Robinhood Ira Accounts Option Spread Allowed

Imagine a crisp autumn morning. Sunlight streams through your window, illuminating the screen where you're managing your retirement savings. The aroma of freshly brewed coffee fills the air as you contemplate a new strategy, a way to potentially boost your IRA's growth. Now, picture having access to options spreads within that very IRA, a tool previously out of reach for many.

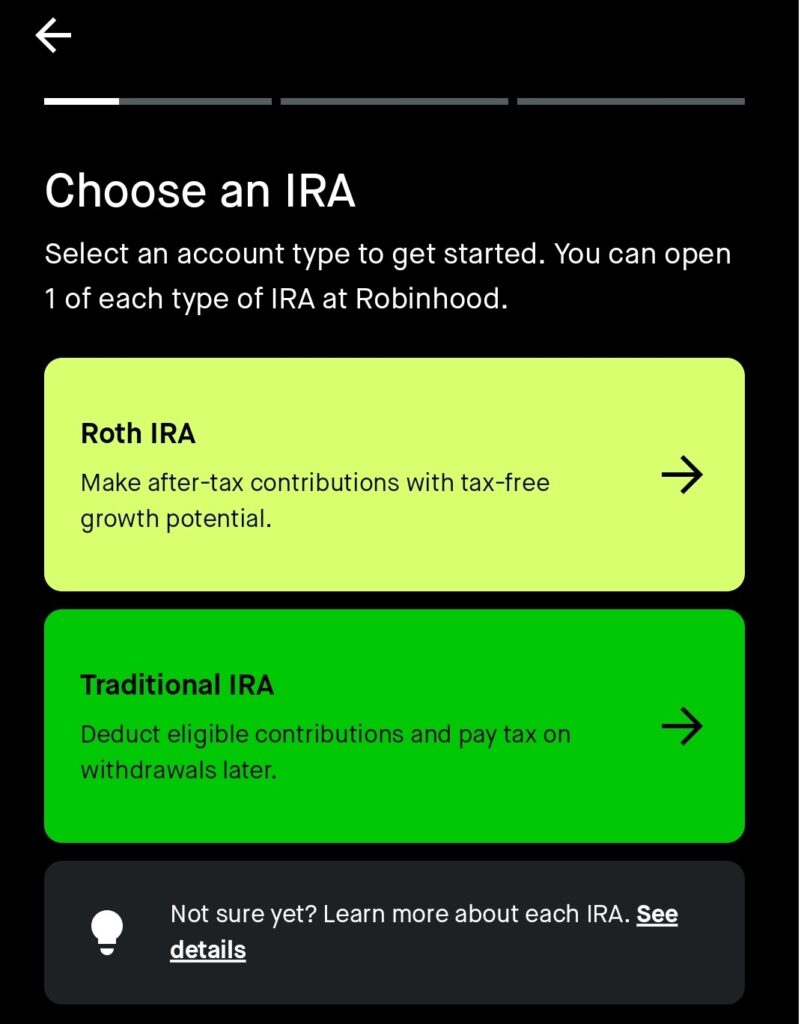

