Charities And Social Enterprises Accounting In East Renfrewshire

Did you know that East Renfrewshire boasts a vibrant ecosystem of charities and social enterprises dedicated to serving the community? What sets their financial management apart?

Understanding how these organizations handle their accounting and financial reporting is crucial, not just for transparency, but also for ensuring their long-term sustainability and impact.

The Unique Accounting Landscape

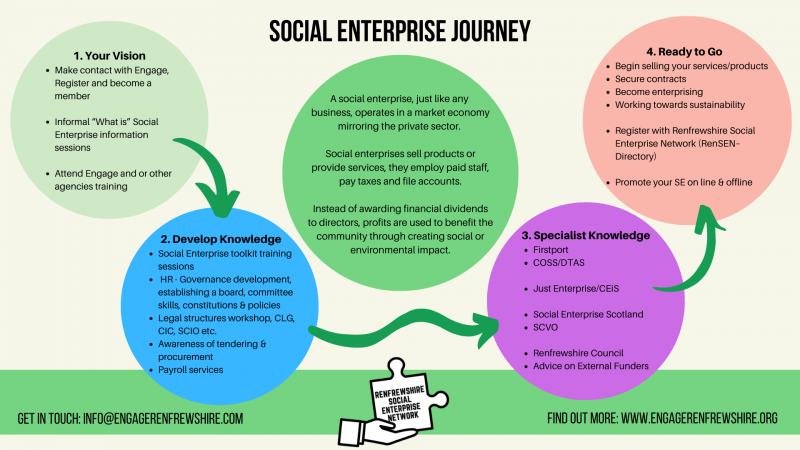

Charities and social enterprises in East Renfrewshire operate with a dual mandate: achieving social good while maintaining financial viability.

This blend requires a specific approach to accounting, diverging from standard for-profit practices.

Key Differences in Accounting Practices

Restricted funds, a common feature in charity accounting, require meticulous tracking to ensure donations are used for their intended purposes.

Unlike for-profit businesses, charities must clearly demonstrate how their resources are allocated to programs and beneficiaries.

Social enterprises, combining profit-making with social missions, face the added challenge of measuring and reporting their social impact alongside financial performance.

Navigating the Regulatory Framework

Charities in Scotland are regulated by the Office of the Scottish Charity Regulator (OSCR). This is according to the Charities and Trustee Investment (Scotland) Act 2005.

OSCR sets standards for governance, transparency, and financial reporting, requiring charities to submit annual accounts and reports.

Social enterprises, while not subject to charity-specific regulations, must comply with general business laws and often adopt voluntary codes of conduct that emphasize social impact.

Essential Compliance Requirements

Preparing accurate and timely annual accounts that adhere to the Scottish Statement of Recommended Practice (SORP) is paramount for charities.

Social enterprises must maintain clear records of both their financial performance and their social impact metrics, ensuring accountability to stakeholders.

Regular audits are often required for larger charities, providing an independent assessment of their financial health and compliance.

Challenges and Opportunities

Many charities and social enterprises in East Renfrewshire face challenges in securing adequate funding and resources for accounting support.

The complexity of charity accounting can be daunting, particularly for smaller organizations with limited administrative capacity.

However, there are also opportunities to leverage technology and pro bono services to improve accounting practices and enhance transparency.

