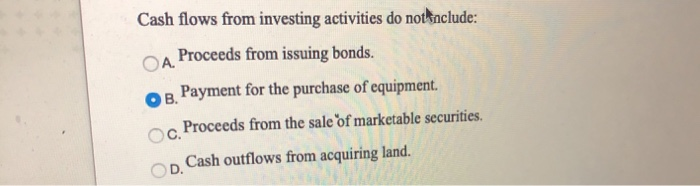

Cash Flows From Investing Activities Do Not Include

The intricate dance of financial statements often leaves individuals and businesses alike seeking clarity. Understanding the nuances of cash flow statements, particularly the investing activities section, is crucial for assessing a company's financial health. A common misconception lies in what activities *do not* fall under this category.

This article aims to clarify the boundaries of cash flows from investing activities. It will explore specifically what transactions are excluded and why this understanding is essential for accurate financial analysis. Understanding this distinction is vital for investors, analysts, and business owners seeking a true picture of a company's capital expenditures.

Defining Cash Flows from Investing Activities

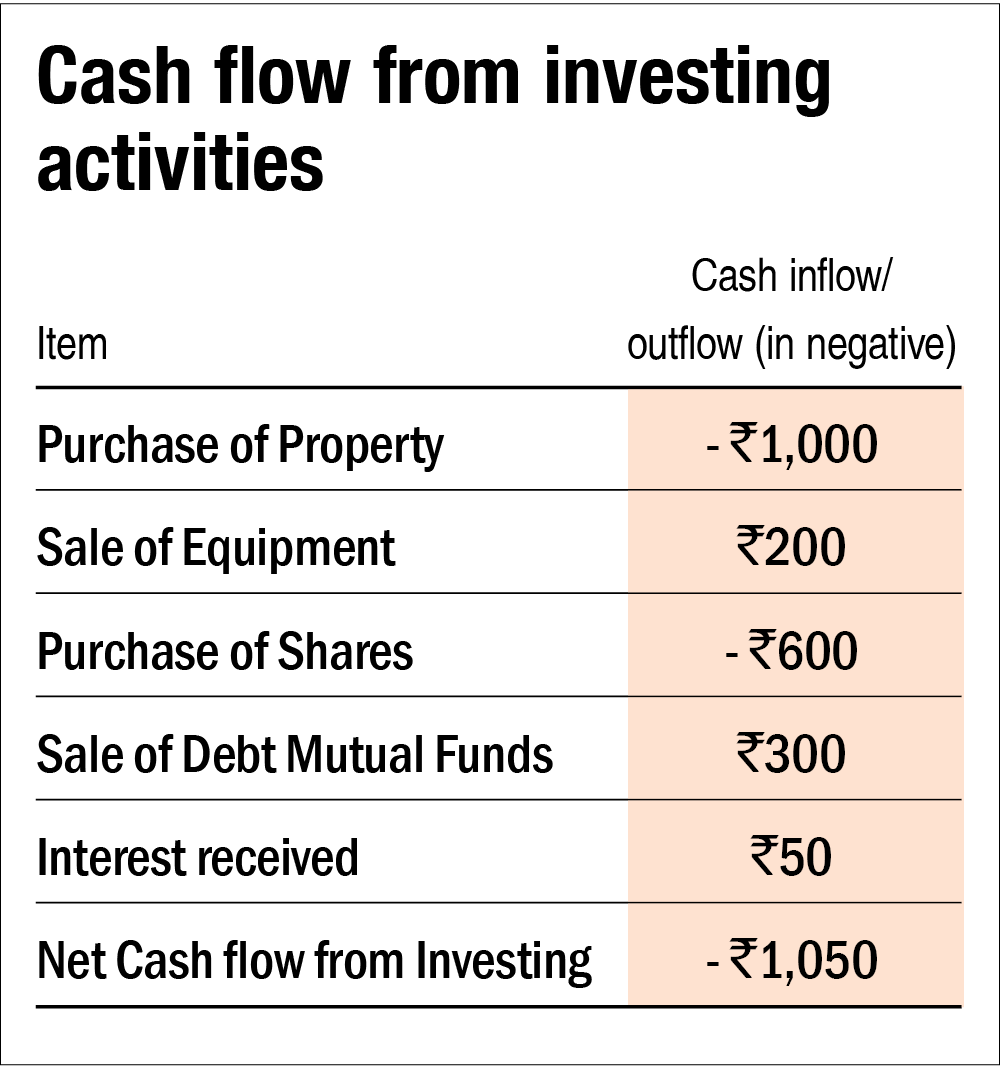

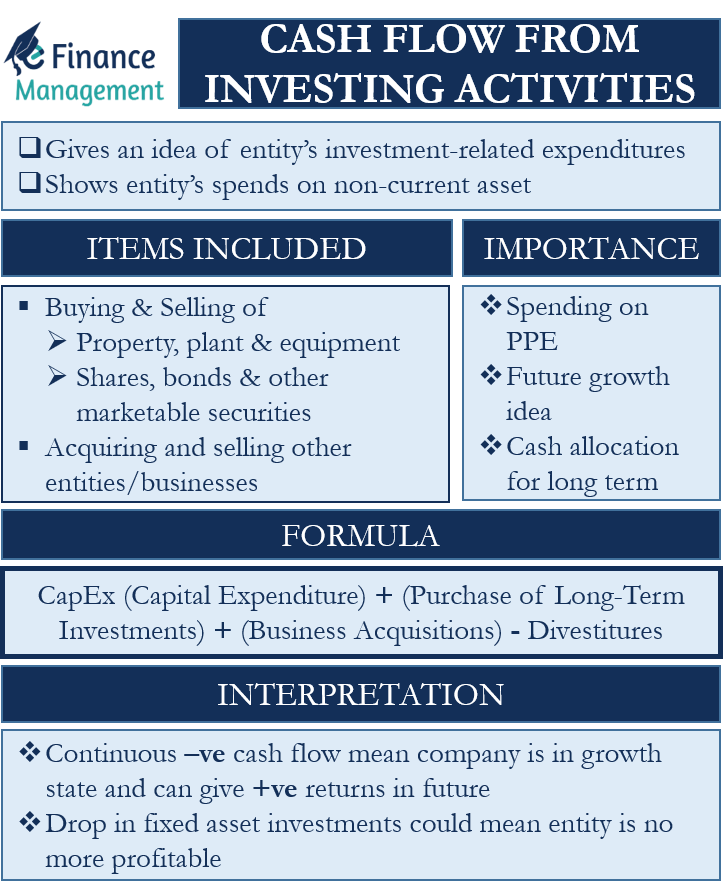

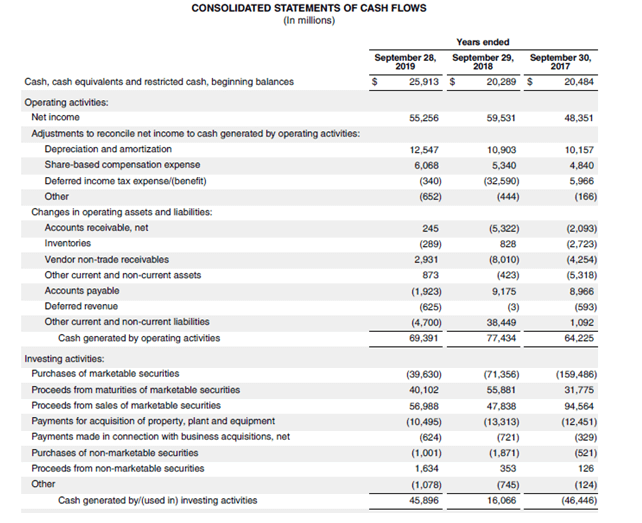

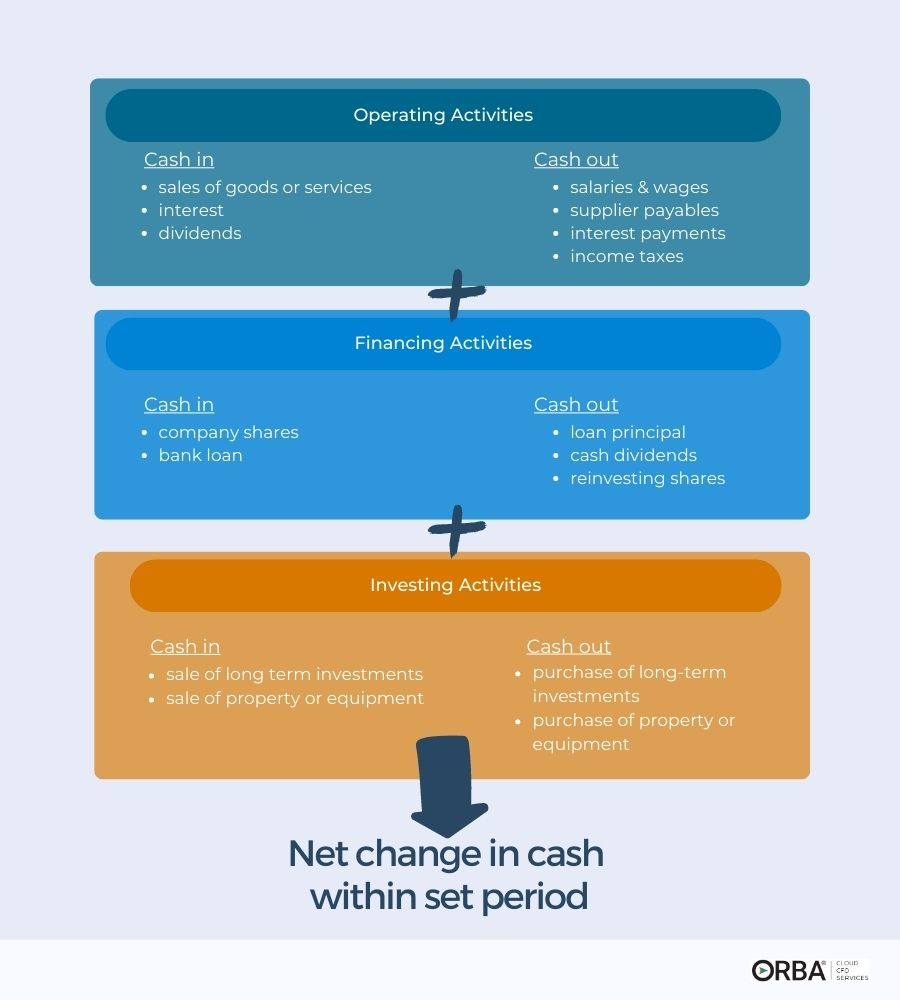

Cash flows from investing activities represent the cash inflows and outflows related to a company's long-term investments. These activities generally involve the purchase and sale of long-term assets. These assets include property, plant, and equipment (PP&E), investments in securities, and intangible assets.

The purpose of this section is to show how a company is using its cash to generate future income. It reveals how a company spends money on capital expenditures. This is in order to maintain or improve its operations.