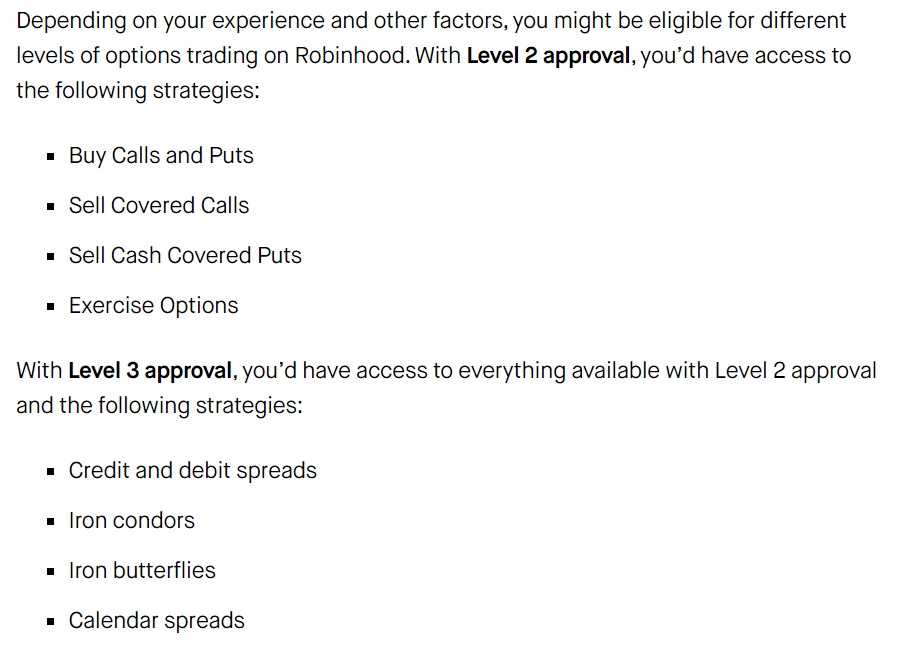

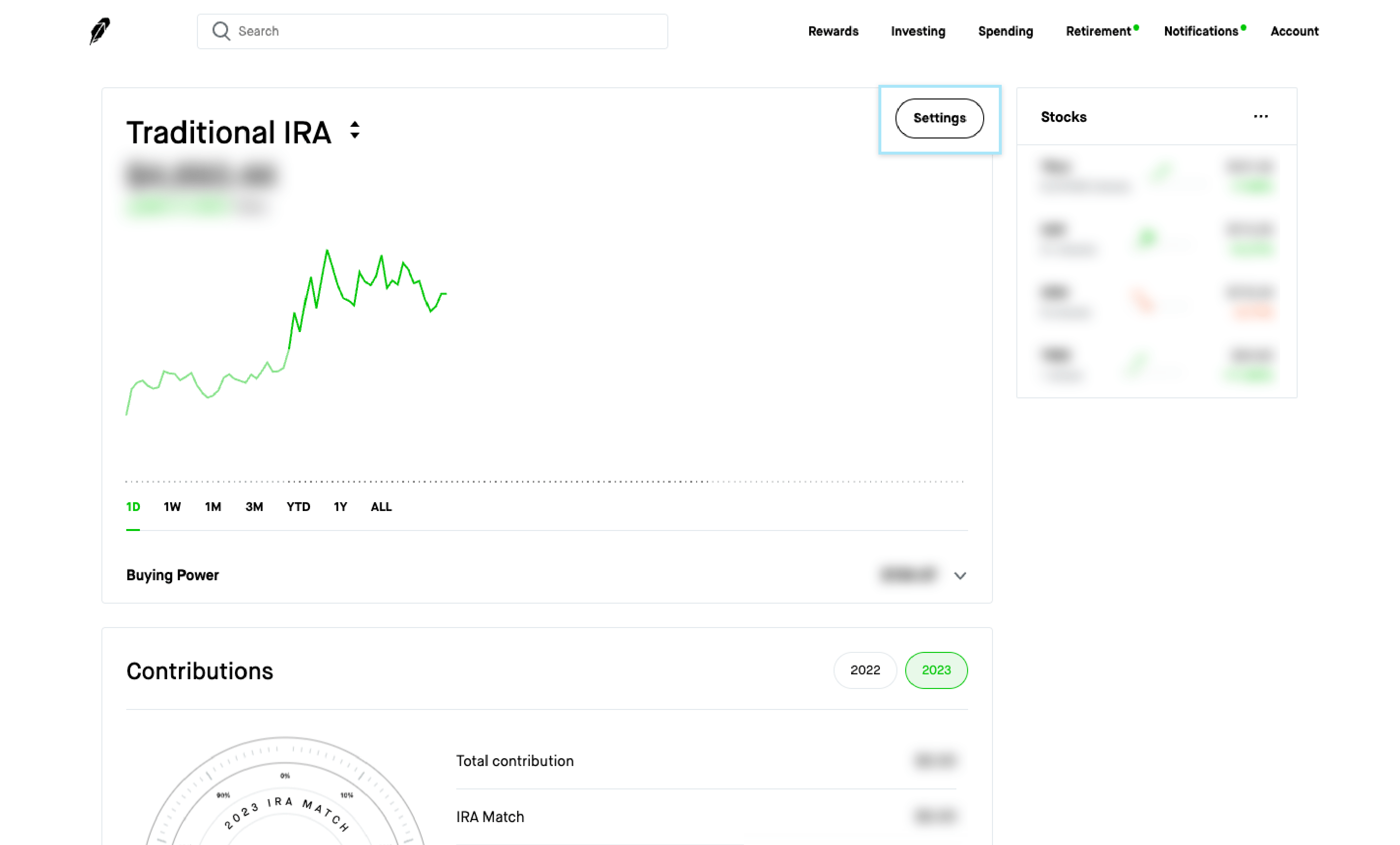

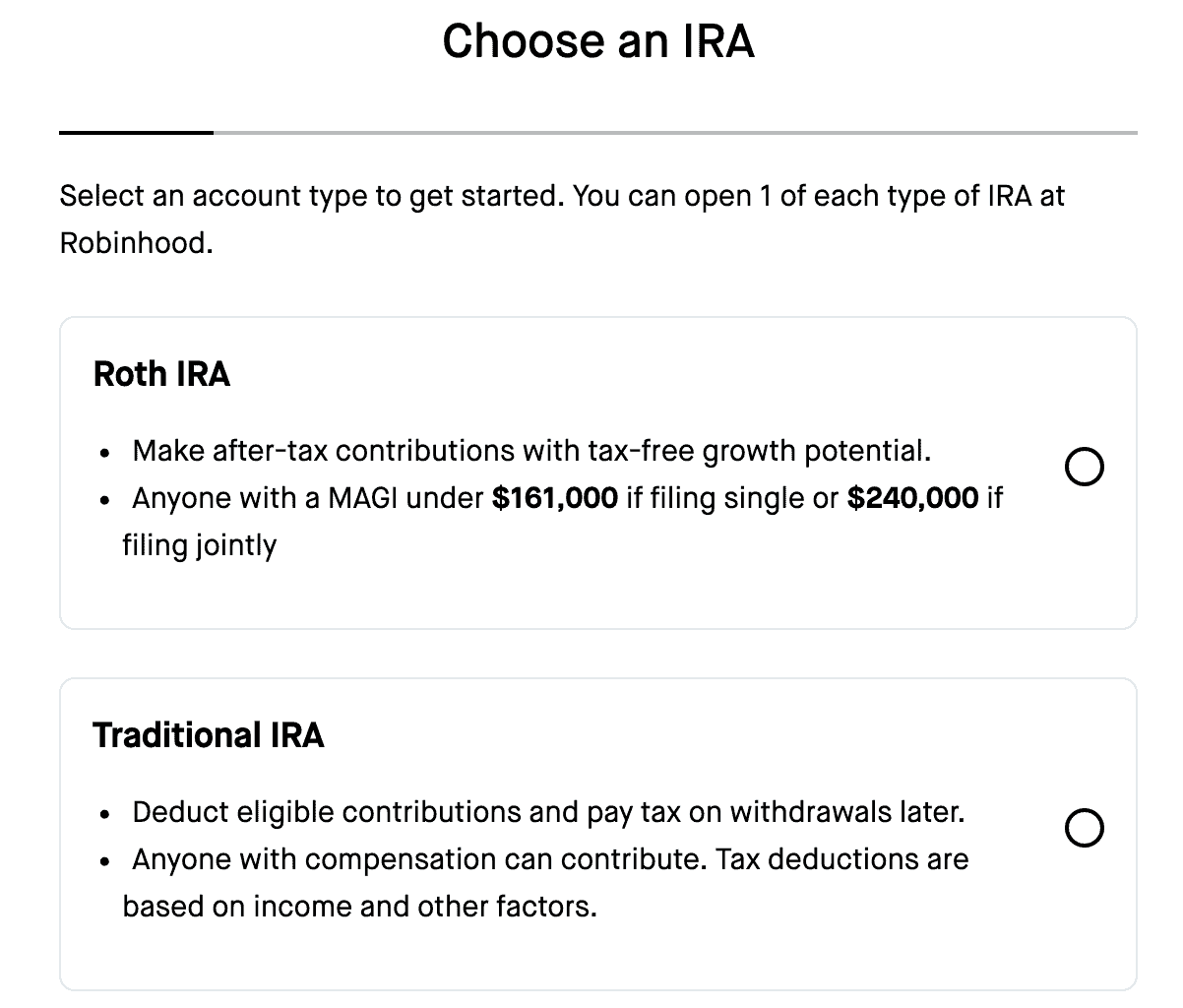

Robinhood has recently announced the rollout of options trading within its Individual Retirement Accounts (IRAs), specifically allowing for the use of options spreads. This development grants a broader range of investment strategies to Robinhood IRA users, potentially offering both increased risk management and opportunities for enhanced returns, though not without inherent complexities.

The Dawn of Options Spreads in Robinhood IRAs

The introduction of options spreads in Robinhood IRAs marks a significant expansion of the platform's offerings. Robinhood, known for its mission to democratize finance, has long provided access to stocks, ETFs, and even cryptocurrency trading. However, until now, the more sophisticated world of options strategies, particularly options spreads, was absent from their retirement accounts.