Leveraging Technology for Efficiency

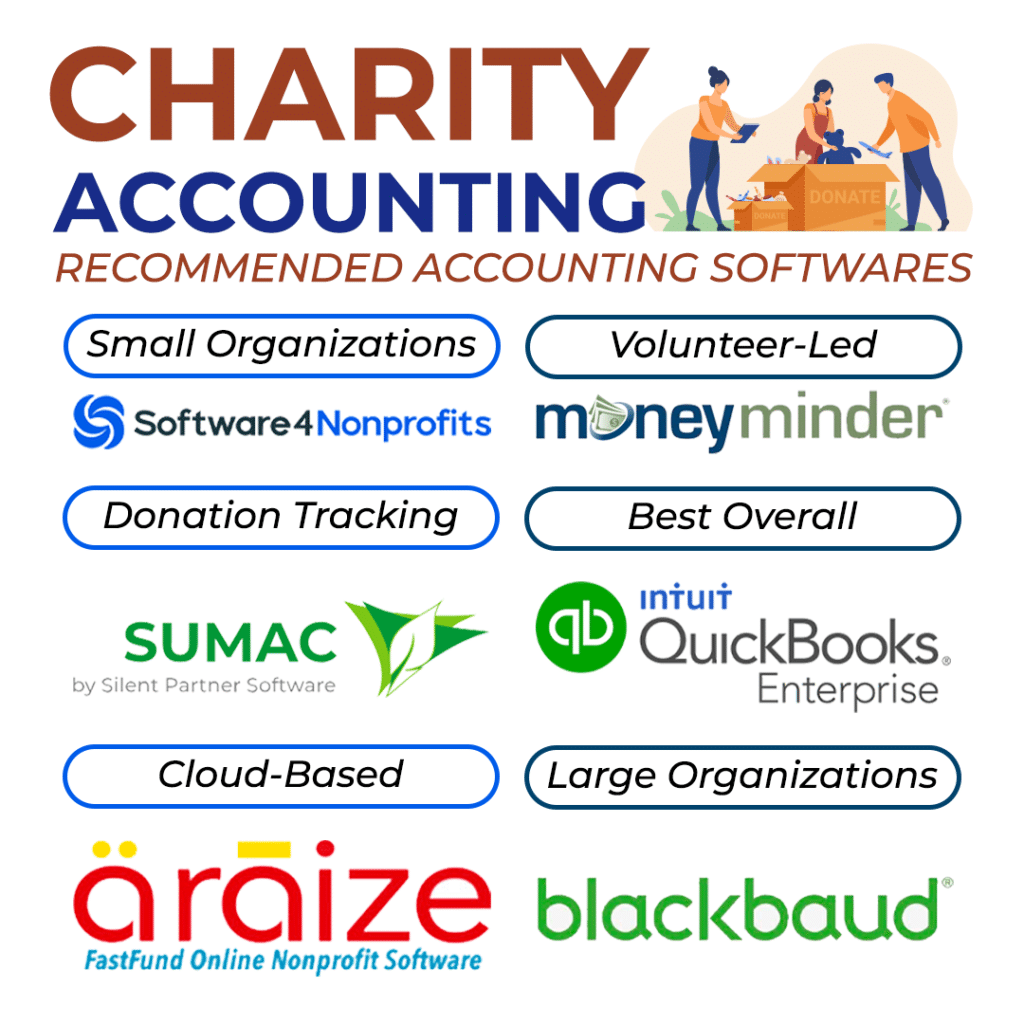

Cloud-based accounting software can streamline financial processes, improve accuracy, and facilitate real-time reporting.

These tools offer features like automated bank reconciliation, grant tracking, and donor management, reducing the administrative burden on charities.

Some software providers offer discounted rates or free access to charities and social enterprises, making technology more accessible.

Seeking Professional Guidance

Engaging a qualified accountant with experience in the charity sector is crucial for ensuring compliance and optimizing financial management.

Many accounting firms in East Renfrewshire offer specialized services tailored to the needs of charities and social enterprises, including audit, tax advice, and strategic planning.

Pro bono accounting services are also available through organizations like Pro Bono Economics, providing valuable support to smaller charities with limited resources.

The Importance of Transparency and Accountability

Transparency is fundamental to building trust and maintaining the credibility of charities and social enterprises.

Openly sharing financial information and demonstrating the impact of programs helps attract donors, volunteers, and other stakeholders.

Accountability ensures that resources are used effectively and that organizations are fulfilling their missions.

Building Stakeholder Confidence

Publishing annual reports and accounts on the organization's website promotes transparency and accessibility.

Communicating the social impact of programs through impact reports and storytelling helps demonstrate the value of the organization's work.

Actively engaging with stakeholders and seeking feedback on programs and financial management fosters trust and collaboration.

Looking Ahead

The future of charity and social enterprise accounting in East Renfrewshire will likely be shaped by increasing demands for transparency and accountability.

Technology will continue to play a vital role in streamlining financial processes and enhancing reporting capabilities.

By embracing best practices and investing in professional guidance, charities and social enterprises can ensure their long-term sustainability and impact on the community.

"Charities must ensure they are transparent and accountable so that the public can have confidence in how they are run."- OSCR.

What steps will your organization take to improve its accounting practices and demonstrate its commitment to transparency?