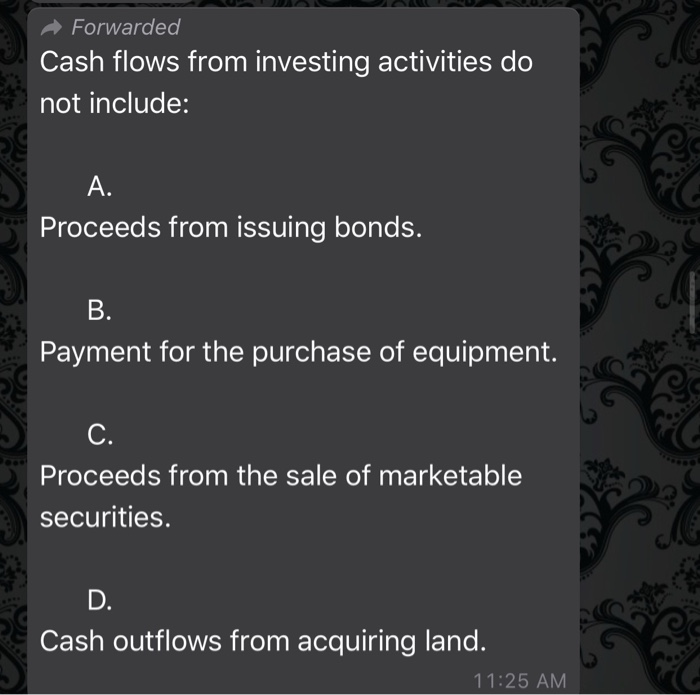

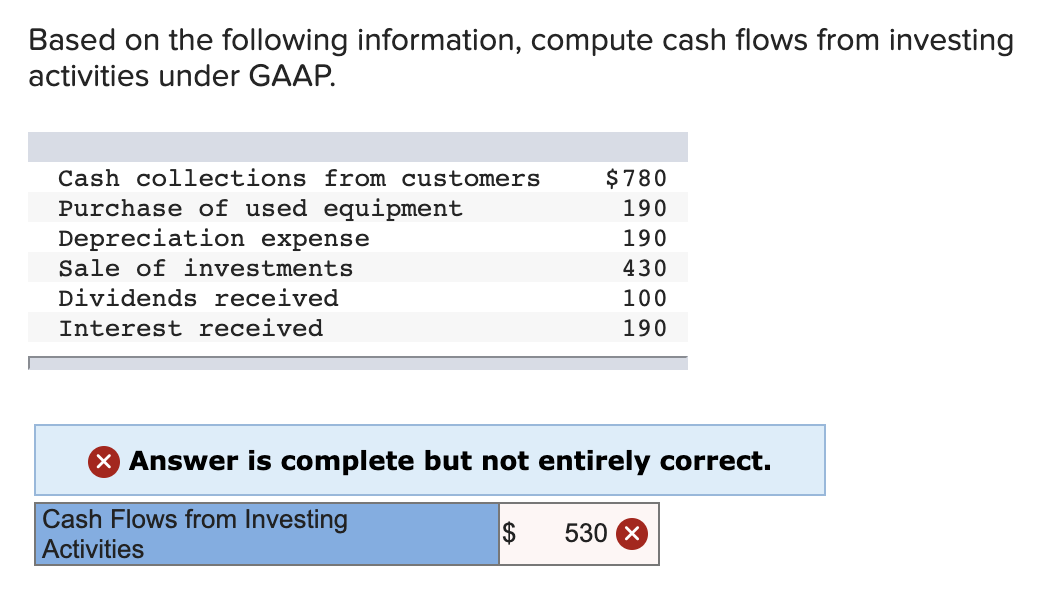

What's Excluded?

Several types of cash flows are often mistakenly categorized as investing activities. The most important to understand are those related to day-to-day operations. These are classified as operating activities.

Specifically, cash flows from investing activities do not include transactions related to the normal buying and selling of inventory. These belong in the operating activities section. Similarly, short-term investments are often handled differently.

Another area of confusion often revolves around expenses related to research and development (R&D). While R&D can lead to the creation of intangible assets. The *cash outflows associated with the R&D itself are generally classified as operating activities*.