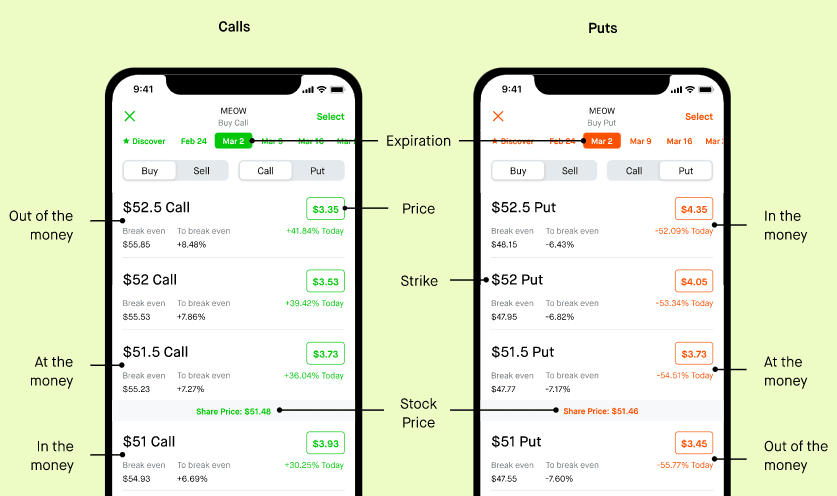

Options spreads involve simultaneously buying and selling options contracts on the same underlying asset, but with different strike prices or expiration dates. This strategy allows investors to limit both their potential profit and potential loss. Options Spreads are generally considered less risky than buying or selling options alone.

What are Options Spreads?

Before delving deeper, let's clarify what options spreads actually are. They are strategies that utilize two or more options contracts to create a defined range of potential outcomes.

Common examples include bull call spreads, bear put spreads, and iron condors. Each aims to profit from a specific market movement while mitigating the unlimited risk associated with selling naked options.

For example, a bull call spread involves buying a call option at a lower strike price and selling a call option at a higher strike price. The investor profits if the underlying asset price increases, but their profit is capped at the difference between the strike prices, minus the net premium paid.

Robinhood's Rationale and the Investor Benefit

Robinhood's decision to introduce options spreads in IRAs stems from a desire to provide users with greater control and flexibility over their retirement investments. The company believes that allowing access to these strategies empowers investors to tailor their portfolios to their specific risk tolerance and financial goals.

“We’re excited to expand our offerings and give customers even more ways to invest for their future,” stated a Robinhood spokesperson. They emphasized the importance of providing educational resources to help users understand the complexities and risks involved.

The potential benefit to investors lies in the ability to potentially generate income, hedge against market downturns, and manage risk more effectively. Unlike simply buying and holding stocks or ETFs, options spreads can be designed to profit from a variety of market conditions, including sideways movement or even slight declines.

Understanding the Risks and Responsibilities

While the allure of enhanced returns is tempting, it's crucial to acknowledge the inherent risks associated with options trading. Options are complex financial instruments, and options spreads, while generally less risky than outright options positions, still require a thorough understanding of market dynamics and potential pitfalls.

Robinhood emphasizes the importance of education and responsible trading. The platform provides resources, including articles, tutorials, and risk disclosures, to help users make informed decisions.

However, the onus ultimately falls on the investor to conduct their own due diligence and understand the potential consequences of their trades. Overconfidence and a lack of understanding can lead to significant losses.

For instance, a poorly constructed spread could still result in substantial losses if the market moves unexpectedly. Moreover, the limited profit potential of some spreads means that even correct market predictions may not yield significant returns.

The Broader Implications for Retirement Investing

Robinhood's move may influence the broader landscape of retirement investing. It could encourage other brokerage firms to expand their options offerings within IRAs, potentially making these strategies more accessible to a wider range of investors.

This trend could lead to a greater emphasis on financial literacy and education. As more individuals gain access to sophisticated investment tools, it becomes increasingly important to ensure they have the knowledge and skills to use them responsibly.

The availability of options spreads also allows for more nuanced portfolio construction within a retirement account. Investors can potentially use these strategies to complement their existing holdings, reduce overall portfolio volatility, and generate income to reinvest.

A Cautious Optimism

The introduction of options spreads in Robinhood IRAs represents a step towards greater financial flexibility and control for investors. It offers the potential for enhanced returns and risk management, but it also demands a heightened level of responsibility and understanding.

It is important to remember that options trading is not a get-rich-quick scheme. It requires careful planning, diligent research, and a willingness to learn from both successes and failures.

Ultimately, the success of this new offering will depend on how responsibly investors utilize these powerful tools and how effectively Robinhood continues to educate and support its user base. While risks should never be ignored, the increased accessibility of options spreads within IRAs could open new avenues for achieving long-term financial goals with a little bit of knowledge and responsible investing.