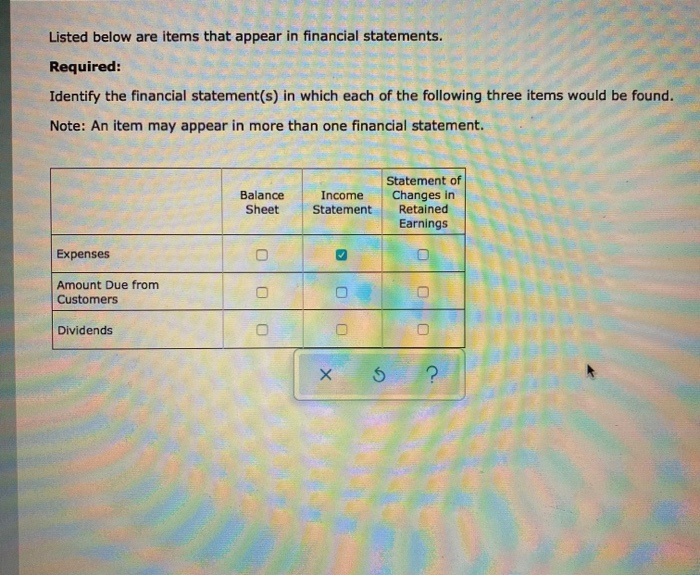

Current vs. Non-Current Assets

Another important distinction is between current and non-current assets. Current assets are those expected to be converted into cash or used up within one year, such as cash, accounts receivable, and inventory.

Non-current assets, also known as fixed assets, have a longer lifespan and are not expected to be converted into cash within one year. Examples include property, plant, and equipment (PP&E).

Impact on Financial Decision-Making

A clear understanding of what constitutes an asset is vital for sound financial decision-making. For individuals, accurately assessing their assets allows for better financial planning and investment strategies.

For businesses, proper asset management is crucial for optimizing resource allocation, improving financial performance, and attracting investors. Misclassifying assets can lead to inaccurate financial statements and flawed investment decisions.

This misclassification could potentially mislead stakeholders like investors and lenders about the true financial health of a company. Therefore, the definition of an asset has far-reaching consequences.

Expert Opinions and Perspectives

Dr. Emily Carter, a professor of finance at the University of Pennsylvania, emphasizes the importance of considering the economic context when defining an asset. "The definition of an asset is not static," she says.

"It evolves with changes in technology, market conditions, and regulatory frameworks. What was once considered a non-asset may become a valuable asset in the future, and vice versa."

John Smith, a certified financial planner (CFP), highlights the human element. "For individuals, their most valuable asset is often their ability to earn income," Smith explains.

"While this may not be reflected on a traditional balance sheet, it's a critical factor in their long-term financial security. Ignoring this is a common mistake I see."

Conclusion

Defining an asset is a multifaceted endeavor with significant implications for individuals, businesses, and the economy as a whole. While the core principles of control, past events, and future economic benefits provide a solid foundation, nuances arise when considering intangible resources and evolving economic contexts.

By understanding the different types of assets, competing interpretations, and expert perspectives, individuals and organizations can make more informed financial decisions and optimize their resource allocation.

Ultimately, a clear and accurate definition of an asset is essential for fostering financial literacy, promoting sound investment practices, and ensuring the stability of the global economy.

:max_bytes(150000):strip_icc()/dotdash_Final_Financial_Statements_Aug_2020-03-aac8341b98da4fd3a4f13ed3ee7fa053.jpg)