Charles Schwab Wealth Management Reviews

In an era defined by market volatility and economic uncertainty, the performance and reliability of wealth management firms are under intense scrutiny. Charles Schwab, a titan in the financial services industry, is no exception. Clients and industry observers alike are dissecting the company's wealth management offerings, seeking clarity on their effectiveness, cost-efficiency, and overall client experience.

This article delves into a comprehensive review of Charles Schwab Wealth Management, analyzing its services, investment strategies, fee structures, and client satisfaction rates. We'll explore the perspectives of financial analysts, independent advisors, and, most importantly, Schwab's clients to provide a balanced assessment of the firm's strengths and weaknesses in a fiercely competitive landscape. This includes examining recent performance data, evaluating the accessibility of their advisors, and scrutinizing any regulatory actions or customer complaints that might impact investor confidence.

Service Offerings and Investment Strategies

Charles Schwab Wealth Management offers a range of services designed to cater to diverse investor needs. These include personalized financial planning, investment management, retirement planning, and estate planning services.

Their investment strategies typically involve a blend of active and passive management, utilizing both Schwab's proprietary funds and third-party offerings.

The firm emphasizes a disciplined, long-term approach to investing, aligning portfolio construction with individual client goals and risk tolerance.

Fee Structure and Transparency

Fee transparency is a crucial consideration for investors. Charles Schwab employs various fee structures, including advisory fees based on assets under management (AUM), commissions on certain transactions, and fees for specific services.

While Schwab has made strides in simplifying its fee disclosures, some critics argue that certain fees can still be difficult for the average investor to fully understand. A recent report by Investopedia highlighted the importance of carefully reviewing Schwab's fee schedules and seeking clarification from a financial advisor when necessary.

It is vital for potential clients to compare Schwab's fee structure with those of other wealth management firms to ensure they are receiving competitive value.

Client Satisfaction and Advisor Accessibility

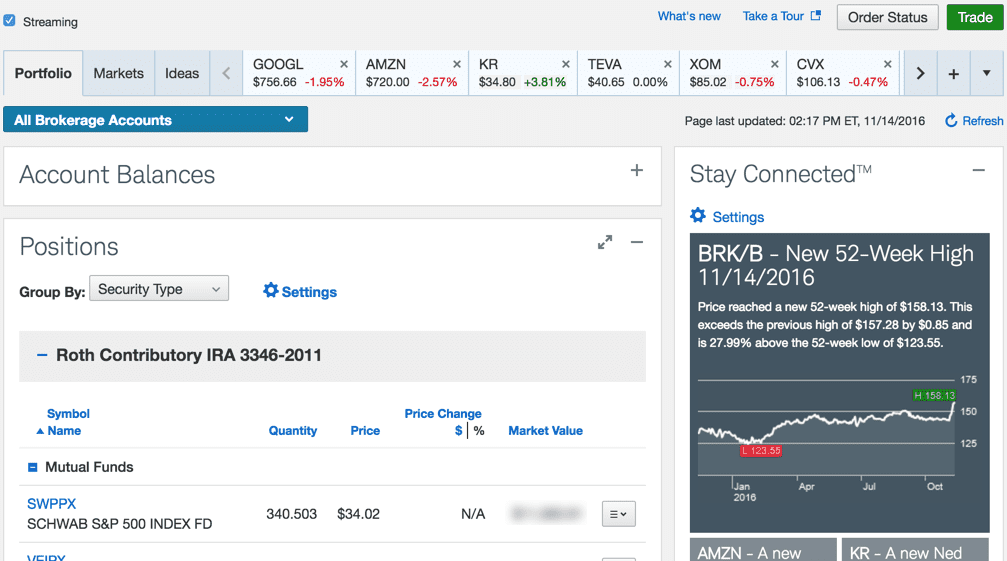

Client satisfaction is a key indicator of a wealth management firm's success. Schwab consistently scores well in various customer satisfaction surveys, particularly in areas such as online platform usability and research resources.

However, some clients have expressed concerns regarding the accessibility of their advisors, particularly during periods of high market volatility. Schwab is actively working to improve advisor availability through enhanced communication channels and expanded staffing.

Customer reviews analyzed by Consumer Affairs show a mixed bag, with some praising the firm's proactive service and others citing frustration with response times.

"Schwab's online tools are excellent, but getting personalized advice can sometimes be a challenge," one reviewer noted.

Performance Data and Benchmarking

Analyzing performance data is essential for evaluating the effectiveness of any wealth management strategy. Schwab provides clients with detailed performance reports, allowing them to track the progress of their portfolios against relevant benchmarks.

It is important to note that past performance is not indicative of future results, and investors should carefully consider their individual circumstances when making investment decisions.

Independent analysts at Morningstar have observed that Schwab's actively managed funds have, on average, delivered competitive returns compared to their respective benchmarks over the long term.

Regulatory Scrutiny and Risk Management

As a major financial institution, Charles Schwab is subject to regulatory oversight by agencies such as the Securities and Exchange Commission (SEC) and the Financial Industry Regulatory Authority (FINRA).

Schwab has a comprehensive risk management framework in place to mitigate potential risks and protect client assets. Any regulatory actions or customer complaints are thoroughly investigated and addressed promptly.

Recent scrutiny regarding sweep account practices led to settlements with regulators. *This highlights the importance of ongoing vigilance and transparency in all aspects of wealth management.*

The Future of Schwab Wealth Management

Looking ahead, Charles Schwab Wealth Management is focused on enhancing its technology platform, expanding its service offerings, and improving the overall client experience. The acquisition of TD Ameritrade has further solidified Schwab's position as a leading player in the industry, providing access to a broader range of resources and expertise.

The firm is also investing heavily in artificial intelligence and machine learning to personalize investment recommendations and streamline operational processes. Charles Schwab is committed to adapting to the evolving needs of its clients and staying ahead of the curve in a rapidly changing financial landscape.

Ultimately, the decision of whether to entrust one's wealth to Charles Schwab requires careful consideration of individual circumstances, investment goals, and risk tolerance. Consulting with a qualified financial advisor is crucial to making an informed decision and achieving long-term financial success.

/Charles_Schwab-5c61ec9146e0fb000184a2a0.png)

/charles-schwab_inv-c39b35f51ebc4d8490927ec6e90529b2.png)