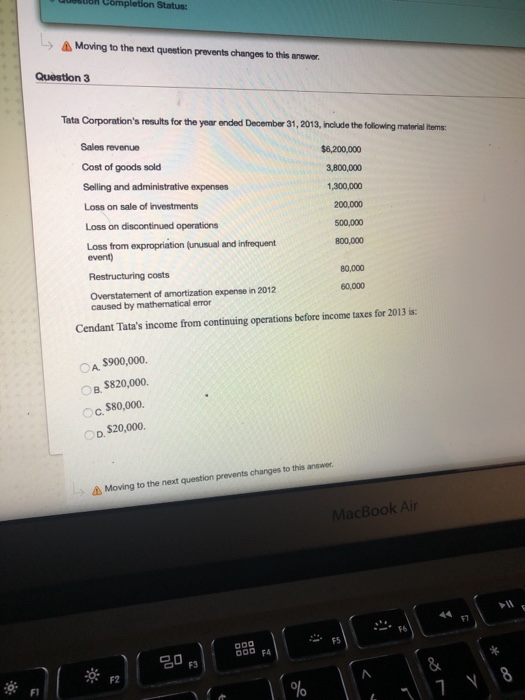

Operating Activities vs. Investing Activities

The key difference between operating and investing activities lies in the nature of the transactions. Operating activities relate to the primary revenue-generating activities of a business. Investing activities concern the acquisition and disposal of long-term assets and investments.

For example, consider a manufacturing company. The purchase of raw materials is an operating activity. Whereas the purchase of a new piece of machinery is an investing activity.

The Statement of Cash Flows published by the FASB provides detailed guidance. This guidance helps distinguish operating and investing activities.

Financing Activities: A Separate Category

It is crucial to also differentiate investing activities from financing activities. Financing activities concern the raising of capital. This can be through debt or equity, and the repayment of debt.

Examples of financing activities include issuing bonds, taking out loans, and paying dividends. These are distinct from the investments a company makes in its operations.

For example, if a company sells shares of stock to raise money, this is a financing activity. The use of that money to purchase a new factory is an investing activity.

Why is this distinction important?

Accurately categorizing cash flows is crucial for several reasons. It provides investors and analysts with a clearer picture of how a company is using its cash. This allows them to make better investment decisions.

Misclassifying activities can distort key financial ratios and metrics. These metrics are used to assess a company's profitability, liquidity, and solvency.

Moreover, incorrect categorization can hinder a company's ability to manage its cash effectively. Understanding the distinction between investing, operating, and financing activities is essential for sound financial management.

Impact on Investors

Investors rely on the cash flow statement to assess a company's financial health and future prospects. A company that consistently generates positive cash flows from investing activities may be selling off its assets. This indicates a potential lack of investment in the future.

Conversely, a company that consistently spends a significant amount of cash on investing activities. This suggests the company is investing in its growth and expansion.

By carefully analyzing the investing activities section, investors can gain valuable insights into a company's long-term strategy. They can assess its commitment to innovation and growth.

Conclusion

Distinguishing what is *not* included in cash flows from investing activities is as important as understanding what *is* included. Activities related to normal operations, such as purchasing inventory or expenses related to R&D, are not considered investing activities.

By correctly categorizing cash flows, investors, analysts, and business owners can gain a more accurate understanding of a company's financial performance. They can make informed decisions about its future.

The accuracy of cash flow statements is paramount for effective financial analysis and decision-making. A clear understanding of these distinctions is essential for everyone involved in the financial ecosystem.

:max_bytes(150000):strip_icc()/AppleCFJune2019-7034d23092e14723b39c1c22f5e170b3.jpg)

:max_bytes(150000):strip_icc()/dotdash_Final_Cash_Flow_Statement_Analyzing_Cash_Flow_From_Investing_Activities_Jul_2020-01-5297a0ec347e4dd8996f307b3d9d61ad.jpg)

:max_bytes(150000):strip_icc()/cashflowfinvestingactivities-recirc-8787bbde413f4036b2f8cfad5c4c6a99.png)